ST Engineering Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ST Engineering Bundle

What is included in the product

Tailored analysis for the featured company’s product portfolio

Printable summary optimized for A4 and mobile PDFs, offering easy understanding of business performance.

What You See Is What You Get

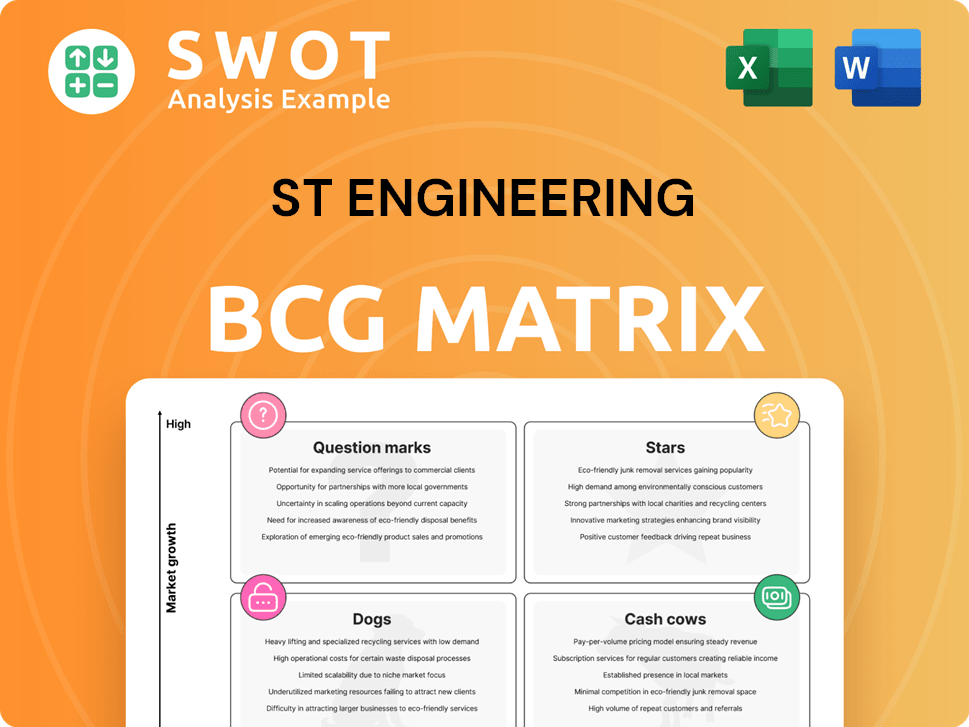

ST Engineering BCG Matrix

The ST Engineering BCG Matrix preview is identical to the file you'll download. After purchase, you'll receive the full, ready-to-use report with professional formatting and in-depth analysis.

BCG Matrix Template

ST Engineering's BCG Matrix reveals its product portfolio's strengths and weaknesses. See which offerings are Stars, poised for growth, and which are Cash Cows, generating steady income. Identify the Dogs, requiring careful consideration, and the Question Marks, demanding strategic investment decisions. This snapshot is just a glimpse. Purchase the full version for in-depth quadrant analysis and strategic recommendations you can act on.

Stars

The Commercial Aerospace MRO is a star in ST Engineering's portfolio. This segment experiences high growth, fueled by rising air traffic. ST Engineering's MRO secured a 15-year contract with Akasa Air. The global commercial aircraft MRO market is forecast to reach $108.8 billion in 2024.

The Defense & Public Security Systems segment is a "Star" for ST Engineering, thriving on global defense spending. In 2024, this segment significantly boosted revenue, supported by demand for AI and cybersecurity solutions. ST Engineering's focus on advanced tech, like cloud infrastructure, strengthens its market position. This segment is critical for achieving ST Engineering's financial goals.

The Digital Systems & Cyber business is a star for ST Engineering, fueled by rapid growth in digital solutions and cybersecurity. This segment capitalizes on the worldwide digitalization trend and the need for robust cyber protection. ST Engineering's strengths in AI-driven command systems and cloud-based security services drive its growth. In 2024, this sector saw a 20% revenue increase, reflecting strong market demand.

Smart Mobility Solutions

ST Engineering's Smart Mobility solutions are a star within the Urban Solutions & Satcom segment, driven by the push for sustainable transport. The company's rail contracts and smart junction projects in Asia place it well to benefit from this rising market. This segment aims to outpace industry growth, supporting sustainable urban development. In 2024, the Urban Solutions & Satcom segment contributed significantly to ST Engineering's revenue.

- Focus on sustainable transport systems.

- Involvement in Asian rail contracts.

- Aim to exceed industry growth rates.

- Contribution to sustainable cities.

Freighter Conversions (PTF)

ST Engineering's Passenger-to-Freighter (PTF) conversions are a shining star. This segment excels, surpassing its 2021 Investor Day revenue goals ahead of schedule. It thrives on the growing need for cargo transport and efficient freighter solutions. ST Engineering's PTF expertise fuels significant revenue growth, solidifying its star status.

- In 2023, ST Engineering's Aerospace segment, which includes PTF conversions, reported a 17% year-over-year revenue increase.

- The company's order book for PTF conversions is robust, with deliveries extending into 2026.

- The global air cargo market is projected to grow, supporting continued demand for PTF conversions.

- ST Engineering has invested in expanding its PTF conversion capabilities, including new facilities and partnerships.

ST Engineering's "Stars" consistently drive growth, capitalizing on high-demand markets. These segments, like Commercial Aerospace MRO, Defense & Public Security Systems, Digital Systems & Cyber, and Smart Mobility, show robust revenue increases. Passenger-to-Freighter (PTF) conversions also shine, exceeding goals.

| Segment | Key Drivers | 2024 Revenue Growth (approx.) |

|---|---|---|

| Commercial Aerospace MRO | Rising Air Traffic, New Contracts | Forecasted to reach $108.8B market in 2024 |

| Defense & Public Security | Global Defense Spending, AI, Cybersecurity | Significant revenue boost in 2024 |

| Digital Systems & Cyber | Digitalization, Cybersecurity Demand | 20% increase in 2024 |

| Smart Mobility | Sustainable Transport, Rail Contracts | Significant contribution to revenue in 2024 |

| PTF Conversions | Growing Cargo Transport Needs | Aerospace segment up 17% YoY in 2023 |

Cash Cows

ST Engineering's legacy aerospace manufacturing is a cash cow, providing consistent cash flow. These mature businesses boast a strong market share. However, growth is slower than in other segments. In 2024, this sector likely contributed significantly to overall revenue, but expansion is limited. Recent financial reports show steady profitability.

Certain traditional land systems within ST Engineering's Defense & Public Security segment can be considered cash cows. These established offerings, like armored vehicles, hold a strong market share but show modest growth. For instance, in 2024, the Land Systems sector generated a substantial revenue, contributing significantly to the company's overall financial performance. They provide a steady income stream.

Established Satcom technologies represent cash cows for ST Engineering, providing steady revenue from a solid customer base. These technologies, while profitable, experience slower growth due to rising competition. ST Engineering's 2023 revenue from the Satcom segment was $1.2 billion. The company aims to revitalize this segment, with a strategic focus on innovation and market expansion to regain growth momentum.

Public Safety and Security Solutions (Singapore Core)

In ST Engineering's BCG matrix, Public Safety and Security Solutions within the Defence & Public Security segment, specifically for the Singapore market, are classified as cash cows. These solutions, designed for Singapore, enjoy consistent demand, leading to stable revenue streams. The strategy emphasizes maintaining and optimizing these already established, profitable operations. For instance, in 2024, ST Engineering's Defence & Public Security sector reported robust revenue, reflecting the consistent demand for these solutions.

- Consistent demand ensures steady revenue.

- Focus is on maintaining and optimizing operations.

- Solutions are tailored for the Singapore market.

- The Defence & Public Security sector saw robust revenue in 2024.

MRO Services for Mature Aircraft

Maintenance, Repair, and Overhaul (MRO) services for mature aircraft are a cash cow for ST Engineering. These services benefit from steady demand for existing aircraft, ensuring a stable revenue flow. ST Engineering's global presence and expertise help maintain its strong market position. The MRO sector is expected to grow, with a market size of $88.6 billion in 2024.

- MRO services provide predictable revenue.

- ST Engineering has a strong global presence.

- The MRO market is large and growing.

- Demand for MRO is consistent.

Cash cows in ST Engineering's portfolio generate consistent revenue with low investment needs. These established businesses boast strong market positions in mature markets. This translates to stable profits and cash flow. In 2024, cash cow segments like aerospace manufacturing and MRO services contributed significantly to ST Engineering's financials, ensuring financial stability.

| Business Segment | Characteristics | 2024 Financial Impact |

|---|---|---|

| Aerospace Manufacturing | Strong market share, slower growth | Steady revenue contribution |

| Land Systems | Established, modest growth | Significant revenue |

| Satcom Technologies | Steady revenue, competition | $1.2B (2023 revenue) |

Dogs

Satcom hardware facing obsolescence, like older terminals, aligns with the Dogs quadrant. These products have low market share and limited growth. For example, legacy VSAT equipment sales decreased by 10% in 2024. This suggests divestiture might be considered.

In ST Engineering's BCG matrix, commoditized component manufacturing, characterized by low margins and minimal differentiation, falls under the "Dogs" category. These activities, facing fierce price competition, offer limited growth prospects. For instance, in 2024, certain component manufacturing segments showed profit margins under 5% due to global competition. This situation often leads to consideration of divestment to improve overall portfolio performance. These businesses struggle to compete.

Niche legacy defense products at ST Engineering, like certain older radar systems, likely fit the "Dogs" category. These products face limited demand and slow market growth. For example, sales of legacy defense systems decreased by 5% in 2024. Their contribution to overall revenue is minimal compared to newer, high-growth areas.

Outdated Urban Solutions Technologies

Outdated urban solutions technologies, classified as "Dogs" in ST Engineering's BCG matrix, face diminishing market share and limited growth. These technologies, like legacy traffic management systems or obsolete waste disposal methods, struggle against modern, efficient alternatives. For instance, the global smart city market, estimated at $615.3 billion in 2023, highlights the shift away from these older technologies.

- Legacy systems face declining demand.

- Low growth potential and market share.

- Smart city tech market valued at $615.3B in 2023.

- Outdated tech replaced by newer solutions.

Low-Margin Government Contracts

Certain low-margin government contracts at ST Engineering can be categorized as dogs, consuming resources without significant financial gains. These contracts might be kept for strategic purposes, such as maintaining relationships or securing future opportunities, but they offer limited profitability. For example, in 2024, some defense contracts showed profit margins as low as 2%, indicating their dog status. Such situations can tie up capital and personnel, potentially hindering more profitable ventures.

- Low Profit Margins: Contracts with margins under 5%.

- Resource Intensive: Requiring significant capital and labor.

- Strategic Importance: Maintained for long-term relationship.

- Limited Financial Benefit: Contributing little to overall profit.

In ST Engineering's BCG matrix, the "Dogs" represent business units with low market share and minimal growth, often warranting divestiture. These include commoditized components and outdated technologies. Legacy defense systems and certain low-margin government contracts also fall under this category. These segments showed profit margins under 5% in 2024, while the smart city market was valued at $615.3 billion in 2023, highlighting shifts away from these areas.

| Category | Characteristics | 2024 Data |

|---|---|---|

| Satcom Hardware | Obsolescence, low growth | Legacy VSAT sales down 10% |

| Component Manufacturing | Low margins, price competition | Profit margins under 5% |

| Legacy Defense | Limited demand, slow growth | Sales decreased by 5% |

| Urban Solutions Tech | Diminishing market share | N/A |

| Govt. Contracts | Low margin, resource intensive | Some defense contracts 2% |

Question Marks

ST Engineering's AAM ventures, including eVTOL partnerships, are question marks. These ventures target a high-growth market, yet currently hold a low market share. Significant investment is needed for market acceptance, with potential for success but uncertain outcomes. In 2024, the AAM market is projected to reach $13.8 billion, with substantial growth expected by 2030.

ST Engineering's space sector projects, including collaborations with end-to-end space primes, are classified as question marks. The space sector promises substantial growth, potentially reaching $1 trillion by 2030. However, ST Engineering's market share is currently modest. Strategic investments are crucial for expansion.

New AI and cybersecurity solutions are question marks. They have high growth potential, driven by rising demand for advanced security and AI. However, their current market share is low. ST Engineering's focus could yield significant returns. Cybersecurity market is projected to reach $345.4 billion by 2026.

Smart City Digital Platforms

ST Engineering's smart city digital platforms are classified as question marks within the BCG matrix. These platforms, offering new integrated solutions, are in a high-growth market but lack significant market share. To compete, they need considerable investment in development, marketing, and strategic partnerships. For example, the global smart city market was valued at $607.8 billion in 2023 and is projected to reach $1.4 trillion by 2028.

- Market growth offers high potential but also high risk.

- Significant investment is needed for platform development.

- Partnerships are crucial for market penetration.

- Competition includes established industry players.

International Defense Expansion

ST Engineering's push into international defense markets, especially those with geopolitical risks, puts it in the "Question Mark" quadrant of the BCG Matrix. This means significant investment is needed to gain a foothold, build connections, and win contracts in these new areas. The defense market is expanding, creating opportunities but also uncertainty for ST Engineering. Success hinges on effective execution and strategic adaptation in these complex environments.

- Defense spending globally is expected to reach $2.7 trillion by 2024.

- ST Engineering's revenue from its defense and public security segment was $2.9 billion in 2023.

- Expansion requires major investments in research and development, potentially impacting short-term profitability.

- Geopolitical instability introduces volatility and risk to revenue streams.

ST Engineering's international defense market initiatives are question marks. They involve entering high-growth, yet geopolitically sensitive markets. To gain traction, the firm needs substantial investments in research and development. Global defense spending is predicted to hit $2.7 trillion in 2024.

| Aspect | Details | Impact |

|---|---|---|

| Market Growth | Global defense market | High potential |

| Investment | R&D, Partnerships | Strategic, financial |

| Risk | Geopolitical Instability | Revenue Volatility |

BCG Matrix Data Sources

The ST Engineering BCG Matrix relies on public financial filings, market analysis, and industry reports, plus competitor data to inform its strategic positions.