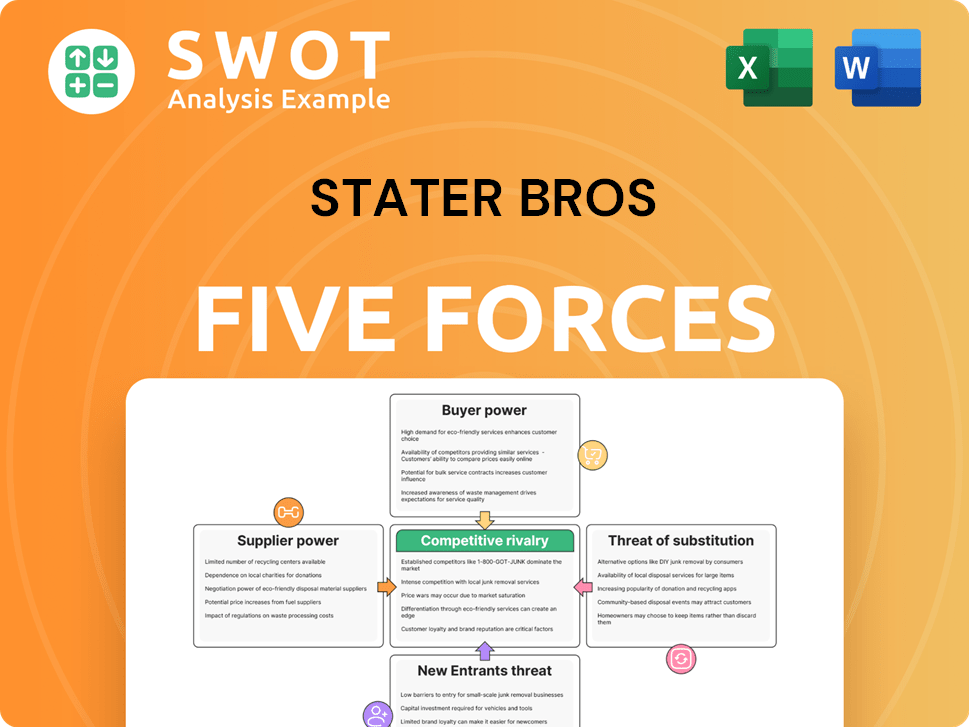

Stater Bros Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Stater Bros Bundle

What is included in the product

Detailed analysis of each competitive force, supported by industry data and strategic commentary.

Instantly reveal competitive threats with clear charts and easy-to-understand summaries.

Full Version Awaits

Stater Bros Porter's Five Forces Analysis

This preview details the Porter's Five Forces analysis of Stater Bros. It examines industry rivalry, supplier power, buyer power, threat of substitutes, and threat of new entrants. The analysis provides strategic insights into Stater Bros' competitive landscape. You're looking at the actual document. Once you complete your purchase, you’ll get instant access to this exact file.

Porter's Five Forces Analysis Template

Stater Bros operates within a competitive grocery market, facing pressures from established players, discounters, and evolving consumer preferences. Analyzing the Porter's Five Forces reveals the intensity of these competitive dynamics. Examining buyer power is critical, given consumer choice. Supplier influence, particularly from food manufacturers, is another key factor. Competition from substitutes, like online grocery services, is significant. The threat of new entrants and competitive rivalry shape Stater Bros' strategic landscape.

Our full Porter's Five Forces report goes deeper—offering a data-driven framework to understand Stater Bros's real business risks and market opportunities.

Suppliers Bargaining Power

Stater Bros. benefits from a diverse supplier network, which limits the influence of individual suppliers. This setup enables Stater Bros. to find alternative sources if a supplier's terms are unfavorable. With multiple options, Stater Bros. can negotiate better prices and maintain product quality. For example, in 2024, Stater Bros. sourced from over 500 suppliers.

Many grocery products are standardized, allowing Stater Bros. to switch suppliers. Commodities like produce and canned goods lack significant differentiation. This standardization reduces supplier power, as Stater Bros. finds alternatives easily. For example, in 2024, Stater Bros. sourced produce from multiple vendors, ensuring supply diversity. This strategy helps maintain competitive pricing and product availability.

Stater Bros., as a major supermarket chain, uses its significant purchasing volume to negotiate beneficial terms with suppliers. This bulk-buying strategy gives Stater Bros. substantial bargaining power, allowing the company to secure lower prices and advantageous payment schedules. For instance, in 2024, large grocery chains like Stater Bros. were able to negotiate discounts of up to 10% on high-volume product orders.

Supplier Competition

Supplier competition is fierce in the grocery sector, impacting Stater Bros. Suppliers fight for shelf space, putting downward pressure on prices. Retailers like Stater Bros benefit from this dynamic. Incentives are often offered to secure distribution. This boosts Stater Bros' profitability.

- Grocery sales in the US reached approximately $800 billion in 2024.

- Supplier profit margins in the grocery industry average 3-5%.

- Shelf space is highly competitive, with thousands of products vying for placement.

- Stater Bros operates over 170 stores, giving it significant buying power.

Private Label Alternatives

Stater Bros. can reduce supplier power by offering private label products. These store brands serve as alternatives, increasing negotiating leverage with national brands. Promoting private label goods allows Stater Bros. to control pricing and margins better. In 2024, private label sales accounted for about 20% of total grocery sales, showing their impact. The company's focus on its own brands strengthens its market position.

- Private label sales make up approximately 20% of grocery sales.

- Private labels offer alternatives to national brands.

- Stater Bros. can better control pricing with private labels.

- This strategy boosts Stater Bros.' market position.

Stater Bros. has substantial bargaining power over suppliers, reducing their influence. A diverse supplier base and the availability of standardized products further limit supplier power. This allows Stater Bros. to negotiate favorable terms and pricing. In 2024, this strategy helped to secure better deals.

| Factor | Impact | Example (2024) |

|---|---|---|

| Supplier Diversity | Reduces supplier power | Sourcing from over 500 suppliers |

| Product Standardization | Easier to switch suppliers | Standardized produce and canned goods |

| Buying Power | Negotiate better terms | Discounts up to 10% on bulk orders |

Customers Bargaining Power

Customers in the grocery market are price-sensitive, especially in Southern California. Stater Bros. must maintain competitive pricing and offer promotions. Price awareness increases customer bargaining power. In 2024, grocery price inflation in the US was around 2.2%. This sensitivity impacts profitability.

Consumers can choose from many grocery stores, like Kroger and Walmart. This wide choice boosts their power, letting them switch easily. Stater Bros. needs to stand out to keep customers. In 2024, the grocery market saw a 3.2% shift in consumer spending habits due to the presence of substitute options.

Grocery shoppers face low switching costs; they can easily change stores. This mobility gives customers power, forcing Stater Bros. to stay competitive. Loyalty programs help, yet customers remain highly mobile. In 2024, the average U.S. household spent about $6,000 on groceries, highlighting customer influence.

Access to Information

Customers wield significant bargaining power due to readily available information. Online platforms and mobile apps offer instant access to pricing, product details, and promotional offers, fostering price transparency. This empowers consumers to make informed choices and compare offerings, enhancing their ability to negotiate. For instance, in 2024, online grocery sales in the U.S. reached $106.9 billion, highlighting the impact of digital information.

- Online price comparisons lead to increased customer leverage.

- Transparency in pricing and promotions enhances customer decision-making.

- Digital platforms facilitate informed customer choices.

- Empowered customers can negotiate better terms.

Demand for Quality and Service

Customers' expectations for high-quality products and superior service are constantly rising. Stater Bros. needs to prioritize investments in these areas to satisfy customer demands and foster loyalty. Neglecting these aspects can cause customers to switch to competitors, especially in the competitive grocery market. This is crucial considering the intense competition in the supermarket sector, where even minor service failures can lead to customer churn.

- In 2024, customer satisfaction scores for grocery retailers showed a significant correlation with loyalty, with a 10% increase in satisfaction leading to a 5% rise in repeat business.

- Stater Bros. must meet the needs of the customers to keep up with the latest trends.

- Failure to meet these demands can lead to a loss of customers.

- The customer is always right.

Customers' bargaining power in the grocery sector is substantial due to price sensitivity and market choices.

Price transparency and readily available information online enable informed decisions, fostering negotiation leverage for consumers.

Meeting high-quality expectations and service demands is crucial, as even small failures can shift customers. For 2024, the average consumer spent roughly $6,000 on groceries, indicating the considerable customer influence.

| Factor | Impact | 2024 Data |

|---|---|---|

| Price Sensitivity | High | Grocery price inflation: 2.2% |

| Market Choice | Significant | Consumer spending shift due to substitutes: 3.2% |

| Switching Costs | Low | Online grocery sales in US: $106.9B |

Rivalry Among Competitors

The Southern California grocery scene is a battlefield. Major chains and niche stores aggressively compete for customers. This drives down prices and squeezes profits. Stater Bros. needs to stand out to survive. In 2024, the grocery market saw razor-thin margins.

Frequent price wars among competitors, like those seen in the grocery sector, can significantly erode profitability. Retailers often use aggressive pricing to lure customers, which can squeeze margins. For example, in 2024, the average profit margin for U.S. supermarkets was around 2%. Stater Bros. must balance competitive pricing with the need to stay profitable.

Differentiating in the grocery market is tough due to product standardization. Stater Bros. needs to excel in areas like customer service and community ties. Consider that in 2024, the top grocery retailers in the US compete fiercely on these factors. A unique shopping experience is essential for Stater Bros. to stand out from its competitors.

Market Saturation

The Southern California grocery market is highly competitive, with numerous established players vying for consumer dollars. This saturation restricts organic growth, compelling Stater Bros. to fight hard to keep its market share. To succeed, the company relies on strategic store locations and focused marketing campaigns. In 2024, the grocery sector saw a 3.5% increase in competitive activity.

- Market saturation limits organic growth.

- Stater Bros. must aggressively compete.

- Strategic store placement is key.

- Targeted marketing is essential for customer acquisition.

Consolidation Trends

The grocery sector is experiencing consolidation, with major players buying smaller ones. This boosts competitive pressure on chains like Stater Bros. In 2024, Kroger and Albertsons faced regulatory hurdles for their merger, indicating scrutiny of such deals. Adapting and staying competitive is key in this evolving market.

- Kroger and Albertsons merger faced regulatory challenges in 2024.

- Consolidation increases competitive pressure.

- Independent chains must adapt.

Competitive rivalry in the SoCal grocery market is intense. Stater Bros. faces pressure from major chains and niche stores, impacting profit margins. The market's saturation restricts growth, requiring strategic efforts to maintain market share. In 2024, competition drove prices down, affecting all players.

| Metric | 2024 Data | Impact |

|---|---|---|

| Average Supermarket Profit Margin | ~2% | Squeezed profitability |

| Increase in Competitive Activity | 3.5% | Heightened pressure |

| Kroger/Albertsons Merger Challenges | Regulatory Scrutiny | Industry Consolidation |

SSubstitutes Threaten

Consumers have numerous options beyond traditional supermarkets. Discount stores like Walmart and Target, along with warehouse clubs such as Costco, present viable alternatives for grocery shopping. These formats often attract budget-minded shoppers, intensifying the competitive landscape. In 2024, Walmart's grocery sales reached approximately $260 billion, reflecting strong consumer preference. Stater Bros. must provide exceptional value to maintain customer loyalty.

Meal kit and delivery services pose a growing threat. These services offer convenience, appealing to busy consumers. In 2024, the meal kit market reached approximately $5.2 billion. Stater Bros. needs to compete by offering its own convenient meal solutions. This could involve ready-to-eat meals or partnerships.

Restaurants and takeout pose a threat as substitutes for groceries. The convenience of dining out competes directly with home cooking. With options like McDonald's and Chipotle, Stater Bros. faces competition for consumer dollars. In 2024, restaurant sales are projected to be about $1 trillion, highlighting the significant diversion of spending. Stater Bros. needs to highlight the cost savings and health benefits of home-cooked meals to remain competitive.

Convenience Stores

Convenience stores pose a threat as substitutes, offering limited grocery selections but with the advantage of quick access. They capitalize on impulse buys and immediate needs, making them a viable option for certain consumers. In 2024, the convenience store market in the U.S. is valued at approximately $300 billion, reflecting their significant presence. Stater Bros. needs to compete by focusing on value and variety.

- Convenience stores offer easy access for quick shopping.

- They often have higher prices due to their convenience factor.

- Stater Bros. must provide better value to compete effectively.

- The U.S. convenience store market was worth ~$300B in 2024.

Farmers Markets and Specialty Stores

Farmers markets and specialty stores present a threat to Stater Bros. by offering unique, high-quality products. These alternatives appeal to consumers seeking fresh, local, and artisanal goods, potentially diverting customers. To compete, Stater Bros. could collaborate with local producers to supply similar items. This strategic move helps retain customers.

- Specialty food stores revenue in the US reached $200 billion in 2024.

- Farmers market sales in the US were around $4 billion in 2024.

- Stater Bros. has around 170 stores in Southern California as of late 2024.

The threat of substitutes significantly impacts Stater Bros' market position. Consumers can choose from discount stores, meal kits, restaurants, and convenience stores. In 2024, restaurants took up about $1T in sales, highlighting a huge diversion of spending. These alternatives force Stater Bros. to focus on value and convenience.

| Substitute | 2024 Market Size (Approx.) | Impact on Stater Bros. |

|---|---|---|

| Walmart Grocery Sales | $260 Billion | Requires exceptional value to keep customers. |

| Meal Kit Market | $5.2 Billion | Needs its own convenient meal solutions. |

| Restaurant Sales | $1 Trillion | Must highlight home-cooking benefits. |

| Convenience Stores | $300 Billion | Focus on value and variety. |

Entrants Threaten

High capital requirements are a barrier. Starting a supermarket chain demands substantial investment. This includes real estate, inventory, and store infrastructure. These large initial costs make it tough for new competitors to enter the market. Stater Bros. leverages its existing infrastructure and scale, giving it an edge.

Stater Bros. enjoys robust brand loyalty, a significant barrier for new entrants. New supermarkets face the challenge of building brand recognition and trust. This advantage allows established brands to maintain customer bases, as seen in 2024 market share data. Brand loyalty reduces the threat of new competitors.

The grocery sector faces stringent regulations concerning food safety, zoning, and environmental standards. These regulations, like the Food Safety Modernization Act, demand substantial investment in compliance. New entrants, such as innovative delivery services, may struggle with these high initial costs. Compliance with regulations acts as a significant barrier, potentially impacting profitability and market entry.

Established Supply Chains

Established supermarket chains like Stater Bros. benefit from strong supply chains, a significant barrier for new entrants. These chains have long-standing relationships with suppliers, ensuring access to goods and favorable terms. Building a comparable supply chain requires substantial investment and time, hindering new competitors. Efficient supply chain management is vital for competitive pricing and product availability.

- Walmart's supply chain costs are around 3-4% of sales, showcasing efficiency.

- New entrants often face higher initial supply chain costs.

- Negotiating power with suppliers is crucial for profitability.

- Stater Bros. can leverage its existing distribution network.

Competitive Pricing

The grocery market is fiercely competitive, which poses a significant challenge for new entrants regarding pricing. Established retailers like Kroger and Walmart, with their extensive scale and purchasing power, can offer highly competitive prices, making it tough for newcomers. To succeed, new entrants must differentiate themselves. They must find ways to provide unique value to attract and retain customers in this price-sensitive market.

- Kroger's market share in the U.S. grocery market was around 9% in 2024.

- Walmart holds a significant market share, underscoring the competitive landscape.

- Inflation continues to impact grocery prices, with private label brands gaining popularity.

The threat of new entrants to Stater Bros. is moderate, facing considerable hurdles. High capital costs for infrastructure and initial inventory act as a significant barrier. Stringent regulations, such as those related to food safety, also limit market entry.

Established brands also benefit from brand loyalty. Moreover, the competitive pricing environment and established supply chains further complicate the ability of new competitors to enter the market effectively.

New entrants struggle with scale, pricing, and supply chain dynamics. These factors collectively shape the intensity of competitive pressure.

| Barrier | Impact | Example |

|---|---|---|

| Capital Requirements | High initial investment | Real estate, inventory |

| Brand Loyalty | Customer retention | Existing customer base |

| Regulations | Compliance costs | Food Safety Modernization Act |

Porter's Five Forces Analysis Data Sources

This analysis leverages Stater Bros' financial reports, industry publications, and market share data. Competitive landscape data, including consumer trends, adds strategic depth.