Storskogen Group Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Storskogen Group Bundle

What is included in the product

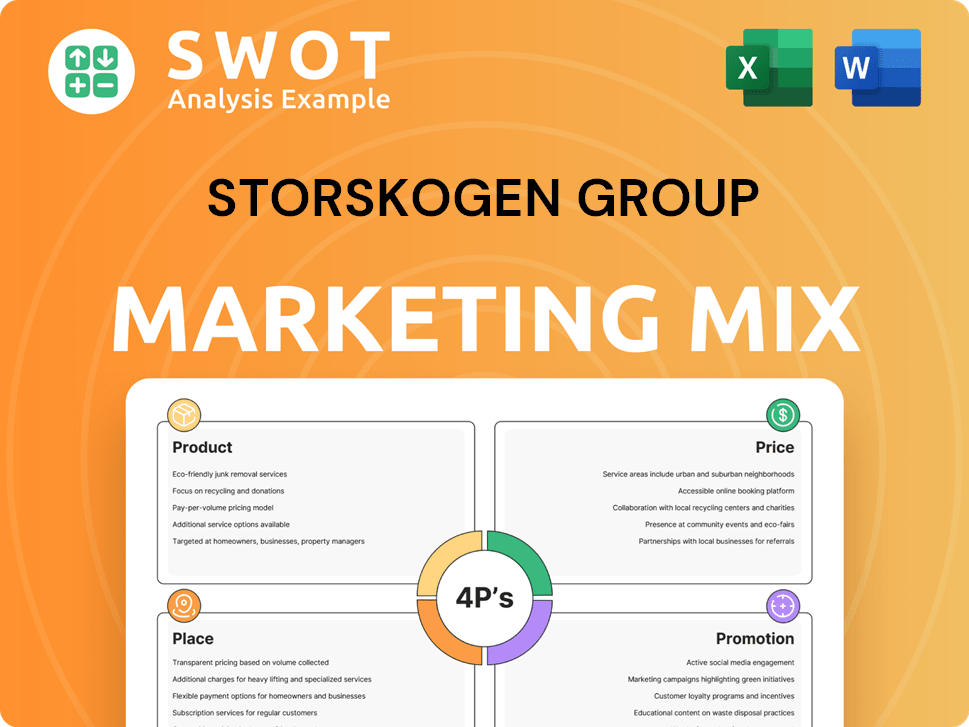

Provides a comprehensive 4P's analysis of Storskogen Group, revealing Product, Price, Place, and Promotion strategies.

Summarizes the 4Ps concisely, making the brand's direction easily understandable for everyone.

Same Document Delivered

Storskogen Group 4P's Marketing Mix Analysis

This detailed Storskogen Group 4P's Marketing Mix analysis preview showcases the exact content you'll get.

We've removed any doubt; the presented document is what you will download.

Upon purchase, you'll receive the fully realized and ready-to-use document.

You can explore this marketing mix model and analysis with full confidence.

Enjoy instant access to the completed analysis after your purchase.

4P's Marketing Mix Analysis Template

Storskogen Group strategically navigates its diverse portfolio, impacting its product offering through acquisitions and industry diversification.

Their pricing strategies seem tailored to various segments and acquired businesses. Distribution appears multifaceted, considering various industry verticals. Promotion strategies are often blended, emphasizing both organic and inorganic growth.

Discover the complete 4Ps Marketing Mix Analysis, examining Product, Price, Place, and Promotion for detailed business and strategic insights. This provides a professional analysis for both learning and internal business decisions.

Product

Storskogen's primary product is its diverse portfolio of SMEs. In Q1 2024, the group comprised 186 companies. These firms, spanning Trade, Industry, and Services, are the core of Storskogen's value proposition. The portfolio's composition is key to its strategic diversification and resilience. As of May 2024, Storskogen continues to actively manage and expand this portfolio.

Storskogen's strength lies in acquiring and developing companies, offering more than just ownership. They provide crucial resources like capital and strategic guidance. This approach has led to significant growth, with Storskogen's revenue reaching approximately SEK 21.3 billion in 2024. Their expertise also includes operational efficiency, fostering knowledge sharing among subsidiaries.

Storskogen's long-term ownership model is a central part of its strategy. This approach assures acquired businesses of stability, promoting sustainable growth rather than a quick turnaround. As of Q1 2024, Storskogen showed a commitment to long-term value creation, with a focus on operational improvements across its portfolio. This model is reflected in its financial performance, with the company aiming for consistent, long-term returns.

Decentralized Operational Model

Storskogen's decentralized operational model is a key aspect of its marketing mix. This approach empowers the management teams of acquired companies. They retain their entrepreneurial spirit with Storskogen's support. Subsidiaries function largely independently, fostering agility. In Q1 2024, Storskogen reported SEK 1.03 billion in revenue, showcasing the model's effectiveness.

- Focus on decentralized operations.

- Support independent subsidiaries.

- Empower entrepreneurial spirit.

- Reported revenue in Q1 2024.

Access to Capital and Resources

Storskogen's access to capital and shared resources is a key aspect of its value proposition. This support is especially valuable for smaller companies, enabling them to invest in growth areas. In 2024, Storskogen facilitated over 100 acquisitions, injecting capital into various business units. Digitalization and internationalization efforts are supported through these resources. Talent recruitment is enhanced via shared HR platforms.

- 2024: Over 100 acquisitions completed by Storskogen.

- Shared resources include HR, IT, and financial expertise.

- Focus on supporting SMEs with growth initiatives.

- Capital infusion helps businesses scale operations.

Storskogen's core offering is its diversified portfolio of SMEs across Trade, Industry, and Services, totaling 186 companies as of Q1 2024.

The firm offers strategic resources like capital and expertise, driving growth, with revenue reaching approximately SEK 21.3 billion in 2024.

Storskogen focuses on long-term ownership, fostering sustainable growth within acquired businesses, reflected in their consistent returns.

| Feature | Details | Data (2024) |

|---|---|---|

| Portfolio Composition | SMEs across various sectors | 186 companies |

| Revenue | Generated in 2024 | ~ SEK 21.3 billion |

| Acquisitions | Number of acquisitions | Over 100 |

Place

Storskogen's geographical diversification is key. It operates across Europe, including the Nordics, Germany, Switzerland, and the UK. This reduces risk. In Q1 2024, Storskogen reported that 60% of its revenue came from outside the Nordics, showing its international focus.

Storskogen Group's presence spans Trade, Industry, and Services. This diversification boosts resilience. In Q1 2024, Services grew organically by 12%. Sectoral spread helps navigate economic fluctuations. Industry's Q1 2024 EBITA margin was 9.6%.

Storskogen's decentralized model allows business units to operate in local markets, ensuring tailored strategies. This approach, alongside centralized support, fosters agility and local market responsiveness. In 2024, Storskogen reported revenue of SEK 24.3 billion, reflecting the impact of its decentralized structure. The decentralized model helps Storskogen to achieve a 12% organic growth.

Targeting Market Leaders

Storskogen's 'Place' strategy centers on acquiring market leaders. This approach leverages the existing strong market positions of acquired companies. As of Q1 2024, Storskogen reported that 75% of its portfolio companies held leading market shares in their segments. This focus on established businesses reduces market risk and enhances potential for growth. Such a strategy supports sustainable value creation and improved financial performance.

- Acquisition of companies with strong market positions.

- Focus on market leadership to minimize market risk.

- 75% of portfolio companies hold leading market shares (Q1 2024).

- Strategy supports sustainable value creation.

Strategic Acquisitions

Storskogen's strategic acquisitions are key to its growth, broadening its reach across current and new markets. The group carefully manages the acquisition process to ensure companies align with its strategy. This approach contributes to diversification and strengthens its market position. In 2024, Storskogen completed several acquisitions, expanding its portfolio.

- In Q1 2024, Storskogen acquired companies for a total of SEK 1.2 billion.

- The acquisitions are focused on businesses with strong cash flow and growth potential.

- Storskogen aims to build a diversified portfolio across various industries.

Storskogen Group focuses its 'Place' strategy on acquiring market leaders, aiming for sustainable value. In Q1 2024, 75% of its companies had leading market shares, lowering risks and boosting growth potential. Acquisitions, totaling SEK 1.2 billion in Q1 2024, are a cornerstone.

| Place Aspect | Details | Data (2024) |

|---|---|---|

| Market Focus | Acquisition of market leaders | 75% portfolio firms hold leading market shares |

| Acquisition Value (Q1 2024) | Total value | SEK 1.2 billion |

| Strategy Goal | Sustainable Value Creation | Key Driver |

Promotion

Storskogen Group prioritizes investor relations to build trust and transparency. In 2024, they held Capital Markets Days to discuss strategy. They regularly publish financial reports and engage with analysts to ensure clear communication. This approach aims to maintain a strong relationship with investors and stakeholders. Their Q1 2024 report showed revenues of SEK 5.1 billion.

Storskogen Group emphasizes financial reporting and transparency, crucial for stakeholder trust. They release annual and interim reports detailing financial performance and strategic moves. In 2024, the company's revenue was approximately SEK 25 billion. This commitment helps maintain investor confidence.

Storskogen Group leverages news releases to share key events. This includes acquisitions, divestments, and business updates, keeping stakeholders informed. In Q1 2024, Storskogen announced several acquisitions, enhancing its portfolio. The company's press releases aim to build transparency and trust with investors.

Capital Markets Days and Presentations

Storskogen Group utilizes Capital Markets Days and presentations to promote its strategy and financial performance. These events offer direct communication with investors and analysts, fostering engagement. For example, in 2024, Storskogen held several presentations, reaching a wide audience. This approach supports transparency and builds investor confidence. They also provide updates on key performance indicators (KPIs).

- These events are crucial for disseminating information.

- They enhance investor relations and transparency.

- Capital Markets Days are strategic for stakeholder engagement.

- Storskogen's 2024 presentations included detailed financial reviews.

Website and Online Presence

Storskogen's website acts as a primary promotional tool, offering crucial information to stakeholders. It features financial reports and company details, enhancing transparency. In Q1 2024, the website saw a 15% increase in unique visitors. This online presence supports investor relations and brand building.

- Offers financial reports.

- Details its business model.

- Supports investor relations.

- Builds brand awareness.

Storskogen Group focuses on investor relations, using reports and events. Their strategy includes Capital Markets Days to share financial results. By Q1 2024, they reported SEK 5.1B in revenue.

| Promotion Strategy | Activities | Impact |

|---|---|---|

| Investor Relations | Reports, Analyst Engagements | Enhances Trust |

| Capital Markets Days | Presentations, KPIs | Direct Communication |

| Website | Financial Information, Reports | 15% traffic increase in Q1 2024 |

Price

Storskogen's strategy capitalizes on lower valuations of SMEs. In 2024, SME valuations showed potential for growth. This approach supports Storskogen's acquisition and value creation model. Attractive valuations increase potential investment returns. These conditions are beneficial for Storskogen's financial performance.

Storskogen's pricing strategy hinges on acquiring profitable businesses. This approach directly boosts financial health and value creation. In Q1 2024, Storskogen reported a 6.5% increase in adjusted EBITA, showing the impact of profitable acquisitions. The valuation process heavily relies on the acquired businesses' profitability.

Storskogen prioritizes enduring value via active ownership and reinvesting cash flow. This approach shapes investor perception and future returns, aligning with a long-term investment horizon. In Q1 2024, Storskogen reported a 12% organic growth, reflecting this strategy's impact. The company's focus is on sustainable expansion, which attracts investors seeking lasting value. Their strategy, as of Q1 2024, resulted in a 10% increase in adjusted EBITA.

Financial Targets and Performance

Storskogen Group's financial targets, like profitability and cash flow, directly impact its financial 'price' and overall performance. These targets are crucial for investor assessment and valuation. Meeting these goals is vital for maintaining investor confidence and driving growth. Storskogen's performance in 2024 showed revenues of SEK 18.8 billion.

- 2024 Revenue: SEK 18.8 billion

- Focus on profitability and cash flow targets.

- Investor perception influenced by financial results.

- Key performance indicators (KPIs) are critical.

Capital Allocation Strategy

Storskogen's capital allocation strategy is central to its financial health, influencing its perceived 'price' in the market. The firm strategically invests in sectors poised for substantial long-term growth. This targeted approach aims to maximize shareholder value. In 2024, Storskogen’s investment portfolio showed a 12% increase.

- Investment Strategy: Focuses on long-term value creation.

- Performance: 12% growth in investment portfolio (2024).

- Impact: Directly affects market valuation and investor confidence.

Storskogen's "price" is tied to financial health and performance metrics.

Profitability and cash flow are central, influencing valuation and investor confidence. Meeting financial targets, vital for growth, directly boosts the firm's market perception.

Strategic capital allocation and investment in growth sectors significantly impact shareholder value, reflected in its overall performance.

| Aspect | Details | Impact |

|---|---|---|

| Revenue (2024) | SEK 18.8 billion | Shows market valuation |

| Organic Growth (Q1 2024) | 12% | Demonstrates long-term value |

| Portfolio Growth (2024) | 12% increase | Boosts investor confidence |

4P's Marketing Mix Analysis Data Sources

Storskogen's 4P analysis uses annual reports, investor presentations, press releases, and company websites for accuracy. It also includes industry data.