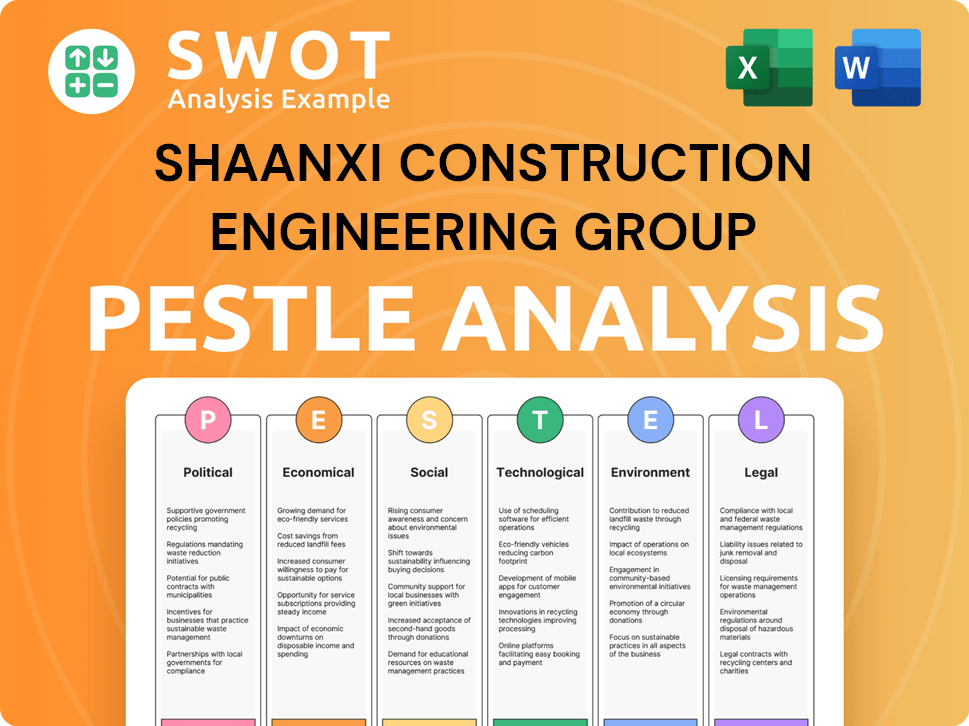

Shaanxi Construction Engineering Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Shaanxi Construction Engineering Group Bundle

What is included in the product

Assesses how external factors shape the Shaanxi Construction Engineering Group across Political, Economic, etc.

Helps support discussions on external risk & market positioning during planning sessions.

Full Version Awaits

Shaanxi Construction Engineering Group PESTLE Analysis

The Shaanxi Construction Engineering Group PESTLE Analysis preview you're viewing showcases the complete document. This fully formatted, professional analysis will be available for immediate download post-purchase. There are no differences between what you see now and what you'll receive. It is ready to use.

PESTLE Analysis Template

Navigating the dynamic construction industry requires a strategic lens. Our PESTLE analysis for Shaanxi Construction Engineering Group uncovers key external factors shaping their market. We delve into political influences, economic conditions, and tech impacts. Understanding these is crucial for any strategic planning. Get the full version and gain actionable intelligence!

Political factors

The Chinese government's commitment to infrastructure, especially under the 14th Five-Year Plan, fuels growth for construction firms. This national priority creates a robust market for companies like Shaanxi Construction Engineering Group. New urbanization policies and measures to stabilize property prices further affect the demand for construction services. In 2024, infrastructure investment in China reached approximately $3.3 trillion.

Shaanxi Construction Engineering Group, as a state-owned enterprise, operates under the influence of the state and the Communist Party. This can affect decision-making processes, which may lack transparency. The Chinese government's infrastructure spending, a key driver for the company, reached approximately $3.6 trillion in 2024, underscoring this influence. Navigating these dynamics is crucial for the company's strategic planning.

Shaanxi Province is a BRI hub, creating infrastructure opportunities for construction companies. This boosts international expansion and project potential for the Group. The BRI saw $23.7 billion in Chinese investment in 2023. Shaanxi's involvement supports economic cooperation.

Regional Development Policies

Shaanxi Construction Engineering Group's operations are significantly impacted by regional development policies. These policies, focused on economic transformation and quality growth, influence the types of construction projects undertaken. The government prioritizes sectors like advanced manufacturing and green development, which directs the Group's project focus. For instance, in 2024, Shaanxi allocated 15% of its infrastructure budget to green projects. This policy emphasis affects investment decisions.

- Green building projects are expected to increase by 18% in 2025.

- The government plans to invest $2 billion in technology-related construction by 2026.

- Regional policies prioritize infrastructure projects in Xi'an.

Regulatory Environment and Compliance

Shaanxi Construction Engineering Group faces a complex regulatory environment in China's construction industry. Strict adherence to national and local regulations on construction quality, safety, and environmental protection is crucial. Government oversight and enforcement significantly impact operations and costs. Non-compliance leads to penalties, project delays, and reputational damage.

- China's construction market was valued at $1.1 trillion in 2023.

- Compliance costs can add up to 10-15% of project budgets.

- Environmental regulations are becoming stricter, with potential fines reaching millions of yuan.

Political factors greatly influence Shaanxi Construction Engineering Group, from state-driven infrastructure spending to regional development plans. The government's commitment to infrastructure, exemplified by the $3.6 trillion invested in 2024, directly boosts the company's growth. Strategic alignment with initiatives like the Belt and Road Initiative and adherence to stringent regulations are crucial for success.

| Political Aspect | Impact on SCG | 2024-2025 Data |

|---|---|---|

| Govt. Spending | Drives project opportunities | Infrastructure Investment: $3.6T (2024) |

| Regulatory Environment | Dictates compliance costs | Compliance costs: 10-15% project budget |

| Regional Policies | Direct project focus | Xi'an infra projects prioritized |

Economic factors

China's GDP growth, though slowing, fuels the construction sector. In 2024, GDP growth is projected around 5%. Government investment in infrastructure and manufacturing is key. Fixed asset investment in 2024 is expected to be around 4.2%. This supports Shaanxi Construction's projects.

The downturn in the property market affects Shaanxi Construction. Property development investment declines, posing challenges. Residential sector stabilization is expected, but regional variance occurs. Over supply impacts some cities, influencing market dynamics. In 2024, housing sales fell, impacting construction projects.

Infrastructure investment in China, while ongoing, faces tempered growth due to local debt and stricter spending. Air and railway sectors show increased investment, reflecting strategic priorities. In 2024, China's infrastructure spending totaled $3.8 trillion, with a projected 5% growth for 2025. This growth is slower than prior years due to financial constraints.

Access to Financing and Credit Conditions

Monetary policy and credit conditions significantly impact Shaanxi Construction Engineering Group. In 2024, China's central bank, the People's Bank of China, has adjusted interest rates and reserve requirements to influence credit availability. Despite ample liquidity, corporate borrowing could be weak. Access to financing, especially for private projects, is crucial.

- China's Q1 2024 GDP growth: 5.3%.

- Real estate investment in China fell by 9.5% year-on-year in Q1 2024.

- PBOC's recent moves aim to support construction and infrastructure.

Rising Costs and Profitability

Shaanxi Construction Engineering Group is feeling the pinch of rising costs, a common woe in the construction world. Profit margins are under pressure, making it tougher to stay in the black. For instance, the average profit margin in the Chinese construction sector dipped to around 5% in 2024. Companies must become super-efficient to survive.

- Material price inflation, especially for steel and cement, eats into profits.

- Labor costs are also climbing, impacting project budgets.

- Competitive bidding drives down prices, squeezing margins further.

- Effective cost management is crucial for survival.

Economic factors significantly influence Shaanxi Construction. China's 2024 GDP growth is about 5%, supporting infrastructure investment. Property market downturns and rising costs impact profit margins. Monetary policy changes by the PBOC affect project financing.

| Economic Factor | Impact on Shaanxi Construction | Data (2024) |

|---|---|---|

| GDP Growth | Influences demand for construction | Q1 Growth: 5.3% |

| Real Estate | Impacts project demand and revenue | Investment Down 9.5% |

| Profit Margins | Pressure from rising costs | Construction Margin: ~5% |

Sociological factors

Urbanization in Shaanxi fuels construction demand. China's urbanization rate hit 65.22% in 2022. This trend drives need for new housing and infrastructure. Rural-to-urban migration shapes development needs. The pace varies across regions.

Shaanxi Construction Engineering Group faces labor availability challenges. China's construction sector sees an aging workforce. Labor shortages could impact costs and project timelines. In 2024, construction labor costs rose by about 5% due to these factors. This increase is expected to continue into 2025.

Evolving social needs drive construction project demands. Green buildings, smart homes, and better urban infrastructure are rising. In 2024, the green building market was valued at $367.2 billion globally, and it's expected to reach $789.6 billion by 2032. Companies need to adapt to meet these changing preferences.

Income Levels and Housing Demand

Increased household incomes fuel demand for superior housing and urban improvements. Income inequality and unequal public service access shape construction needs. In Shaanxi, average disposable income grew, yet disparities persist. This affects project types and locations.

- Shaanxi's urban per capita disposable income in 2024: approximately ¥38,000.

- Rural-urban income gap persists, influencing housing preferences.

- Government initiatives aim to reduce inequality through infrastructure.

Public Perception and Social Responsibility

Public perception significantly influences a construction company's success, especially regarding safety, environmental impact, and labor practices. A negative reputation can hinder project approvals and damage relationships with stakeholders. Companies are under increasing pressure to adopt and demonstrate social responsibility, which directly impacts their brand value and market access. For instance, in 2024, 65% of consumers globally considered a company's social responsibility when making purchasing decisions.

- Reputation Management: Positive perception attracts investors and clients.

- Risk Mitigation: Addressing concerns proactively minimizes legal and operational risks.

- Stakeholder Relations: Strong CSR builds trust with communities and governments.

- Market Access: Socially responsible companies often gain preferential treatment.

Sociological factors profoundly affect Shaanxi Construction Engineering Group. Urbanization and rising incomes boost demand for new construction. Public perception, including social responsibility, influences project success.

| Factor | Impact | Data |

|---|---|---|

| Urbanization | Increased demand for housing/infrastructure | China's urbanization rate: 65.22% (2022) |

| Income | Higher demand for improved living conditions | Shaanxi's per capita disposable income (2024): ¥38,000 |

| Public Perception | Brand value and stakeholder relations. | 65% of consumers consider social responsibility (2024) |

Technological factors

The Chinese construction sector's digital transformation, fueled by technologies like BIM, IoT, and AI, is intensifying. This shift aims to boost efficiency and safety, offering Shaanxi Construction Engineering Group opportunities. In 2024, the Chinese construction market's digital spending reached approximately $35 billion, with expected growth to $50 billion by 2025. Shaanxi can enhance operations by integrating these digital tools.

Prefabrication and modular construction are becoming more popular in China. These methods involve offsite manufacturing, potentially speeding up construction and cutting costs. The Chinese government supports these techniques, aiming for 30% of new construction to use prefabricated elements by 2025. This shift aligns with goals to boost efficiency and reduce environmental impact. In 2024, the prefabricated construction market in China was valued at approximately $200 billion, projected to grow further.

Technological advancements in construction equipment, including smart and automated machinery, are enhancing productivity and safety. Modern equipment gives companies a competitive advantage. The global construction equipment market is projected to reach $190.1 billion by 2025. Automated machinery can reduce labor costs by up to 30%.

Smart Buildings and Urban Development

The rise of smart cities and smart buildings offers Shaanxi Construction Engineering Group significant growth prospects. These developments, integrating technologies for energy efficiency and improved building management, are becoming increasingly common. For instance, the global smart building market is projected to reach $125.9 billion by 2025, according to Statista. This trend creates opportunities for companies skilled in these advanced construction techniques.

- Market Growth: The smart building market is expected to hit $125.9B by 2025.

- Technological Integration: Focus on energy efficiency and building management systems.

- Efficiency: Smart technologies aim to improve occupant comfort and building performance.

- Opportunities: Construction firms with expertise in these areas can capitalize on growth.

Challenges in Technology Adoption

Shaanxi Construction Engineering Group faces technological hurdles. Weak digital infrastructure and a shortage of skilled workers can hinder progress. Resistance to change within the company may slow down technology adoption. According to a 2024 report, only 30% of construction firms fully embrace digital tools. Overcoming these issues is vital for efficiency.

- Digital infrastructure gaps can limit project communication and data sharing.

- The skills gap requires investing in training programs for employees.

- Organizational culture needs to adapt to new technologies.

China’s construction tech spending hit $35B in 2024, expected to reach $50B by 2025. Prefab construction is supported, targeting 30% use by 2025. The smart building market is projected to hit $125.9B by 2025.

| Technology Trend | Impact on Shaanxi | Data Point |

|---|---|---|

| Digital Transformation | Enhances efficiency | $50B market by 2025 |

| Prefabrication | Reduces costs | 30% of new builds by 2025 |

| Smart Buildings | Offers growth | $125.9B market by 2025 |

Legal factors

Shaanxi Construction Engineering Group must adhere to China's strict construction laws. These laws cover bidding, quality, and safety standards. For instance, in 2024, the Ministry of Housing and Urban-Rural Development reported 1,870 construction accidents. Non-compliance can lead to hefty fines and project delays. Proper legal adherence is essential for operational success.

Shaanxi Construction Engineering Group faces stringent environmental protection laws. These laws mandate environmental impact assessments and pollution control. Compliance includes protecting natural resources and adhering to evolving standards. In 2024, environmental fines for non-compliance in China's construction sector totaled $1.2 billion, emphasizing the need for strict adherence.

Labor laws in China, especially those concerning worker protection, are crucial for construction companies like Shaanxi Construction Engineering Group. Compliance with these laws, covering wages, working conditions, and safety, is non-negotiable. In 2024, labor disputes in China's construction sector increased by 8%, with wage arrears being a significant cause. Failure to adhere to these regulations can result in legal challenges and reputational damage.

Land Use and Planning Regulations

Land use and planning regulations significantly impact Shaanxi Construction Engineering Group. They must secure necessary permits and comply with urban and rural planning rules for all projects. Non-compliance can lead to project delays, fines, or legal challenges. In 2024, the construction sector in China faced stricter environmental and land-use regulations. These factors influence project feasibility and operational costs.

- Compliance with local planning laws is essential for project commencement.

- Environmental impact assessments are increasingly critical for approval.

- Permit acquisition timelines can significantly affect project schedules.

- Changes in zoning laws can impact project viability.

Contract Law and Dispute Resolution

Shaanxi Construction Engineering Group faces legal challenges in contract law and dispute resolution, crucial for project success. Contract negotiation, performance, and dispute resolution are key areas. In 2024, construction contract disputes rose by 15% in China, highlighting the need for robust legal strategies. This includes managing risk, ensuring compliance, and understanding the legal environment.

- Contract disputes can delay projects and increase costs.

- Understanding legal frameworks is vital for compliance.

- Legal expertise minimizes risks and protects interests.

Shaanxi Construction Engineering Group must rigorously comply with Chinese construction laws to avoid fines and project delays. Strict adherence to environmental laws, as evidenced by $1.2 billion in fines in 2024, is crucial. Labor laws are also critical; the 8% rise in labor disputes in 2024 highlights the importance of worker protection. Land use regulations influence project feasibility, requiring careful permit acquisition and planning compliance.

| Legal Area | Compliance Requirement | 2024 Impact/Data |

|---|---|---|

| Construction Laws | Bidding, quality, and safety | 1,870 construction accidents reported |

| Environmental Laws | Environmental Impact Assessments | $1.2B in environmental fines |

| Labor Laws | Wages, working conditions | 8% rise in labor disputes |

Environmental factors

China's construction sector is increasingly focused on green building. Government policies and public awareness support this shift. The goal is to boost energy efficiency and use eco-friendly materials. For example, in 2024, the green building market in China was valued at $1.2 trillion, and it is projected to reach $2.5 trillion by 2030.

Shaanxi Construction Engineering Group faces pollution and waste challenges. Construction generates waste gas, wastewater, and dust. Regulations demand pollution control and waste management. In 2024, China's construction waste recycling rate aimed for over 60%. Effective waste management impacts project costs and environmental compliance.

Shaanxi Construction must adhere to environmental laws to protect natural resources. These laws focus on safeguarding vegetation, water, and land during construction. For instance, in 2024, environmental fines in China rose by 15%, highlighting the need for strict compliance. The company needs to implement measures to minimize its environmental footprint.

Climate Change and Energy Efficiency

Climate change concerns are pushing for energy efficiency in construction, aiming to cut carbon emissions. This shift involves adopting energy-saving designs and technologies. The construction sector is a significant contributor to global carbon emissions. In 2024, the global building sector accounted for approximately 37% of energy-related and process-related carbon emissions.

- China, including Shaanxi, is implementing stricter building energy codes and promoting green building standards.

- The Chinese government aims for buildings to reduce energy consumption by 50% by 2030.

- Investments in green building materials and technologies are increasing.

- Shaanxi Construction Engineering Group can benefit by incorporating these technologies.

Environmental Impact Assessments

Shaanxi Construction Engineering Group, like all construction firms in China, must navigate environmental impact assessments (EIAs). These assessments are mandatory for all construction projects to evaluate environmental impacts and define mitigation strategies. Failure to comply can lead to project delays, fines, and reputational damage. In 2024, the Chinese government intensified its focus on environmental regulations, increasing the scrutiny of EIAs.

- EIAs are legally required before project commencement in China.

- Non-compliance can result in significant penalties.

- Environmental regulations are becoming stricter.

Environmental factors significantly influence Shaanxi Construction Engineering Group. Green building trends are driven by government support and rising public awareness, the market was at $1.2T in 2024. Stricter environmental regulations necessitate robust pollution control. Energy efficiency and carbon emission reduction are key drivers in construction.

| Aspect | Details | 2024 Data |

|---|---|---|

| Green Building Market | Growing rapidly | $1.2 Trillion market value |

| Waste Recycling | Focus on waste reduction | >60% target recycling rate |

| Carbon Emissions | Construction contribution | 37% of emissions from building sector |

PESTLE Analysis Data Sources

This PESTLE analysis incorporates diverse data from government, industry reports, economic databases, and regulatory bodies.