Sopra Steria Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sopra Steria Group Bundle

What is included in the product

Strategic Sopra Steria analysis across the BCG Matrix quadrants for informed investment decisions.

Quickly understand Sopra Steria's portfolio with this export-ready BCG Matrix design.

Delivered as Shown

Sopra Steria Group BCG Matrix

The Sopra Steria Group BCG Matrix preview mirrors the final, downloadable document. It's the complete report, fully formatted for your strategic needs and ready upon purchase.

BCG Matrix Template

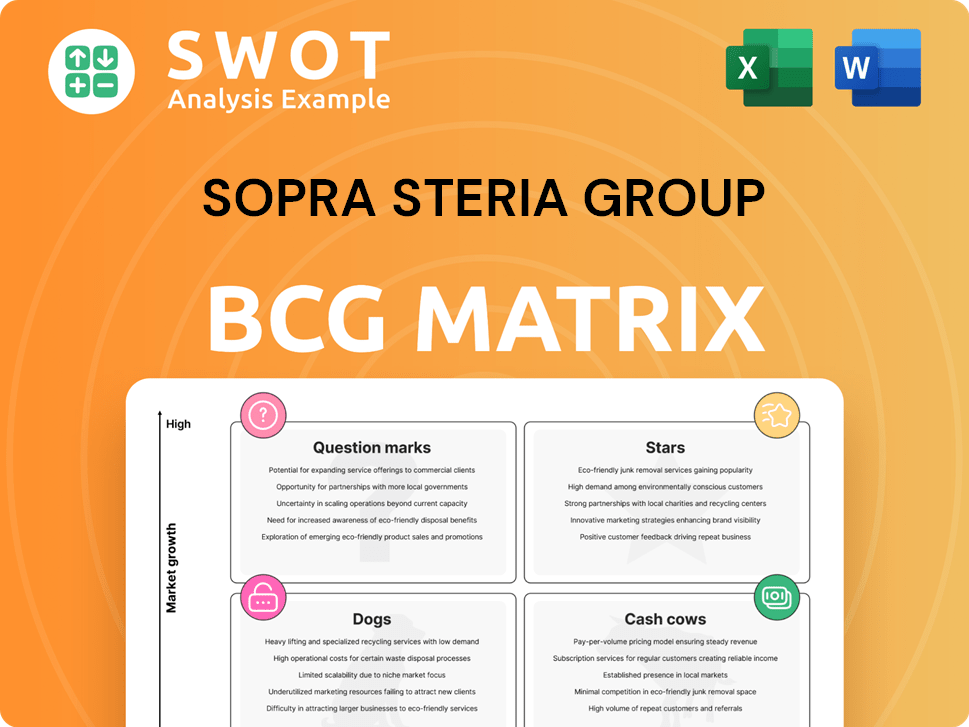

Sopra Steria Group's BCG Matrix offers a snapshot of its diverse portfolio. Question marks highlight areas ripe for growth or potential challenges. Cash cows represent established revenue streams, while dogs signal opportunities for optimization. This preliminary view hints at strategic allocation decisions.

Dive deeper into Sopra Steria's BCG Matrix and gain a clear view of its product's positions—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Sopra Steria excels in AI and GenAI services, a strategic move given the GenAI market's projected $100 billion value by 2028. Their leadership in this area is evident through integrating Generative AI technologies, showing strong market positioning. This focus enhances software engineering, ensuring efficient code development and maintenance. The company's strategic focus on AI positions it well for future growth.

Sopra Steria excels in Cloud-Native Application Development. Their Modern Apps services swiftly transform concepts into Minimum Viable Products (MVPs). DigiLabs enhance teamwork and showcase practical applications, pushing innovation forward. In 2024, the cloud services market is projected to reach over $600 billion, reflecting strong growth for cloud-native solutions.

Sopra Steria excels in digital transformation, aiding clients with cloud-native solutions. Their alliance with Mia-Platform drives innovation across sectors. This helps clients stay competitive. In 2024, digital transformation spending is expected to reach $2.6 trillion globally.

Cybersecurity Services

Sopra Steria's cybersecurity services are a "Star" in its BCG matrix, representing a high-growth, high-market-share business. This segment is experiencing significant expansion, driven by escalating cyber threats and the need for robust security solutions. They provide critical services like secure cloud transformation and data analytics to protect client operations.

- In 2023, the global cybersecurity market was valued at approximately $200 billion, with projections to reach $300 billion by 2026.

- Sopra Steria's revenue from cybersecurity services grew by 15% in 2024.

- Their services include incident response, threat intelligence, and security audits.

- The company is investing heavily in AI-driven security solutions.

Strategic Consulting

Sopra Steria is significantly boosting its strategic consulting arm, targeting a doubling of its consulting revenue by 2028. The firm's strategic moves include acquiring Aurexia, a financial services consulting specialist, to boost its market presence. This expansion focuses on helping clients with strategic planning, operational restructuring, and implementing cutting-edge technologies. Sopra Steria's consulting services are designed to offer comprehensive support.

- Sopra Steria aims to double consulting business by 2028.

- Acquisition of Aurexia strengthens financial services consulting.

- Consulting services cover strategic planning and tech adoption.

- Focus on operational restructuring for clients.

Sopra Steria's cybersecurity is a Star due to high growth and market share. The cybersecurity market was valued at $200B in 2023, expanding to $300B by 2026. Revenue from these services grew by 15% in 2024, driven by rising threats.

| Metric | Value | Year |

|---|---|---|

| Cybersecurity Market Value | $200B | 2023 |

| Projected Market Value | $300B | 2026 |

| Sopra Steria Cybersecurity Revenue Growth | 15% | 2024 |

Cash Cows

Sopra Steria's systems integration and solutions are a cash cow, vital for revenue. They design IT solutions, integrate ERP systems, and implement applications. This mature market offers consistent income. In 2024, this segment generated approximately €1.5 billion in revenue, showcasing its financial stability.

Sopra Steria's outsourcing services, like IT infrastructure and HR operations, are cash cows. These services generate consistent revenue, vital for the company. Their focus on quality ensures client retention. In 2024, outsourcing contributed significantly to their €5.7 billion revenue.

Hybrid cloud management and technology services form a crucial revenue stream for Sopra Steria Group. The rise in cloud adoption fuels consistent demand for their offerings. Sopra Steria's proficiency in diverse cloud environments meets varied client needs. In 2024, the company's IT services segment, which includes cloud management, generated a substantial portion of its €5.6 billion revenue. Their focus on hybrid solutions positions them well in the evolving market.

Services in Aerospace, Defence and Security

Sopra Steria's aerospace, defense, and security services are a cash cow within its portfolio. They provide engineering, manufacturing, and maintenance services globally. This sector benefits from their extensive delivery network and innovative strategies. In 2024, the global aerospace and defense market was valued at approximately $840 billion.

- Aerospace & Defense revenues are a significant portion of Sopra Steria's overall revenue.

- The firm's global presence supports its cash generation capabilities.

- They have a strong focus on innovation.

Financial Services and Insurance Solutions

Sopra Steria's financial services and insurance solutions are a key cash cow. They offer consulting, digital services, and software development to these sectors. This focus helps banks build trust and increase client engagement. In 2024, the financial services sector saw a 5% rise in digital transformation spending.

- Consulting services are in high demand.

- Digital services are key for innovation.

- Software development enhances efficiency.

- Focus on client engagement boosts revenue.

Sopra Steria's cash cows are its consistent revenue generators. Systems integration and outsourcing services provide steady income. Hybrid cloud and financial solutions also significantly contribute. Aerospace & Defense revenues are a significant portion of Sopra Steria's overall revenue.

| Segment | 2024 Revenue (approx.) | Key Feature |

|---|---|---|

| Systems Integration | €1.5 Billion | Mature market, consistent income |

| Outsourcing | Significant contribution to €5.7 Billion | IT infrastructure & HR operations |

| IT Services (incl. Cloud) | Substantial portion of €5.6 Billion | Hybrid solutions |

| Financial Services | Increased digital transformation spending | Consulting, digital services |

| Aerospace & Defense | Part of $840B global market | Global presence, innovation |

Dogs

Traditional software licensing could be a "Dog" for Sopra Steria. The shift to cloud and subscriptions challenges this segment. Digital services are prioritized, indicating a move away from traditional licensing. In 2023, cloud services grew, while traditional licenses faced pressure. Re-evaluation or divestiture might be considered.

Maintaining Sopra Steria's legacy systems without modernization could position them as a 'dog' within the BCG matrix. Clients in 2024 are seeking digital transformation. Upkeep of old tech may not align with strategic goals. This area requires active management. In 2023, legacy IT spending was $1.7 trillion.

Sopra Steria prioritizes key regions like France, UK, and Germany. Smaller markets, not crucial for revenue or strategy, could be 'dogs'. These areas might face strategic reviews. Consider their impact on overall profitability, such as the 2024 operating margin of 7.7%.

Specific Declining Verticals (Potentially)

In Sopra Steria's BCG Matrix, "Dogs" represent business units with low market share in declining markets. Some of Sopra Steria's verticals might face challenges due to changing market dynamics or tech advancements. These areas might need strategic shifts or even divestiture. Continuous market analysis is crucial for identifying these potentially declining sectors.

- Financial results in 2024 may show revenue declines in specific legacy IT services.

- Certain government contracts might face budget cuts or increased competition.

- Sopra Steria's investments in digital transformation are ongoing, but returns aren't immediate.

- Areas with slow adoption of cloud services could be at risk.

Commoditized IT Services (Potentially)

Commoditized IT services, characterized by low margins and intense competition, align with the "dogs" quadrant in a BCG matrix. Sopra Steria's strategic direction, emphasizing higher-value offerings, indicates a shift away from these basic services. Automation and outsourcing strategies present more efficient alternatives for these less profitable areas. In 2024, the global IT services market is valued at approximately $1.4 trillion, with commoditized services facing significant price pressure.

- Low margins in commoditized IT services.

- Sopra Steria's focus on high-value services.

- Automation and outsourcing as alternatives.

- Global IT services market size in 2024.

Dogs in Sopra Steria's BCG matrix include low-growth, low-share business units. Traditional IT licensing faces declines due to cloud shifts. Legacy systems without modernization also struggle. In 2024, commoditized services face margin pressure.

| Category | Characteristics | Example |

|---|---|---|

| Low Growth/Share | Declining markets; low profitability | Legacy IT, commoditized services |

| Strategic Actions | Re-evaluate, divest, or restructure | Focus on high-value digital transformation |

| 2024 Market Data | $1.4T IT services, margin pressures | Cloud services adoption & focus |

Question Marks

Sopra Crypto Solutions, a white-label offering from Sopra Steria, is a question mark in the BCG matrix. Launched to aid banks in crypto-asset adoption, its success hinges on cryptocurrency market acceptance and regulation. In 2024, the crypto market saw significant volatility, with Bitcoin's price fluctuating considerably. The regulatory environment remains uncertain, impacting the long-term viability of such ventures.

The OpenSky Platform, a collaboration between Sopra Steria and Thales, targets the digital evolution of European Air Traffic Management. Its future hinges on uptake by Air Navigation Service Providers and seamless flight operation integration. The platform faces regulatory and technological hurdles, classifying it as a question mark. In 2024, the air traffic management market was valued at approximately $3.5 billion, with projections for significant growth.

Sopra Steria excels in AI, yet Generative AI's industry use is nascent. Overcoming data, privacy, and regulatory hurdles is key. Successful adoption of GenAI is crucial. Continuous adaptation is vital. In 2024, the global AI market hit $230 billion, showing rapid growth.

Expansion into New Geographic Markets

Sopra Steria's expansion strategy focuses on growing and rebalancing its presence across Europe. Entering new markets presents challenges, requiring a deep understanding of local conditions. Building partnerships and adapting to local regulations are crucial for success. In 2024, Sopra Steria aimed to increase its revenue from international markets by 10%.

- Geographic expansion is a key strategic move.

- Risks include market unfamiliarity.

- Partnerships can mitigate risks.

- Adaptation to regulations is essential.

New Service Lines (Digital Platform Services, Cybersecurity)

Digital Platform Services and Cybersecurity represent Sopra Steria's emerging service lines. These areas are vital for growth, yet they require strategic focus. Success hinges on solid market presence and delivering high-value solutions. Competition from established players necessitates ongoing investment.

- These services are crucial for adapting to digital transformation trends.

- They are likely positioned in the "Question Mark" quadrant of the BCG matrix.

- Sopra Steria needs to invest to gain market share.

- Success will depend on innovation and customer acquisition.

Digital Platform Services and Cybersecurity are emerging service lines facing challenges.

These areas are vital but need strategic focus. They likely sit in the "Question Mark" quadrant of the BCG matrix.

Sopra Steria must invest to gain market share amid competition. In 2024, the cybersecurity market was valued at over $200 billion.

| Service Line | BCG Matrix | 2024 Market Value |

|---|---|---|

| Digital Platform Services | Question Mark | $100B+ (estimated) |

| Cybersecurity | Question Mark | $200B+ |

| Investment Need | High | Ongoing |

BCG Matrix Data Sources

Sopra Steria's BCG Matrix leverages company financials, market analyses, and expert insights. This ensures data-driven and strategic positioning.