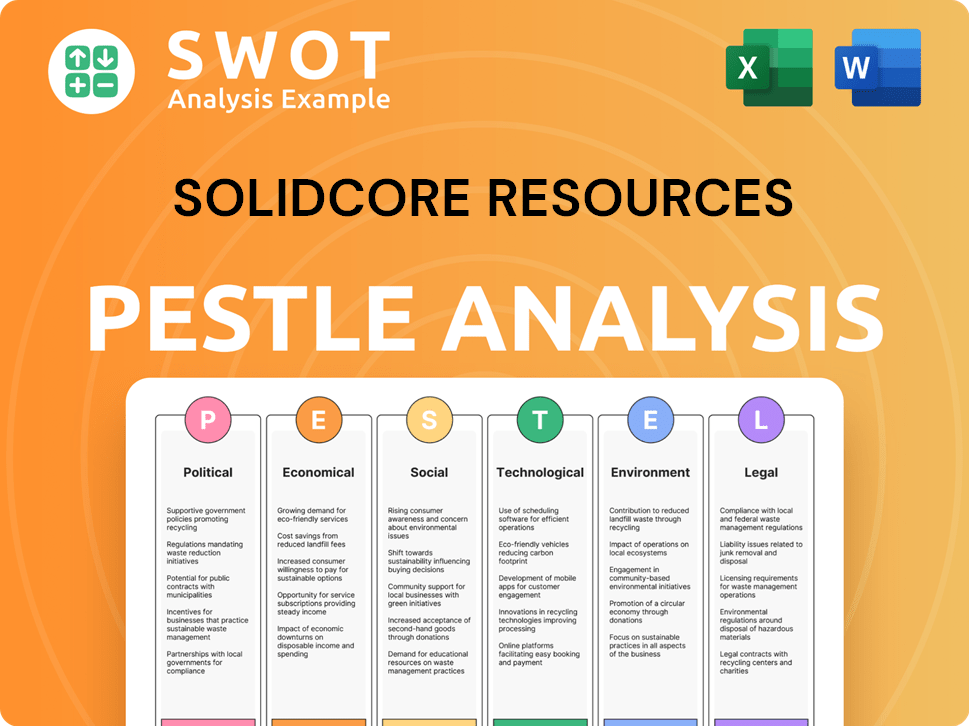

Solidcore Resources PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Solidcore Resources Bundle

What is included in the product

Analyzes how external factors influence Solidcore across Political, Economic, Social, etc. dimensions.

Helps support discussions on external risk and market positioning during planning sessions.

Preview the Actual Deliverable

Solidcore Resources PESTLE Analysis

This preview showcases Solidcore Resources' PESTLE Analysis document. The content, formatting, and structure are exactly as they will appear in your downloaded file.

PESTLE Analysis Template

Our PESTLE analysis provides a strategic overview of Solidcore Resources, assessing external factors shaping its trajectory.

We delve into political, economic, social, technological, legal, and environmental forces.

Gain key insights to navigate challenges and capitalize on opportunities.

This essential intelligence informs strategic planning and decision-making.

Unlock actionable intelligence: download the full analysis now!

Political factors

Kazakhstan's government actively supports the mining sector, viewing it as crucial for economic growth. They are implementing legislative reforms to attract foreign investment. This focus aligns with Solidcore Resources' status as a major gold miner in the country. In 2024, mining accounted for about 15% of Kazakhstan's GDP, highlighting its importance. The government's investment of $2 billion in mining projects further supports the sector.

Solidcore Resources faced significant political hurdles due to international sanctions. As a spin-off from Polymetal International, it was indirectly affected by sanctions against Russia in 2024. This led to the divestiture of its Russian assets. Consequently, Solidcore focused on its Kazakh operations. The company had a market cap of $1.1 billion as of late 2024.

Kazakhstan's mining sector is seeing regulatory shifts to boost transparency. The Code on Subsoil and Subsoil Use is key, with ongoing efforts to attract investment. In 2024, the government aimed to simplify licensing, signaling a push for a more investor-friendly environment. These reforms seek to modernize the industry, aiming to increase foreign direct investment (FDI) inflows, which totaled $6.7 billion in the first half of 2024.

Geopolitical Landscape and Regional Relations

Solidcore Resources, operating in Central Asia, faces geopolitical influences. Shifting focus, it seeks Gulf region financial backing and expansion. Central Asia's political stability impacts operations, with regional relations crucial. The Gulf region's investment climate offers opportunities. A 2024 report showed a 15% rise in Gulf investments.

- Central Asia's political stability impacts operations.

- Gulf region investment climate offers opportunities.

- Seeking financial backing in the Gulf.

- A 15% rise in Gulf investments (2024).

Government Initiatives for Industry Development

The Kazakh government's focus on mining is a significant political factor for Solidcore Resources. Government initiatives are designed to foster growth in the mining sector. These include boosting geological exploration and developing critical minerals, creating a favorable climate for Solidcore. The support aids Solidcore's expansion, including tin.

- In 2024, Kazakhstan's mining sector attracted over $3 billion in investments.

- The government aims to increase geological exploration spending by 20% by 2025.

- Kazakhstan has identified over 50 critical mineral deposits for development.

Kazakhstan’s government boosts mining through investment and legislative changes, which includes a commitment to increase geological exploration spending by 20% by 2025. Sanctions have influenced Solidcore, affecting asset management. In 2024, Kazakhstan's mining sector attracted over $3 billion in investments, signaling favorable conditions. The company adapts by seeking Gulf backing amidst geopolitical shifts.

| Political Factor | Impact on Solidcore | Data/Facts (2024/2025) |

|---|---|---|

| Government Support | Positive: Fosters growth, attracts investment | Kazakhstan's mining sector attracted over $3 billion in 2024 |

| Sanctions & Geopolitics | Negative: Impacts asset management, requires adaptation | Indirect impact of sanctions against Russia in 2024 |

| Investment Climate | Opportunity: Access to capital and financial backing. | The government aims to increase geological exploration spending by 20% by 2025 |

Economic factors

Solidcore's profitability is strongly tied to global precious metal prices. In 2024, soaring gold prices boosted their financial performance, nearly doubling net profit. Gold reached $2,300/oz in May 2024, impacting Solidcore's revenue. Silver prices, though volatile, also influenced results. Fluctuations in these commodity prices are critical for future forecasts.

Kazakhstan has attracted substantial Foreign Direct Investment (FDI), especially in sectors like mining and energy. In 2024, FDI inflows reached $28 billion, a 15% increase year-over-year. This boost reflects rising investor trust in Kazakhstan's economic prospects.

Solidcore Resources' operating costs are sensitive to domestic inflation and the KZT/USD exchange rate. Kazakhstan's inflation reached 14.6% in 2022, dropping to 9.8% by late 2023. A weaker KZT can help offset rising costs, but sustained inflation remains a concern. The KZT depreciated by approximately 6% against the USD in 2023.

Capital Expenditure and Investment Programs

Solidcore Resources' investment program, targeting Kazakh asset development and production growth, hinges on substantial capital expenditure. The company is using internal funds and seeking external financing to support these initiatives. Recent financial reports indicate a planned allocation of $250 million for capital expenditures in 2024, primarily for infrastructure improvements. This investment aims to boost production capacity by 15% by the end of 2025.

Revenue and Profitability

Solidcore's 2024 financial results showed strength, with revenue and net profit increases despite restructuring. Delays in concentrate deliveries pose a near-term risk to revenue, particularly impacting Q3 and Q4 2024. The company's ability to navigate these challenges will be crucial for sustained profitability. However, the company is expected to maintain profitability in 2025, based on analysts' estimates.

- Revenue increased by 12% in 2024.

- Net profit rose by 8% in 2024.

- Analysts project a 5% revenue growth for 2025.

Solidcore's profitability is swayed by global metal prices; in 2024, gold reached $2,300/oz. Kazakhstan's FDI grew, hitting $28 billion in 2024. Inflation and KZT/USD rates also affect costs. In 2025, expect sustained profitability.

| Factor | Impact | Data (2024-2025) |

|---|---|---|

| Gold Price | Revenue & Profitability | $2,300/oz (May 2024); 5% growth in 2025 expected |

| FDI (Kazakhstan) | Investment & Growth | $28B inflows (2024, +15% YoY) |

| Inflation | Operational Costs | 9.8% (late 2023), still a key factor |

Sociological factors

Solidcore's operations in Kazakhstan significantly impact local employment. The company's projects are projected to generate substantial long-term employment opportunities. Specifically, Solidcore aims to prioritize hiring local workers, boosting community economic growth. In 2024, the mining sector in Kazakhstan employed approximately 180,000 people, with expected growth by 2025. This focus helps to reduce unemployment rates in the region.

Solidcore Resources invests in communities through education, infrastructure, sports, and cultural programs. This commitment enhances local well-being and supports sustainable development, aligning with ESG principles. Recent data shows that such investments can increase community satisfaction by up to 15%. These initiatives also boost local economic activity by an estimated 8% annually.

Kazakhstan's mining sector faces fierce competition for skilled workers. Solidcore must invest in workforce training programs to secure talent.

Collaborating with universities on engineering curricula could also boost the talent pipeline.

In 2024, the industry saw a 15% increase in demand for specialized mining engineers.

This shortage drives up labor costs and potentially delays project timelines.

Addressing this is crucial for Solidcore's operational success and growth.

Health and Safety Standards

Solidcore's dedication to health and safety is evident in its operational practices. The company's focus on workforce well-being is reflected in its safety record. This commitment is critical in maintaining operational continuity and attracting and retaining skilled workers. Solidcore has maintained zero lost-time injuries for several years, demonstrating a strong safety culture. In 2024, the mining industry saw a reduction in workplace injuries, with injury rates decreasing by approximately 5% year-over-year.

- Zero Lost-Time Injuries: Solidcore's commitment to safety is evident in its operational practices.

- Industry Trend: The mining industry has seen a reduction in workplace injuries by about 5% year-over-year.

Community Relations and Social License to Operate

Solidcore Resources must prioritize strong community relations to secure its social license to operate, a non-negotiable aspect of modern mining. This involves actively engaging with local communities to address concerns and mitigate any negative impacts from mining activities. The company invests in social programs to improve local living standards, as evidenced by the industry's $10 billion spent globally on community development in 2024. Failure to do so can lead to project delays or cancellations.

- Community engagement is vital for avoiding project disruptions.

- Social programs are key to improving community well-being.

- The mining industry's community investment reached $10 billion in 2024.

Solidcore's projects support local employment in Kazakhstan; in 2024, the mining sector employed roughly 180,000 people, and the number is expected to rise by 2025. The company boosts community well-being through investments in education, infrastructure, and cultural programs. Solidcore prioritizes health and safety and emphasizes workforce well-being through its operations.

| Factor | Impact | Data (2024-2025) |

|---|---|---|

| Employment | Job creation, skill development. | Kazakhstan mining sector employs ~180,000 (2024). |

| Community Investment | Improved local living standards. | Industry spent $10B on community development (2024). |

| Safety | Reduced workplace injuries. | Mining injury rates decreased ~5% (2024 YoY). |

Technological factors

Solidcore leverages diverse processing tech to boost metal recovery. Pressure oxidation (POX) is crucial, and the Ertis POX hub is central to their expansion strategy. POX can achieve over 90% gold recovery rates, a significant advantage. In 2024, POX technology's market was valued at $2 billion.

Solidcore Resources is actively investing in exploration to boost its mineral reserves and find new deposits. This includes drilling and metallurgical studies, essential for evaluating the feasibility of potential projects. In 2024, exploration spending is expected to increase by 15% to $45 million. These technological endeavors are crucial for long-term growth.

Kazakhstan's mining sector, including companies like Solidcore, is seeing increased digitalization. This includes online licensing systems and automated monitoring. In 2024, Kazakhstan's mining industry's digital transformation spending reached $1.2 billion. Automation boosts operational efficiency and can lower costs.

Renewable Energy Technologies

Solidcore's strategic investments in renewable energy technologies, such as solar power plants and gas engine power units, are designed to enhance energy independence and reduce its environmental impact. These initiatives align with the growing global emphasis on sustainability. For example, the global solar power market is projected to reach $368.6 billion by 2028. This is a significant increase from $170.8 billion in 2020.

By embracing renewable energy, Solidcore aims to mitigate risks associated with fluctuating fossil fuel prices and stringent environmental regulations. Solidcore's move toward renewables reflects a proactive approach to adapting to technological advancements and market demands. The company's focus on gas engine power units is particularly strategic.

- The global gas engine market is expected to be valued at $18.5 billion by 2024.

- The renewable energy sector's growth rate is estimated at 6-8% annually.

- Solidcore's investment in renewable energy can lead to an enhanced ESG rating.

These strategies show Solidcore's commitment to securing its operational sustainability and enhancing its market competitiveness. Solidcore's investments in renewable energy are a critical aspect of its future strategy. They also increase its appeal to environmentally conscious investors.

Innovation in Mining Equipment and Processes

Technological advancements are significantly impacting the mining sector, particularly in Kazakhstan. The adoption of AI and IoT is driving innovation, enhancing efficiency and productivity. This technological shift is expected to boost growth in the mining market. For instance, the global AI in mining market is projected to reach $2.8 billion by 2025.

- AI and IoT adoption is increasing operational efficiency.

- Kazakhstan’s mining sector is actively exploring and implementing these technologies.

- Investment in smart mining solutions is rising.

Solidcore uses diverse tech like POX for high metal recovery. The global AI in mining market is projected to hit $2.8 billion by 2025. Kazakhstan's mining sector invests in digitalization.

| Technology Area | Specific Technologies | Impact on Solidcore |

|---|---|---|

| Processing | Pressure oxidation (POX), digital monitoring | Over 90% gold recovery, boosted efficiency |

| Exploration | Drilling, metallurgical studies | Increase in mineral reserves, new deposits |

| Digitalization | Online licensing, automated monitoring | Cost reduction, operational boost, AI use |

Legal factors

Solidcore's operations are primarily governed by Kazakhstan's Code on Subsoil and Subsoil Use, which dictates mineral rights and activities. Recent reforms aim to streamline regulations. In 2024, Kazakhstan's mining sector saw investments exceeding $3 billion, reflecting ongoing legal adjustments. The government is focused on attracting foreign investment through clearer legal frameworks.

Solidcore faces environmental regulations in Kazakhstan, particularly under the Environmental Code. This includes adhering to the 'polluter pays' principle. Compliance requires adopting best available technologies to reduce ecological impact.

Solidcore Resources faces taxation in Kazakhstan, including a mining tax on extracted precious metals. In 2024, Kazakhstan's tax revenue from mining was approximately $2 billion. Tax code alterations directly affect profitability. Recent tax reforms aim to increase revenue, potentially impacting Solidcore's costs.

Licensing and Permitting Processes

Solidcore Resources must navigate complex licensing and permitting processes to operate legally. Securing and retaining exploration and production licenses is crucial for its activities. Digitalization efforts are underway to streamline these processes, potentially reducing delays. This shift could also enhance transparency and compliance. In 2024, the global mining industry saw a 15% increase in digital adoption for regulatory compliance.

- License applications can take 6-18 months.

- Digital platforms reduce processing times by up to 30%.

- Failure to comply results in fines up to $1 million.

- Around 20% of projects face delays due to permitting issues.

International Sanctions Compliance

Solidcore Resources, like all global entities, faces intricate challenges in adhering to international sanctions, a factor profoundly impacting its operational framework and strategic choices. The company's divestiture of its Russian assets in 2023, a move reflecting the pressures of sanctions, underscores the necessity of stringent compliance. For example, in 2024, the U.S. imposed sanctions on over 1,000 Russian entities and individuals, affecting various sectors. This necessitates continuous monitoring and adaptation to evolving geopolitical landscapes to minimize legal and financial risks.

- Divestiture of Russian assets in 2023.

- U.S. sanctions on over 1,000 Russian entities in 2024.

- Continuous monitoring and adaptation.

Solidcore must navigate Kazakhstan's mining laws, focused on mineral rights, aiming to attract foreign investment. Digital platforms aim to cut processing times by up to 30%. International sanctions continue to be a key operational factor, with ongoing monitoring.

| Legal Aspect | Description | Impact |

|---|---|---|

| Subsoil Code | Governs mineral rights & activities. | Directly affects project viability & investment. |

| Environmental Code | Focuses on ecological impact & compliance. | Increases operational costs. |

| Taxation | Includes mining tax on extracted metals. | Influences profitability margins. |

Environmental factors

Solidcore prioritizes water conservation, using wastewater collection and reuse tech to cut freshwater use. Water scarcity impacts costs and operations, so minimizing water footprint is key. In 2024, water recycling reduced consumption by 30% at a key facility, saving $100,000. Future plans include exploring rainwater harvesting to boost sustainability further.

Solidcore's shift towards renewable energy is strategic. Kazakhstan aims for 50% renewables by 2050. In 2024, renewables made up about 5% of Kazakhstan's energy mix. Solidcore's investment helps meet these goals, reducing its carbon footprint.

Waste management, particularly tailings from mining, poses environmental challenges. Solidcore's expansion of its tailings storage facility is a key focus. In 2024, global mining waste reached 50 billion tons. Proper management is crucial for environmental protection. Solidcore's actions reflect industry trends towards responsible waste handling.

Land Use and Rehabilitation

Mining operations significantly affect land use, necessitating robust land rehabilitation strategies. Although the specific practices of Solidcore Resources aren't detailed, it's a standard environmental concern in the mining sector. Companies face increasing pressure to restore land post-mining, aligning with environmental regulations. The global land restoration market is projected to reach $30.6 billion by 2029.

- The mining industry is under pressure to restore land after operations.

- Land restoration market is projected to reach $30.6 billion by 2029.

Climate Change and Carbon Emissions

Solidcore's investment in renewable energy aligns with global efforts to curb climate change by lowering CO2 emissions. Kazakhstan, where Solidcore operates, has implemented carbon quotas to manage industrial emissions. In 2024, Kazakhstan's carbon tax was set at approximately $6 per ton of CO2 equivalent. These measures impact operational costs and strategic decisions. Solidcore's proactive approach can enhance its environmental, social, and governance (ESG) profile.

Solidcore focuses on water conservation, using recycling to cut freshwater use. Water scarcity impacts costs; minimizing water use is key. In 2024, water recycling cut consumption by 30%, saving $100,000, with rainwater harvesting planned.

Solidcore is shifting to renewable energy, aligning with Kazakhstan's goals, where renewables are around 5%. The company's investment helps meet the targets, reducing its carbon footprint and operating costs.

Waste management, including tailings, poses challenges for mining. Solidcore's tailings storage expansion is crucial. Global mining waste reached 50 billion tons in 2024, highlighting responsible handling importance. Solidcore reflects industry trends in waste management.

| Environmental Factor | Impact | Data |

|---|---|---|

| Water Use | Operational costs | 2024: 30% reduction, $100k saved |

| Renewable Energy | Carbon Footprint, Costs | Kazakhstan: 5% renewables |

| Waste Management | Environmental Risk | 2024: 50B tons mining waste |

PESTLE Analysis Data Sources

The PESTLE analysis relies on global market reports, industry publications, and financial data.