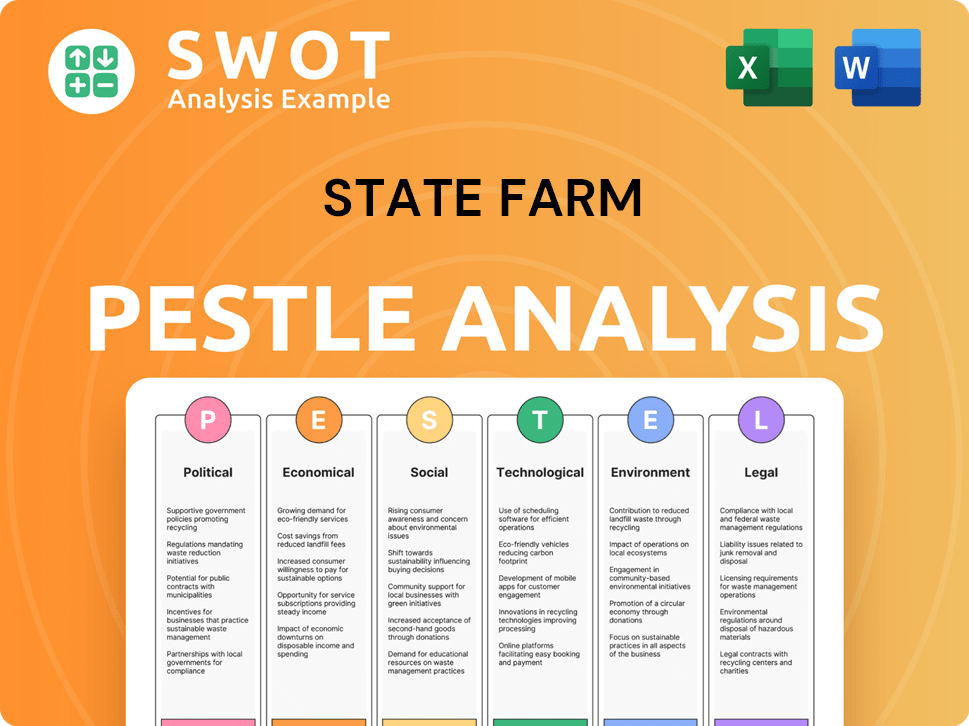

State Farm PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

State Farm Bundle

What is included in the product

Unveils macro-environmental influences on State Farm using Political, Economic, Social, etc. factors.

Provides a concise summary perfect for rapid external factor review or brief team communications.

Preview the Actual Deliverable

State Farm PESTLE Analysis

We're showing you the real product. After purchase, you’ll instantly receive this exact State Farm PESTLE analysis file.

PESTLE Analysis Template

Our PESTLE Analysis for State Farm reveals crucial external factors shaping its market position. Examine political landscapes, economic shifts, and social trends influencing the company. We'll analyze technological advancements, legal frameworks, and environmental concerns. Gain critical insights into State Farm's operations, risks, and opportunities. Access comprehensive data to inform your strategies and decisions. Purchase the full report today and unlock actionable intelligence!

Political factors

State Farm faces stringent state-level insurance regulations that affect its operations, especially in California. Regulatory approvals of rate increases directly impact profitability and claims coverage. In 2024, California regulators scrutinized rate hikes due to wildfire risks and inflation. This directly affects State Farm's ability to manage claims.

State Farm, like other insurers, actively lobbies policymakers. In 2023, the insurance industry spent over $200 million on lobbying. This lobbying influences regulations impacting premiums and claims. State Farm’s political actions aim to secure advantages within the competitive insurance market. These efforts affect the company’s operational costs and profitability.

Government responses to natural disasters, like providing aid, directly affect insurance claims. In 2024, the U.S. government allocated billions for disaster relief, influencing payouts. This aid's scale impacts claim numbers and sizes for insurers, including State Farm. Federal assistance can lessen the financial burden on policyholders.

State-Specific Operating Environment

State Farm's operations are highly tailored to each state, recognizing that political and regulatory environments differ greatly. This strategic approach is essential for compliance and risk management across diverse legal landscapes. They must navigate these variations to maintain financial strength and operational integrity in every region they serve. For instance, insurance regulations vary significantly, impacting product offerings and pricing strategies.

- Premium rates and policy terms are subject to state-level approval.

- Lobbying efforts are directed towards state legislatures and insurance commissioners.

- State Farm's compliance departments manage state-specific regulatory requirements.

- Political factors influence insurance availability and consumer protection.

Government Incentives and Programs

Government programs and incentives, though not directly insurance-related, influence State Farm through their agricultural client base. These initiatives can impact farming practices and financial stability. For instance, the U.S. Department of Agriculture (USDA) allocated $3.1 billion in 2024 for conservation programs. These programs indirectly affect State Farm by altering the risk profiles of agricultural clients.

- USDA conservation programs received $3.1 billion in 2024.

- These programs influence farming practices.

State Farm is significantly affected by state insurance regulations. These regulations, varying greatly by state, impact premium approvals and claims. In 2024, scrutiny over rate hikes and lobbying efforts continue, affecting profitability and operations. Political actions and government responses to disasters further shape their operational environment.

| Factor | Impact on State Farm | 2024/2025 Data |

|---|---|---|

| Regulation | Rate approvals & claims. | California scrutinized hikes. |

| Lobbying | Affects regulations. | Industry spent over $200M. |

| Gov't Aid | Influences claim sizes. | Billions for disaster relief. |

Economic factors

Inflation significantly affects State Farm's claims costs, especially in construction and healthcare. Rising costs can weaken underwriting performance if premiums lag behind claim payouts. In 2024, construction costs rose ~5%, impacting property claims. Medical inflation also increased, potentially affecting health insurance segments. These factors demand careful premium adjustments.

Catastrophe losses, particularly from wildfires, are a significant economic factor for State Farm. In 2023, insured catastrophe losses in the U.S. totaled $63.1 billion. These events lead to underwriting losses. They also affect the company's capital position, impacting financial stability.

State Farm's net income is significantly affected by investment and other income, including capital gains. Market fluctuations, like those in the U.S. equities market, directly impact their investment portfolio. In 2023, State Farm's net income was $6.2 billion, influenced by investment results. The company's financial performance thus closely mirrors market trends.

Premium Rates and Affordability

State Farm, like other insurers, faces the challenge of balancing profitability with customer affordability. Rising costs, including those from increased catastrophe losses, necessitate premium rate adjustments. This can make insurance less accessible for some, potentially leading to a reduction in the customer base or a move towards government-backed insurance options. These shifts directly impact State Farm's market position and overall financial performance.

- In 2024, the insurance industry saw a significant rise in claims, with many companies increasing premiums by double-digit percentages.

- Affordability concerns are particularly acute in regions prone to natural disasters, where premium hikes have been most pronounced.

- State Farm's market share has been affected by these trends, with some policyholders switching to competitors offering lower rates.

Farm Economy Conditions

The farm economy's health indirectly affects State Farm. Rural customers and business operations can be influenced by agricultural sector performance. The USDA projects a decrease in net farm income for 2024. A weaker farm economy may lead to reduced spending and potential insurance claims.

- Net farm income is forecast to decline by 2.5% in 2024.

- The agricultural sector's contribution to GDP was $1.2 trillion in 2023.

Economic conditions heavily shape State Farm's performance. Inflation and rising claims costs in areas like construction and healthcare directly impact its profitability. Catastrophes, like wildfires, led to $63.1B in U.S. insured losses in 2023. Market fluctuations and agricultural trends also play crucial roles.

| Factor | Impact | Data |

|---|---|---|

| Inflation | Increased claims costs | Construction cost up ~5% (2024) |

| Catastrophes | Underwriting losses | $63.1B US insured loss (2023) |

| Market Fluctuations | Investment Income impact | Net farm income -2.5% (2024) |

Sociological factors

State Farm prioritizes customer expectations for service and tailored solutions. They aim to exceed customer needs. In 2024, State Farm's customer satisfaction score was 82, reflecting a strong focus on customer experience. The company uses technology to boost satisfaction and retain customers.

Demographic shifts, including Millennial and Gen Z preferences, influence State Farm's strategies. These generations prioritize digital interactions and personalized services. In 2024, Millennials and Gen Z represent a significant portion of the insurance market, with projected spending increasing. State Farm must adapt its marketing to resonate with these groups. They need to enhance digital platforms to stay competitive.

State Farm's "good neighbor" image is central to its brand. Recent actions, like policy non-renewals, can harm this perception. For example, in 2024, State Farm faced criticism for decisions affecting policyholders in specific regions. Such moves can spark controversy and erode trust, impacting customer loyalty and brand value.

Societal Attitudes Towards Risk

Societal attitudes towards risk are constantly shifting, especially concerning climate change and natural disasters. These changing views directly affect demand for insurance products, like those offered by State Farm. For example, in 2024, the U.S. experienced over 20 weather/climate disaster events, each exceeding $1 billion in damage. This impacts where people choose to live and the types of coverage they seek.

- Increased awareness of climate risks boosts demand for specific insurance.

- Areas prone to natural disasters might see rising insurance costs or reduced coverage.

- Consumers are increasingly prioritizing risk assessment in housing and investment choices.

Community Involvement and Trust

State Farm's commitment to community involvement is a key element of its strategy to foster trust and enhance its brand reputation. This involvement often manifests through supporting local programs and being readily available to aid policyholders during difficult periods. For instance, in 2024, State Farm contributed over $100 million to community initiatives, reflecting its dedication to social responsibility. These efforts help to build strong, long-lasting relationships with customers.

- State Farm invested $104 million in community projects in 2024.

- The company sponsors numerous educational programs and disaster relief efforts.

- Local presence and support enhance customer loyalty.

Societal views on climate risk significantly affect insurance demands and where people choose to live. State Farm's community involvement, like investing over $100 million in 2024, builds customer trust. Shifting demographics, such as Millennials and Gen Z, impact State Farm's marketing needs and require better digital platforms.

| Aspect | Details | 2024 Data |

|---|---|---|

| Climate Risks | Growing concerns, demand for specialized insurance. | US had 20+ climate disasters ($1B+ each) |

| Community | Investment in local programs and relief. | $104M invested in projects |

| Demographics | Millennials & Gen Z prefer digital. | Significant market share increase expected. |

Technological factors

State Farm is actively digitizing to enhance customer experiences. They're using apps and online platforms. This shift helps customers with self-service. In 2024, State Farm's mobile app saw over 10 million users. This is a 15% increase year-over-year, showing digital adoption.

State Farm leverages AI and data analytics. They use it to improve customer service and automate tasks. For instance, they're automating underwriting. In 2024, these technologies helped reduce operational costs by 10%. This is a strategic move to enhance efficiency.

State Farm leverages telematics and IoT extensively. This tech enables usage-based insurance, offering personalized premiums. Data from these devices enhances risk assessment. By 2024, the global telematics market reached $40 billion. IoT integration streamlines claims, improving efficiency.

Technology for Underwriting and Risk Assessment

Technological advancements are reshaping State Farm's underwriting and risk assessment processes. The insurance industry is increasingly leveraging synthetic data and advanced analytics. These tools enhance accuracy and efficiency in evaluating risks and setting premiums. For instance, according to a 2024 report, AI-driven underwriting reduced processing times by up to 40% for some insurers.

- AI-powered tools are now used in approximately 60% of insurance companies.

- The investment in Insurtech reached $15.4 billion in 2024.

- About 75% of insurers plan to increase their AI budgets by 2025.

Efficiency and Cost Reduction through Technology

State Farm focuses on technology to boost efficiency and cut costs. Automation streamlines processes, reducing manual work and potentially lowering operational expenses. However, integrating new tech presents challenges, including initial investment and staff training. State Farm's tech investments in 2024 totaled $2.5 billion, with a projected $2.7 billion in 2025. These investments aim to improve customer service and claims processing.

- 2024 Tech Investment: $2.5 billion

- 2025 Projected Investment: $2.7 billion

- Focus: Customer service and claims

State Farm is heavily investing in technology to enhance its customer service and streamline its processes. In 2024, State Farm spent $2.5 billion on technology, with $2.7 billion earmarked for 2025. AI tools are now used by about 60% of insurance companies, transforming risk assessment and underwriting, while reducing processing times.

| Tech Focus | 2024 Spend | 2025 Projection |

|---|---|---|

| Digital Platforms | Significant investment | Continued expansion |

| AI and Data Analytics | Cost reduction focus | Enhanced efficiency |

| Telematics and IoT | Usage-based insurance | Risk assessment |

Legal factors

State Farm faces strict insurance regulations, varying by state. They must comply with rate approvals and solvency requirements. This ensures financial stability and consumer protection. In 2024, the insurance industry's regulatory landscape continues to evolve, impacting operations. State Farm's compliance costs are significant.

Proposition 103 in California mandates State Farm to seek prior approval for rate adjustments, potentially delaying and limiting its ability to respond to market changes. This law empowers consumers to challenge rate increases, which can lead to legal battles and financial repercussions. State Farm has faced scrutiny and legal challenges related to its rates under Proposition 103. The company's operations in California are heavily influenced by this regulation. In 2024, State Farm's California auto insurance market share was approximately 19%, reflecting the impact of regulatory constraints.

State Farm frequently deals with legal issues, including claims disputes and regulatory compliance. Litigation, potentially very costly, can arise from these areas, affecting the company's financial performance. The company has faced lawsuits over claims denials and other practices. For instance, in 2024, State Farm paid out over $10 billion in claims across various lines of insurance.

Changes in Tort Liability and Litigation Costs

Changes in tort liability and rising litigation expenses are significant for State Farm. These factors directly influence claim expenses, especially in auto and liability lines, impacting premium rates and profitability. Increased litigation costs can lead to higher payouts and operational expenses. For instance, in 2024, the average cost of a car insurance claim was $4,700.

- Rising liability claims can strain State Farm's financial resources.

- Increasing litigation costs can affect State Farm's premium pricing strategies.

- Changes in tort laws could influence the company's risk exposure.

- State Farm must adapt to evolving legal environments to maintain profitability.

Data Privacy and Security Regulations

State Farm faces rigorous data privacy and security regulations due to its vast customer data holdings. Compliance is essential to avoid hefty penalties and maintain customer trust. Regulations like GDPR and CCPA, along with state-specific laws, mandate data protection measures. These measures include data encryption, access controls, and breach notification protocols. Non-compliance can lead to significant financial repercussions and reputational damage.

- In 2024, data breach costs averaged $4.45 million globally.

- GDPR fines can reach up to 4% of annual global turnover.

- The CCPA allows for penalties of up to $7,500 per violation.

- State Farm needs to invest in cybersecurity to mitigate risks.

State Farm operates under stringent, state-specific insurance regulations. These laws govern rate approvals and ensure solvency. This impacts operational costs. Compliance with data privacy laws, like GDPR, is crucial.

| Area | Impact | Data (2024/2025) |

|---|---|---|

| Regulatory Costs | Affect profitability | Industry compliance costs up 7% |

| Claims & Litigation | Financial Risks | Average claim: $4,700; Data breach cost $4.45M |

| Data Privacy | Customer trust & Penalties | GDPR fines: up to 4% global turnover |

Environmental factors

Climate change is a major environmental concern for State Farm, contributing to more frequent and intense natural disasters. This increase in events like wildfires and severe storms directly impacts State Farm's financial performance. In 2024, the company paid out billions in claims due to extreme weather. Analysts predict these trends will continue, affecting underwriting and profitability. State Farm must adapt its risk assessment and pricing strategies to address these environmental challenges.

State Farm must comply with environmental regulations. The company is actively working on sustainability. For example, it aims to cut greenhouse gas emissions. They're also investing in renewable energy sources to support these goals. In 2024, the insurance sector's ESG investments grew by 15%.

State Farm's geographical footprint significantly shapes its environmental risk profile. Operations in regions susceptible to hurricanes, floods, or wildfires increase potential losses. For example, in 2024, State Farm faced substantial claims due to severe weather events, with payouts potentially reaching billions of dollars. This necessitates robust risk management and strategic resource allocation.

Investment in Fossil Fuels and Environmental Concerns

State Farm's investment portfolio includes fossil fuel companies, which raises environmental concerns and potential reputational risks. These investments may conflict with growing environmental, social, and governance (ESG) standards. The company faces pressure to align its investments with climate goals.

- In 2023, the global fossil fuel industry saw investments of over $950 billion.

- State Farm's ESG ratings and disclosures are under increasing stakeholder scrutiny.

- Reputational damage could affect customer loyalty and brand value.

- Regulatory changes related to climate could impact investment returns.

Influence on Underwriting and Pricing

Environmental factors significantly impact State Farm's underwriting and pricing strategies. Climate change is intensifying, leading to more frequent and severe weather events like hurricanes and wildfires, which directly affect property and casualty claims. This necessitates updated risk models and can lead to higher premiums in high-risk areas. State Farm, in 2024, reported a substantial increase in claims related to extreme weather, reflecting these environmental pressures.

- 2024 saw a 15% increase in weather-related claims.

- Risk models are being updated annually to account for climate change.

- Premiums in some regions have risen by up to 10%.

Environmental issues pose major challenges for State Farm. Climate change increases disaster frequency and intensity, affecting claims and financial results. In 2024, weather-related claims saw a significant rise. State Farm faces regulatory changes and must adapt its risk assessment and pricing models.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Climate Change | Increased claims, risk | 15% rise in claims |

| Regulations | Compliance, investment changes | ESG investments +15% |

| Geographic Footprint | Exposure to risk | Billions in payouts |

PESTLE Analysis Data Sources

The analysis uses governmental databases, financial reports, and industry publications. Data is pulled from market research firms and technology forecasts.