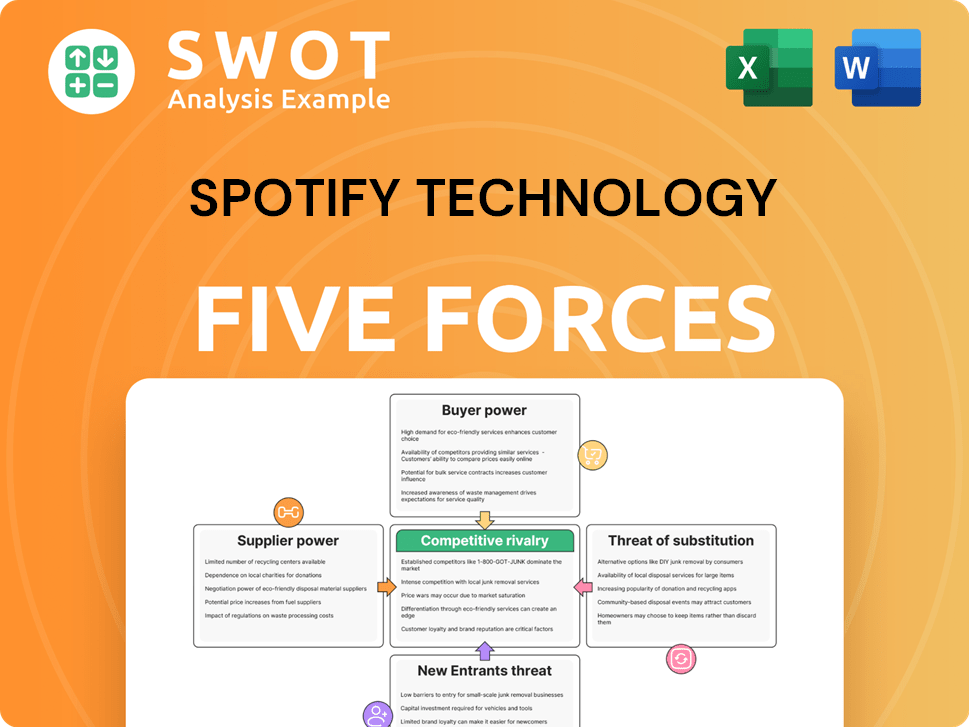

Spotify Technology Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Spotify Technology Bundle

What is included in the product

Analyzes Spotify's competitive landscape, including rivalries, buyer power, and barriers to entry.

Clean, simplified layout—ready to copy into pitch decks or boardroom slides.

Preview Before You Purchase

Spotify Technology Porter's Five Forces Analysis

This is the full Spotify Technology Porter's Five Forces Analysis. The preview you see showcases the exact document you'll receive after purchase. There are no changes to the format or content. It's ready for your review and immediate use. Expect the same professional analysis.

Porter's Five Forces Analysis Template

Spotify faces intense competition in the music streaming market, increasing the bargaining power of buyers who can easily switch platforms. Supplier power, dominated by major record labels, creates cost pressures. The threat of new entrants, like Apple Music and Amazon Music, is high due to low barriers to entry. Substitute products, such as podcasts and radio, pose a constant challenge to Spotify's revenue. Rivalry among existing competitors, including aggressive pricing and exclusive content deals, is fierce.

Ready to move beyond the basics? Get a full strategic breakdown of Spotify Technology’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Major record labels, including Universal, Sony, and Warner, wield considerable power over music content. They control a large share, affecting Spotify's licensing and royalty rates. In 2024, these labels' influence remained strong, impacting Spotify's profit margins. To combat this, Spotify is fostering artist partnerships. Data from 2024 shows the impact of label negotiations on Spotify's content costs.

High-profile artists wield significant influence, negotiating favorable terms due to their subscriber-attracting power. Exclusive content deals, where platforms pay huge sums for content, highlight this influence. Securing exclusive content lets artists pressure platforms for higher payouts. For instance, in 2024, top artists like Taylor Swift secured deals boosting their bargaining power.

Exclusive content gives suppliers leverage, boosting user engagement and subscriptions. Spotify depends on licensing deals with suppliers like record labels and artists. In 2024, Spotify's content costs rose, highlighting supplier power. Mutually beneficial royalty negotiations are key to profitability. Spotify's 2024 revenue was $14.6 billion, underlining its reliance on content deals.

Podcast Creators

Podcast creators are gaining bargaining power, particularly those with exclusive or highly sought-after content. The podcast market is forecasted to reach $134.68 billion by 2029, indicating significant growth. This growth, with a CAGR of 29.5%, increases the demand for specialized content, giving creators leverage. This allows them to negotiate better terms with platforms like Spotify.

- Market Growth: The podcasting market is projected to grow to $134.68 billion by 2029.

- CAGR: A CAGR of 29.5% underscores the rapid expansion of the podcasting industry.

- Negotiation Power: Creators of popular podcasts can demand better deals.

Royalty Rates

Spotify faces supplier power from music labels and artists who negotiate royalty rates, directly impacting its cost structure and profitability. Royalty payments constitute a substantial portion of Spotify's revenue, making it a major expense. For instance, in Q4 2023, content costs were EUR 2.4 billion. Managing these costs is critical, leading Spotify to explore strategies like direct artist partnerships and original content creation.

- Content costs in Q4 2023 were EUR 2.4 billion.

- Royalty rates significantly affect Spotify's profitability.

- Spotify seeks to manage costs through various initiatives.

Spotify contends with powerful suppliers, particularly major record labels and high-profile artists, influencing content costs. These suppliers negotiate royalty rates, significantly impacting Spotify's profitability. In Q4 2023, Spotify's content costs reached EUR 2.4 billion, highlighting the financial stakes.

| Supplier | Impact | Financial Data (2023-2024) |

|---|---|---|

| Major Record Labels | Control content licensing, royalty rates | Q4 2023 Content Costs: EUR 2.4B |

| High-Profile Artists | Negotiate favorable terms | Revenue in 2024: $14.6B |

| Podcast Creators | Growing influence, content leverage | Podcast market forecast: $134.68B by 2029 |

Customers Bargaining Power

Customers' ability to switch platforms is high due to low costs. Switching is easy since many streaming services are available, like Apple Music and Amazon Music. In 2024, Spotify's premium subscribers totaled 236 million, showing its appeal despite competition. Continuous innovation is vital for Spotify to stay competitive.

Customers of Spotify have considerable bargaining power due to the many alternatives available. Competitors like Apple Music and Amazon Music offer similar streaming services. The music streaming market is saturated, with Spotify alone featuring over 80 million songs. This competition gives customers leverage to switch platforms based on price or features, as of 2023.

Spotify faces considerable customer price sensitivity, as users can readily opt for cheaper music streaming services or free, ad-supported options. To remain competitive, Spotify must balance pricing with value-added features, such as personalized playlists and exclusive content. The monthly subscription costs span $9.99 to $15.99 across different platforms in 2024, influencing customer decisions.

Demand for Ad-Free Listening

Customers' preference for ad-free listening significantly influences Spotify's revenue model. A substantial portion of users are willing to pay for premium subscriptions to avoid ads. As of Q4 2023, Spotify reported 226 million premium subscribers out of 574 million monthly active users. This demonstrates the bargaining power of customers in shaping Spotify's service offerings.

- Ad-free preference drives premium subscriptions.

- Spotify has 226M premium subscribers in Q4 2023.

- Customers influence service offerings.

Personalized Recommendations

Consumers highly value personalized music recommendations, which significantly impacts platform choice and customer retention. Platforms excelling in this area often attract and keep more users. Spotify leverages personalized user experiences to differentiate itself, offering tailored music and podcast suggestions based on listening habits. This focus has helped Spotify maintain a strong position in a competitive market.

- Personalized recommendations are crucial for user engagement and retention.

- Spotify's strategy includes data-driven personalization.

- Customer preference for personalization influences platform selection.

- In 2024, Spotify had over 600 million users.

Customers' bargaining power is high due to readily available alternatives like Apple Music. Price sensitivity forces Spotify to balance pricing with value; monthly subs are $9.99-$15.99. Personalized recommendations are crucial, influencing platform choice.

| Aspect | Details | Impact |

|---|---|---|

| Switching Costs | Low, many alternatives | High customer bargaining power |

| Price Sensitivity | Significant, influenced by free options | Requires competitive pricing |

| Personalization | Key for retention, driven by data | Enhances user engagement |

Rivalry Among Competitors

The music streaming market is fiercely competitive. Spotify battles giants like Apple Music and Amazon Music. These rivals spend heavily on marketing and securing content. In 2024, Spotify's subscriber count reached approximately 239 million, but competition remains intense.

The music streaming market is highly saturated, intensifying rivalry. Consolidation is evident; Spotify, Apple Music, and Amazon Music hold about 80% of the market as of 2023. This dominance restricts new competitors. Differentiation is tough, heightening the competition to gain and retain users.

To thrive, companies must constantly innovate and differentiate themselves. Innovation and differentiation are crucial in music streaming. Spotify excels here, consistently enhancing content and user experience. In Q3 2023, Spotify's MAUs reached 575 million, showing the success of its strategies.

Pricing Wars

Pricing wars significantly impact Spotify's profitability. Aggressive pricing, especially against tech giants, squeezes margins. Spotify must balance competitive pricing with unique offerings to retain its edge. In 2024, Spotify's premium subscribers reached 236 million, showing its pricing strategy's impact.

- Pricing wars with Apple Music and Amazon Music are constant.

- Spotify's gross margin was around 26% in Q3 2024.

- Subscription discounts and bundles are common strategies.

- Price sensitivity of consumers is a key factor.

Content Acquisition

Spotify's competitive landscape heavily involves content acquisition. Securing exclusive content and partnerships with artists and podcasters is key. Negotiating licensing agreements affects costs and content availability. Exclusive content remains crucial; in 2021, Spotify noted it could drive up to 15% of engagement.

- Exclusive content boosts user engagement.

- Licensing costs significantly impact profitability.

- Partnerships with creators are vital.

- Content availability differentiates Spotify.

Spotify faces intense competition with giants. Market saturation and consolidation limit new entries. Constant innovation and differentiation are vital. Pricing wars, impacting margins, are ongoing.

| Aspect | Details | Impact |

|---|---|---|

| Market Share | Spotify, Apple, Amazon control 80% (2023) | Limits new entrants. |

| Pricing | Aggressive discounts and bundles | Squeezes margins. |

| Innovation | Enhancements in content and UX | Differentiates Spotify. |

SSubstitutes Threaten

Free streaming services, like YouTube Music and SoundCloud, are a notable threat to Spotify. YouTube Music reported over 80 million users in 2021, and Pandora had about 55 million users. These platforms offer ad-supported music, which directly competes with Spotify's free tier. The availability of free alternatives can reduce the number of users willing to pay for Spotify Premium, impacting revenue.

Downloaded music and personal music collections serve as substitutes for Spotify, allowing users to own tracks outright. Although alternatives exist, Spotify's creation was a substitute for traditional music consumption methods. A defining factor is Spotify's offering of customizable playlists and access to over 100 million songs, according to 2024 data. This provides a user experience that is significantly different from radio or purchasing individual albums.

Alternative entertainment, like video games and social media, competes with Spotify for user time. Shifting consumer tastes can affect music streaming. In 2024, social media music consumption grew, with platforms like TikTok drawing listeners. This impacts dedicated services like Spotify, where monthly active users hit 615 million in Q1 2024.

Physical Music Formats

Physical music formats, such as CDs and vinyl records, present a substitute threat to Spotify. These formats appeal to audiophiles and collectors who value tangible ownership. While physical music sales still exist, streaming services have become dominant. The music streaming industry accounted for approximately 84% of the global recorded music revenue in 2024.

- Physical formats cater to a niche market, representing a smaller portion of overall music consumption.

- Streaming's convenience and accessibility make it a preferred choice for many listeners.

- Streaming services have a far greater reach than physical formats.

- The ease of access and vast music libraries on streaming platforms offer a compelling alternative.

Radio

Traditional radio stations pose a threat to Spotify, especially for users who prefer free, curated music. Radio offers a substitute for Spotify's paid subscription, attracting casual listeners who might not want to pay. However, Spotify differentiates itself through customizable playlists and an extensive library. In 2024, radio still reaches a significant audience, with 83% of Americans listening weekly, highlighting the ongoing substitution threat.

- Radio's free, curated content competes with Spotify's paid model.

- Spotify's customizable playlists and vast library are key differentiators.

- 83% of Americans listen to radio weekly (2024 data).

- The threat is most significant for casual listeners.

Spotify faces substitute threats from free streaming, downloaded music, and alternative entertainment like social media. The shift in consumer behavior and the rise of platforms like TikTok impact dedicated music streaming. Streaming's dominance is evident, representing 84% of global recorded music revenue in 2024. This highlights the ongoing substitution threat from free radio and other accessible alternatives.

| Substitute | Description | Impact on Spotify |

|---|---|---|

| Free Streaming | YouTube Music, SoundCloud (ad-supported) | Reduces willingness to pay for Spotify Premium. |

| Downloaded Music | Personal music collections | Offers outright ownership of tracks. |

| Alternative Entertainment | Video games, social media (TikTok) | Competes for user time and attention. |

| Physical Formats | CDs, vinyl records | Appeals to a niche market of audiophiles. |

| Radio | Free, curated music | Attracts casual listeners. |

Entrants Threaten

New entrants face substantial hurdles due to the high initial investment needed. This includes securing licensing agreements, which is a very costly process. For example, Spotify's content costs were over €4 billion in 2024. Acquiring rights to a vast music catalog demands significant capital and negotiation prowess. The upfront financial commitment creates a barrier to entry.

The music streaming market is dominated by established players like Spotify, Apple Music, and Amazon Music. These companies collectively hold around 80% of the market share, a figure that has remained relatively stable. This market concentration presents a significant barrier to entry for new competitors. In 2024, Spotify's revenue grew by 14% year-over-year, demonstrating its strong position.

Securing licensing agreements with major record labels is a significant barrier to entry for Spotify. The recorded music industry is heavily concentrated. Universal Music Group, Sony Music Entertainment, and Warner Music Group control roughly 69.5% of the global market share. New entrants face high costs and complex negotiations.

Technology and Innovation

New entrants in the music streaming market must bring innovative technology and unique features to stand out. Spotify combats this by consistently innovating, expanding content, and improving user experience. They invest heavily in algorithms and data analysis to personalize recommendations and offer exclusive content. This strategy helps maintain its competitive edge against new and existing rivals.

- Spotify's R&D spending in 2023 was $583 million, showing a commitment to innovation.

- The company has over 600 million users, highlighting its market dominance.

- Spotify's focus on personalized playlists and podcasts differentiates it.

- New entrants face high barriers to entry due to Spotify's established brand and user base.

Marketing and Branding

Marketing and branding pose a significant threat to Spotify. Building a strong brand and attracting a large user base necessitates considerable marketing investments. In 2024, Spotify's marketing expenses were a substantial part of its operating costs. Major tech companies, like Apple and Amazon, possess the resources to enter the streaming market. Spotify's brand recognition and existing leadership position are key advantages.

- Spotify's marketing expenses are a substantial part of its operating costs.

- Major tech companies can enter the streaming market.

- Brand recognition and leadership position are key advantages.

New entrants face high barriers. Licensing costs and established market players like Spotify make entry difficult. Spotify's strong brand and innovation also pose challenges.

| Aspect | Details | Impact |

|---|---|---|

| High Costs | Licensing & tech expenses. | Raises the bar for new entrants. |

| Market Dominance | Spotify's strong position & large user base. | Makes it tough to gain market share. |

| Innovation | Spotify's R&D spending in 2023 was $583 million. | Constant improvements keep rivals at bay. |

Porter's Five Forces Analysis Data Sources

We draw on Spotify's financials, analyst reports, and market research. We also use industry publications and competitor analyses for thorough insights.