Stitch Fix PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Stitch Fix Bundle

What is included in the product

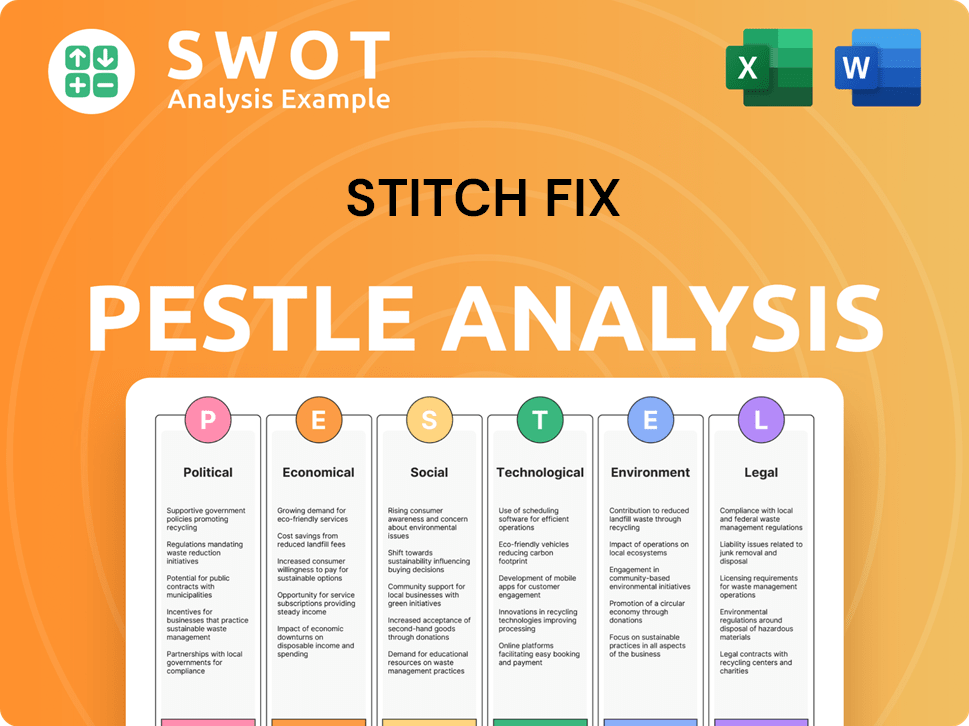

Unpacks external factors impacting Stitch Fix through PESTLE, offering strategic insights across key areas.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions.

What You See Is What You Get

Stitch Fix PESTLE Analysis

What you’re previewing here is the actual file—fully formatted and professionally structured. This Stitch Fix PESTLE analysis is the document you'll receive after buying it. You can rely on the accuracy & completeness of this real file. There are no adjustments needed. It is ready for your needs!

PESTLE Analysis Template

Navigate Stitch Fix's dynamic landscape with our detailed PESTLE Analysis. Uncover key factors across Political, Economic, Social, Technological, Legal, and Environmental areas influencing its growth.

This comprehensive analysis arms you with crucial insights, aiding strategic planning and informed decision-making.

Gain a competitive edge and understand market trends affecting Stitch Fix's performance and opportunities.

Designed for investors, consultants, and analysts, this PESTLE analysis is ready to use.

Uncover real external trends that impact Stitch Fix's operations.

Optimize your strategy—download the full PESTLE analysis now!

Political factors

Stitch Fix must comply with U.S. consumer protection, payment, and data privacy laws. International expansion means navigating varied global regulations. For instance, the EU's GDPR impacts data handling. Trade policy changes, like 2024 tariffs, could raise costs. In 2024, the US imposed new tariffs on textiles.

Political stability significantly impacts consumer spending habits. Economic downturns often correlate with reduced spending on non-essential items, potentially affecting Stitch Fix. For example, in 2024, consumer confidence dipped by 5%, reflecting economic unease. This decline could negatively affect Stitch Fix's sales figures.

E-commerce taxation poses a significant challenge for Stitch Fix. State-level sales tax nexus thresholds vary, demanding compliance across numerous jurisdictions. This complexity increases operational costs, as seen with increased tax compliance spending in 2024. The administrative burden impacts profitability, requiring careful tax planning and management.

Labor Laws and Regulations

Changes in labor laws affect Stitch Fix's costs, especially for warehouse and styling staff. For instance, the 2024 updates to overtime rules could increase expenses. These regulations can influence hiring strategies and operational budgets. The company must adapt to stay compliant and manage costs effectively.

- Overtime rule changes in 2024 could increase labor costs.

- Compliance requires adjustments to staffing and budgeting.

International Regulations and Market Entry

Stitch Fix's international growth hinges on understanding varied cultural tastes and complying with diverse regulations. Entering new markets demands strategic planning to meet local consumer expectations. For instance, the EU's GDPR impacts how Stitch Fix handles customer data.

- In Q1 2024, international net revenue was $17.9 million.

- Compliance costs and potential tariffs can significantly affect profitability.

- Adapting marketing and styling to local preferences is crucial.

Political factors significantly influence Stitch Fix. Regulatory compliance, like GDPR, affects data handling. Tax policies and labor laws add to operational costs. International expansion depends on understanding varied regulations and adapting to local preferences.

| Factor | Impact | 2024/2025 Data |

|---|---|---|

| Tariffs | Increased costs | US tariffs on textiles affected cost |

| Labor Laws | Increased expenses | Overtime rules could impact budgets |

| Taxation | Compliance challenges | Increased tax compliance spending in 2024 |

Economic factors

Stitch Fix thrives on consumer spending, particularly on discretionary items like clothing. Rising inflation and economic downturns can significantly reduce disposable income, leading to less spending on non-essential goods. For instance, in 2024, apparel sales saw fluctuations due to these economic pressures. Decreased consumer spending directly translates to lower demand for Stitch Fix's services, affecting its revenue.

The macroeconomic climate significantly impacts Stitch Fix. Economic downturns, like the projected slowdown in 2024, can lead to decreased consumer spending on non-essential items. Retail sales data from early 2024 show this trend, with a slight dip in apparel purchases. This can directly affect Stitch Fix's revenue and profitability. A potential recession, as predicted by some economists, could further strain the company's financial performance.

Stitch Fix faces fierce competition in the retail sector. Traditional retailers and online styling services pressure pricing. In 2024, Amazon's fashion sales grew 11%, intensifying competition. Stitch Fix needs sustained marketing to keep customers. For Q1 2024, their revenue was $330.5 million, reflecting the challenges.

Supply Chain Costs and Management

Stitch Fix relies heavily on efficient supply chain management to ensure timely delivery of its curated clothing items. Rising costs of raw materials, labor, and transportation, alongside potential supply chain disruptions, pose significant challenges. These factors can directly affect Stitch Fix's profitability and its ability to offer competitive pricing. The company must carefully navigate these economic hurdles to maintain its financial health and customer satisfaction.

- In Q4 2023, the apparel industry faced rising costs, with transportation costs up 10-15%.

- Delays in shipping from Asia increased lead times, impacting inventory management.

- Material costs, like cotton, saw a 5% increase in early 2024.

- Stitch Fix's gross margin decreased by 2% in 2023 due to higher supply chain costs.

Company Financial Performance and Growth

Stitch Fix's financial performance and growth are crucial economic indicators. The company's financial health, including revenue and profitability, reflects its market position. Recent data shows a decline in active clients and revenue. However, gross margin and average order value have improved.

- Net revenue decreased 18% year-over-year in Q1 2024.

- Active clients fell to 2.9 million in Q1 2024.

- Gross margin improved to 45.2% in Q1 2024.

- Average order value increased to $56 in Q1 2024.

Economic factors are crucial for Stitch Fix, affecting consumer spending and the apparel market. Inflation, economic downturns, and shifts in consumer behavior impact Stitch Fix's revenue. Challenges include supply chain costs and fierce competition within the retail landscape.

| Economic Factor | Impact | Data |

|---|---|---|

| Consumer Spending | Affects demand for discretionary items | Apparel sales saw fluctuations in 2024. |

| Macroeconomic Climate | Influences consumer spending | Q1 2024 revenue was $330.5M. |

| Supply Chain | Raises costs and delivery times | Gross margin fell by 2% in 2023. |

Sociological factors

Consumer preferences and fashion trends are in constant flux. Stitch Fix must adapt to stay relevant. Offering diverse styles caters to varying customer tastes. In 2024, the online apparel market reached $435 billion. Staying ahead boosts customer attraction and retention.

Stitch Fix capitalizes on the demand for personalization. Its model offers tailored styling and convenience. In 2024, the personalized shopping market grew by 15%. This reflects consumers' desire for curated selections. Convenience is key; home delivery boosts appeal.

Consumers increasingly prioritize sustainability and ethical practices. This trend impacts fashion significantly, creating both challenges and chances for companies like Stitch Fix. Adhering to eco-friendly and ethical sourcing attracts customers. In 2024, the global market for sustainable fashion was valued at $9.81 billion. It is projected to reach $15 billion by 2027, showing growing consumer interest.

Influence of Social Media and Online Communities

Social media significantly influences fashion trends and consumer choices. Stitch Fix utilizes platforms like Instagram and Pinterest for marketing, reaching a broad audience. However, the quick spread of trends online means Stitch Fix must adapt swiftly. In 2024, social media ad spending hit $220 billion globally.

- Rapid Trend Dissemination: Fashion trends evolve quickly on platforms like TikTok, requiring agility.

- Customer Engagement: Platforms offer direct interaction, feedback, and brand building.

- Influencer Marketing: Partnerships with influencers can boost brand visibility and sales.

- Competitive Landscape: Constant monitoring of social media is crucial for staying ahead.

Lifestyle Changes and Shopping Habits

Changes in lifestyle significantly impact consumer behavior, with online shopping and curated experiences gaining popularity. Stitch Fix capitalizes on these trends, offering personalized styling and convenient delivery. The global online fashion market is projected to reach $1.2 trillion by 2025, reflecting this shift. Stitch Fix's subscription model aligns with the demand for convenience and personalized services.

- Online fashion market is projected to reach $1.2 trillion by 2025.

- Stitch Fix offers personalized styling and convenient delivery.

Shifting consumer habits favor convenience and curated shopping experiences, boosting Stitch Fix's appeal. The online fashion market is forecasted to hit $1.2 trillion by 2025. Personalized styling and home delivery further enhance customer satisfaction and loyalty.

| Factor | Impact | Data (2024/2025) |

|---|---|---|

| Personalization | Increased Demand | Personalized shopping market grew 15% in 2024. |

| Online Shopping | Market Expansion | Projected to $1.2T by 2025. |

| Sustainability | Consumer Preference | Sustainable fashion valued at $9.81B in 2024. |

Technological factors

Stitch Fix heavily relies on data science, machine learning, and AI. These technologies power personalized styling, boosting customer experience and sales. In 2024, such AI-driven personalization increased customer retention by 10%. Continuous investment in these technologies is crucial for future growth and relevance.

Stitch Fix's e-commerce platform is crucial for its business model, handling customer interactions, styling, and order fulfillment. The global e-commerce market is projected to reach $8.1 trillion in 2024. Enhancements in mobile commerce and user experience are key. In 2023, mobile commerce accounted for 72.9% of e-commerce sales. Investing in these areas is vital for customer retention.

Stitch Fix leverages technology for supply chain optimization. This includes inventory management, logistics, and demand forecasting. Data analytics enhances efficiency and cost reduction. In 2024, they invested heavily in AI-driven supply chain tools. This helped reduce shipping costs by 5% and improve inventory turnover by 10%.

Emerging Technologies (AR/VR, Voice Search)

Emerging technologies like augmented reality (AR) and virtual reality (VR) offer new ways to shop. Voice search is becoming more popular. Stitch Fix could use these to improve customer engagement. AR could let customers "try on" clothes virtually.

- Global AR/VR market expected to reach $86 billion by 2025.

- Voice shopping is projected to hit $40 billion by 2025.

Data Privacy and Security Technology

Stitch Fix heavily relies on data, making data privacy and security a top priority. They must comply with regulations like GDPR and CCPA, which can lead to substantial fines if breached. Recent data breaches have cost companies millions; for example, a 2024 report showed average breach costs at $4.45 million. Investing in cybersecurity is crucial for their reputation and financial stability.

- GDPR fines can reach up to €20 million or 4% of annual global turnover.

- The average time to identify and contain a data breach is 277 days.

- Cybersecurity spending is projected to reach $215.7 billion in 2024.

Stitch Fix uses tech for personalized styling and e-commerce. AI boosts customer retention, and mobile shopping is crucial. Supply chain optimization reduces costs; in 2024, they reduced shipping costs by 5%.

| Technology Aspect | Impact | 2024/2025 Data |

|---|---|---|

| AI/Machine Learning | Personalization, Customer Experience | 10% increase in customer retention |

| E-commerce Platform | Customer Interaction, Sales | $8.1 trillion global market (2024) |

| Supply Chain Optimization | Efficiency, Cost Reduction | 5% shipping cost reduction (2024) |

Legal factors

Stitch Fix heavily relies on customer data, increasing the importance of adhering to data privacy laws. The California Consumer Privacy Act (CCPA) and the General Data Protection Regulation (GDPR) pose significant compliance challenges. Failure to comply could lead to substantial fines; for instance, GDPR violations can incur penalties up to 4% of global annual revenue. In 2024, several companies faced such repercussions, underscoring the need for robust data protection practices.

Stitch Fix must comply with consumer protection laws. These laws mandate fair online retail practices. For example, in 2024, the FTC received over 2.6 million fraud reports. This includes clear pricing disclosures. Advertising must be truthful, avoiding misleading claims.

Stitch Fix must comply with general e-commerce rules. These cover online transactions and website accessibility. Data from 2024 shows e-commerce sales hit $1.1 trillion in the US, highlighting the importance of these regulations. Website accessibility laws ensure inclusivity, impacting user experience and legal compliance. Non-compliance can lead to significant fines and reputational damage.

Intellectual Property Protection

Stitch Fix must safeguard its proprietary technology and algorithms using intellectual property laws to maintain its competitive edge. This protection is crucial for preventing rivals from replicating its personalized styling and e-commerce platform. The company's ability to analyze customer data and provide tailored fashion recommendations is a key differentiator. Legal battles can be costly, with intellectual property disputes costing companies millions annually. In 2024, the global IP market was valued at $3.2 trillion.

- Patents: Stitch Fix has patents on its styling algorithms.

- Copyrights: Protects the software code and user interface.

- Trademarks: Safeguards the Stitch Fix brand name and logos.

Labor Laws and Employment Regulations

Stitch Fix must adhere to labor laws, including wage and hour regulations, to maintain legal compliance. This includes ensuring fair employment practices and avoiding lawsuits. These regulations can vary significantly by location, impacting operational costs. Non-compliance can lead to hefty fines and reputational damage. In 2024, the U.S. Department of Labor recovered over $247 million in back wages for workers.

- Wage and hour compliance is crucial to avoid penalties.

- Employment practices must be non-discriminatory.

- Labor laws vary by state and country.

- Legal compliance affects operational costs.

Stitch Fix faces legal risks from data privacy laws like CCPA and GDPR, with potential fines reaching up to 4% of global revenue, as seen with some companies in 2024.

Consumer protection and e-commerce regulations, vital with 2024's $1.1T US e-sales, demand fair practices, truthful advertising, and accessible websites.

Protecting intellectual property, including patents, copyrights, and trademarks, is vital, especially with 2024's $3.2T global IP market, to prevent algorithm and brand replication and maintain a competitive edge.

| Legal Area | Key Compliance Issues | 2024 Data/Impact |

|---|---|---|

| Data Privacy | CCPA, GDPR compliance | GDPR fines up to 4% of revenue; 2024 saw major fines |

| Consumer Protection | Fair online retail, advertising truth | 2024 FTC fraud reports >2.6 million; clear disclosures |

| E-commerce | Online transactions, website accessibility | 2024 US e-sales: $1.1T; Accessibility laws |

Environmental factors

Stitch Fix faces growing pressure to adopt sustainable sourcing and use eco-friendly materials. The company aims to increase the percentage of sustainable materials in its private label. In 2024, sustainable fashion market was valued at $9.2 billion, projected to reach $15.7 billion by 2027. This shift impacts sourcing, design, and consumer perception.

Reducing waste and promoting circularity are key environmental issues. Stitch Fix utilizes a data-driven model to manage inventory, aiming to reduce overstock and waste. They have partnerships to address excess inventory, aligning with circular economy principles. In 2024, the fashion industry saw increased pressure to adopt sustainable practices. Data shows that in 2024, over 20% of fashion companies are implementing circular models.

Packaging sustainability is crucial for online retailers. Stitch Fix uses recycled, recyclable materials for boxes and mailers. They aim to cut down on packaging size and weight. According to a 2024 report, sustainable packaging is a $244 billion market, expected to reach $367 billion by 2028.

Carbon Footprint and Logistics

Stitch Fix's operations have a carbon footprint due to shipping and returns. Transportation of goods, from distribution centers to customers and back, contributes to emissions. In 2023, the logistics sector accounted for roughly 15% of global carbon emissions. Optimizing routes and using sustainable transport are key to reducing this impact. The company could consider carbon offsetting programs.

- Logistics emissions represent a significant portion of overall carbon emissions.

- Sustainable transportation options can reduce environmental impact.

- Carbon offsetting can help mitigate emissions.

- Companies are under increasing pressure to reduce their carbon footprint.

Animal Welfare Policies

Consumer demand for ethical sourcing significantly impacts fashion. Stitch Fix prioritizes animal welfare in its supply chain. They prohibit materials like fur, angora, and mohair to meet these ethical standards. This commitment can enhance brand image and attract conscious consumers. In 2024, ethical fashion sales are projected to reach $9.8 billion, showing growing consumer interest.

Stitch Fix's environmental considerations include sustainable sourcing and circular economy practices. They use recycled packaging and aim to cut shipping emissions. In 2024, the sustainable packaging market was $244 billion.

| Environmental Factor | Stitch Fix Action | Data Point (2024/2025) |

|---|---|---|

| Sustainable Materials | Increase use in private label | Sustainable fashion market: $9.2B |

| Waste Reduction | Data-driven inventory; partnerships | Over 20% fashion companies using circular models |

| Packaging | Recycled/recyclable materials | Sustainable packaging market: $244B |

| Carbon Footprint | Optimize shipping, sustainable transport, carbon offsets | Logistics sector ~15% global emissions |

| Ethical Sourcing | Prioritize animal welfare | Ethical fashion sales: $9.8B (projected) |

PESTLE Analysis Data Sources

The Stitch Fix PESTLE utilizes diverse sources including industry reports, consumer data, economic indicators, and market analysis to cover all the factors.