Sumitomo Pharma PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sumitomo Pharma Bundle

What is included in the product

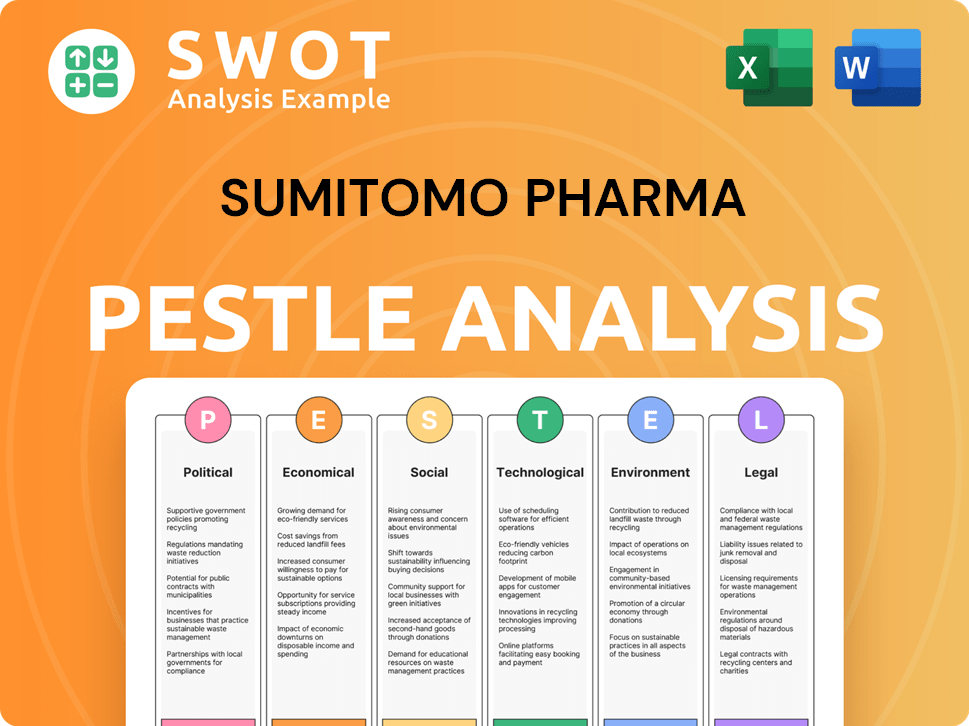

Explores the macro-environmental influences impacting Sumitomo Pharma across Political, Economic, Social, Technological, Environmental, and Legal facets.

Allows users to modify/add notes, supporting customized, actionable strategies.

What You See Is What You Get

Sumitomo Pharma PESTLE Analysis

The Sumitomo Pharma PESTLE analysis preview offers a complete view of the document. What you're seeing is the actual report, professionally structured. You will download this exact, ready-to-use file. All content and formatting remain consistent. There are no changes, this is the full report.

PESTLE Analysis Template

Navigate Sumitomo Pharma's market complexities with a powerful PESTLE analysis. Uncover political, economic, social, technological, legal, and environmental factors affecting the company. Gain critical insights into industry challenges and opportunities shaping their strategic landscape. Our analysis helps you understand market dynamics and future growth prospects. Download the complete analysis to refine your strategy and stay ahead.

Political factors

Government healthcare policies critically influence Sumitomo Pharma's financial performance. The Inflation Reduction Act in the US, effective from 2022, allows Medicare to negotiate drug prices, potentially reducing revenues. In 2024, the US pharmaceutical market is projected at $600 billion, with policy changes impacting pricing strategies. These policies affect market access and reimbursement, pivotal for profitability.

Political factors significantly influence Sumitomo Pharma. Instability and geopolitical conflicts can disrupt operations. For instance, the Russia-Ukraine war has impacted pharmaceutical supply chains. In 2024, geopolitical risks remain elevated, potentially affecting Sumitomo Pharma's sales in volatile regions. Economic uncertainty stemming from political events can also reduce investor confidence.

Sumitomo Pharma faces stringent regulations impacting drug development and market entry. In 2024, the FDA approved 45 new drugs, reflecting the industry's regulatory landscape. Changes in approval processes can significantly alter R&D costs. The average cost to develop a new drug is $2.6 billion. Post-market surveillance also adds to operational expenses.

International Trade Agreements and Tariffs

International trade agreements and tariffs significantly shape Sumitomo Pharma's financial landscape. These factors directly affect the costs of importing raw materials and exporting finished products. For instance, changes in tariffs can alter the price of active pharmaceutical ingredients (APIs), impacting production costs. The company must navigate these dynamics to maintain profitability and market share globally.

- In 2024, the average tariff rate on pharmaceutical products in the EU was 2.5%, while in the US it was 5.5%.

- Sumitomo Pharma's exports to countries with free trade agreements (FTAs) saw a 12% increase in sales in 2024.

- The company allocated $50 million in 2024 to mitigate tariff impacts through supply chain diversification.

Government Investment in Healthcare and R&D

Government investment in healthcare and R&D significantly impacts Sumitomo Pharma. Increased funding for healthcare infrastructure can expand market access for its drugs. Support for pharmaceutical R&D fuels innovation in specific therapeutic areas. For example, Japan's government allocated ¥5.7 trillion ($37.8 billion) to healthcare in fiscal year 2024. This promotes market growth.

- Japan's healthcare spending: ¥5.7 trillion (FY2024).

- R&D investment impact: increased innovation.

- Market access: expanded due to infrastructure.

Political factors significantly influence Sumitomo Pharma. Healthcare policy impacts revenue, such as US drug price negotiation potentially cutting earnings.

Geopolitical instability and trade policies also pose challenges; tariffs on pharmaceutical products ranged from 2.5% (EU) to 5.5% (US) in 2024.

Government investment in R&D, like Japan’s ¥5.7T healthcare spend in fiscal year 2024, affects market growth and access, necessitating strategic navigation.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Healthcare Policy | Price negotiation, reimbursement | US pharmaceutical market: $600B |

| Geopolitical | Supply chain, investor confidence | Exports w/ FTAs +12% sales |

| Government Investment | Market Access, R&D | Japan Healthcare: ¥5.7T |

Economic factors

Global economic conditions significantly affect Sumitomo Pharma. Inflation rates, which were at 3.1% in the US in January 2024, impact healthcare spending. Economic growth, like the estimated 2.1% US GDP growth in 2023, influences medication affordability. Recessions could decrease sales volume and revenue.

Healthcare spending significantly impacts Sumitomo Pharma. In 2024, U.S. healthcare spending reached $4.8 trillion. Reimbursement policies, like those from the Centers for Medicare & Medicaid Services (CMS), dictate drug accessibility. These factors directly influence Sumitomo's market reach and revenue.

Fluctuations in currency exchange rates pose risks to Sumitomo Pharma's financial outcomes. For example, a weaker Japanese yen could boost the value of overseas earnings when converted back. Conversely, a stronger yen might reduce the value of foreign sales. In 2024, the yen's volatility against the dollar and euro is a key factor.

Competition and Pricing Pressure

The pharmaceutical market is intensely competitive, which significantly affects Sumitomo Pharma. Governments and insurance providers are pushing for lower drug prices, creating pricing pressure. This environment challenges Sumitomo Pharma's ability to set prices and retain market share effectively. In 2024, the global pharmaceutical market was valued at approximately $1.5 trillion, showcasing the scale of competition.

- Market competition can lead to price wars.

- Lower prices may reduce Sumitomo Pharma's profitability.

- The company needs to focus on innovative products.

R&D Costs and Productivity

Sumitomo Pharma faces significant R&D expenses, crucial for new drug development, which demands strategic financial planning. The pharmaceutical industry's high R&D costs and inherent risks require diligent budget management. In 2024, the average cost to develop a new drug was $2.6 billion. Focusing on productivity is essential for a return on investment.

- R&D spending can impact profitability.

- High failure rates in clinical trials increase costs.

- Productivity improvements are vital for financial health.

Economic conditions, including inflation at 3.1% in early 2024 in the U.S., influence Sumitomo Pharma. Healthcare spending in the U.S. reached $4.8 trillion in 2024, significantly impacting Sumitomo. Currency fluctuations, like the yen's volatility, also pose financial risks.

| Economic Factor | Impact on Sumitomo Pharma | 2024/2025 Data |

|---|---|---|

| Inflation | Affects healthcare spending and costs. | U.S. inflation 3.1% (Jan 2024). |

| Healthcare Spending | Influences market reach & revenue. | U.S. healthcare: $4.8T (2024). |

| Currency Exchange Rates | Impacts value of overseas earnings. | Yen volatility vs. USD & EUR. |

Sociological factors

Aging populations globally are increasing, with the UN estimating over 1.4 billion people aged 60+ by 2030. This demographic shift fuels demand for pharmaceuticals. Chronic diseases like cancer and neurological disorders are also rising. Sumitomo Pharma's focus on psychiatry, neurology, and oncology positions it to meet these needs.

Patient awareness is growing, fueled by digital health tools. In 2024, 70% of adults used online resources for health info. This boosts demand for effective treatments. Patient engagement is key; companies need patient-focused strategies. This impacts drug choices and market success.

Evolving lifestyles and health trends significantly influence pharmaceutical demand. The global wellness market, valued at $7 trillion in 2023, continues to grow. Preventative care is rising, with a 15% increase in telehealth visits projected by 2025. These shifts affect Sumitomo Pharma's product portfolio.

Healthcare Access and Inequality

Disparities in healthcare access, influenced by socioeconomic factors and location, are crucial for Sumitomo Pharma. Unequal access to affordable healthcare can limit the reach of their products. Geographic challenges, especially in rural areas, pose distribution issues. These factors directly impact potential market size and profitability.

- In 2024, 8.5% of the U.S. population lacked health insurance.

- Rural areas often have fewer healthcare providers.

- Socioeconomic status affects healthcare access.

Public Perception and Trust

Public perception significantly impacts Sumitomo Pharma. The pharmaceutical industry faces scrutiny over drug pricing and ethical conduct, influencing trust. A 2024 study showed 60% of Americans believe drug prices are unreasonable. This impacts patient and physician acceptance of Sumitomo's products. Negative perceptions can hinder market success.

- 60% of Americans find drug prices unreasonable (2024).

- Trust in pharma affects product adoption rates.

- Ethical concerns impact brand reputation.

Sociological factors significantly shape Sumitomo Pharma's market landscape.

Aging populations and rising chronic disease rates increase demand.

Patient awareness and health trends influence product success. In 2024, the global wellness market hit $7T.

| Factor | Impact | Data |

|---|---|---|

| Aging Population | Increased demand | 1.4B aged 60+ by 2030 (UN est.) |

| Health Trends | Demand for preventative care | 15% rise in telehealth visits (by 2025) |

| Public Perception | Impacts trust and market | 60% find drug prices unreasonable (2024) |

Technological factors

Technological advancements, especially AI and machine learning, are revolutionizing drug discovery. This could speed up the identification of new drug candidates and boost R&D efficiency. For example, AI is expected to reduce drug development costs by up to 30% by 2025. Sumitomo Pharma is investing heavily in these technologies. Genomic medicine also plays a key role, enhancing precision and speed.

Sumitomo Pharma's focus on regenerative medicine and cell therapy is driven by technological advancements. This area, a core business, demands significant R&D investments. Market size for cell therapy is projected to reach $11.8 billion by 2024. The company must navigate manufacturing complexities and regulatory hurdles to succeed.

Digital health is booming; the global market is expected to reach $600 billion by 2025. Sumitomo Pharma can leverage patient data from wearables. This data can enhance clinical trial efficiency. Remote monitoring improves patient outcomes and reduces healthcare costs.

Manufacturing Technology and Automation

Sumitomo Pharma leverages advanced manufacturing tech. Automation and process control boost efficiency and cut costs in drug production. These tech improvements also enhance drug quality. The global pharmaceutical automation market is projected to reach $8.6 billion by 2025. This represents a significant investment in technological upgrades.

- Robotics and AI are increasingly used in drug manufacturing.

- Real-time monitoring ensures product consistency.

- Automated systems reduce human error.

- Advanced analytics optimize manufacturing processes.

Data Analytics and Artificial Intelligence in Operations

Sumitomo Pharma leverages data analytics and AI beyond R&D, optimizing operations. This includes supply chain management, manufacturing, and commercial activities. These technologies improve efficiency and inform better decision-making. The global AI in pharma market is projected to reach $6.9 billion by 2025.

- AI adoption in pharma is growing, with a 40% increase in the use of AI-powered tools in 2024.

- Manufacturing optimization can reduce operational costs by up to 15%.

- Supply chain analytics can decrease lead times by 20%.

Sumitomo Pharma capitalizes on AI and machine learning to expedite drug discovery, potentially slashing development costs. By 2025, the company's tech-driven focus includes substantial investments in regenerative medicine and digital health solutions. Manufacturing enhancements through automation further optimize processes.

| Technological Area | Impact | Data |

|---|---|---|

| AI in Drug Discovery | Reduce development costs, speed R&D | AI to cut drug costs by 30% by 2025 |

| Cell Therapy Market | Focus of core business | Projected to hit $11.8B by 2024 |

| Digital Health | Improve patient care, trials | Market reaches $600B by 2025 |

Legal factors

Drug pricing regulations, like the Inflation Reduction Act in the US, are critical for Sumitomo Pharma. These laws directly affect revenue and profitability. The IRA could lead to price negotiations for certain drugs, impacting earnings. In 2024, expect continued scrutiny and potential price adjustments. Sumitomo must adapt to stay competitive.

Sumitomo Pharma relies heavily on patent laws to safeguard its drug innovations. Strong intellectual property rights are essential for preventing generic drug competition. This protection allows Sumitomo Pharma to recoup R&D costs. In 2024, the global pharmaceutical market was valued at approximately $1.5 trillion, with significant portions driven by patented drugs.

Sumitomo Pharma faces strict clinical trial regulations, affecting drug development. Compliance with patient safety, data integrity, and ethical standards is crucial. Regulatory hurdles impact timelines and increase costs. In 2024, the FDA approved 46 new drugs, showing the rigorous standards. These factors significantly influence Sumitomo's market entry strategies.

Product Liability and Litigation

Sumitomo Pharma faces considerable legal risks from product liability lawsuits concerning its pharmaceuticals. The pharmaceutical industry saw over $8 billion in settlements and judgments in 2023, reflecting the high stakes. A single adverse event can trigger costly litigation, impacting financials. Companies must navigate complex regulations to mitigate these risks.

- Product liability lawsuits can lead to substantial financial losses.

- Regulatory compliance is crucial to minimize litigation risks.

- The industry's legal landscape is constantly evolving.

Antitrust and Competition Law

Antitrust and competition laws are crucial for Sumitomo Pharma's strategic decisions, particularly regarding mergers and acquisitions. These laws, like those enforced by the U.S. Federal Trade Commission (FTC), scrutinize deals to ensure fair market competition. For example, in 2024, the FTC blocked several mergers, indicating a heightened focus on maintaining competitive markets. These regulations directly impact Sumitomo Pharma’s ability to expand through acquisitions and influence its market access and pricing strategies.

- In 2024, the FTC challenged over 10 mergers, reflecting strict enforcement.

- Antitrust fines can reach billions, significantly impacting financial performance.

- Compliance costs, including legal and regulatory fees, are a major expense.

Sumitomo Pharma must navigate complex legal factors to succeed. Strict drug pricing and patent laws significantly influence the company’s revenue streams. Litigation, compliance, and antitrust regulations also pose critical financial risks.

| Legal Factor | Impact | Data |

|---|---|---|

| Drug Pricing | Impacts Revenue | US IRA: potential price negotiations |

| Patents | Protects innovation | Global market: $1.5T in 2024 |

| Litigation | Financial risk | 2023 settlements: $8B+ |

Environmental factors

Sumitomo Pharma must navigate stricter environmental rules. The pharmaceutical sector faces increasing scrutiny regarding its impact. This includes waste management, water use, and energy. In 2024, the global green pharmaceutical market was valued at $45.7 billion.

Sumitomo Pharma must adhere to stringent waste management protocols. This includes responsible disposal of manufacturing byproducts and expired drugs. Improper disposal can lead to water and soil contamination, impacting ecosystems and public health. The global pharmaceutical waste management market was valued at $10.8 billion in 2023 and is projected to reach $15.4 billion by 2028.

Sumitomo Pharma's operations face environmental scrutiny regarding water usage and wastewater. Pharmaceutical production often demands significant water resources, impacting sustainability. Regulations are tightening on wastewater treatment to remove APIs. The global pharmaceutical water treatment market, valued at $1.8 billion in 2024, is expected to reach $2.5 billion by 2029.

Energy Consumption and Greenhouse Gas Emissions

The pharmaceutical industry's energy consumption significantly impacts greenhouse gas emissions, a critical environmental factor. Sumitomo Pharma, like its peers, is under increasing pressure to reduce its carbon footprint. This involves transitioning to sustainable energy sources and optimizing production processes. The global pharmaceutical industry's carbon emissions were estimated at 55 million metric tons of CO2e in 2019.

- Sumitomo Pharma is investing in renewable energy and energy efficiency measures.

- The company is setting targets for emissions reduction.

- Sumitomo Pharma is focusing on sustainable supply chain practices.

Impact of Climate Change on Supply Chains and Operations

Climate change poses significant risks to Sumitomo Pharma's operations. Extreme weather, like the 2023 floods, can disrupt supply chains and manufacturing. Resource scarcity, potentially impacting raw materials, is also a concern. These factors could increase operational costs and impact product availability. The pharmaceutical industry faces growing pressure to adopt sustainable practices.

- 2023 saw a 20% increase in supply chain disruptions due to extreme weather events.

- The cost of raw materials is projected to increase by 15% by 2025 due to climate-related issues.

- Regulatory bodies are increasing pressure on pharma companies to reduce carbon emissions.

Sumitomo Pharma deals with environmental rules, especially waste, water, and energy use. Green pharma market reached $45.7B in 2024. It must handle waste responsibly, with the market for waste management projected to hit $15.4B by 2028.

The company faces climate-related supply chain and resource risks, and it is implementing measures for emissions reductions. The cost of raw materials is projected to increase by 15% by 2025 because of the climate-related issues.

| Environmental Aspect | Impact on Sumitomo Pharma | Financial Implication |

|---|---|---|

| Waste Management | Risk of contamination and compliance issues | Market of $15.4B by 2028 for waste management |

| Water Usage | Scrutiny, impacting sustainability | Water treatment market projected at $2.5B by 2029 |

| Climate Change | Supply chain disruptions and resource scarcity | Raw materials costs may rise 15% by 2025 |

PESTLE Analysis Data Sources

Sumitomo Pharma's PESTLE relies on reputable government, financial, and industry data.