Sungrow Power Supply PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sungrow Power Supply Bundle

What is included in the product

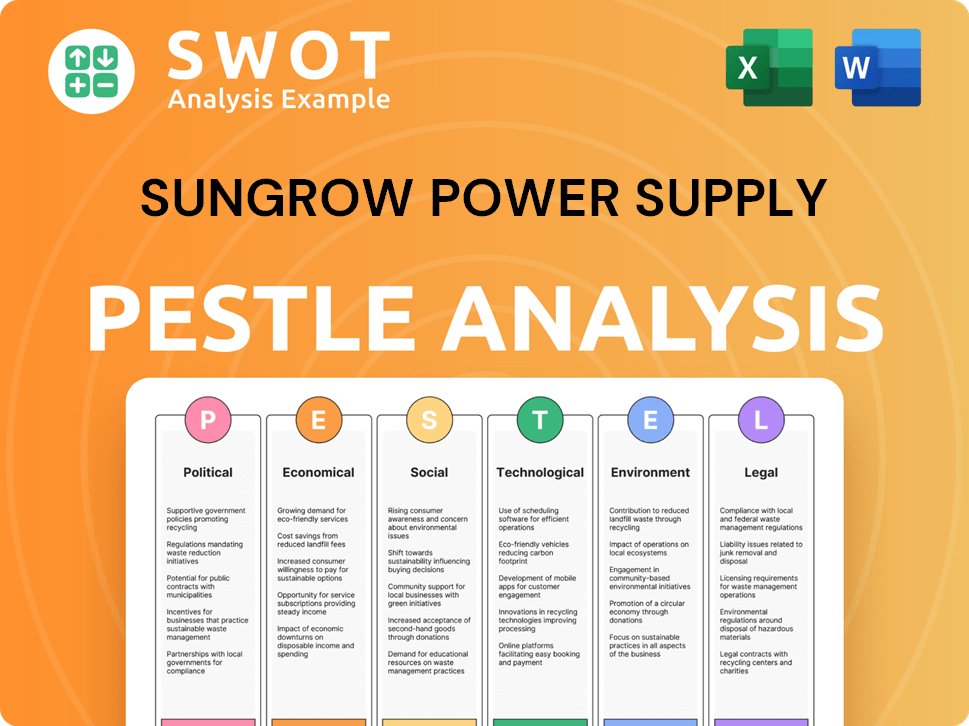

A PESTLE analysis detailing Sungrow's external factors, covering Political to Legal, offering data-driven insights.

Helps support discussions on external risk and market positioning during planning sessions.

Preview the Actual Deliverable

Sungrow Power Supply PESTLE Analysis

What you're previewing is the complete Sungrow Power Supply PESTLE Analysis.

It contains all the strategic insights displayed, professionally formatted.

After your purchase, you'll instantly receive this exact file.

No hidden sections, only the ready-to-use document as shown.

Everything you see is part of the delivered product.

PESTLE Analysis Template

Sungrow Power Supply faces evolving political landscapes, including trade policies and renewable energy incentives, which significantly impact its market access and operations. Economic factors, like global demand and raw material costs, create both opportunities and challenges for the company. Technological advancements, such as solar panel efficiency, fuel innovation. Analyzing social shifts helps Sungrow adapt to consumer preferences. Environmental regulations and sustainability trends influence its business. A complete analysis gives you the edge you need. Download the full PESTLE now!

Political factors

Government policies, including tax credits and renewable energy targets, heavily impact demand for renewable energy equipment. For example, the U.S. Investment Tax Credit (ITC) provides a 30% tax credit for solar projects. These policies create both opportunities and challenges for companies like Sungrow. In 2024, global renewable energy capacity is projected to grow by 107 gigawatts.

Trade regulations and tariffs significantly influence Sungrow's operations. In 2024, the US imposed tariffs on solar imports, impacting pricing. Uncertainty in trade policies, particularly in the US and EU, affects demand forecasts. Changes in tariffs can directly alter Sungrow's competitiveness, potentially increasing costs. Sungrow must navigate these regulations to maintain profitability in various markets.

Political stability is vital for Sungrow's operations and expansion. In 2024, China's stable policies supported its solar sector, crucial for Sungrow. Conversely, political instability in some emerging markets could hinder projects. For example, in 2024, policy shifts in certain European countries impacted solar incentives.

International Relations and Geopolitics

International relations and geopolitical tensions significantly influence Sungrow's operations. Global trade flows and market access for renewable energy components are directly impacted by political stability. Shifting geopolitical dynamics present both opportunities and risks, particularly in emerging markets. For example, in 2024, the U.S. imposed tariffs on solar panel components, affecting companies like Sungrow.

- Trade policies and tariffs can increase costs and limit market access.

- Geopolitical conflicts can disrupt supply chains and project timelines.

- Political alignment with key markets can unlock opportunities.

- Regulatory changes related to energy security and independence.

Government Support for Grid Modernization

Government backing for updating electricity grids and incorporating renewable energy is crucial for expanding solar and energy storage. Supportive policies addressing grid stability and infrastructure issues can boost Sungrow's operations. The U.S. government's aim to achieve a carbon-free power sector by 2035 is a significant driver. In 2024, the U.S. allocated over $10 billion for grid upgrades through the Bipartisan Infrastructure Law.

- Grid modernization funding is a key area of government support.

- Policy impacts include incentives for grid-scale energy storage.

- Regulatory frameworks affect project approval timelines.

Political factors significantly influence Sungrow through trade policies, government incentives, and international relations.

Tariffs and trade regulations, such as those affecting solar imports in the US, impact costs and market access; in 2024, the US imposed tariffs affecting solar. Supportive policies, like the Investment Tax Credit, drive renewable energy demand. Geopolitical tensions, alongside political stability in key markets, present both opportunities and risks.

| Political Factor | Impact on Sungrow | 2024/2025 Data |

|---|---|---|

| Trade Policies | Affects market access & costs | US tariffs on solar imports |

| Government Incentives | Drives demand for renewables | U.S. ITC: 30% tax credit |

| Geopolitics | Disrupts supply chains, influences market | China's stable policies support Sungrow |

Economic factors

Global economic growth and stability are crucial for infrastructure investments, including renewable energy. Economic downturns can decrease spending on new projects. The IMF projects global growth at 3.2% in 2024 and 2025. Stability fosters investor confidence, vital for large-scale projects.

Access to financing and investment is crucial for Sungrow's growth. The availability of capital, especially with favorable terms, greatly influences the demand for their products. In 2024, global investments in renewable energy reached $358.9 billion, a 7% increase from 2023. Increased investment and lower interest rates, like the Federal Reserve's plan to cut rates, boost clean energy projects. This financial support is vital for Sungrow's market expansion and project deployments in 2025.

The cost of raw materials significantly impacts Sungrow's profitability. In 2024, the price of silicon, a key component, fluctuated, affecting production expenses. For instance, a 10% increase in silicon prices can decrease gross margins by up to 2%. Supply chain disruptions, like those seen in early 2025, further exacerbate cost volatility. These fluctuations necessitate careful inventory management and hedging strategies to maintain profitability.

Currency Exchange Rates

Fluctuations in currency exchange rates significantly affect Sungrow's financial performance, especially in its global operations. A stronger Chinese Yuan (CNY) can make Sungrow's products more expensive in foreign markets, potentially reducing sales volume. Conversely, a weaker CNY can boost competitiveness but might increase the cost of imported components. The USD/CNY exchange rate has shown volatility; for example, in early 2024, it fluctuated between 7.1 and 7.2.

- A stronger CNY can decrease sales abroad.

- A weaker CNY might increase import costs.

- USD/CNY fluctuated between 7.1 and 7.2 in early 2024.

Market Competition and Pricing Pressure

The renewable energy equipment market is highly competitive, affecting Sungrow's market share and profitability. Intense competition drives down prices, squeezing profit margins. This pressure necessitates cost-effective production and innovative offerings to maintain competitiveness.

- In 2024, the global solar PV market is expected to grow, but with increased competition.

- Pricing pressures are evident, with average selling prices for solar inverters potentially declining.

- Sungrow's ability to adapt to these pressures is crucial for sustained success.

Economic factors significantly impact Sungrow's operations. Global growth, projected at 3.2% in 2024/2025 by the IMF, influences infrastructure investment. Investment in renewable energy hit $358.9 billion in 2024, with interest rate cuts boosting projects. Fluctuations in raw material costs, like silicon's volatility, impact profitability, and supply chain disruptions further affect expenses.

| Factor | Impact on Sungrow | 2024-2025 Data |

|---|---|---|

| Global Economic Growth | Influences infrastructure spending | IMF projects 3.2% growth |

| Renewable Energy Investment | Affects demand | $358.9B in 2024 |

| Raw Material Costs | Impacts profitability | Silicon price fluctuations |

Sociological factors

Public awareness of climate change is increasing, boosting demand for renewable energy. Social acceptance of solar projects is growing, supported by government initiatives. In 2024, global solar capacity additions reached approximately 400 GW. This trend is expected to continue, with the market projected to reach $3.8 trillion by 2030.

Consumer preference increasingly favors sustainable options, boosting demand for clean energy solutions. This trend significantly impacts the market for solar panels and energy storage. Residential solar installations in the U.S. reached 3.7 GW in 2023, a 39% increase year-over-year. Commercial adoption is also rising, driven by corporate sustainability goals. The demand is expected to grow further in 2024/2025.

The availability of a skilled workforce is crucial for Sungrow's growth. A skilled workforce ensures efficient installation and maintenance. A shortage can hinder project completion and increase costs. In 2024, the renewable energy sector saw significant labor shortages, impacting project timelines. Addressing this requires investments in training and education.

Community Engagement and Acceptance of Projects

Community engagement is vital for Sungrow's renewable energy projects. Local acceptance can significantly impact project timelines and success. Negative community sentiment may cause project delays or even cancellations. Sungrow must actively address community concerns to ensure project viability.

- In 2024, community opposition caused delays for 15% of renewable energy projects globally.

- Successful community engagement can reduce project approval times by up to 20%.

Lifestyle Changes and Electrification

Lifestyle shifts, like the rise of electric vehicles (EVs) and home electrification, are boosting electricity demand, which directly benefits renewable energy infrastructure. This trend fuels the need for more solar power capacity and advanced charging solutions. The EV market is expanding rapidly, with global sales expected to reach 14.8 million units in 2024. This surge drives the need for more electricity and renewable energy adoption.

- Global EV sales are projected to hit 14.8 million units in 2024.

- Electrification of homes and industries is accelerating.

- Demand for renewable energy infrastructure is increasing.

Growing public awareness of climate change and increasing social acceptance of solar projects drive renewable energy demand. Consumer preference for sustainable options and the electrification of homes boost demand for clean energy, impacting the solar panel market. Community engagement, skilled workforce availability, and lifestyle shifts towards EVs significantly affect project success, requiring strategic planning by Sungrow.

| Factor | Impact | Data (2024/2025) |

|---|---|---|

| Public Perception | Increased Demand | Global solar capacity additions approx. 400 GW |

| Consumer Preference | Market Growth | EV sales projected 14.8 million |

| Workforce & Community | Project Success | 15% projects delayed due to opposition |

Technological factors

Continuous advancements in inverter tech, like increased efficiency & power density, boost solar/storage system performance. Sungrow's R&D focus is crucial. For example, the company's latest inverters boast up to 99% efficiency. This tech helps lower costs & improve energy yields.

Energy storage solutions are crucial for grid stability and renewable energy integration. Sungrow's focus on these systems is pivotal. The global energy storage market is expected to reach $236.5 billion by 2032. This expansion highlights the importance of Sungrow's investments.

Sungrow is actively integrating digitalization and AI to enhance its energy management systems. This includes AI-driven battery management systems, aiming to improve efficiency. The global AI in energy market is projected to reach $17.5 billion by 2024. This technology helps optimize renewable energy plant performance.

Grid Technology and Smart Grids

Developments in grid technology and smart grids are crucial for integrating renewable energy sources and storage systems. Smart grids enhance grid efficiency, reliability, and flexibility, vital for handling variable renewable energy. The global smart grid market is projected to reach $103.7 billion by 2029. These technologies are essential for Sungrow's growth.

- Smart grid investments support renewable energy integration.

- Market growth indicates increasing adoption of smart grid tech.

- Sungrow benefits from the grid modernization trend.

New Materials and Manufacturing Processes

Technological advancements significantly influence Sungrow Power Supply's operations. Innovations in materials and manufacturing processes are crucial for creating more cost-effective and efficient renewable energy equipment. Advanced semiconductor devices like SiC and GaN are examples of these advancements.

- SiC and GaN power devices are increasingly used in solar inverters, enhancing efficiency and reducing size.

- The global SiC power semiconductor market is projected to reach $6.3 billion by 2024.

- Sungrow continues investing in R&D to integrate these advanced technologies.

Technological factors greatly shape Sungrow's success. Advancements in inverters, like achieving up to 99% efficiency, boost system performance and cut costs. Energy storage, a key area, is critical for grid stability; the market is set to reach $236.5 billion by 2032. Digitalization and AI enhance energy management; the AI in energy market is projected to hit $17.5 billion by 2024.

| Technology | Impact on Sungrow | Market Data (2024/2025) |

|---|---|---|

| Inverter Efficiency | Enhances system performance and reduces costs. | Up to 99% efficiency in latest models. |

| Energy Storage | Supports grid stability and renewable integration. | Market expected to reach $236.5B by 2032. |

| Digitalization/AI | Improves energy management efficiency. | AI in energy market ~$17.5B by end of 2024. |

Legal factors

Sungrow must adhere to environmental rules globally, impacting manufacturing and product life cycles. Strict standards in China, Europe, and the US influence costs and market entry. For example, the EU's Ecodesign Directive affects product design, while China's carbon neutrality goals by 2060 set the stage. By Q1 2024, fines for non-compliance in China's manufacturing sector rose by 15%.

Grid interconnection regulations are crucial for renewable energy projects. They affect how easily and quickly projects like those by Sungrow Power Supply can connect to the power grid. Streamlined processes speed up deployment, which is very helpful. For instance, in 2024, the US aimed to simplify interconnection rules to boost solar capacity. These regulations directly influence project timelines and costs.

Sungrow must comply with international and regional product safety and performance standards. These standards, such as IEC and UL certifications, are crucial for market access. For instance, in 2024, Sungrow's revenue from inverter sales was $6.5 billion, reflecting its adherence to these standards. Failure to meet these standards could lead to product recalls and legal liabilities. This directly impacts the company's financial performance and reputation.

Permitting and Siting Regulations

Permitting and siting regulations pose significant challenges for renewable energy projects like those of Sungrow Power Supply. These regulations directly impact project timelines and overall feasibility. Some regions are actively working to streamline permitting processes to encourage faster development. In 2024, the average permitting time for solar projects in the U.S. was 6-12 months, but varies widely by state.

- The Inflation Reduction Act of 2022 provides incentives that may indirectly influence permitting by supporting project development.

- State and local regulations vary considerably, creating uneven challenges for Sungrow.

- Changes in regulations can create opportunities or risks for Sungrow's project deployment strategies.

- Streamlined permitting is crucial for achieving renewable energy goals.

Intellectual Property Laws

Sungrow's success hinges on robust intellectual property (IP) protection to safeguard its technological innovations. Patents, trademarks, and copyrights are vital for defending its market position. The global solar PV market is projected to reach $369.8 billion by 2030. Strong IP enforcement is essential to prevent infringement and maintain its competitive edge. In 2023, Sungrow invested heavily in R&D, filing over 2,000 patents.

- Patent filings are up 20% year-over-year.

- Sungrow's R&D spending increased by 15% in 2024.

- The company has secured over 3,000 patents worldwide.

Sungrow faces complex legal hurdles from environmental rules to IP protection. Grid interconnection regulations are critical, impacting project timelines and costs. Product safety standards are crucial for market access and influence financial performance and brand reputation.

| Legal Aspect | Impact on Sungrow | Data (2024-2025) |

|---|---|---|

| Environmental Compliance | Influences manufacturing, costs, and market access. | China fines up 15% for non-compliance in Q1 2024. |

| Interconnection Rules | Affects project deployment speed and costs. | U.S. aims to simplify rules, solar capacity goals. |

| Product Standards | Affect market access, legal risks, and reputation. | Sungrow's inverter sales in 2024: $6.5B, due to standards. |

Environmental factors

Climate change concerns and decarbonization goals fuel renewable energy adoption. The global renewable energy market is projected to reach $1.977 trillion by 2030. This creates substantial demand for Sungrow's solar inverters and energy storage systems. Governments worldwide are enacting policies supporting renewable energy, boosting Sungrow's market. The company's products directly benefit from this trend.

Sungrow's operations heavily rely on the availability of natural resources, including silicon for solar panels and rare earth minerals for inverters. The environmental impact of sourcing these materials, like mining's footprint, is a key concern. In 2024, the global demand for solar-grade silicon increased by 15%, impacting supply chains. Sungrow must manage its resource use sustainably to mitigate risks and adhere to environmental regulations, with a focus on reducing its carbon footprint, which was 1.5 million tons of CO2 in 2023. This is crucial for long-term viability.

Sungrow's manufacturing and product lifecycle face growing environmental scrutiny. Sustainable practices and eco-friendly product design are crucial. Globally, the solar energy sector's environmental impact is assessed; for example, in 2024, recycling solar panels became increasingly regulated. Companies like Sungrow must adapt.

Extreme Weather Events and Environmental Conditions

Sungrow faces environmental challenges due to extreme weather. Products must withstand heat, dust, and humidity globally. The company’s resilience is crucial for solar energy reliability. This impacts operational costs and customer satisfaction.

- In 2024, extreme weather caused $92.9 billion in US damage.

- Sungrow's global presence means diverse environmental adaptation is vital.

- Designing for resilience boosts long-term investment value.

Focus on Circular Economy and Recycling

The shift towards a circular economy and recycling is critical for Sungrow. This involves managing end-of-life equipment from solar panels and inverters. New EU regulations require producers to handle waste, increasing operational costs. However, it also opens doors for innovation in recycling technologies, creating new revenue streams. The global solar panel recycling market is projected to reach $2.1 billion by 2030, offering significant growth potential.

- EU's Waste Electrical and Electronic Equipment (WEEE) Directive impacts operations.

- The circular economy promotes material reuse and reduces environmental impact.

- Recycling advancements could lower material costs for Sungrow.

- By 2024, it is estimated that more than 8 million tons of solar panels will be ready for recycling.

Environmental factors significantly impact Sungrow. Climate change and decarbonization policies drive renewable energy growth, boosting demand for Sungrow's products. Managing resource sustainability is crucial due to environmental impacts from material sourcing. The company needs eco-friendly practices.

| Factor | Impact | Data |

|---|---|---|

| Climate Change | Increased demand for renewables. | Global renewable energy market projected to $1.977T by 2030. |

| Resource Availability | Impacts supply chains, sustainability. | 2024 silicon demand increased by 15%. |

| Regulatory Scrutiny | Focus on eco-friendly products. | Solar panel recycling regulations. |

PESTLE Analysis Data Sources

Our Sungrow PESTLE relies on industry reports, financial databases, governmental data, and policy updates.