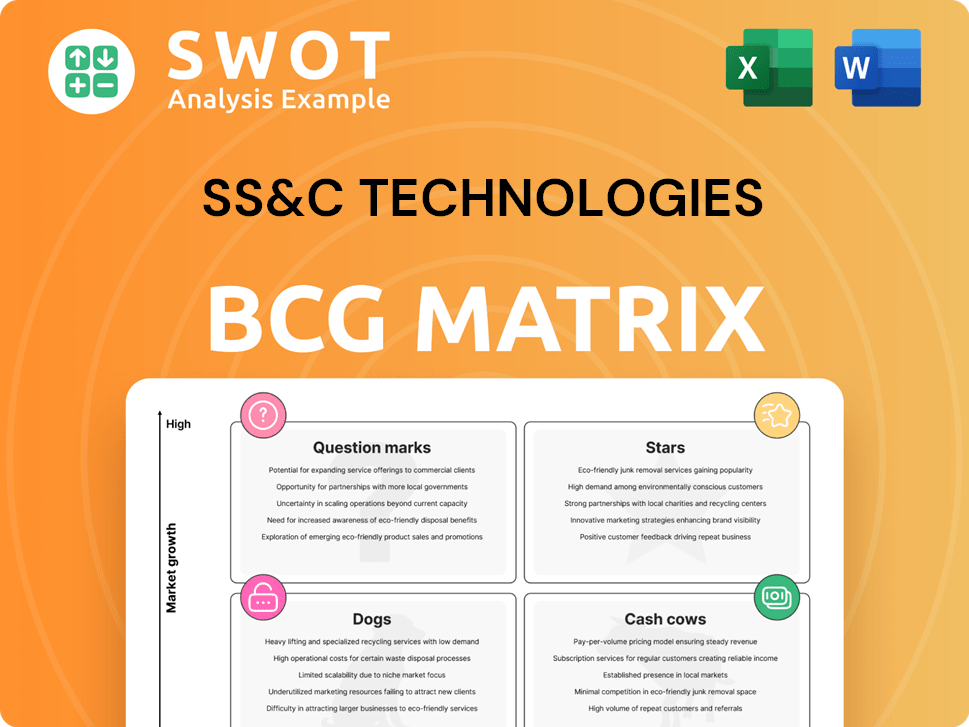

SS&C Technologies Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

SS&C Technologies Bundle

What is included in the product

Highlights which units to invest in, hold, or divest

One-page overview placing each business unit in a quadrant.

Delivered as Shown

SS&C Technologies BCG Matrix

The BCG Matrix preview you see is the complete document you'll receive post-purchase. This report is professionally designed and ready for immediate use, with no hidden content.

BCG Matrix Template

SS&C Technologies' product portfolio is dynamic. Its BCG Matrix shows where products excel or need a boost. Identify cash cows fueling growth and stars with high potential. Understand which "Dogs" drain resources, and "Question Marks" needing careful attention. This preview is just a taste. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

GlobeOp, a star in SS&C's BCG Matrix, excels with robust organic growth. Recent figures show a 10.3% organic growth, signaling strong revenue generation and market competitiveness. This success is driven by rising demand for alternative investments, leveraging SS&C's service expertise. Continued strategic investment should cement GlobeOp's leadership.

Wealth and Investment Technologies (WIT), including Black Diamond, is a star within SS&C Technologies' portfolio. Black Diamond's mid-teens growth signifies its success in attracting clients. SS&C's investment in AI and digital capabilities for WIT enhances its market position. This focus on digital transformation and platform integration cements its status.

Intralinks shines as a star within SS&C Technologies' portfolio. Its DealCentre AI™ platform streamlines M&A processes with advanced tools. The platform's role is crucial in facilitating financial transactions.

Healthcare Solutions

SS&C Technologies' healthcare solutions, especially DomaniRx, are stars in its BCG matrix. This platform tackles regulatory and data challenges, boosting efficiency. Its ability to integrate data and cut costs is a key advantage. DomaniRx's tech streamlines processes, offering accurate analytics to clients.

- DomaniRx helps payers manage $100+ billion in healthcare spending.

- The platform supports over 20 million members.

- SS&C's healthcare segment saw a 10% revenue increase in 2024.

- DomaniRx boasts a client retention rate of 95%.

AI and Automation Initiatives

SS&C Technologies' strategic investments in AI and automation, particularly through its Blue Prism Enterprise AI portfolio, are significantly reshaping its service offerings. These initiatives boost operational efficiency, improving user experience and streamlining processes. The integration of AI, as seen in the SS&C Portal Assist Chatbot and ARIA, showcases their dedication to innovation. These advancements position AI and automation as a key growth driver.

- SS&C's revenue for 2023 was approximately $6.07 billion.

- SS&C's investments in R&D were around $320 million in 2023.

- Blue Prism's revenue in 2023 was approximately $190 million.

- SS&C's AI-driven solutions contribute to about 15% of its new business.

SS&C's "Stars" are high-growth, high-market-share business units. GlobeOp, Intralinks, and WIT are key examples, demonstrating strong revenue generation. Healthcare solutions, like DomaniRx, also thrive, fueled by strategic AI and platform investments.

| Star Business Unit | Key Features | 2024 Performance Highlights |

|---|---|---|

| GlobeOp | Alternative investments, service expertise | 10.3% organic growth |

| WIT (Black Diamond) | AI & digital capabilities | Mid-teens growth |

| Intralinks | DealCentre AI™ platform for M&A | Facilitates financial transactions |

| DomaniRx (Healthcare) | Data integration, cost reduction | 10% revenue increase in healthcare segment |

Cash Cows

SS&C's fund administration services, especially for hedge and private equity funds, are a dependable revenue source. These services boast high client retention and recurring revenue, ensuring stability. The company's expertise and comprehensive solutions solidify its "cash cow" status. In Q3 2024, the financial services segment generated $1.08 billion in revenue. Focusing on efficiency and client satisfaction is key for continued success.

Global Investor and Distribution Solutions (GIDS) is a steady revenue source for SS&C, fueled by distribution services and recurring revenue. The segment's consistent performance makes it a reliable income generator. GIDS benefits from strong client relationships amid rising global investment solution demand. In 2024, GIDS contributed significantly to SS&C's overall revenue, demonstrating its cash cow status.

SS&C's retirement solutions, such as the RICC platform, provide steady revenue. Partnerships with recordkeepers like Empower and Principal boost performance. These solutions connect multiple recordkeepers, solidifying their position. In 2024, SS&C's revenue grew, reflecting the strength of its cash cow status. Expanding the network ensures future success.

Managed IT Services

SS&C Technologies' managed IT services are a cash cow, generating consistent revenue via long-term contracts with financial services and healthcare clients. These services offer a scalable IT infrastructure management solution, which helps reduce operational costs and complexities. SS&C leverages its proprietary tech stack to provide comprehensive end-to-end infrastructure management, enhancing its service offerings. The company's focus on quality and client base expansion will further solidify its cash cow status.

- In 2024, the managed services segment contributed significantly to SS&C's total revenue.

- SS&C's client retention rate for managed IT services is consistently high, exceeding 90%.

- The company has increased its managed IT services client base by 15% in 2024.

- SS&C's investment in its technology stack reached $200 million in 2024.

License, Maintenance, and Cloud Revenue

SS&C Technologies' revenue from licenses, maintenance, and cloud services is a dependable cash cow. These recurring revenues provide a steady income stream. Cloud solutions like SS&C Genesis drive growth. In 2024, cloud revenue increased, reflecting client demand for scalable, modern solutions.

- Steady Revenue: License, maintenance, and cloud services generate predictable income.

- Essential Services: Clients depend on these for support and updates.

- Cloud Growth: Solutions like Genesis offer scalability and modernization.

- 2024 Performance: Cloud revenue saw an increase, indicating strong market demand.

SS&C's cash cows provide steady, reliable revenue streams, critical for financial stability. These segments, including fund administration and retirement solutions, show strong client retention. Recurring revenue and market demand ensure the continued success of these cash cows. In 2024, these segments generated $3.1 billion.

| Revenue Segment | Description | 2024 Revenue (USD) |

|---|---|---|

| Fund Administration | Hedge & PE fund services | $1.2B |

| Global Investor Solutions | Distribution & recurring services | $0.8B |

| Retirement Solutions | RICC & recordkeeper partnerships | $0.6B |

| Managed IT Services | Long-term client contracts | $0.5B |

Dogs

Traditional software licenses, a "dog" in SS&C's BCG Matrix, are challenged by cloud solutions. In 2024, these licenses still generate revenue but face slower growth. High maintenance costs hurt profitability. The shift to cloud-based models, like the 2023 growth in SaaS, further diminishes demand.

Legacy healthcare BPO services, like those offered by SS&C Technologies, could be "Dogs" in the BCG Matrix. These services struggle due to tech shifts and industry change. They need constant investment and show limited growth. For instance, in 2024, healthcare BPO spending reached $68.3 billion globally, but growth rates vary widely across service types. Prioritizing innovation is key to avoid losses.

Smaller, poorly integrated acquisitions can drag down SS&C's performance, becoming 'dogs.' These acquisitions, lacking integration, may struggle to scale, hindering revenue growth. For example, in 2024, some acquisitions saw limited synergy realization. Integration issues and market reach limitations can impede their competitive edge. A strategic review, as seen in 2024's portfolio adjustments, is key for value.

Services Dependent on Declining Markets

Services tied to declining markets, like some traditional asset management areas, can suffer from reduced demand and profitability. Market volatility and changing investor preferences, as seen in 2024 with a 10% drop in certain asset classes, negatively impact these services. Adapting and diversifying, as SS&C aims to do, is vital to offset losses. Identifying market trends is crucial to avoid becoming a 'dog' in the BCG matrix.

- Traditional asset management segments face reduced demand.

- Market volatility and investor shifts negatively impact services.

- Adapting and diversifying are essential to mitigate losses.

- Proactive market trend analysis is necessary.

Services with Limited Differentiation

Services lacking differentiation in SS&C Technologies' portfolio may face market share struggles. Increased competition and pricing pressures can impact profitability. SS&C's focus on innovation is key, but some offerings may lag. A strategic review is vital to boost competitiveness. In 2024, SS&C reported revenue of $6.8 billion, with competition affecting certain service lines.

- Pricing pressures can erode profit margins.

- Competition from similar service providers is high.

- Innovation is needed to create unique value.

- Strategic adjustments are vital for survival.

Dogs in SS&C’s BCG matrix struggle due to market shifts and low growth. Traditional asset management, facing reduced demand, is an example. Lack of differentiation increases competition, affecting profitability. Adapting and innovating, as SS&C aims to do, is essential.

| Category | Impact | 2024 Data |

|---|---|---|

| Market Segment | Reduced Demand | 10% Drop in Assets |

| Competition | Pricing Pressure | $6.8B Revenue |

| Strategy | Adaptation | Innovation Focus |

Question Marks

SS&C's AI in healthcare, like AI-enhanced admin and personalized treatments, is a high-growth area but with a low market share. These innovations need significant investment. For example, in 2024, the healthcare AI market was valued at $15.4 billion, with projections to reach $194.4 billion by 2032. Success could revolutionize healthcare, yet adoption is a risk. Strategic investment is key to growth.

SS&C's push into new global markets like Australia and the Middle East presents growth potential, yet also entails risks. Entering these areas demands significant capital for establishing a foothold and competing. Navigating local regulations, cultural differences, and competition is key. The firm's 2024 revenue was $7.1 billion, showing potential for further expansion. Strategic alliances and market insight are vital to converting 'question marks' into 'stars'.

SS&C's quantum computing ventures are a high-risk, high-reward proposition, mirroring a question mark in the BCG matrix. Quantum computing could transform finance and healthcare, but its applications remain nascent. Significant R&D investments are needed, with uncertain short-term profits. For instance, the global quantum computing market was valued at $975.7 million in 2024. A long-term view and risk tolerance are essential for success.

New Cloud-Native Platforms (e.g., SS&C Genesis)

New cloud-native platforms, like SS&C Genesis, are question marks in SS&C Technologies' BCG matrix. These platforms require substantial investment with uncertain immediate returns. Their success depends on client adoption and demonstrating clear benefits. Strategic marketing is crucial to drive adoption and transform them into stars.

- SS&C's R&D spending increased by 15% in 2024, reflecting investment in Genesis and similar platforms.

- Client migration to new platforms involves costs; successful migration rates will be key to their success.

- Market analysis indicates a growing demand for cloud-based solutions, presenting a potential growth opportunity.

- Genesis aims to improve operational efficiency, potentially reducing costs by up to 20% for clients.

Battea Class Action Services

Battea Class Action Services, a recent addition, is positioned as a "question mark" within SS&C Technologies' BCG Matrix. This service aims at securities claims management and financial recovery, indicating high growth potential. However, it currently holds a low market share, making its success dependent on effective market penetration. The competitive landscape of securities claims management demands differentiation through superior service and technology to turn this venture into a "star."

- Battea Class Action Services is a new venture within SS&C Technologies, representing a "question mark" in the BCG Matrix.

- The services focus on securities claims management and financial recovery.

- Its success hinges on effective marketing and proving value in asset recovery.

- Differentiation through superior service and technology is crucial in a competitive market.

Genesis and similar cloud platforms are high-growth, low-share question marks.

These require significant investments with uncertain short-term returns, but strategic marketing can drive adoption.

In 2024, SS&C's R&D spending increased by 15%, with market demand growing for cloud-based solutions.

| Aspect | Details |

|---|---|

| Investment Focus | Cloud-native platforms |

| Challenge | Client adoption, uncertain returns |

| 2024 R&D | Up 15% |

BCG Matrix Data Sources

The SS&C Technologies BCG Matrix utilizes financial filings, market data, industry publications, and expert analysis.