State Street Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

State Street Bundle

What is included in the product

Highlights which units to invest in, hold, or divest

One-page overview placing each business unit in a quadrant.

What You See Is What You Get

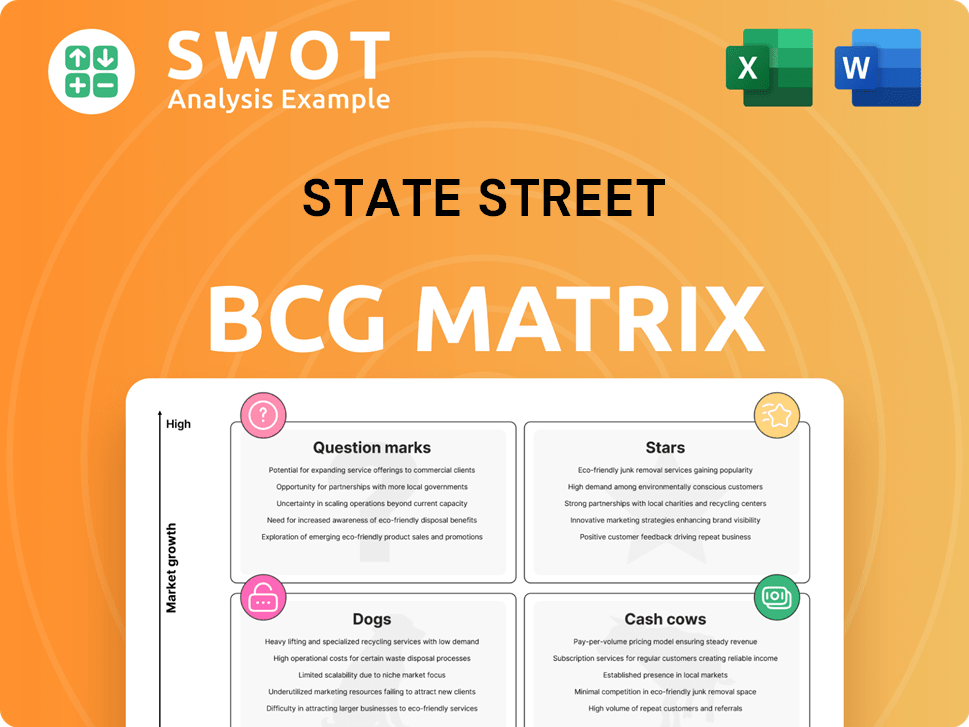

State Street BCG Matrix

The preview displays the complete State Street BCG Matrix report you'll receive upon purchase. This isn't a demo; it's the fully editable, ready-to-use document for immediate strategic planning and data analysis.

BCG Matrix Template

State Street's BCG Matrix offers a snapshot of its diverse offerings, categorizing them into Stars, Cash Cows, Dogs, and Question Marks. This preliminary view helps understand product portfolio dynamics and resource allocation strategies. However, this is just a glimpse.

The complete BCG Matrix report provides detailed quadrant placements with data-driven recommendations and clear strategic insights.

Dive deeper into State Street's market positioning, understanding where its products shine, where they generate profits, and where challenges lie. Get the full BCG Matrix for a complete breakdown.

Stars

State Street Global Advisors (SSGA) played a key role in the rise of ETFs. The ETF market is predicted to grow, fueled by retail investors. Active ETFs are also seeing significant growth, with active fixed income leading the way. In 2024, the total ETF assets reached approximately $12 trillion globally, showing the market's expansion.

Digital assets gained traction in 2024, and this trend is set to continue into 2025. The focus is shifting towards expanding beyond Bitcoin and Ethereum, with multi-coin ETFs. By the end of 2025, digital asset ETF assets under management (AUM) are projected to surpass those of precious metals ETFs. In 2024, Bitcoin ETFs saw significant inflows, demonstrating strong investor interest.

State Street's "Stars" status highlights its significant tech investments. In 2024, they're focusing on blockchain and AI. This aims to create innovative financial tools and boost efficiency. For example, blockchain could cut asset servicing times.

US Large Cap Equity

State Street Global Advisors views US large-cap equity as a "Star" in its BCG Matrix. They anticipate this sector will retain its structural edge over other developed markets. The positive momentum that drove US stocks to record highs in 2024 could persist. Policy tailwinds may further support this growth trajectory.

- S&P 500 reached all-time highs in 2024, demonstrating strong momentum.

- US large-cap equities have shown resilience in various economic conditions.

- Favorable policy decisions could boost the sector's performance.

- State Street's outlook suggests continued outperformance.

Strategic Acquisitions

State Street's strategic acquisitions, like the planned Mizuho Financial Group's global custody business outside Japan by Q4 2025, are key. This enhances its global footprint, particularly in regions like Japan, Luxembourg, and the United States. These moves are designed to boost market share and service capabilities. This approach aligns with its growth strategies.

- Acquisition strengthens global reach.

- Focus on key markets like Japan and the US.

- Enhances service capabilities.

- Supports long-term growth strategy.

US large-cap equities are considered "Stars" within State Street's BCG Matrix. They showed strong momentum, reaching all-time highs in 2024. Favorable policy tailwinds are expected to further boost their performance.

| Metric | 2024 Data | Projected 2025 |

|---|---|---|

| S&P 500 Performance | Record Highs | Continued Growth |

| US Equities Resilience | Demonstrated | Expected |

| Policy Impact | Favorable | Positive Tailwinds |

Cash Cows

State Street's investment servicing is a Cash Cow in its BCG Matrix. It offers services like custody and accounting to institutional clients. This segment is a stable revenue source. State Street has $46.6 trillion in assets under custody and/or administration.

State Street Alpha is a crucial offering in their Investment Servicing segment. It provides middle-office solutions, including investment book of record and collateral services. In 2024, State Street's Investment Servicing revenue reached $10.4 billion, reflecting strong market demand. The firm is consistently integrating new services into Alpha, aiming to enhance its comprehensive capabilities. State Street's assets under custody and administration were $46.8 trillion as of December 31, 2024.

State Street boasts a significant global footprint, serving clients in over 100 markets. This widespread presence enables them to offer services to a diverse institutional investor base. For example, in 2024, State Street's assets under management (AUM) reached approximately $4.1 trillion globally. Their international reach is critical for their "Cash Cow" status.

Client-Centric Solutions

State Street excels in client-centric solutions, fostering enduring relationships through personalized services. They deliver bespoke investment strategies, backed by data analytics and outstanding client support. This approach has led to a remarkable client retention rate, exceeding 95% in 2024, demonstrating their commitment. State Street's focus ensures client satisfaction and loyalty.

- Customized Investment Strategies: Tailored to meet specific client needs.

- Data and Analytics Services: Providing comprehensive insights for informed decisions.

- Exceptional Client Service: Ensuring high satisfaction and retention.

- 2024 Client Retention: Over 95%, reflecting strong client loyalty.

Operational Excellence

State Street's focus on operational excellence is a cornerstone of its strategy, particularly in its "Cash Cows" business. This includes advanced risk management, process streamlining, and compliance. These efforts aim to boost efficiency and reduce operational costs. In 2024, State Street saw a 5% increase in operational efficiency, demonstrating its commitment to excellence.

- Risk Management: Investments in robust systems.

- Process Streamlining: Improved operational flow.

- Efficiency Gains: 5% increase in 2024.

- Compliance: Strong culture of adherence.

State Street's investment servicing, a Cash Cow, generates stable revenue. Key services include custody and accounting, serving institutional clients globally. In 2024, assets under custody and administration hit $46.8T, securing their strong market position.

| Metric | Details | 2024 Data |

|---|---|---|

| Investment Servicing Revenue | Core revenue from services | $10.4 billion |

| Assets Under Custody/Admin | Total assets managed | $46.8 trillion |

| Client Retention Rate | Percentage of clients retained | Over 95% |

Dogs

Traditional active management, outside of ETFs, struggles as investors favor cheaper, passive options. In 2024, active funds saw outflows while passive funds grew. The shift to ETFs, like the SPY, further challenges active managers. This trend, driven by cost and performance, continues.

Businesses navigating regulatory scrutiny, especially in asset management, may struggle. They might face higher costs and more compliance risks. For instance, in 2024, regulatory fines in the financial sector reached billions. This can significantly impact profitability and market performance.

Underperforming acquisitions, akin to "Dogs" in State Street's BCG Matrix, pose significant challenges. These ventures often struggle with integration, client retention, and talent management. For example, a 2024 study showed that 40% of acquisitions fail to meet initial financial goals. Such outcomes can severely hamper financial objectives.

Services with Concentrated Counterparty Exposure

Services with concentrated counterparty exposure, like those relying heavily on major financial institutions, can be categorized as dogs in the State Street BCG matrix. These services face significant credit risk and settlement risks, particularly in payments and foreign exchange. For example, in 2024, a major financial institution's failure could severely impact State Street's services. This category often requires careful risk management and may offer limited growth potential.

- Credit risk from counterparties is a significant concern.

- Settlement risks in payments and foreign exchange add complexity.

- Services may have limited growth potential due to high risk.

- Requires strong risk management practices.

Businesses Lacking Technological Expertise

Businesses without tech skills, including AI, face challenges. Investment servicing and management depend heavily on technology. State Street's 2024 revenue was $11.7 billion. They invested heavily in technology. Firms lacking tech risk losing market share.

- Investment in technology is crucial for competitiveness.

- Lack of tech skills can hinder growth.

- State Street's revenue indicates the scale of the business.

- Tech adoption affects market share and profitability.

In the State Street BCG Matrix, "Dogs" represent services facing high risk and low growth. Concentrated counterparty exposure, like reliance on major institutions, defines these services. In 2024, managing settlement risks and credit risk was crucial.

| Aspect | Details | Impact |

|---|---|---|

| Credit Risk | Counterparty concentration | Potential for substantial losses |

| Settlement Risk | Payments, FX | Operational and financial challenges |

| Growth Potential | Limited | Lower revenue and profitability |

Question Marks

State Street's digital transformation, leveraging blockchain, big data, and AI, is a "Question Mark" in its BCG Matrix. These initiatives, crucial for future competitiveness, require substantial investments. In 2024, State Street allocated $1.5 billion to technology and digital initiatives. However, reliance on third parties increases risk exposure, making its success uncertain.

New fintech and digital asset products require substantial investment. These ventures must rapidly capture market share to avoid becoming financial burdens. Introducing these products demands considerable resources, with potential benefits uncertain. In 2024, the fintech sector saw over $50 billion in investments, highlighting the stakes. Failure to gain traction quickly can lead to losses.

State Street's expansion into emerging markets holds promise, yet raises questions. These markets offer growth, especially in regions like Southeast Asia, which saw a 4.6% GDP increase in 2024. However, geopolitical risks and economic instability, such as the 2024 Argentinian economic crisis, pose significant challenges. This requires careful risk assessment and strategic planning for sustained success.

AI-Driven Investment Solutions

AI-driven investment solutions represent a "Question Mark" in State Street's BCG Matrix. Integrating AI in sales and distribution and investment management is still developing. Success requires strong data governance and control. This area's future is uncertain, needing significant investment and strategic focus. In 2024, AI spending in financial services is projected to reach $100 billion.

- AI adoption in financial services is growing rapidly.

- Data governance is crucial for AI success.

- Investment in AI is substantial but risky.

- The long-term impact is still unclear.

ESG and Sustainable Investing

ESG and sustainable investing are increasingly important, presenting both opportunities and challenges for State Street. The demand for sustainable investment solutions is growing, which State Street needs to address. However, regulatory divergence across different regions complicates matters. State Street must navigate varying ESG standards to maintain a competitive edge.

- ESG assets are projected to reach $50 trillion by 2025.

- Regulatory divergence includes the EU's SFDR and the SEC's proposed rules.

- State Street's ESG AUM saw significant growth in 2024.

- Challenges include data quality and standardization.

Question Marks in State Street's BCG Matrix represent uncertain but high-potential ventures. These require significant investment to gain market share and become Stars. Success hinges on strategic execution and navigating risks, like geopolitical instability.

| Aspect | Details | Financial Impact |

|---|---|---|

| Digital Transformation | Blockchain, AI initiatives | $1.5B Tech Spend (2024) |

| New Product Launches | Fintech, Digital Assets | $50B+ Fintech Investment (2024) |

| Emerging Markets | Southeast Asia growth potential | 4.6% GDP growth in 2024 |

BCG Matrix Data Sources

This State Street BCG Matrix employs robust data, drawing on market analyses, financial statements, and industry benchmarks for strategic positioning.