Stepan Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Stepan Bundle

What is included in the product

Highlights which units to invest in, hold, or divest

One-page overview placing each business unit in a quadrant

What You’re Viewing Is Included

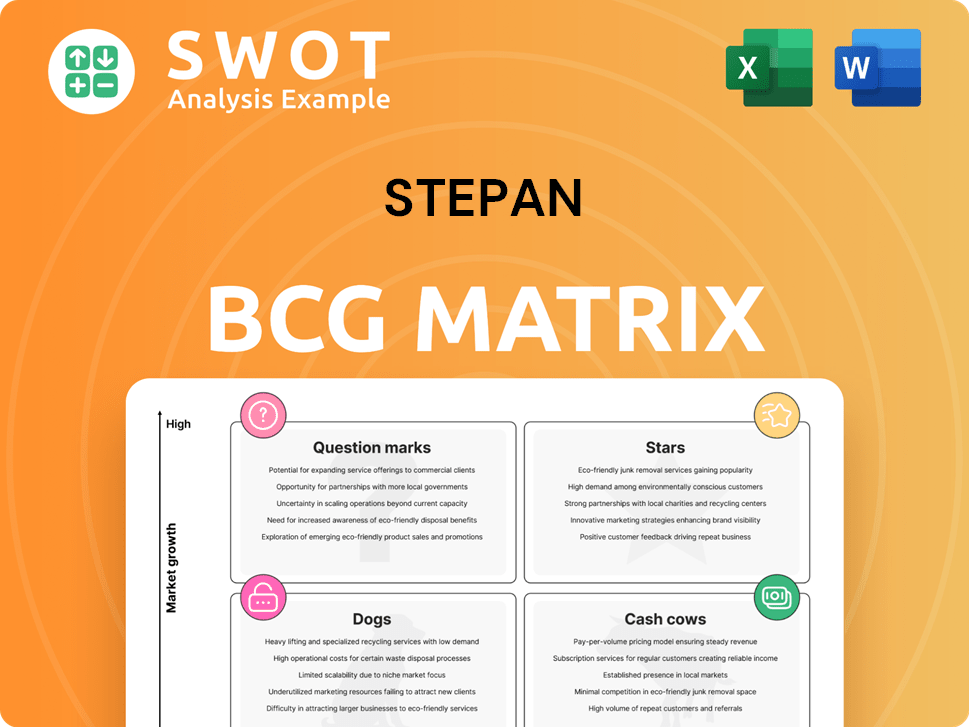

Stepan BCG Matrix

The preview is the final Stepan BCG Matrix you'll receive. It's a fully functional, ready-to-use document, identical to the purchased version.

BCG Matrix Template

The Stepan Company's BCG Matrix offers a snapshot of its product portfolio. This framework categorizes products as Stars, Cash Cows, Dogs, or Question Marks. Understanding these placements is crucial for strategic allocation. This quick glimpse is just a taste of the power within.

Purchase now and gain access to the complete BCG Matrix report. Receive a deep dive into the company's strategy and recommendations. Unlock strategic insights to fuel your business success.

Stars

Stepan's surfactant business shines, especially in agriculture and oilfields, boosting revenue substantially. In 2023, Stepan's net sales were $2.2 billion, showing strong performance. They lead by focusing on growth areas, needing continuous investment. The Pasadena facility strengthens their market position.

Stepan's specialty products, including medium chain triglycerides, are experiencing robust growth due to increased sales and better pricing. This segment's revenue grew by 8% in 2024. Expansion and investment are key to leveraging market demand. Focus is on margin recovery and extending the product range to boost performance.

The Pasadena facility is a star for Stepan, fueling growth. It's a strategic investment, key for volume and efficiency gains. This alkoxylation plant should boost Stepan's financials. Successful integration is vital. Stepan's Q1 2024 sales were $663.3M.

Cost Reduction Initiatives

Stepan's cost-cutting measures, including $48 million in savings in 2024, boost profitability and market competitiveness. These savings provide funds for reinvestment in high-growth sectors, supporting its star products. Continuous operational efficiency is crucial for sustained success. For example, Stepan's Q1 2024 earnings show the impact of these strategies.

- Cost savings directly improve profit margins.

- Reinvestments can fuel innovation and expansion.

- Operational efficiency enhances resilience.

- Focus on efficiency is a long-term strategy.

Dividend King Status

Stepan's Dividend King status, with 57 consecutive years of dividend increases, highlights its financial strength. This impressive track record signals reliability to investors. For instance, Stepan's dividend yield in late 2024 was around 2.5%. Sustaining this requires consistent financial success. Moreover, the company's revenue in 2024 is projected to be approximately $2.5 billion.

- Dividend King status with 57 years of increases.

- Dividend yield around 2.5% in late 2024.

- Revenue projected at $2.5 billion in 2024.

- Reflects financial stability and shareholder focus.

Stars in Stepan's portfolio, like the Pasadena facility and specialty products, show high growth and market share, needing continuous investment. Specialty product revenue grew by 8% in 2024, with cost savings of $48 million. These sectors drive revenue and profitability, crucial for Stepan's success.

| Aspect | Details |

|---|---|

| Key Products | Surfactants, Specialty Products |

| 2024 Revenue (Projected) | $2.5 Billion |

| Cost Savings (2024) | $48 Million |

Cash Cows

Stepan's core surfactant business is a cash cow, generating steady revenue from established cleaning markets. These mature markets, while offering limited growth, boast high market share, ensuring consistent cash flow. Maintaining efficiency and optimizing the product mix are key strategies. In 2024, Stepan's net sales were approximately $2.2 billion, reflecting the stability of this segment.

Stepan's polyurethane polyols represent a Cash Cow in its BCG matrix. They supply this market, especially thermal insulation, ensuring stable demand and customer loyalty. This segment yields consistent cash flow with limited growth potential. In 2024, the global polyurethane market was valued at approximately $80 billion, with steady growth. Investment should focus on market position and optimizing production for sustained profitability.

Stepan benefits from a broad global customer base, reducing market-specific risks. This customer diversity helps stabilize demand for its products, supporting its cash cow position. In 2024, Stepan's sales were spread across various regions, with no single customer accounting for a large percentage. The company actively works to strengthen and grow these customer relationships.

Operational Efficiency

Stepan's strong emphasis on operational efficiency significantly boosts its profit margins, especially within its established cash cow segments. This focus involves strict cost controls and streamlined production methods, ensuring these products generate robust cash flow. Continuous enhancement of operational strategies is key, allowing Stepan to maintain its competitive edge and profitability. In 2024, Stepan reported a gross profit of $1.3 billion.

- Cost Management: Stepan implements rigorous cost control measures.

- Production Optimization: The company refines its manufacturing processes.

- Cash Flow Maximization: They aim to get the most from cash cow products.

- Operational Improvement: Stepan constantly seeks to enhance efficiency.

Strategic End Markets

Stepan's cash cows thrive in stable end markets like construction and industrial solutions. These sectors provide consistent demand, underpinning reliable revenue streams. Stepan benefits from established customer relationships in these areas. A strong presence in these markets is crucial for sustaining cash flow. For example, in 2024, Stepan's industrial solutions segment generated approximately $800 million in revenue.

- Stable Demand: Construction and industrial markets offer consistent needs.

- Customer Relationships: Stepan leverages established partnerships.

- Revenue Stream: These markets ensure a reliable income source.

- Market Presence: Maintaining a strong position is essential.

Stepan's cash cows, like surfactants and polyols, are key to its financial stability. These mature segments generate substantial, reliable cash flow due to high market share. In 2024, the company's focus remained on optimizing operational efficiency to boost profits.

| Aspect | Details | 2024 Data |

|---|---|---|

| Revenue Stability | Steady income from established markets | $2.2B (Net Sales) |

| Market Position | Strong market share in core sectors | Global Polyurethane Market ~$80B |

| Operational Efficiency | Focus on cost controls & production | Gross Profit ~$1.3B |

Dogs

In 2024, Stepan's commodity Phthalic Anhydride faced decreased demand and competitive pressures, impacting sales volume and profitability. This product line, with low growth and market share, aligns with the 'dog' quadrant of the BCG Matrix. Considering 2024 data, divestiture or strategic repositioning might be necessary to improve performance. Despite market challenges, Stepan's net sales for the first nine months of 2024 were $1.56 billion.

Select Polymer Products within Stepan's portfolio might be classified as 'dogs' due to weak demand and competition. These products may need substantial investment with low growth prospects. In 2024, Stepan's net sales decreased, reflecting challenges in certain segments. Careful evaluation, potentially including divestiture, is essential for these underperforming products. Consider the impact of market dynamics on profitability.

In Stepan's BCG Matrix, underperforming geographies are classified as 'dogs,' showing low growth and market share. These areas might need considerable investment to boost performance, but with uncertain returns. For instance, if Stepan's sales in Eastern Europe dropped 5% in 2024, that area could be a dog. A thorough strategic review is crucial for these regions. The goal is to either revitalize them or consider divestiture.

Products Facing Reformulation

In the Stepan BCG Matrix, products facing decreased demand due to reformulations or new tech are "dogs." These products need innovation to compete. Stepan's Q3 2024 report indicated a 5% drop in sales for specific product lines due to these changes. R&D spending is crucial.

- Product adaptation is key for survival.

- Innovation requires strategic investment.

- Market analysis helps identify reformulation needs.

- Stepan's R&D budget was $65 million in 2024.

Assets with High Operating Costs

In the Stepan BCG Matrix, assets like facilities with high operating costs and low profitability are 'dogs.' These assets consume resources, hindering overall profitability. Consider optimization or divestiture to boost efficiency. For example, a struggling factory might have high maintenance costs. In 2024, companies focused on cutting operational expenses.

- High operating costs indicate inefficiency.

- Low profitability means poor financial returns.

- Optimization aims to reduce costs.

- Divestiture involves selling the asset.

In Stepan's BCG Matrix, 'dogs' represent low-growth, low-share products needing strategic action. These include underperforming geographies or product lines impacted by market shifts, like specific products with a 5% sales drop in Q3 2024. Assets such as facilities with high operating costs and low profitability also fall into this category. Stepan's 2024 R&D budget was $65 million, reflecting its focus on innovation.

| Category | Characteristics | Action |

|---|---|---|

| Products | Decreased demand; low market share | Divestiture or Reformulation |

| Geographies | Low growth; reduced sales | Strategic review or Divestiture |

| Assets | High costs; low profitability | Optimization or Divestiture |

Question Marks

Venturing into emerging markets places Stepan in "question mark" territory, offering high growth prospects but low current market share. These expansions demand substantial capital for infrastructure and brand building. Strategic alliances and thorough market research are essential for success. Consider that in 2024, emerging markets saw an average GDP growth of 4.5%, indicating significant potential.

Stepan's specialty chemical innovations are question marks, facing market uncertainty. These require substantial marketing efforts for adoption. Customer feedback and market testing are crucial. In 2024, Stepan invested $100 million in R&D, focusing on these new products. Success hinges on effective promotion and consumer response.

Stepan's sustainable chemistry efforts are question marks. They require long-term investment despite uncertain, near-term returns. Consumer preferences and regulations are key. In 2024, the global green chemicals market was valued at $75.4 billion. Monitoring this growth is vital.

Strategic Acquisitions

Strategic acquisitions represent question marks for Stepan, offering high potential but carrying substantial risks. These moves could broaden Stepan's product offerings or extend its geographical footprint. Success hinges on meticulous due diligence and seamless integration strategies. Financial assessments and risk evaluations are crucial to mitigate potential pitfalls.

- In 2024, Stepan's acquisitions included the purchase of a specialty surfactants business.

- Stepan's acquisition of the Surfactants business cost $150 million.

- These ventures can boost Stepan's market share and drive innovation.

- Successful integration post-acquisition is key to realizing synergies.

Alkoxylation Business Growth

Stepan's alkoxylation business is categorized as a question mark in its BCG Matrix, indicating potential for growth but also uncertainty. The company aims to fully leverage its investments, including the Pasadena facility, to boost market share. This involves strategic market penetration and effective customer acquisition efforts. Continuous monitoring and adaptation are crucial for success.

- Stepan's net sales in 2024 were approximately $2.6 billion.

- The alkoxylation market is competitive, with key players like BASF and Dow.

- Successful market penetration requires understanding customer needs and offering competitive pricing.

- Adaptation includes adjusting to changing market dynamics and customer feedback.

Stepan's "Question Marks" face high growth potential but uncertain market shares. They require significant investment in R&D, marketing, and acquisitions to expand. Successfully navigating these ventures demands strategic planning and market adaptation.

| Category | Details | 2024 Data |

|---|---|---|

| R&D Investment | Focus on new products | $100 million |

| Acquisition Cost | Specialty surfactants business | $150 million |

| Net Sales | Stepan Corporation | $2.6 billion |

BCG Matrix Data Sources

This Stepan BCG Matrix is informed by industry reports, financial filings, and competitor analysis, delivering a data-driven strategic overview.