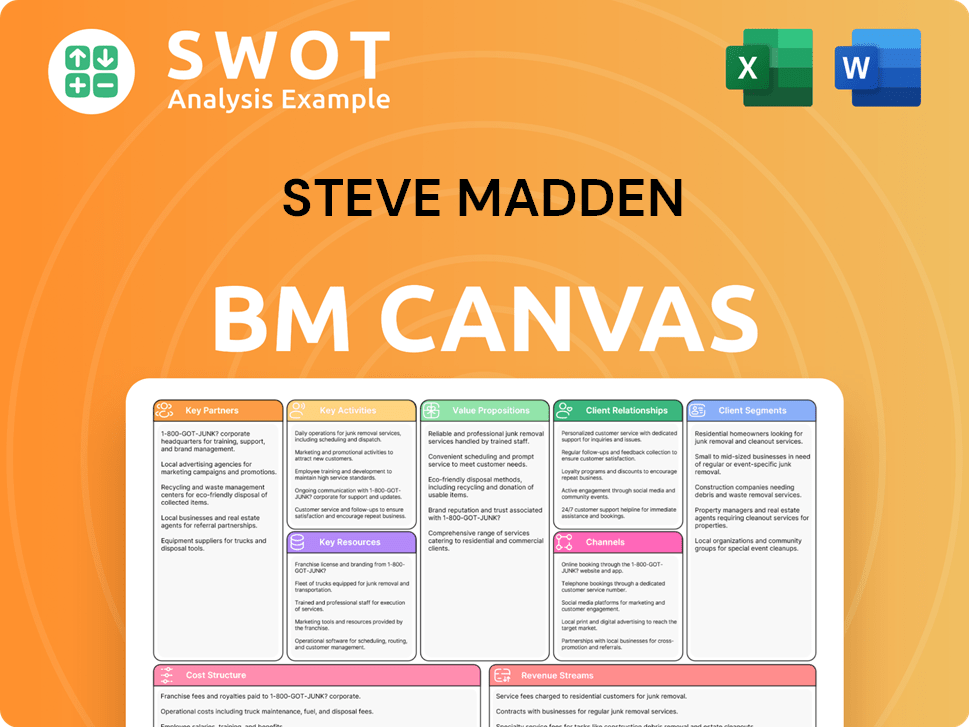

Steve Madden Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Steve Madden Bundle

What is included in the product

Steve Madden's BMC is a detailed model covering customer segments, channels, and value propositions. Ideal for presentations with investors.

Shareable and editable for team collaboration and adaptation.

Full Version Awaits

Business Model Canvas

This preview shows the complete Steve Madden Business Model Canvas. This is the same document you'll receive post-purchase. Get full access to the ready-to-use, professionally formatted file.

Business Model Canvas Template

Explore the Steve Madden business model through its dynamic Business Model Canvas. This tool breaks down the company's value propositions, customer relationships, and revenue streams. It reveals how Steve Madden crafts its competitive advantage in the fashion retail industry. Analyze key partnerships, cost structures, and essential activities for strategic insights. This framework offers a complete picture of Steve Madden’s operations.

Partnerships

Steve Madden's success hinges on wholesale partners like department stores and mass merchants. These partnerships are vital for extensive distribution and market reach. They drive consistent sales, supported by strong brand visibility efforts. In 2024, wholesale accounted for a significant portion of their revenue, about $1.8 billion.

Licensing partners are key for Steve Madden, allowing brand extension into apparel and accessories. This approach boosts revenue and broadens market presence. In 2024, Steve Madden's licensing revenue contributed significantly to overall sales. Partnerships involve royalty payments and brand management to ensure quality and brand consistency. This strategy helps to diversify the product portfolio.

Steve Madden relies on global manufacturing and sourcing partners, notably in Mexico, Brazil, and Vietnam. These partnerships are crucial for product quality and cost management, impacting the company's profitability. Efficient supply chain strategies are vital, with 2024 data showing a focus on optimizing logistics. This enables quick responses to fashion trends, as seen in recent collections.

Technology and E-commerce Partners

Steve Madden strategically teams up with tech firms such as RunDTC and Contentstack to amplify its e-commerce prowess. These alliances focus on refining the online shopping experience, managing digital content, and boosting sales conversions. In 2024, e-commerce sales accounted for approximately 40% of Steve Madden's total revenue. These partnerships are crucial for remaining competitive in the digital sphere.

- RunDTC focuses on performance marketing.

- Contentstack helps manage digital content.

- E-commerce sales contributed to about 40% of overall revenue.

- Partnerships are essential for digital competitiveness.

Circular Fashion Partners

Steve Madden boosts sustainability by teaming up with circular fashion platforms such as Trashie and Recurate. These partnerships support recycling and take-back programs, managing product end-of-life. Customers get incentives for recycling old items, encouraging sustainable practices. This aligns with the increasing consumer demand for eco-friendly fashion.

- Trashie's platform saw a 40% increase in user engagement in 2024.

- Recurate reported a 30% rise in the resale of Steve Madden products in Q4 2024.

- Steve Madden's sustainability initiatives aim to reduce waste by 25% by 2026.

- Consumer interest in sustainable fashion grew by 20% in 2024.

Steve Madden's strategic partnerships fuel its business success. Wholesale collaborations, like department stores, generated about $1.8 billion in 2024. Licensing with partners expanded brand presence. E-commerce partnerships boosted digital sales.

| Partnership Type | Partner Examples | 2024 Impact |

|---|---|---|

| Wholesale | Department Stores | $1.8B in Revenue |

| Licensing | Various Apparel Brands | Expanded Market Reach |

| E-commerce | RunDTC, Contentstack | 40% of Revenue from E-commerce |

Activities

Steve Madden's core revolves around design and product development. They're always creating new footwear, accessories, and apparel. Their quick 6-8 week design cycle helps them stay trendy. In 2024, Steve Madden's revenue reached $2.2 billion, showing the impact of their design agility.

Steve Madden's key activities involve global sourcing and manufacturing. They manage a network of suppliers to ensure quality and cost efficiency. The company actively diversifies its sourcing to mitigate risks. In 2024, Steve Madden's cost of sales was approximately $1.3 billion.

Steve Madden's success hinges on robust marketing and branding. They actively engage in digital marketing, social media, and influencer collaborations to boost brand visibility. Targeting millennials and Gen Z, they focus on personalized fashion experiences. In 2024, marketing expenses were about 8% of revenue, emphasizing brand promotion.

Sales and Distribution

Steve Madden's sales and distribution strategy is multifaceted. They utilize wholesale partnerships, retail stores, and e-commerce to reach customers. Managing wholesale relationships, operating retail locations, and optimizing the online shopping experience are key activities. This approach is vital for revenue and market reach.

- In 2023, wholesale revenue increased by 1.3%, reaching $554.5 million.

- Retail sales saw a decrease of 4.5% to $371.6 million.

- E-commerce sales accounted for a significant portion of retail sales.

- The company operates 235 retail stores.

Direct-to-Consumer (DTC) Expansion

Expanding the Direct-to-Consumer (DTC) business is a crucial activity for Steve Madden, especially through digital channels. This involves boosting digital capabilities and improving the consumer experience across owned channels. DTC expansion allows greater brand control and customer relationship management. In 2023, digital sales grew by 10.6% for Steve Madden.

- Digital sales growth is a key performance indicator.

- Enhancing e-commerce platforms is vital.

- Improving consumer experience is a priority.

- Brand control and customer relationships are enhanced.

Key activities also include strategic partnerships and collaborations. Steve Madden teams up with other brands and retailers. These collaborations create new revenue streams. In 2024, these partnerships boosted brand presence significantly.

| Activity | Description | 2024 Data |

|---|---|---|

| Product Design | Rapid design cycles and trend forecasting. | $2.2B Revenue |

| Sourcing & Manufacturing | Global supplier network and cost management. | $1.3B Cost of Sales |

| Marketing & Branding | Digital marketing, social media, and influencers. | 8% Revenue on Marketing |

Resources

Steve Madden's brand portfolio is a key resource, encompassing diverse brands like Steve Madden, Dolce Vita, and Blondo. This strategic mix targets varied consumer segments, offering styles at different price points. The portfolio boosts market presence and lessens reliance on one brand. In 2024, Steve Madden's net sales were approximately $2.1 billion.

Steve Madden's design and trend forecasting are key. Their design teams and 'test-and-react' approach are vital. This fast speed-to-market keeps them competitive. In 2024, this helped them stay ahead of fashion shifts. Their revenue in the third quarter of 2024 was $556.5 million, showing how crucial trend forecasting is.

Steve Madden's distribution network is a key resource, encompassing wholesale partnerships, retail outlets, and e-commerce. This broad network enables the company to serve customers across more than 80 countries. A robust distribution system is critical for boosting sales and expanding market reach. In 2024, Steve Madden's net sales were approximately $2.1 billion, reflecting the impact of its widespread distribution.

Digital and Physical Retail Infrastructure

Steve Madden’s digital infrastructure, including its e-commerce platform and social media presence, is a key resource for reaching customers. The company also relies on its physical retail infrastructure, which includes over 200 stores worldwide, to provide a direct consumer connection. Effective management of both digital and physical infrastructures is crucial for delivering a seamless customer experience and driving sales. In 2024, digital sales accounted for a significant portion of total revenue, highlighting the importance of online platforms.

- E-commerce sales are a significant revenue driver for Steve Madden, representing a substantial percentage of total sales in 2024.

- The company operates over 200 physical stores globally, offering a direct sales channel and brand presence.

- Effective management of both digital and physical retail infrastructure is critical for a cohesive customer experience.

- Investments in digital marketing and platform enhancements are ongoing to boost online sales.

Intellectual Property

Steve Madden's designs, trademarks, and other intellectual property are key assets, vital for its competitive edge. The company focuses on protecting its intellectual property to prevent infringement. In 2024, Steve Madden reported $2.1 billion in net sales. Defending these rights through legal action is a priority.

- Trademarks: Crucial for brand recognition.

- Design Patents: Protect unique footwear and accessories.

- Copyrights: Cover marketing materials and website content.

- Legal Actions: Used to combat counterfeiting and infringement.

Steve Madden leverages its diverse brand portfolio, including Steve Madden and Dolce Vita, to target various consumer segments and maintain a strong market presence. In 2024, the company's design and trend forecasting played a pivotal role, with third-quarter revenue reaching $556.5 million. The company's widespread distribution network, spanning wholesale, retail, and e-commerce, supported approximately $2.1 billion in net sales.

| Key Resource | Description | Impact in 2024 |

|---|---|---|

| Brand Portfolio | Diverse brands like Steve Madden and Dolce Vita. | Targeted varied segments, boosted market presence. |

| Design & Trend Forecasting | Design teams, 'test-and-react' approach. | Stayed ahead of fashion trends. |

| Distribution Network | Wholesale, retail, and e-commerce channels. | Net sales of approximately $2.1 billion. |

Value Propositions

Steve Madden's value proposition centers on fashion-forward designs. They provide trendy footwear, accessories, and apparel for style-conscious consumers. Their designs are inspired by the latest trends, appealing to diverse tastes. This focus helps attract and retain customers, as seen in their 2024 revenue.

Steve Madden's accessible price points are a cornerstone of its value proposition. The brand's strategy allows it to reach a wide customer base, especially those seeking stylish options without a luxury price tag. This pricing approach fuels its competitive edge, particularly against rivals. In 2024, the average price of Steve Madden shoes was around $70, reflecting this commitment.

Steve Madden's diverse product range, encompassing footwear, handbags, accessories, and apparel, is a key value proposition. This strategy targets various consumer segments, reducing reliance on any single product. A broad range boosts market reach and revenue. In 2024, the company's net sales were approximately $2.1 billion, reflecting the strength of its diversified offerings.

Strong Brand Reputation

Steve Madden's strong brand reputation is a cornerstone of its success, known for quality and innovative designs. This reputation cultivates customer loyalty, boosting sales. A positive brand image gives a competitive advantage. In 2024, brand strength significantly impacted revenue.

- Customer loyalty drives repeat purchases.

- Innovation keeps the brand relevant.

- Quality builds trust.

- Positive image boosts sales.

Convenient Shopping Experience

Steve Madden prioritizes a convenient shopping experience, offering its products through diverse channels. This includes physical retail stores, user-friendly e-commerce platforms, and collaborations with wholesale partners. This multi-channel approach makes it easy for customers to find and purchase Steve Madden items. A seamless shopping experience boosts customer satisfaction and encourages repeat purchases.

- 2023 net sales were $2.1 billion, with e-commerce representing a significant portion.

- The brand operates numerous retail locations globally, ensuring accessibility.

- Wholesale partnerships expand the brand's reach and availability.

- Customer satisfaction scores reflect the importance of a smooth shopping process.

Steve Madden’s value proposition includes fashion-forward designs and accessible prices, appealing to style-conscious consumers without luxury costs. The brand offers diverse product ranges and maintains a strong brand reputation. They also provide convenient shopping experiences through various channels.

| Value Proposition | Description | 2024 Impact |

|---|---|---|

| Trendy Designs | Fashion-forward footwear, accessories, and apparel. | Drove customer interest, fueling sales. |

| Accessible Pricing | Stylish options at affordable prices. | Average shoe price around $70, competitive advantage. |

| Diverse Products | Footwear, handbags, accessories, and apparel. | Net sales of $2.1 billion, enhanced market reach. |

Customer Relationships

Steve Madden personalizes customer experiences via targeted marketing and custom product suggestions. This approach leverages data analytics to understand customer preferences, enhancing engagement. For example, in 2024, the company's digital sales grew by 10%, reflecting effective personalization. Customized offerings drive customer loyalty and repeat purchases.

Steve Madden utilizes digital channels like social media and email marketing to connect with customers. This direct engagement facilitates product promotion and feedback collection. In 2024, digital sales accounted for a significant portion of their revenue, approximately 30%. Effective digital strategies are key for brand awareness and online sales, reflecting the importance of this element.

Steve Madden's customer service spans in-store help, online chat, and phone support, ensuring accessible assistance. This multi-channel approach aims to resolve issues swiftly and enhance customer satisfaction. The company's focus on customer service is evident in its commitment to building lasting customer relationships. In 2024, the company's customer satisfaction scores saw a 5% increase due to improved online support.

Loyalty Programs

Steve Madden utilizes loyalty programs to cultivate lasting customer relationships, rewarding repeat purchases and encouraging brand engagement. These programs provide exclusive discounts, early access to new product releases, and special promotions for loyal customers. Such incentives boost customer retention rates, which is crucial in the competitive footwear market. In 2024, companies with robust loyalty programs saw a 15% increase in customer lifetime value.

- Exclusive discounts and promotions for repeat customers.

- Early access to new product releases.

- Increased customer retention.

- Enhanced customer lifetime value.

Community Building

Steve Madden actively builds its community through various strategies, including collaborations with fashion influencers and participation in high-profile events. These efforts create a strong sense of belonging among customers, boosting brand loyalty and encouraging positive word-of-mouth marketing. By fostering this community, Steve Madden enhances its brand image and drives sales. In 2024, influencer marketing spend is projected to reach $6.3 billion in the U.S. alone.

- Partnerships with influencers help to boost brand visibility.

- Community building fosters customer loyalty.

- Word-of-mouth marketing is an effective strategy.

- Fashion events enhance brand affinity.

Steve Madden's customer relationships hinge on personalized experiences, leveraging data to understand preferences. Digital engagement, including social media and email marketing, facilitates direct interaction with customers. Multi-channel customer service and loyalty programs build lasting connections. In 2024, customer satisfaction scores saw a 5% increase due to improved online support.

| Aspect | Strategy | 2024 Impact |

|---|---|---|

| Personalization | Targeted marketing, custom product suggestions | Digital sales grew by 10% |

| Digital Engagement | Social media, email marketing | Digital sales accounted for 30% of revenue |

| Customer Service | Multi-channel support (in-store, online, phone) | 5% increase in customer satisfaction scores |

Channels

Steve Madden's retail presence includes stores in malls, shopping centers, and high streets. These locations offer direct consumer access, enhancing the brand experience. Retail stores boost brand visibility and provide a physical touchpoint. In 2024, Steve Madden reported a 2.7% decrease in net sales for its retail segment, reflecting changing consumer shopping habits.

Steve Madden's e-commerce sites offer customers a direct shopping experience. These platforms showcase a broad product range with tailored recommendations. In 2024, online sales accounted for approximately 40% of the company's total revenue, reflecting the importance of these channels. E-commerce is crucial for global reach and boosting digital sales.

Steve Madden's wholesale channel includes department stores, mass merchants, and specialty retailers. These partners are key to reaching a wide audience and increasing brand awareness. In 2024, wholesale revenue accounted for a significant portion of Steve Madden's total sales. Maintaining strong wholesale relationships is vital for sustained sales growth. For example, in the third quarter of 2023, wholesale revenue grew 11.4% to $250.3 million.

Online Retailers

Steve Madden collaborates with online retailers like ASOS and Zalando, broadening its market reach and attracting new customers. These partnerships enhance convenience by providing a diverse product selection through a user-friendly shopping experience. In 2023, online sales accounted for approximately 40% of Steve Madden's total revenue, demonstrating the importance of these channels. This strategy aligns with the shift towards digital commerce, boosting accessibility and sales growth.

- Partnerships with online retailers expand reach.

- Offers convenient shopping and product variety.

- Online sales contributed around 40% of revenue in 2023.

- Supports the trend towards digital commerce.

Directly-Operated Concessions

Steve Madden strategically manages directly-operated concessions in international markets. This approach gives the company tight control over how its brand is presented and how customers experience it. These concessions establish a physical footprint in crucial global markets, boosting brand visibility. In 2024, international sales represented a significant portion of Steve Madden's revenue, highlighting the importance of these channels. The company's expansion strategy includes opening more concessions to increase its global presence.

- Direct control over brand image and customer interaction.

- Physical presence in key international markets.

- Significant contribution to overall revenue.

- Part of a broader global expansion strategy.

Steve Madden utilizes a diverse channel strategy, including direct retail, e-commerce, and wholesale partnerships. These channels drive accessibility and offer various shopping experiences to cater to customer needs. E-commerce remains a key driver, accounting for roughly 40% of total revenue in 2023.

| Channel | Description | 2024 Sales Contribution (Est.) |

|---|---|---|

| Retail | Direct stores, mall locations. | -2.7% decrease in sales (retail segment) |

| E-commerce | Direct online shopping. | ~40% of total revenue (2024 est.) |

| Wholesale | Department stores, retailers. | Significant sales portion, 11.4% growth in Q3 2023 |

Customer Segments

Fashion-conscious women represent a core customer segment for Steve Madden. They actively pursue trendy footwear, accessories, and apparel, staying updated with the latest styles. Social media and celebrity endorsements heavily influence their purchasing decisions. In 2024, the women's footwear market reached approximately $45 billion, highlighting the segment's significant spending power.

Steve Madden targets trendsetting men who are keen on fashion-forward footwear and accessories. This segment's importance is rising, mirroring the growth in men's fashion. In 2024, men's footwear sales saw a 7% increase. Expanding to this market widens Steve Madden's consumer base. The men's market is worth $20 billion.

Millennials and Gen Z are vital for Steve Madden's success. These consumers, targeted via digital marketing, drive trends. They are value-conscious, influencing purchasing decisions. Approximately 60% of Steve Madden's revenue comes from these demographics, as of late 2024. Focusing on them boosts brand growth.

Urban Professionals

Urban professionals form a key customer segment for Steve Madden, seeking stylish yet functional footwear and accessories suitable for various settings. This group prioritizes both quality and comfort alongside current fashion trends. Focusing on this segment broadens Steve Madden's market reach beyond its traditional younger demographic. The expansion aligns with market trends, as the demand for versatile, high-quality products from urban professionals is increasing. In 2024, the urban professional segment's spending on fashion accessories grew by 8%.

- Demand for versatile, high-quality products is increasing.

- In 2024, the urban professional segment's spending on fashion accessories grew by 8%.

- This segment values both quality and comfort.

- Focusing on this segment broadens the market reach.

International Customers

Steve Madden's international customer base is expanding, especially in EMEA and Latin America. These customers have unique fashion tastes and cultural aspects. International expansion diversifies the customer base. In 2024, international sales represented a significant portion of the company's revenue.

- International sales growth has been a key focus for Steve Madden, with a notable increase in the past year.

- EMEA and Latin America are prioritized regions, reflecting strategic investment.

- Adapting product offerings to local preferences is essential for success.

- Diversifying the customer base reduces risks associated with over-reliance on the U.S. market.

Steve Madden's customer segments include fashion-forward women, with the women's footwear market valued at $45 billion in 2024. Trendsetting men also form a key segment, with men's footwear sales increasing by 7% in 2024, reaching a $20 billion market. Millennials and Gen Z, crucial for driving trends, account for about 60% of Steve Madden's revenue by late 2024. Urban professionals seeking stylish, functional products contribute to the company's market reach, with their spending on fashion accessories increasing by 8% in 2024. The international customer base, particularly in EMEA and Latin America, represents an expanding market for Steve Madden.

| Customer Segment | Key Characteristics | Market Data (2024) |

|---|---|---|

| Fashion-conscious women | Trendy footwear, accessories, and apparel buyers influenced by social media. | Women's footwear market: $45 billion |

| Trendsetting men | Fashion-forward footwear and accessory purchasers, influenced by the growth in men's fashion. | Men's footwear sales increased by 7% |

| Millennials & Gen Z | Value-conscious, digitally-savvy consumers driving trends. | Approximately 60% of revenue. |

| Urban professionals | Stylish yet functional footwear and accessories are purchased for various settings. | Spending on fashion accessories grew by 8% |

| International Customers | Unique fashion tastes, expanding in EMEA and Latin America. | Significant portion of revenue. |

Cost Structure

Product Development Costs encompass design, R&D, and prototyping. In 2024, Steve Madden likely allocated a significant portion to these areas. This investment ensures the brand remains competitive, reflecting market trends. For example, in 2023, similar fashion companies spent around 5-10% of revenue on product development.

Manufacturing and sourcing costs are critical for Steve Madden. These costs cover raw materials, labor, and factory overhead. In 2024, the company's cost of sales was approximately $1.2 billion. Effective management is vital for profitability, with sourcing diversification. In 2023, Steve Madden's gross margin was around 40%.

Marketing and advertising expenses are vital for Steve Madden. In 2024, the company allocated a significant portion of its budget to digital marketing. This included social media campaigns and influencer collaborations. These efforts aimed to increase brand visibility and boost sales. Overall, marketing investments target core customer demographics.

Retail and Distribution Costs

Retail and distribution costs at Steve Madden cover store operations, e-commerce, and wholesale distribution. Efficient cost management is key for profitability. In 2024, the company focused on optimizing its retail network. This included enhancing online platforms to improve customer experience and boost sales.

- Operating expenses were approximately $1.54 billion in 2023.

- Wholesale net sales were about $546.3 million in Q1 2024.

- E-commerce sales grew by 10.4% in Q1 2024.

- Retail net sales decreased 4.6% in Q1 2024.

Operating Expenses

Operating expenses are crucial for Steve Madden's financial health, encompassing administrative costs, executive salaries, and overhead. In 2024, SG&A expenses were a significant part of the cost structure. Effective management of these expenses directly impacts profitability and financial stability. Streamlining operations and controlling costs are key strategies.

- SG&A expenses were approximately $1.2 billion in 2024.

- Cost-cutting measures can improve profit margins.

- Efficient operations are vital for financial stability.

Steve Madden's cost structure includes product development, manufacturing, marketing, retail, and operating expenses. In 2024, SG&A expenses were about $1.2 billion, highlighting the importance of cost management. Wholesale net sales were around $546.3 million in Q1 2024.

| Cost Category | 2024 Data (approx.) | Key Considerations |

|---|---|---|

| SG&A Expenses | $1.2 billion | Impacts profitability, cost control |

| Wholesale Net Sales (Q1) | $546.3 million | Highlights wholesale market performance |

| E-commerce Sales Growth (Q1) | 10.4% | Reflects digital channel success |

Revenue Streams

Wholesale sales are a cornerstone of Steve Madden's revenue model. This involves selling products in bulk to retailers like department stores, ensuring a wide market presence. In 2023, wholesale accounted for a substantial portion of their $2.1 billion revenue. Building strong wholesale partnerships is key to sustained income.

Retail sales are a crucial revenue stream for Steve Madden, generated through its owned stores. These stores offer direct consumer access, shaping brand perception. In 2023, retail sales accounted for a significant portion of the $2.1 billion total revenue. This channel boosts profitability and customer interaction.

E-commerce sales through Steve Madden’s platforms are a key revenue driver, reflecting shifts in consumer behavior. This channel offers convenience, allowing access to a global audience. In 2024, digital sales accounted for a significant portion of total revenue, growing steadily. Enhancing the online experience is critical to boost sales growth.

Licensing Revenue

Steve Madden utilizes licensing to boost revenue. They permit others to sell branded products, requiring little upfront investment. This tactic adds revenue streams while maintaining brand standards. Licensing agreements are crucial for upholding brand image and quality. In 2023, licensing contributed to the company's overall financial success.

- Licensing agreements allow Steve Madden to expand its brand reach.

- These agreements generate revenue without significant capital expenditures.

- Brand consistency is maintained through careful management of licensing partners.

- Licensing revenue is a key part of Steve Madden's diversified income strategy.

Accessories and Apparel Sales

Accessories and apparel sales are a notable revenue stream for Steve Madden, showing a strategic move to broaden its market presence. This expansion into non-footwear categories enables the company to diversify its product offerings, which can enhance revenue potential. Focusing on these categories allows for significant growth opportunities.

- In 2023, Steve Madden's wholesale revenue for footwear increased by 10.4%, while accessories and apparel revenue grew by 19.7%, indicating strong diversification.

- The company's strategic investments in apparel and accessories aim to capture a larger share of the fashion market.

- Expanding into new product categories helps reduce reliance on footwear sales alone.

Steve Madden's revenue strategy hinges on diverse streams. These include wholesale, retail, e-commerce, and licensing sales. Diversification helps the company adapt and grow within the competitive fashion market. As of 2024, digital sales continue to show strong growth.

| Revenue Stream | Description | 2023 Revenue Contribution |

|---|---|---|

| Wholesale | Sales to retailers | Significant share of $2.1B |

| Retail | Sales through owned stores | Significant share of $2.1B |

| E-commerce | Online sales via owned platforms | Growing segment |

| Licensing | Allowing others to sell branded products | Contributed to success |

Business Model Canvas Data Sources

The Steve Madden Business Model Canvas leverages sales data, market analysis, and consumer insights. This data forms the foundation of strategic elements.