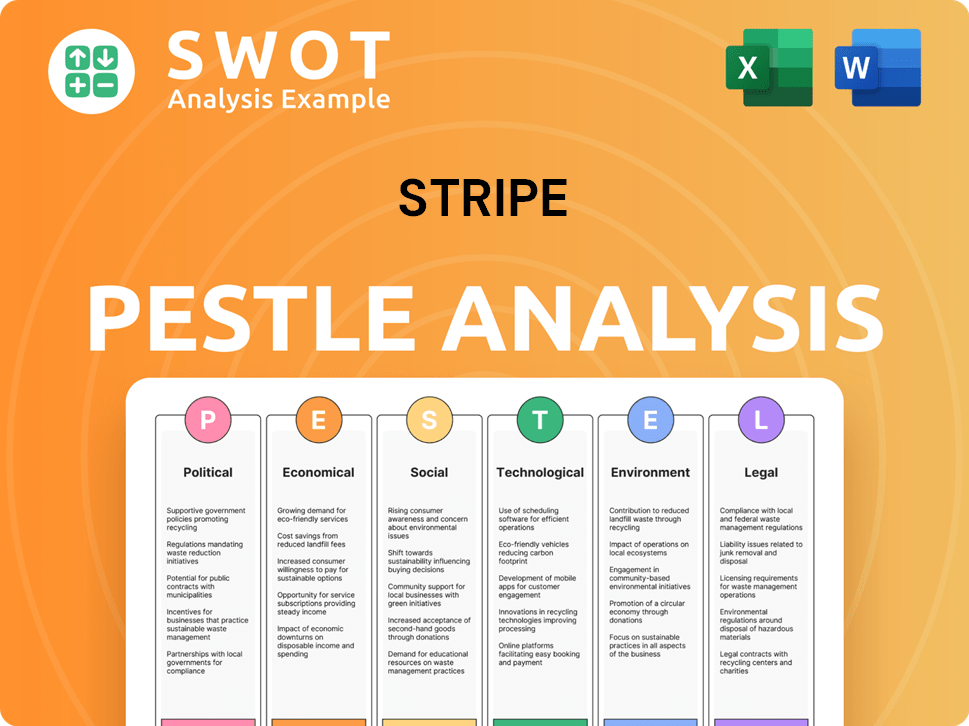

Stripe PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Stripe Bundle

What is included in the product

Examines how external macro factors affect Stripe. Includes detailed sub-points with examples specific to the business.

Helps support discussions on external risk and market positioning during planning sessions.

Full Version Awaits

Stripe PESTLE Analysis

The preview showcases the complete Stripe PESTLE Analysis—a comprehensive view. This document you see now is identical to the file you'll receive upon purchase. It’s fully formatted, containing all the detailed insights. No hidden extras, just ready-to-use information. Download immediately after your purchase!

PESTLE Analysis Template

Explore Stripe's external environment with our in-depth PESTLE Analysis. Uncover the political, economic, social, technological, legal, and environmental factors shaping its strategy. Gain a comprehensive understanding of Stripe’s operating landscape and the potential challenges and opportunities it faces. Arm yourself with the knowledge needed to make informed decisions. Ready to go beyond the surface? Download the full version now.

Political factors

Stripe faces stringent government regulations globally, especially concerning payments and data privacy. Compliance with regulations like PSD2, GDPR, and CCPA is essential. In 2024, Stripe invested heavily in compliance, with costs estimated at $200 million. AML and KYC regulations are also vital for preventing financial crimes, adding to operational complexities. Navigating diverse regulatory landscapes adds significant overhead, impacting resource allocation across various markets.

Geopolitical events like the Russia-Ukraine war can trigger sanctions, restricting Stripe's services in certain areas. Stability in Stripe's operating markets is vital for sustained growth. For example, in 2024, political instability in some regions has led to a 10% decrease in transaction volume in those areas. This impacts Stripe's global reach.

Government backing of the digital economy is crucial for Stripe. Initiatives like tax breaks for e-commerce and fintech-friendly regulations can boost Stripe's expansion. These policies directly influence the adoption of digital payments, expanding Stripe's user base. For example, in 2024, the global fintech market was valued at over $150 billion, with substantial growth projected through 2025, indicating a positive trend for Stripe.

Lobbying and Political Influence

Stripe actively lobbies on issues crucial to its business, such as data privacy and online safety regulations. In 2023, Stripe spent over $400,000 on lobbying efforts in the U.S., focusing on financial technology and internet-related policies. This strategic approach is evident in its political spending and board appointments.

- 2023 Lobbying Spending: Over $400,000 in the U.S.

- Focus Areas: Data privacy, fintech, and internet policies.

- Strategic Goal: Manage tech-government relations.

Political Stability in Operating Countries

Political stability significantly impacts Stripe's operations. Unstable environments can trigger regulatory changes and economic policy shifts, creating business risks. Countries with high political stability generally offer more predictable environments. For example, the World Bank's Worldwide Governance Indicators provide data on political stability, with scores varying widely across countries where Stripe operates.

- Political stability directly affects regulatory compliance costs.

- Changes in government can alter tax policies.

- Economic instability increases financial risks.

- Stable environments foster long-term investment.

Stripe's compliance costs hit $200M in 2024, reflecting regulatory burdens. Geopolitical events, like the Russia-Ukraine war, impacted transactions. Lobbying efforts exceeded $400,000 in 2023. Political stability critically affects Stripe's predictability and costs.

| Factor | Impact | Example/Data |

|---|---|---|

| Regulations | High compliance costs | $200M in 2024 |

| Geopolitics | Market restrictions | 10% transaction decrease in unstable areas (2024) |

| Lobbying | Influencing Policy | $400K+ (2023) |

Economic factors

Stripe's success hinges on global economic health and online commerce expansion. Robust global GDP and rising digital transactions are beneficial for Stripe's payment processing. Economic slowdowns can hurt Stripe, reducing transaction volumes. In Q4 2023, global e-commerce sales reached $8.2 trillion, a 10% increase from 2022, indicating growth.

Currency fluctuations pose risks to Stripe's global revenue, especially in volatile markets. Hyperinflation can severely increase operational costs and decrease purchasing power. For instance, the Argentinian peso saw a 211.4% inflation rate in 2023. Therefore, Stripe must actively manage these risks through hedging strategies and pricing adjustments to protect its margins.

Unemployment rates significantly influence consumer spending, directly impacting Stripe. Elevated unemployment often reduces online spending, affecting businesses using Stripe. For example, in early 2024, the U.S. unemployment rate hovered around 3.9%, potentially bolstering consumer confidence. Conversely, rising unemployment could decrease transaction volumes on Stripe's platform.

Investment and Funding Environment

The investment and funding climate significantly impacts Stripe's clientele, especially startups. A vibrant investment scene fuels the emergence and expansion of businesses needing payment solutions. In 2024, venture capital investments in fintech reached $25.3 billion globally. This surge directly benefits Stripe.

- Fintech VC investments in 2024 totaled $25.3B.

- A strong funding environment supports Stripe's growth.

- Stripe benefits from increased business creation.

Market Competition and Pricing

The payment processing market is intensely competitive. This environment forces companies like Stripe to constantly adjust their pricing strategies. Stripe's transaction-based pricing directly affects the costs for businesses. In 2024, the global payment processing market was valued at approximately $120 billion, with expected growth to $150 billion by 2025, highlighting the market's scale and competitiveness.

- Market size: $120B (2024), $150B (2025 projected)

- Stripe's revenue: $16B (2023)

- Competition: PayPal, Adyen, Square

Economic factors deeply affect Stripe's performance. Strong global economies and e-commerce boosts transaction volumes, like the 10% rise in Q4 2023 e-commerce sales to $8.2T. Currency fluctuations and high inflation, exemplified by Argentina's 211.4% inflation in 2023, present significant risks.

| Economic Factor | Impact on Stripe | Data |

|---|---|---|

| E-commerce Growth | Increases transaction volume | Q4 2023 E-commerce sales: $8.2T (+10%) |

| Currency Fluctuations | Affects global revenue | Argentinian Peso inflation (2023): 211.4% |

| Unemployment | Influences consumer spending | US unemployment (early 2024): 3.9% |

Sociological factors

The surge in digital payments fuels Stripe's growth. Global adoption is rising, with digital transactions expected to hit $10.5 trillion in 2024. Contactless payments and online shopping drive market expansion. In 2024, e-commerce sales are projected to reach $6.3 trillion worldwide. This consumer shift boosts Stripe's potential.

E-commerce continues its upward trajectory, with global sales projected to reach $6.3 trillion in 2024, and potentially $8.1 trillion by 2026. The rise of the creator economy, valued at over $250 billion, and vertical SaaS further expands Stripe's market. Stripe's adaptability supports diverse online businesses, ensuring relevance and growth.

Consumer trust and security are vital for e-commerce. Fraud concerns can hinder digital transaction adoption. Stripe's strong security measures are key. In 2024, online fraud attempts increased by 25%. Stripe's fraud prevention is crucial for business confidence.

Changing Workforce Trends

Workforce trends significantly influence Stripe's operations. The surge in remote work and the gig economy directly impact Stripe's services, especially for platforms and marketplaces. These shifts change how businesses operate and how payments flow. In 2024, remote work grew by 15% in the US.

- Remote work is projected to involve 32.6 million U.S. workers by 2025.

- The gig economy's global market size was $3.47 trillion in 2023.

Digital Literacy and Inclusion

Digital literacy and financial inclusion are key. They influence how people use online payments. Increased digital literacy and financial inclusion can boost Stripe's user base. For example, in 2024, about 77% of U.S. adults used online banking. This shows a growing digital financial landscape. The more digitally included, the more Stripe can grow.

- 77% of U.S. adults used online banking in 2024.

- Financial inclusion efforts expand Stripe's reach.

- Digital literacy is vital for payment adoption.

- Stripe benefits from broader digital access.

Societal trends shape Stripe’s user base and operational landscape. Remote work, growing by 15% in 2024, impacts payment needs, with 32.6M US workers expected to work remotely by 2025. Financial inclusion and digital literacy also expand Stripe’s potential.

| Trend | Data | Impact on Stripe |

|---|---|---|

| Remote Work Growth | 15% growth in 2024; 32.6M US workers in 2025 | Increased demand for flexible payment solutions. |

| Financial Inclusion | 77% of U.S. adults using online banking in 2024 | Expands potential user base. |

| Digital Literacy | Continual improvement | Increases adoption of online payments. |

Technological factors

Stripe leverages AI and machine learning to enhance its payment processing capabilities. For instance, its fraud detection system, Radar, uses ML models, processing billions of transactions. In 2024, Stripe processed over $1 trillion in payments. These technologies boost authorization rates and optimize transaction flows.

Stripe is actively investigating stablecoins, viewing them as a possible future solution for international money transfers. The stablecoin market is projected to reach $2.8 trillion by 2025, indicating substantial growth. This expansion could significantly alter the payments sector, with stablecoins potentially streamlining cross-border transactions for businesses. Stripe's involvement aligns with the trend of integrating blockchain technology into financial systems, offering quicker and more cost-effective payment methods.

Stripe's robust APIs and developer tools are pivotal. They simplify integration, a major draw for online businesses. This approach fuels platform innovation, attracting a wide user base. In 2024, Stripe processed billions in transactions, highlighting its tech-driven success. This tech focus continues to drive their market position.

Fraud Prevention and Security Technology

Stripe heavily invests in fraud prevention and security tech to safeguard transactions and customer data. They use machine learning to spot and stop fraud, crucial for maintaining user trust. In 2024, the global fraud detection and prevention market was valued at approximately $36.2 billion. This is expected to reach $94.7 billion by 2029, showing the importance of these technologies.

- Stripe processes billions of dollars in transactions annually, making robust security vital.

- Machine learning helps in analyzing patterns and identifying suspicious activities in real-time.

- Continuous updates are necessary to adapt to evolving fraud tactics.

Cloud Computing and Infrastructure

Stripe heavily depends on cloud computing to manage its large transaction volumes and ensure service scalability. This reliance on technology is critical, given that Stripe processes billions of dollars annually. In 2024, the global cloud computing market was valued at over $600 billion and is projected to reach $1 trillion by 2027. The availability and reliability of cloud services directly affect Stripe’s ability to operate.

- Cloud computing market size in 2024: Over $600 billion.

- Projected cloud computing market size by 2027: $1 trillion.

Stripe utilizes AI and ML to improve payment processing, including fraud detection via Radar. The firm is exploring stablecoins for international transfers, anticipating substantial market growth to $2.8T by 2025. Developer-friendly APIs drive platform innovation.

| Technology Area | Specific Technologies | Impact on Stripe |

|---|---|---|

| AI/ML | Radar (fraud detection) | Enhances transaction security; in 2024 processed $1T in payments. |

| Blockchain/Stablecoins | Integration of stablecoins for international payments. | Potential to streamline cross-border transactions, growing to a $2.8T market by 2025. |

| APIs and Developer Tools | Robust APIs, developer-friendly tools | Simplified integrations, attracting a broader user base. |

Legal factors

Payment regulations, like PSD2 in Europe, are crucial for Stripe. PSD2 mandates strong customer authentication, impacting payment security. Compliance is essential for Stripe's operations and expansion. Navigating these regional rules is key for market access. In 2024, PSD2 fines reached €100M+ across Europe.

Stripe must comply with data privacy laws like GDPR and CCPA, critical for handling sensitive payment data. These regulations govern data collection, processing, and storage. Non-compliance can lead to significant fines; for example, GDPR fines can reach up to 4% of global annual turnover. In 2024, the average cost of a data breach was $4.45 million globally, highlighting the financial risks.

Stripe faces stringent global Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. Compliance is essential to prevent financial crimes. In 2024, the Financial Crimes Enforcement Network (FinCEN) reported over 2.7 million suspicious activity reports (SARs). Stripe must verify user identities to meet these requirements.

Cross-Border Transaction Regulations

Regulations on cross-border transactions and currency exchange significantly affect Stripe's international operations and pricing strategies. Navigating the diverse and often stringent regulations across various countries presents a complex compliance challenge for the company. These regulations can influence transaction costs and the speed at which funds are processed, thereby impacting Stripe's profitability. For example, in 2024, cross-border payment volumes reached $150 trillion globally, highlighting the scale of these regulatory impacts.

- Compliance costs can represent a substantial portion of operational expenses.

- Regulatory changes can lead to unexpected shifts in market access.

- Currency fluctuations affect revenue and profitability.

- Data privacy laws like GDPR add to compliance complexity.

Licensing and Financial Regulations

Stripe's operations hinge on securing and maintaining licenses and adhering to financial regulations across different regions. This is a critical aspect of its business model. The process can be intricate and demand significant resources to ensure compliance. As of late 2024, Stripe is subject to regulatory scrutiny in several countries. The company must navigate evolving rules.

- Stripe has obtained licenses in over 40 countries.

- The company faces ongoing regulatory changes, particularly in areas like data privacy.

- Compliance costs have increased by 15% in 2024 due to new regulations.

- Stripe's legal team has grown by 20% to manage regulatory demands.

Stripe contends with varied legal landscapes globally, impacting its operations. This involves stringent compliance across payment, data privacy, and AML regulations, each bearing unique financial implications. Regulatory shifts, particularly regarding data and cross-border transactions, continually redefine operational costs and market access for Stripe.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Data Breaches | Compliance | Average cost: $4.45M globally |

| Cross-Border Payments | Transactions | Volumes reached $150T globally |

| PSD2 Fines | Regulation | €100M+ across Europe |

Environmental factors

The environmental impact of data centers powering Stripe's services is a key factor. Energy consumption and carbon emissions are under scrutiny. In 2024, data centers accounted for roughly 2% of global energy use, a figure expected to rise. Stripe is likely assessing its carbon footprint.

Stripe actively supports environmental sustainability. Stripe Climate allows businesses to fund carbon removal. In 2024, Stripe's Climate program facilitated over $20 million in carbon removal purchases. These partnerships highlight environmental responsibility.

Stripe can reduce its carbon footprint by using renewable energy in its data centers. According to the IEA, global renewable energy capacity is expected to grow by 50% between 2023 and 2028. This shift impacts operational costs. In 2024, renewable energy prices are competitive, potentially lowering expenses.

Environmental Regulations

Stripe must adhere to environmental regulations, particularly regarding carbon emissions. These regulations could necessitate changes in operational practices and potentially raise expenses. For example, the EU's Carbon Border Adjustment Mechanism (CBAM), effective from October 2023, might affect Stripe's transactions. Increased compliance costs are a risk.

- EU's CBAM implementation (October 2023).

- Potential for increased operational costs.

- Risk of non-compliance penalties.

- Need for sustainable business practices.

Climate Change Impacts on Businesses

Climate change presents indirect challenges for Stripe. Extreme weather, a consequence of climate change, can disrupt businesses reliant on Stripe's payment processing services. For instance, in 2024, climate-related disasters caused over $100 billion in damages in the U.S., potentially affecting transaction volumes. These disruptions can lead to decreased economic activity and impact Stripe's revenue indirectly.

- 2024 saw over $100B in U.S. climate disaster damages.

- Extreme weather events can disrupt businesses.

- Indirect impact on Stripe's transaction volumes.

- Potential for reduced economic activity.

Stripe's environmental footprint involves data center energy use and carbon emissions, impacting operations. Initiatives like Stripe Climate facilitate carbon removal, with over $20M in purchases in 2024. Regulations and climate impacts pose both cost and operational risks, necessitating sustainable practices.

| Environmental Aspect | Impact | Data |

|---|---|---|

| Data Center Energy Use | Operational Cost & Carbon Footprint | Data centers consume ~2% global energy (2024, expected to grow) |

| Carbon Removal | Sustainability & Brand Reputation | Stripe Climate facilitated $20M+ carbon removal in 2024 |

| Climate Regulations | Compliance Costs & Operational Changes | EU's CBAM, potentially impacting transactions (Oct 2023 onwards) |

PESTLE Analysis Data Sources

Our Stripe PESTLE Analysis uses economic indicators, regulatory updates, market research, and tech reports. These sources ensure accurate assessments of Stripe's environment.