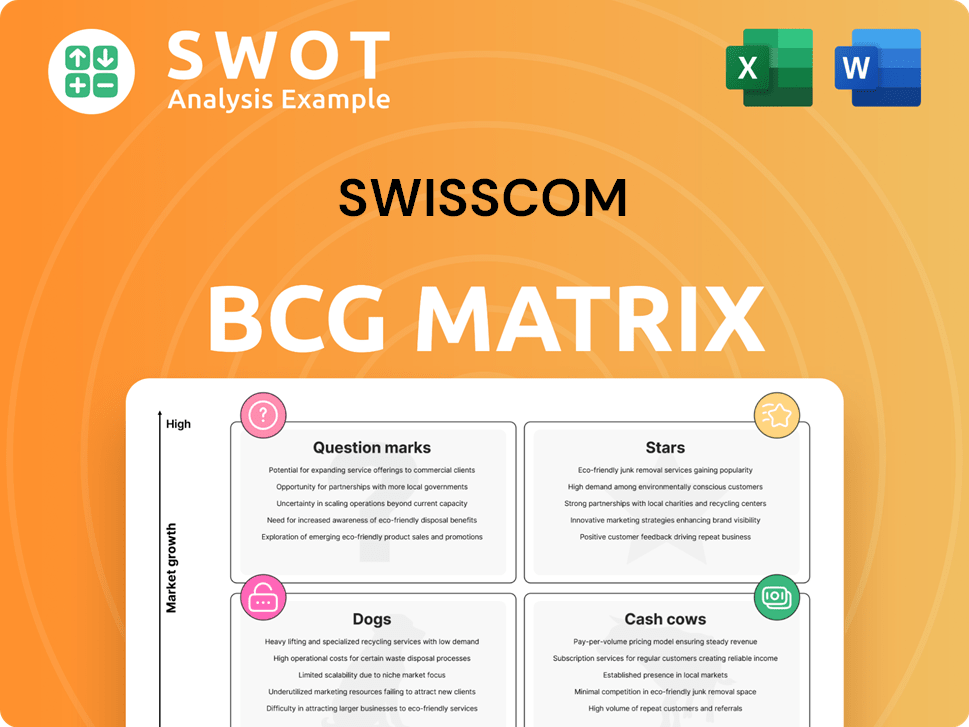

Swisscom Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Swisscom Bundle

What is included in the product

Analyzes Swisscom's business units within the BCG Matrix, suggesting investment, holding, or divestment strategies.

Optimized for C-level presentations with a clean, distraction-free design, delivering concise insights.

What You’re Viewing Is Included

Swisscom BCG Matrix

The Swisscom BCG Matrix preview offers the complete document you'll receive after purchase. It's a fully functional and strategic analysis tool, ready for your immediate application and tailored for professional presentation.

BCG Matrix Template

Swisscom's product portfolio reveals exciting dynamics in its BCG Matrix. Stars are shining bright, and Cash Cows are likely generating steady revenue. Question Marks hint at future potential, while Dogs may require strategic decisions. This peek offers a glimpse, but the full BCG Matrix provides in-depth analysis and strategic recommendations. Get the complete report for a clear competitive edge and informed investment choices!

Stars

Swisscom's 5G+ network leadership is evident, with 81% population coverage in Switzerland, offering speeds up to 2 Gbps. This strong infrastructure supports innovative services and attracts customers. Swisscom invested CHF 1.6 billion in its network in 2023. By 2025, it aims for 90% 5G+ coverage, strengthening its market position.

Fastweb's Italian operations show robust growth, with a 7.2% revenue increase in 2024. Its expanding customer base and diversification into electricity subscriptions bolster its market position. This strategic move significantly boosts Swisscom's financial performance.

Swisscom's ICT solutions are a "Star" in its BCG Matrix. The 3.2% revenue growth from IT services in 2024 proves strong demand. Businesses rely on Swisscom for cloud, security, and IoT. Innovation fuels growth, cementing its ICT leadership.

Swiss AI Platform

Swisscom's 2024 launch of the Swiss AI Platform offers businesses trusted AI solutions, including infrastructure and applications with Swiss data storage. This platform facilitates the collaborative creation of customer-specific AI applications, strengthening Swisscom's leadership in AI innovation. The modular design and access to NVIDIA SuperPOD systems provide flexibility and high processing power. This attracts businesses aiming to use AI for competitive advantage. Swisscom invested CHF 100 million in AI in 2023, showing commitment.

- Launch Year: 2024

- Investment in AI (2023): CHF 100 million

- Focus: Trusted AI solutions with Swiss data storage

- Key Feature: Collaborative application development

Vodafone Italia Integration

Swisscom's late 2024 acquisition of Vodafone Italia is a major move, aiming to become a leading converged provider in Italy. This integration merges Vodafone Italia with Fastweb, combining strengths in both mobile and fixed services. The success of this venture hinges on effectively realizing synergies and integrating the two entities. Swisscom's strategic investment is expected to significantly boost its market position.

- Acquisition: Vodafone Italia in late 2024.

- Merger: Vodafone Italia and Fastweb.

- Goal: Become a leading converged provider.

- Impact: Strengthens market position.

Swisscom's Stars include 5G+, ICT, and the Swiss AI Platform, driving growth. These segments show high market share and growth potential. The Vodafone Italia acquisition further boosts its Star portfolio, aiming for converged leadership.

| Star Category | Key Feature | 2024 Data |

|---|---|---|

| 5G+ | 81% population coverage, 2 Gbps speeds | CHF 1.6B network investment (2023) |

| ICT Solutions | Cloud, security, IoT | 3.2% revenue growth |

| Swiss AI Platform | Trusted AI solutions, Swiss data | CHF 100M AI investment (2023) |

Cash Cows

Swisscom's fixed broadband services are a key cash cow, holding about 50% of the Swiss market. Although connections dipped slightly in 2024, this segment remains highly profitable. This is due to its large, loyal customer base. Investment in infrastructure and customer retention are vital for sustained financial success.

Swisscom's postpaid mobile services are a cash cow, fueled by its premium brand. They hold over 50% of the postpaid mobile market share in Switzerland. This dominance is supported by a loyal customer base. Attractive plans and network superiority will ensure continued cash flow. In 2024, Swisscom reported a strong mobile service revenue.

Blue TV is a core offering, integrating Replay TV and streaming, drawing many subscribers. The platform leverages exclusive sports rights like the Swiss football league, boosting loyalty and revenue. Ongoing platform and content upgrades are vital for maintaining its competitive advantage and profitability. In 2024, Swisscom reported strong growth in its entertainment segment, with Blue TV playing a key role. The platform's subscriber base continues to expand, reflecting its market position.

Wholesale Business in Italy

Fastweb's wholesale business in Italy is a cash cow, demonstrating solid revenue growth. This growth is fueled by rising demand for broadband connections from other operators. Fastweb's robust infrastructure ensures reliable service, enhancing its market position. Expanding wholesale partnerships will boost revenue and cash flow.

- In 2023, Fastweb's wholesale revenue in Italy reached €400 million.

- Fastweb increased its broadband connections by 15% in 2024 through wholesale.

- The wholesale segment contributes 25% to Fastweb's overall revenue.

- Fastweb plans to invest €100 million to expand its wholesale infrastructure by 2025.

Traditional Telecommunication Services

Swisscom's traditional telecommunication services, including fixed and mobile telephony, remain crucial cash cows. Despite intensifying competition and evolving technologies, these services still provide a significant portion of the company's revenue. Swisscom's strategy involves bundled services and high customer satisfaction to ensure steady cash flow from these established areas. Optimizing operations and customer retention are essential for boosting profitability.

- In 2023, Swisscom's revenue from telecom services was substantial, even with market pressures.

- Customer loyalty programs and bundled offerings are key to retaining subscribers.

- Ongoing infrastructure investments support service quality and efficiency.

- Focus on digital transformation to modernize these traditional services.

Swisscom's cash cows generate significant revenue and cash flow due to established market positions. These include fixed broadband, postpaid mobile services, Blue TV, and Fastweb's wholesale business. They feature high customer loyalty and solid infrastructure, enhancing their market positions. Optimizing these segments remains vital for sustained financial success.

| Cash Cow | Key Feature | 2024 Data Highlights |

|---|---|---|

| Fixed Broadband | Market Dominance | 50% market share; Slight dip in connections; Requires investment. |

| Postpaid Mobile | Premium Brand | Over 50% market share; Strong mobile revenue. |

| Blue TV | Integrated Platform | Strong growth in entertainment; Expanding subscriber base. |

| Fastweb Wholesale | Wholesale Business | 15% increase in broadband connections through wholesale. |

| Traditional Telecom | Established Services | Focus on customer retention; Bundled services. |

Dogs

Swisscom's legacy DSL networks face challenges. These networks, still used, offer slower speeds compared to fiber. This can cause customers to switch to faster services.

In 2023, Swisscom's fiber coverage reached 60% of Swiss households. DSL's lower speeds risk customer loss.

Phasing out DSL and focusing on fiber is key. This helps Swisscom stay competitive in the market.

By 2024, Swisscom aims to further expand its fiber network.

This move will boost their overall service quality.

Swisscom's fixed-line voice services are classified as "Dogs" due to declining usage. In 2024, traditional voice revenue decreased, reflecting the shift to mobile and VoIP solutions. This segment's growth is constrained, necessitating strategic investment cuts. Swisscom should prioritize migrating customers to newer, more profitable services.

Swisscom's traditional TV connections face decline as streaming gains traction. In 2024, pay-TV subscriptions dropped, reflecting the shift to platforms like Netflix. This trend challenges traditional models, requiring adaptation. Swisscom must integrate streaming and offer flexible plans to stay competitive.

3G Network

The 3G network, a "dog" in Swisscom's portfolio, faces obsolescence. It demands resources better utilized by 4G and 5G, which accounted for over 80% of Swisscom's mobile data traffic in 2024. Shutting down 3G allows asset repurposing, aligning with the trend of network modernization. This strategic shift is crucial for cost efficiency and technological advancement. Swisscom has already reduced 3G coverage significantly in 2024.

- 3G's declining relevance due to 4G and 5G dominance.

- Resource reallocation for superior technologies.

- Strategic asset repurposing for cost-effectiveness.

- Significant reduction of 3G coverage during 2024.

Low-Growth Business Segments

In Swisscom's BCG matrix, low-growth segments with small market shares are categorized as "Dogs." These might include niche telecom services that consume resources without generating substantial returns. Swisscom, in 2024, evaluated such segments to streamline operations. Divesting or restructuring these areas allows Swisscom to concentrate on more promising ventures.

- Niche services often struggle in competitive markets.

- Resource allocation becomes inefficient.

- Streamlining boosts profitability.

- Focus shifts to growth areas.

Swisscom's "Dogs" include declining services with limited growth, like traditional voice and TV. In 2024, these segments faced revenue declines and shrinking market shares. Strategic cuts and customer migration to newer services are crucial.

| Service | 2024 Revenue Change | Strategic Action |

|---|---|---|

| Fixed-line Voice | -10% | Migrate to VoIP |

| Traditional TV | -8% | Integrate Streaming |

| 3G Network | -100% (Shutdown) | Repurpose Assets |

Question Marks

Swisscom is venturing into AI services, a field with substantial growth prospects but uncertain market positioning. This expansion includes AI-enhanced customer service and personalized digital interactions. To succeed, significant investment in both development and marketing is crucial. The global AI market is projected to reach $200 billion by the end of 2024, according to Statista.

Swisscom's 'Sure' switch-on insurance is a recent move, showing strong growth prospects but a small market presence. This expansion into digital insurance solutions requires smart marketing and partnerships. In 2024, the digital insurance market is booming, with a reported 20% annual growth. Success hinges on adapting to customer needs.

Swisscom's IoT solutions in sectors like smart agriculture and smart cities show high growth potential, but currently have a low market share. Tailored approaches are essential, requiring deep industry understanding. Focused development and strategic partnerships are key to boosting adoption. The global smart agriculture market was valued at $13.2 billion in 2024.

Expansion in the Energy Market

Fastweb's foray into the energy market with electricity subscriptions places it squarely in the Question Marks quadrant of the BCG Matrix. This new venture faces an uncertain market share but holds potential for growth, mirroring strategies seen in other telecom expansions. Success hinges on competitive pricing and reliable service, alongside robust marketing. Fastweb must closely monitor market response and adapt its strategies.

- Fastweb's energy market entry is recent, with no established market share data yet.

- The Italian energy market is competitive, with over 500 suppliers in 2024.

- Customer acquisition costs in the energy sector can range from €50 to €150 per customer.

- Market growth in renewable energy is projected at 8-10% annually in Italy.

5G Enterprise Solutions

Swisscom's 5G enterprise solutions, including private 5G networks, are positioned as a "Question Mark" in its BCG Matrix. This signifies high growth potential but a relatively low current market share. Success hinges on demonstrating clear value to businesses and meeting specific needs, especially with the enterprise 5G market projected to reach $65.3 billion by 2028. Strategic partnerships and targeted marketing are crucial for adoption.

- Market Share: Low, indicating a need for aggressive market penetration.

- Growth Potential: High, fueled by increasing demand for advanced connectivity.

- Key Strategy: Focus on tailored solutions and partnerships.

- Financial Data: Enterprise 5G market expected to reach $65.3B by 2028.

Swisscom's Question Marks show growth prospects but low market shares. These ventures need strategic investment and marketing. Success relies on competitive offerings and market adaptation. The telecom sector sees $1.7 trillion in global revenue in 2024.

| Aspect | Details | Data |

|---|---|---|

| Market Position | Low market share, high growth potential. | Requires aggressive market penetration. |

| Strategic Focus | Tailored solutions, partnerships. | Focus on customer acquisition. |

| Financial Data | Industry growth trends. | Telecom revenue $1.7T in 2024. |

BCG Matrix Data Sources

The Swisscom BCG Matrix leverages financial statements, market analysis, industry insights, and company reports for strategic assessments.