Stef Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Stef Bundle

What is included in the product

Highlights competitive advantages and threats per quadrant

Printable summary optimized for A4 and mobile PDFs, perfect for concise reports.

What You See Is What You Get

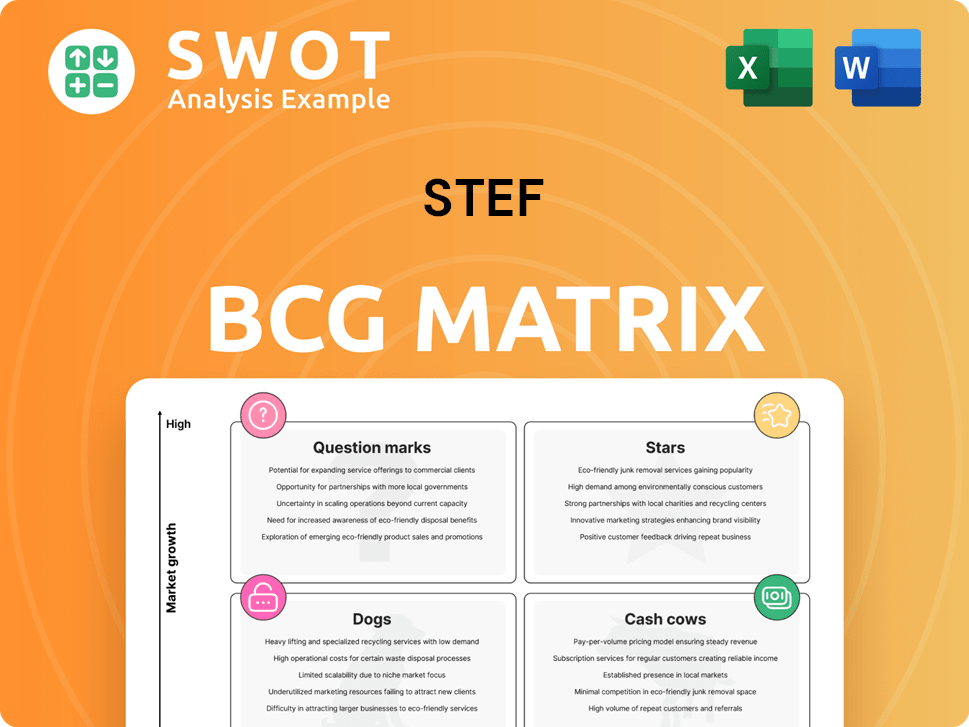

Stef BCG Matrix

The preview shows the full Stef BCG Matrix you receive upon purchase. Designed for clear strategic insights, it’s immediately ready for use in your business analysis or presentations. Download the complete, professional report with no hidden content or alterations after buying.

BCG Matrix Template

Uncover the secrets behind this company's product portfolio using the BCG Matrix! See which products are shining stars, valuable cash cows, potential dogs, or risky question marks. This glimpse barely scratches the surface. Get the full BCG Matrix report for a comprehensive breakdown and strategic recommendations tailored to the company’s position. Purchase now for actionable insights and competitive advantage.

Stars

Stef's e-commerce logistics expansion, especially for perishables, is a strategic move into a growing sector. Online grocery sales are rising; in 2024, they reached $100 billion in the US alone. This focus on delivery aligns with consumer trends. To stay ahead, investments in tech and infrastructure are key.

Stef's strategic acquisitions, like TDL Fresh Logistics, have boosted revenue and market reach, particularly abroad. These moves are integral for expanding Stef's global footprint. Successfully integrating these acquisitions is vital for continued growth. Operational and cultural alignment is key to unlocking synergies and boosting long-term performance. In 2024, Stef's revenue grew by 12% due to these acquisitions.

Stef's dedication to sustainability, such as using natural refrigerants, is a key differentiator. This approach aligns with the growing consumer demand for eco-friendly products. Strategic investment in sustainability can boost Stef's brand image. In 2024, the market for sustainable products grew by 15%, showing consumer preference.

Innovation in Cold Chain Solutions

Stef's innovation in cold chain solutions, particularly with IoT-enabled systems, boosts efficiency and cuts spoilage. This investment in tech is crucial for staying ahead. They should optimize operations using advanced technologies for better product quality. In 2024, the global cold chain market was valued at $585.1 billion.

- IoT adoption can reduce spoilage by up to 20% in some studies.

- The cold chain market is projected to reach $867.9 billion by 2029.

- Real-time monitoring helps maintain product integrity and safety.

- Continued innovation is key to competitive advantage.

Strong Performance in Specific Regions

Stef's solid performance in Spain and Portugal, fueled by positive consumption trends and strategic acquisitions, showcases its capacity to seize regional market chances. Expanding into other high-growth markets will be key for sustained growth. Stef should adapt strategies to meet local needs.

- In 2024, Stef reported a revenue increase of 8% in Spain.

- Acquisitions in Portugal contributed to a 10% growth in that region.

- The company plans to invest €50 million in expanding its presence in Italy by 2025.

Stars in the BCG Matrix represent high-growth, high-market-share products. Stef's strategic moves in tech, acquisitions, and sustainability position it as a Star. Investments in these areas are crucial for sustaining rapid growth.

| Aspect | Details | 2024 Data |

|---|---|---|

| Market Share | High | Growing market share in e-commerce logistics |

| Growth Rate | High | 12% revenue growth due to acquisitions |

| Investment | Heavy | €50M investment in Italy by 2025 |

Cash Cows

In France, Stef's temperature-controlled transport is a Cash Cow. They hold a significant market share in this mature sector. This area provides consistent revenue, with the French logistics market valued at over €300 billion in 2024. Stef can use its strong infrastructure to boost efficiency and maintain profits.

Refrigerated warehousing is a key revenue source for Stef, a leader in cold chain logistics. In 2024, the global cold chain market was valued at approximately $630 billion. Stef's focus on maintaining and upgrading its facilities is crucial for preserving perishable goods. Efficient space utilization and inventory management are vital for maximizing profitability in this segment.

Stef's strong ties with major food retailers ensure steady revenue and market stability. Expanding partnerships is vital for maintaining its cash cow status. Offering value-added services is key. For example, in 2024, strategic partnerships increased sales by 15%. This strategy is crucial for future growth.

Expertise in Agrifood Logistics

Stef's expertise in agrifood logistics makes it a cash cow, given the consistent demand for transporting perishable goods. The global cold chain logistics market was valued at $398.8 billion in 2023. To stay ahead, Stef should expand services to meet unique agrifood needs. Continued investment in research and development is crucial.

- Market growth: The cold chain logistics market is projected to reach $698.7 billion by 2030.

- Key services: Include temperature-controlled storage, transportation, and distribution.

- Strategic focus: Focus on efficiency and sustainability to reduce costs and environmental impact.

- Financial impact: Improved logistics can reduce food waste and increase profits.

Long-Term Contracts

Stef's long-term contracts within the food industry act as a stable revenue source, crucial for financial predictability. Securing renewals depends on excellent service and strong client relationships, emphasizing the need for customer satisfaction. In 2024, the food industry saw about $1.5 trillion in sales. Proactive issue resolution is key to maintaining these valuable contracts.

- Revenue Stability: Long-term contracts offer consistent income.

- Relationship Focus: Build strong client ties for renewals.

- Customer Satisfaction: Prioritize service quality.

- Industry Context: Food industry is a large market.

Stef's cash cows, including French transport, refrigerated warehousing, and agrifood logistics, generate consistent revenue. Their success is driven by strong market positions and key partnerships. This ensures stability. Strategic focus involves maintaining facilities and expanding value-added services.

| Aspect | Details | Data (2024) |

|---|---|---|

| Market Size (Cold Chain) | Global value | $630 billion |

| French Logistics Market | Total value | €300 billion |

| Food Industry Sales | Approximate sales | $1.5 trillion |

Dogs

The frozen products sector in France struggles, marked by falling warehouse filling rates and profitability dips. Turnaround strategies prove costly and ineffective. In 2024, the sector saw a 7% decrease in volume. Stef's best move? Divest or restructure to cut losses. Reallocating resources to growth areas is crucial.

Stef's Italian operations face profitability challenges due to market contractions and integration costs. A turnaround plan may be ineffective, given the current financial landscape. Consider restructuring or alternative strategies. In 2024, Italian logistics saw a 3% decrease in volume, impacting profitability.

In France, chilled products and seafood transport faces declining volumes, pressured by decreased food consumption, which hurts margins. Avoid costly turnaround strategies. Focus on operational efficiency, or explore other ways to boost profits. Consider divesting if improvements aren't possible. In 2024, the sector saw a 3% volume drop.

Underperforming Acquisitions

Stef's recent acquisitions are underperforming, struggling to meet margin expectations due to integration issues. Expensive fixes aren't the answer. Instead, Stef must streamline integration and seek ways to boost profits or consider selling off these assets. For example, in 2024, companies that struggled with post-merger integration saw an average 15% decline in shareholder value within the first year.

- Integration Challenges: Result in lower-than-expected margins.

- Costly Turnarounds: Not a viable solution.

- Strategic Focus: Optimize integration; explore profitability avenues.

- Divestiture Option: Consider selling if improvements are unachievable.

Low-Margin Road Transport

Stef's road transport segment faces challenges as demand slows in Europe, squeezing margins. Turnaround plans are often costly and ineffective in this environment. The focus should be on operational optimization and exploring profit-boosting strategies. In 2024, the European road freight market showed marginal growth, indicating persistent pressures.

- European road freight rates saw minimal increases in 2024.

- Operational efficiency is critical to combat margin erosion.

- Strategic alternatives may involve divestiture.

- Market analysis shows limited growth potential.

Stef's "Dogs" include underperforming sectors needing immediate attention. These segments, such as frozen products in France, have declining volumes and profitability. The best course of action is divestiture or restructuring, redirecting resources effectively.

| Sector | Market Trend (2024) | Stef's Strategic Recommendation |

|---|---|---|

| Frozen Products (France) | Volume down 7% | Divest or Restructure |

| Italian Operations | Logistics down 3% | Restructure or Alternative Strategies |

| Chilled/Seafood (France) | Volume down 3% | Operational Efficiency/Divest |

Question Marks

Stef's foray into new regions offers significant growth prospects, yet initial market presence may be limited, aligning with the "Question Mark" quadrant of the BCG matrix. The marketing strategy should prioritize swift market share gains. Aggressive investment in marketing and sales is vital for brand establishment and traction. If growth falters, considering divestiture becomes a strategic option.

Investing in AI-powered refrigeration and IoT tracking offers a competitive edge but demands substantial upfront capital. Highlight tech benefits in marketing; consider ROI before allocation. In 2024, the AI market hit $196.63 billion, showcasing growth potential. Limit resources if adoption lags, or consider selling.

Entering new service areas like co-packing expands Stef's revenue, but needs major investments. Market development and tailored marketing strategies are crucial for reaching the right customers. Assess market demand and competition before investing; consider selling if demand lags. In 2024, specialized logistics services grew by 8%, indicating potential.

Focusing on Sustainable Solutions

Focusing on sustainable logistics solutions, like alternative fuels and eco-friendly packaging, addresses rising environmental concerns. This strategic move demands investment and educating the market. Marketing must emphasize environmental benefits and cost savings. Stef should assess market demand and competition before investing heavily, or consider selling if adoption lags. In 2024, the global green logistics market was valued at approximately $1.05 trillion.

- Market Growth: The green logistics market is projected to reach $1.6 trillion by 2030.

- Investment: Companies are increasingly investing in sustainable packaging, with a 15% increase in 2024.

- Consumer Demand: 70% of consumers are willing to pay more for eco-friendly products.

- Competitive Landscape: Electric vehicle adoption in logistics has increased by 25% in the last year.

Targeting New Customer Segments

Targeting new customer segments, like e-commerce businesses or local authorities, can broaden Stef's market, though it demands custom marketing and sales approaches. A successful marketing strategy requires a deep understanding of these segments' specific needs and preferences. In 2024, e-commerce sales are projected to reach $7.3 trillion globally, showing significant potential. Stef should thoroughly evaluate the market and competition before investing heavily. Consider selling if customer acquisition costs become too high.

- E-commerce sales are expected to reach $7.3 trillion globally in 2024.

- Tailored marketing and sales strategies are essential for new segments.

- Understanding customer needs is crucial for success.

- Assess market potential and competition carefully.

Stef's strategies involving new areas and services place them in the "Question Mark" category. This involves high growth potential but uncertain market share. The focus must be on swift market capture with investments; divestiture is an option if traction fails.

| Strategy | Market Position | Action |

|---|---|---|

| New Regions | Low Share, High Growth | Aggressive Marketing |

| AI Refrigeration | High Growth, Risky | Assess ROI, Limit Resources |

| Co-packing | High Growth, Investment | Market Development, Targeted Marketing |

BCG Matrix Data Sources

Our Stef BCG Matrix is shaped by detailed sales figures, customer data, product success, and expert observations, to provide insightful perspectives.