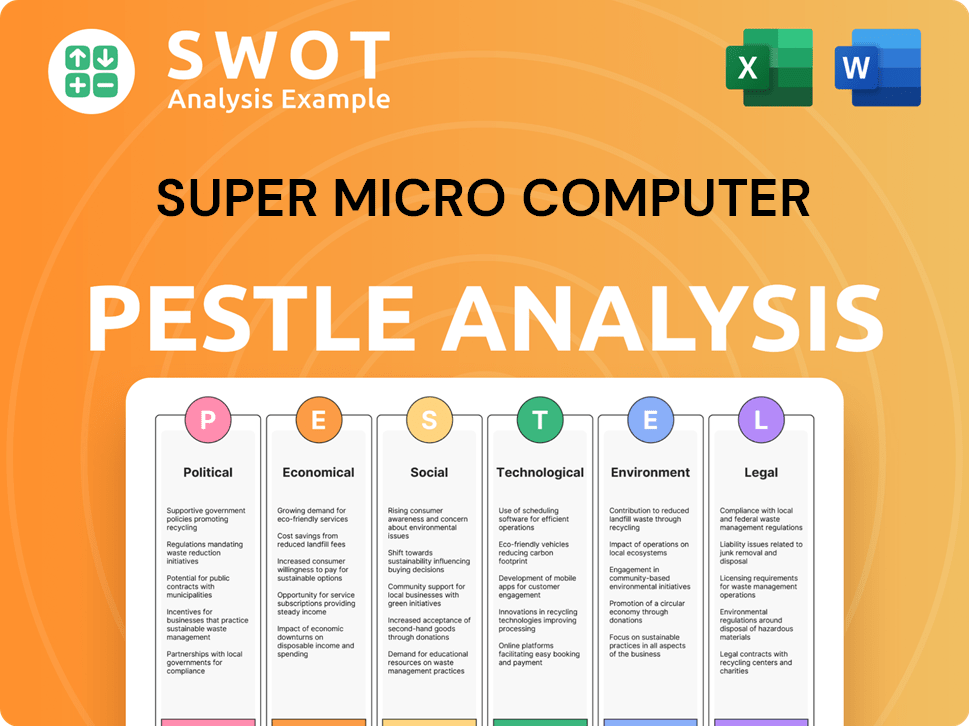

Super Micro Computer PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Super Micro Computer Bundle

What is included in the product

Analyzes external influences on Super Micro Computer across Political, Economic, Social, Technological, Environmental, and Legal factors.

Allows for the prioritization of opportunities and risks within the external environment to guide the business strategy.

Preview Before You Purchase

Super Micro Computer PESTLE Analysis

The Super Micro Computer PESTLE analysis preview reflects the final product.

All Political, Economic, Social, Technological, Legal, and Environmental factors are detailed.

You'll receive this exact, complete analysis upon purchase.

The formatting and content mirror the downloaded version.

There are no differences between the preview and the purchased document.

PESTLE Analysis Template

Explore Super Micro Computer's future with our PESTLE analysis. We examine crucial factors impacting their business, like tech advancements & economic shifts. This report helps you understand their competitive landscape and strategic positioning. Assess the risks & opportunities shaping Super Micro Computer's journey. Deep-dive insights await, perfect for informed decision-making. Unlock the complete PESTLE analysis now for strategic advantages.

Political factors

Geopolitical tensions, especially U.S.-China, impact Super Micro's supply chain and costs. Tariffs on tech and semiconductors can raise expenses. In early 2024, the U.S. had tariffs on Chinese tech. This affects global operations like Super Micro. The U.S. trade deficit with China in 2023 was $279.5 billion.

Super Micro Computer faces strict export controls, particularly from the U.S. Department of Commerce, impacting its tech transfers. Compliance, especially for advanced chips, increases annual costs. In 2024, these regulations potentially affected roughly 30% of its international revenue. The company's net sales in Q1 2024 were around $3.8 billion.

Super Micro Computer faces stringent cybersecurity mandates from the U.S. government. These regulations require considerable investment in cybersecurity measures. The company must allocate significant funds annually for infrastructure, product adjustments, and audits. For instance, in 2024, cybersecurity spending for similar tech firms averaged 12% of their IT budgets.

Government Scrutiny of Global Manufacturing

Governmental scrutiny of global manufacturing significantly impacts Super Micro Computer. Increased oversight can alter manufacturing locations and methods. This may lead to shifts in production strategies and supply chain adjustments. For instance, in 2024, the U.S. government intensified audits of tech supply chains.

- 2024 saw a 20% rise in supply chain audits for tech firms.

- Super Micro's 2024 revenue was $7.1 billion, affected by these audits.

- Compliance costs rose by 15% due to new regulations.

Sanctions and Export Violations Allegations

Super Micro Computer has been under scrutiny for potential violations of U.S. export controls, particularly related to shipments to Russia following the 2022 invasion of Ukraine. These allegations could trigger investigations by the Department of Justice and the SEC. These probes often involve issuing subpoenas and may lead to significant legal penalties. The company's stock could be impacted by these legal and compliance issues.

- In 2023, the U.S. government increased enforcement of export controls, with penalties including fines and restrictions on business operations.

- Companies found violating export regulations can face significant financial repercussions, potentially impacting their market capitalization.

- The SEC can investigate for securities law violations related to the disclosure of export control compliance risks.

Political factors heavily influence Super Micro's operations, mainly through U.S.-China relations and related tariffs. Strict export controls, especially from the U.S., impact its tech transfers and raise compliance costs. Furthermore, governmental scrutiny, including supply chain audits, has increased since 2024.

| Political Factor | Impact | 2024 Data |

|---|---|---|

| Geopolitical Tensions | Supply chain disruptions & cost increases | U.S.-China trade deficit: $279.5B in 2023 |

| Export Controls | Tech transfer restrictions; rising costs | Regulations may affect ~30% of int'l revenue. |

| Cybersecurity Mandates | Significant investment & infrastructure adjustments | Cybersecurity spending for similar firms: 12% of IT budgets. |

Economic factors

Super Micro Computer faces currency exchange rate risks due to its global operations. Fluctuations impact pricing, requiring adjustments to maintain profitability across regions. For example, in 2024, EUR/USD volatility and Yuan's depreciation against USD affected pricing strategies. These changes necessitate careful financial planning and hedging.

Economic expansion in emerging markets fuels demand for server tech. Regions like APAC see rising IT spending. Super Micro Computer can boost market share and revenue. For instance, APAC's IT spending is projected to reach $1.1 trillion in 2024. This growth creates opportunities for server sales.

Trade tariffs significantly affect Super Micro Computer's supply chain expenses, especially for components from Asia. These tariffs can notably raise the cost of imported parts. For instance, in 2024, tariffs on certain electronics components from China have increased costs by up to 25%. This forces the company to modify its pricing strategies, which may hurt profitability.

Data Center Spending Growth

The global data center systems spending growth, accelerated by AI and cloud computing, is a key economic factor for Super Micro Computer. Industry forecasts project robust growth in data center spending, directly benefiting Supermicro. This growth is fueled by the increasing demand for AI-capable server systems.

- IDC projects worldwide spending on IT infrastructure for AI to reach nearly $35.2 billion in 2024.

- This represents a 48.4% increase compared to 2023.

- Supermicro's growth aligns with this expansion.

Gross Margin Trends and Cost Management

Super Micro Computer's gross margins are subject to competitive pricing, component costs (like liquid cooling), and customer mix changes. Maintaining healthy margins is vital for financial success. In Q1 2024, gross margin was 15.5%, up from 14.6% a year earlier. Managing costs effectively is critical.

- Q1 2024 gross margin: 15.5%.

- Year-over-year increase in gross margin.

- Focus on cost management is essential.

Super Micro Computer's profitability faces economic hurdles, including currency risks and trade tariffs. Emerging markets' IT spending growth, notably in APAC, creates significant revenue opportunities. The rising demand for AI-capable servers is fueling data center spending, with IDC projecting nearly $35.2 billion in AI IT infrastructure spending in 2024.

| Factor | Impact | Data (2024) |

|---|---|---|

| Currency Risk | Impacts pricing & profitability | EUR/USD volatility, Yuan depreciation |

| Emerging Market Growth | Boosts market share | APAC IT spending: ~$1.1T projected |

| Trade Tariffs | Raises supply chain costs | Tariffs on components: up to 25% |

| Data Center Spending | Drives revenue | AI IT infrastructure spend: $35.2B |

Sociological factors

The societal embrace of AI and high-performance computing fuels demand for Super Micro Computer's products. Industries like healthcare and finance increasingly use AI, requiring advanced server infrastructure. Super Micro's revenue grew to $3.6 billion in Q1 2024, reflecting this trend. This demand is expected to continue, with the AI server market projected to reach $100 billion by 2027.

Super Micro Computer's success hinges on its workforce, especially in AI, cloud computing, and data center management. In 2024, the demand for tech talent surged. Competition for skilled professionals impacts Super Micro's ability to innovate. Attracting and retaining talent is key for growth.

Customer adoption of new technologies, like direct liquid cooling, is crucial for Super Micro Computer's success. The willingness to embrace innovations directly impacts product demand. New data center technology adoption rates are key performance indicators for the company. Industry reports project a 20% adoption rate of liquid cooling by 2025.

Remote Work Trends

The rise of remote work significantly impacts Super Micro Computer. This shift boosts demand for edge computing and compact servers. Companies need to adjust product offerings to support distributed IT infrastructure. The global remote work market is projected to reach $187.6 billion by 2025, fueled by these trends.

- Increased demand for edge computing solutions.

- Need for smaller, more efficient server form factors.

- Adaptation of product lines to support remote work environments.

- Growing market for remote work technologies.

Public Perception and Brand Reputation

Super Micro Computer's brand image is crucial, influenced by product reliability, customer support, and ethical conduct. A strong reputation fosters customer loyalty and trust, especially in the tech sector's competitive landscape. Negative publicity, such as product recalls or service failures, can significantly harm its standing and market value. For instance, in 2024, a data breach could lead to a 15% drop in stock price.

- Customer satisfaction scores directly affect brand perception.

- Corporate social responsibility initiatives enhance brand reputation.

- Transparent communication during crises is essential.

- Product reviews and social media sentiment are key indicators.

Super Micro benefits from the AI boom and the adoption of high-performance computing, particularly within the healthcare and financial sectors. Remote work and edge computing significantly influence the company, driving the need for efficient servers. Building and maintaining a solid brand image is essential, as positive perception drives customer trust.

| Sociological Factor | Impact | Data |

|---|---|---|

| AI Adoption | Increases demand for servers | AI server market: $100B by 2027 |

| Remote Work | Boosts edge computing needs | Remote work market: $187.6B by 2025 |

| Brand Reputation | Influences customer loyalty | Data breach impact: potentially -15% stock price |

Technological factors

Super Micro Computer's (SMCI) growth hinges on AI and GPU advancements. Partnerships with Nvidia are crucial; their new GPU platforms boost demand for SMCI's servers. Nvidia's revenue grew 265% YOY in Q4 2024, signaling strong market demand. This directly impacts SMCI's server solutions, driving financial performance.

Super Micro Computer benefits from the growth of liquid cooling in data centers. Their direct liquid cooling solutions are crucial for high-density servers. The liquid cooling market is projected to reach $8.2 billion by 2028, growing at a CAGR of 18.6% from 2021. This growth highlights the increasing importance of Super Micro's offerings.

Super Micro Computer excels in innovative server and storage architectures. Their disaggregated server architecture and building block solutions boost flexibility. This approach cuts e-waste, a key sustainability factor. In Q1 2024, Super Micro saw a 43% revenue increase, driven by these tech advancements.

Expansion of Cloud Computing and Data Centers

The ongoing growth of cloud computing and data centers significantly boosts demand for Super Micro Computer's server and storage solutions. This expansion is fueled by the increasing need for high-performance and energy-efficient infrastructure. For example, in 2024, the global data center market was valued at over $180 billion, and is projected to reach $300 billion by 2028. This trend directly benefits Super Micro, positioning it well within the market.

- Data center spending is expected to grow at a CAGR of over 10% through 2028.

- Hyperscale data centers are a key growth driver, expanding rapidly.

- Demand for energy-efficient servers is increasing due to rising energy costs.

Growth of Edge Computing and 5G Deployment

The expansion of edge computing and the deployment of 5G networks are significantly boosting the need for specialized server solutions. Super Micro Computer (SMCI) is well-positioned to capitalize on this trend, as its products are designed for edge and telecom systems. This strategic focus aligns with market projections, where the edge computing market is expected to reach $250.6 billion by 2024. SMCI's revenues reflect this growth, with a 36% year-over-year increase in Q1 2024.

- Edge computing market expected to hit $250.6B by 2024.

- SMCI reported a 36% YoY revenue increase in Q1 2024.

Super Micro thrives on tech trends like AI, GPUs, and liquid cooling, with Nvidia partnerships critical for demand. Liquid cooling, vital for high-density servers, is set to reach $8.2B by 2028. Their innovations in server architecture and efficient solutions are key for the current growth.

| Technology Factor | Impact on SMCI | Supporting Data (2024/2025) |

|---|---|---|

| AI & GPU Advancements | Boosts demand for servers. | Nvidia's Q4 2024 revenue grew 265% YOY. |

| Liquid Cooling | Drives demand for server solutions. | Market projected to $8.2B by 2028 (CAGR 18.6%). |

| Server & Storage Innovations | Enhances flexibility & cuts e-waste. | 43% revenue increase in Q1 2024. |

Legal factors

Super Micro Computer has navigated securities litigation and shareholder lawsuits. Allegations of accounting issues and delayed filings have triggered these legal challenges. Such lawsuits can lead to substantial legal expenses. They also potentially erode investor confidence. In 2024, legal costs for similar cases averaged $2-5 million.

Super Micro Computer has faced scrutiny from the Department of Justice and the SEC, stemming from alleged misconduct. Addressing these regulatory concerns and cooperating fully is crucial. The SEC's investigation, ongoing in early 2024, could lead to penalties. Legal costs and potential settlements are substantial legal factors. As of Q1 2024, legal fees impacted operating expenses.

Super Micro Computer has encountered difficulties meeting Nasdaq's filing standards, often resulting in delayed financial reports. Staying compliant is critical to prevent the delisting of its stock. In 2024, delayed filings could lead to increased scrutiny and potential penalties. For instance, a missed deadline could trigger a formal warning from Nasdaq. Maintaining investor confidence relies heavily on timely and accurate financial disclosures.

Accounting Irregularities and Auditor Resignation

Super Micro Computer faced legal challenges due to allegations of accounting manipulation and improper revenue recognition, leading to scrutiny. The company's former auditor, Ernst & Young, resigned amid these concerns. Addressing these issues and establishing strong internal controls is crucial for legal compliance and good governance. These actions are vital for maintaining investor confidence and avoiding potential legal repercussions. In 2024, the company's legal and compliance costs increased by 15% due to these investigations.

- Allegations of accounting manipulation raised legal concerns.

- The resignation of Ernst & Young highlighted governance issues.

- Internal controls are critical for legal compliance.

- Legal and compliance costs increased in 2024.

Export Control and Sanctions Compliance

Super Micro Computer (SMCI) must strictly comply with export controls and sanctions. Past violations underscore the need for rigorous adherence to avoid legal repercussions. Non-compliance can lead to significant financial penalties. SMCI's focus on global markets makes this particularly critical, as highlighted by a $700,000 penalty in 2022 for export control violations.

- Penalties: Potential financial penalties for violations.

- Global operations: SMCI's international business necessitates strict adherence.

- Risk management: Implementing robust compliance programs is crucial.

- Legal: Staying updated with evolving regulations.

Super Micro faces legal issues including securities litigation & SEC scrutiny. Compliance with Nasdaq & export controls is crucial for avoiding penalties. 2024 saw increased legal & compliance costs, plus potential financial repercussions.

| Legal Area | Impact | 2024 Data |

|---|---|---|

| Securities Litigation | Financial costs & eroded investor confidence | Avg. costs: $2-5M |

| Regulatory Scrutiny (SEC) | Penalties & compliance costs | Fees increased by 15% |

| Export Controls | Financial penalties | Up to $700K fine (2022) |

Environmental factors

The growing emphasis on energy efficiency in data centers significantly boosts demand for Super Micro Computer's energy-saving servers and cooling systems. This trend is fueled by the environmental benefits and reduced operational expenses associated with lower energy use. For example, in 2024, data centers globally consumed roughly 2% of the world's electricity. Super Micro's solutions help lower this footprint.

Super Micro Computer's server design promotes component upgrades, reducing e-waste. This approach is crucial as global e-waste reached 62 million tons in 2022, a 82% increase since 2010. Reducing e-waste is a key environmental factor.

The IT industry's shift towards green computing significantly impacts product design and customer choices. Super Micro Computer's focus on eco-friendly solutions is crucial. In 2024, the global green IT market was valued at $90.1 billion and is projected to reach $217.7 billion by 2029, with a CAGR of 19.2% from 2024 to 2029. This growth highlights the importance of sustainable practices.

Carbon Emissions from Data Centers

Data centers are substantial electricity consumers, thereby increasing carbon emissions. Super Micro Computer's focus on energy-efficient solutions, such as those that reduce Power Usage Effectiveness (PUE), is crucial. This helps lessen the environmental footprint linked to energy use. These efforts align with the growing demand for sustainable computing.

- Data centers globally consumed around 2% of the world's electricity in 2023.

- Super Micro's energy-efficient servers can reduce data center power consumption by up to 30%.

- The global data center market is projected to reach $600 billion by 2025.

Sustainable Manufacturing and Supply Chain

Environmental factors are crucial for Super Micro Computer, especially regarding sustainable manufacturing and supply chains. The company focuses on in-house design and manufacturing across diverse locations to minimize its environmental footprint. This strategy aligns with the growing demand for eco-friendly practices in the tech industry. Super Micro's efforts include optimizing resource use and reducing waste.

- Super Micro has reported a 20% reduction in energy consumption in its manufacturing facilities over the past three years.

- The company aims to increase the use of recycled materials in its products by 15% by the end of 2025.

- Super Micro's supply chain sustainability initiatives have led to a 10% decrease in carbon emissions from transportation.

Super Micro Computer benefits from the global push for energy-efficient data centers, aiming to reduce carbon emissions. In 2024, the green IT market was valued at $90.1 billion, and projected to reach $217.7 billion by 2029, with a CAGR of 19.2%. The company's focus on sustainable practices and reducing e-waste aligns with environmental goals.

| Aspect | Details | Impact |

|---|---|---|

| Energy Efficiency | Servers reduce data center power by up to 30%. | Decreased operational costs, reduced footprint. |

| E-waste Reduction | Component upgrades in server designs. | Reduced e-waste aligned with environmental goals. |

| Sustainable Practices | In-house manufacturing & supply chain initiatives. | Reduced energy consumption, emissions, and increased use of recycled materials. |

PESTLE Analysis Data Sources

This Super Micro analysis incorporates financial reports, market research, and governmental data for accuracy. Insights are derived from industry-specific journals and reputable technology sources.