Stock Yards Bank & Trust PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Stock Yards Bank & Trust Bundle

What is included in the product

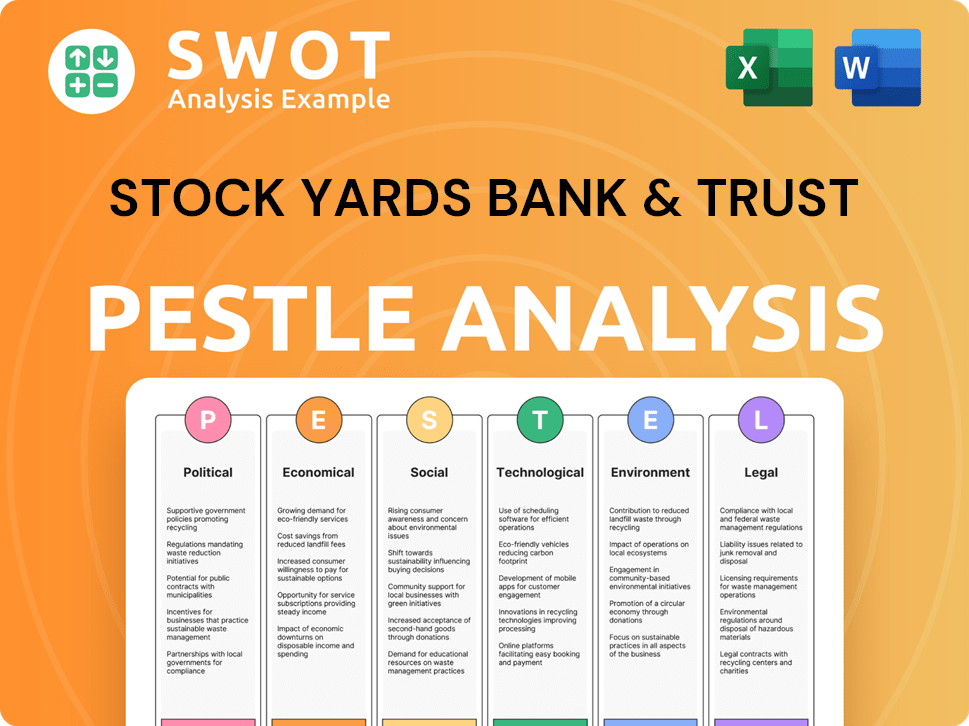

Analyzes macro-environmental factors impacting Stock Yards Bank & Trust. Examines Political, Economic, Social, Technological, etc.

Allows users to modify or add notes specific to their own context, region, or business line.

What You See Is What You Get

Stock Yards Bank & Trust PESTLE Analysis

What you’re previewing here is the actual file—fully formatted and professionally structured for Stock Yards Bank & Trust's PESTLE analysis.

You’ll download this comprehensive assessment instantly after your purchase.

The document offers a deep dive into the bank’s political, economic, social, technological, legal, and environmental factors.

Explore the key challenges and opportunities facing the financial institution as shown in this sample.

The insights in this document are instantly accessible.

PESTLE Analysis Template

Explore the external factors shaping Stock Yards Bank & Trust with our detailed PESTLE analysis. Uncover the impact of political, economic, and social forces on their business strategy.

We provide expert insights into the regulatory environment, market dynamics, and technological advancements affecting the company. Identify potential threats and growth opportunities facing Stock Yards Bank & Trust.

Gain a competitive advantage by understanding the external landscape. This ready-to-use analysis provides actionable intelligence for investors and professionals.

Download the complete PESTLE analysis now to make informed decisions and refine your strategic planning. Unlock in-depth insights!

Political factors

Changes in banking regulations, both federal and state, directly influence Stock Yards Bank & Trust. Compliance requirements and profitability are affected by policies on lending, capital, and consumer protection. For instance, the Federal Reserve's actions in 2024, like adjusting reserve requirements, influence bank liquidity. Data security regulations, with the rise of cyber threats, also demand significant investment to safeguard customer information; the average cost of a data breach for financial institutions in 2024 was $5.9 million.

Political stability in Kentucky, Indiana, and Ohio is crucial for Stock Yards Bank & Trust. These states' economic health directly impacts the bank's performance. For example, stable political environments typically foster business investment. In 2024, Kentucky's GDP grew by 3.2%, reflecting a robust economy.

Trade policies and tariffs indirectly affect Stock Yards Bank & Trust. Businesses in manufacturing, tech, and consumer sectors, key to loan repayment, are vulnerable. In 2024, the U.S. imposed tariffs on $300B of Chinese goods. These tariffs can increase costs and reduce profitability for local businesses.

Government Spending and Fiscal Policy

Government spending and fiscal policies significantly shape economic landscapes, directly impacting the banking sector and Stock Yards Bank & Trust. For example, increased government spending, as seen with the 2023 Infrastructure Investment and Jobs Act, can boost economic activity. This may lead to higher interest rates, potentially affecting profitability for banks. Inflation, influenced by fiscal policies, also plays a key role; the Consumer Price Index (CPI) rose 3.1% in January 2024, impacting loan demand and the value of assets.

- Government spending influences economic growth, impacting banking.

- Higher spending can lead to increased interest rates.

- Inflation, affected by fiscal policies, impacts banks' performance.

- CPI data, like the 3.1% rise in January 2024, is crucial.

Political Engagement and Lobbying

Stock Yards Bank & Trust, like other financial institutions, actively participates in political engagement, including lobbying efforts and political contributions. These activities aim to shape legislation and regulations impacting the banking sector and the bank's specific business interests. In 2024, the financial services industry spent over $300 million on lobbying. This investment reflects a strategic approach to influence policy.

- Lobbying expenditures: Over $300 million by the financial services industry in 2024.

- Political contributions: Specific figures for Stock Yards Bank & Trust are available in their annual reports.

- Regulatory impact: Banking regulations significantly affect operational costs and profitability.

- Policy influence: Efforts to shape legislation related to lending, investments, and compliance.

Political factors substantially affect Stock Yards Bank & Trust.

Changes in banking regulations, such as those from the Federal Reserve in 2024, affect bank operations. Stable political climates, especially in Kentucky (3.2% GDP growth in 2024), Indiana, and Ohio, support business activity.

The financial services industry spent over $300 million on lobbying in 2024.

| Political Factor | Impact on SYBT | 2024/2025 Data |

|---|---|---|

| Banking Regulations | Influences compliance costs, profitability. | Data breach cost $5.9M. Fed adjusting reserve requirements. |

| Political Stability | Impacts economic health, business investment. | Kentucky GDP grew by 3.2% (2024). |

| Trade Policies | Affects loan repayment, business profitability. | US tariffs on $300B of Chinese goods in 2024. |

Economic factors

Fluctuations in interest rates, especially those set by the Federal Reserve, are crucial for Stock Yards Bank & Trust. Higher interest rates, as seen in 2024 and projected into 2025, affect the bank's profitability. This "higher for longer" trend impacts loan demand and the value of the bank's investment portfolio. The Federal Reserve's target range for the federal funds rate was between 5.25% and 5.5% as of late 2024.

The US economy's health, crucial for Stock Yards Bank & Trust, impacts loan growth and deposits. Economic growth in the bank's operating regions is vital. Recession risks for 2024/2025 vary; some predict a slowdown. The Federal Reserve's actions significantly influence economic conditions. GDP growth in Q1 2024 was 1.6%.

Inflation erodes consumer and business purchasing power, impacting Stock Yards Bank & Trust's operations. Operating costs increase, potentially squeezing profit margins. The Federal Reserve's monetary policy is influenced by inflation. While inflation cooled, reaching the 2% target is challenging. In March 2024, the Consumer Price Index rose 3.5% year-over-year.

Unemployment Rates

Unemployment rates in Stock Yards Bank & Trust's operational areas are critical, influencing loan repayment abilities and small business survival. Elevated unemployment increases credit risk for the bank. For example, in Kentucky, where the bank has a significant presence, the unemployment rate was around 4.2% in late 2024, which is up from 3.8% in 2023. This could affect the bank's loan portfolio quality.

- Kentucky's unemployment rate: 4.2% (late 2024)

- Unemployment rate in 2023: 3.8%

Consumer Spending and Confidence

Consumer spending and confidence are crucial for Stock Yards Bank & Trust's performance. Higher consumer spending typically boosts demand for personal banking services and loans. Consumer confidence directly affects the willingness of individuals and businesses to borrow and invest. For instance, in early 2024, consumer spending showed moderate growth, impacting loan demand.

- Consumer spending growth in Q1 2024 was around 2.5%.

- Consumer confidence, as measured by the Conference Board, stood at 103.0 in March 2024.

- Mortgage rates influenced loan activity.

Economic factors substantially affect Stock Yards Bank & Trust. Interest rates, particularly the Federal Reserve's rates, shape profitability and loan demand. US economic health and inflation trends also influence loan growth. Consumer confidence and spending are also essential.

| Factor | Impact | 2024/2025 Data |

|---|---|---|

| Interest Rates | Affect profitability, loan demand | Fed funds rate: 5.25%-5.5% (late 2024) |

| Economic Growth | Influences loan growth, deposits | GDP Q1 2024: 1.6% |

| Inflation | Impacts costs, purchasing power | CPI March 2024: 3.5% YoY |

Sociological factors

Stock Yards Bank & Trust's market faces demographic shifts. Kentucky, Indiana, and Ohio's population changes impact demand. Consider age distribution; older populations may need different services. Income levels affect loan demand and investment products. Diversity influences product relevance; 2024 data shows evolving needs.

Stock Yards Bank & Trust thrives on community trust. The bank's commitment to local projects boosts its image. Being a good employer also helps. Positive community perception increases customer loyalty. This builds a strong foundation for growth.

Customer preferences are shifting, with digital banking becoming dominant; in 2024, over 60% of U.S. adults use mobile banking. Stock Yards Bank & Trust must enhance its digital platforms and personalize services. Financial literacy varies; the bank needs to offer tailored financial education programs to meet diverse customer needs.

Workforce Trends and Labor Availability

Workforce trends and labor availability are crucial for Stock Yards Bank & Trust. The bank's operational efficiency and labor costs are directly impacted by the availability of skilled banking professionals in its operating regions. Recent data indicates shifts in workforce demographics, with an aging workforce and increasing demand for tech-savvy employees. These trends influence the bank's ability to attract and retain talent, affecting its long-term growth.

- The financial services sector saw a 3.2% increase in employment in 2024.

- The median age of bank employees is rising, creating a need for succession planning.

- Remote work options are increasingly influencing employee decisions.

Financial Literacy Levels

Financial literacy significantly shapes customer needs and risk understanding, directly influencing Stock Yards Bank & Trust's educational and advisory roles. In 2024, only 34% of U.S. adults were considered financially literate. This low level necessitates tailored financial education. The bank must adapt its services to cater to varying levels of financial knowledge.

- 2024: 34% of U.S. adults are financially literate.

- 2025: Expect ongoing need for financial education programs.

Community trust bolsters Stock Yards Bank & Trust's brand. Their local investments build positive reputations; 2024 showed increased customer loyalty. Adapting to digital banking, the bank meets evolving consumer needs. Customer financial literacy levels impact service adaptations, which were 34% in 2024.

| Factor | Impact | 2024 Data |

|---|---|---|

| Trust/Reputation | Customer Loyalty | Enhanced trust due to local investments. |

| Digital Adoption | Service demands | Mobile banking used by 60%+ US adults. |

| Financial Literacy | Service Adaption | 34% US adults financially literate. |

Technological factors

Digital banking adoption is rapidly increasing, compelling Stock Yards Bank & Trust to enhance its digital infrastructure. In 2024, mobile banking users in the U.S. reached approximately 200 million. This necessitates investments in cybersecurity, with global spending projected at $214 billion in 2024. User-friendly interfaces are crucial, with 70% of customers preferring mobile banking.

The banking sector faces relentless cyber threats, increasing the need for robust defenses. In 2024, financial institutions saw a 28% rise in cyberattacks. Stock Yards Bank & Trust must prioritize substantial investments in cybersecurity. This includes advanced threat detection, data encryption, and employee training to safeguard sensitive customer information.

The FinTech sector's growth presents both opportunities and threats. In 2024, global FinTech investments reached $191.7 billion. Stock Yards Bank & Trust must adapt to stay competitive. This could involve partnerships or developing its own tech solutions. Failure to innovate could mean losing market share to agile FinTech firms.

Data Analytics and Artificial Intelligence

Data analytics and AI are pivotal for Stock Yards Bank & Trust's strategic advantage. These technologies enable deeper insights into customer behavior, facilitating personalized services and fraud detection. In 2024, the financial sector saw a 30% increase in AI adoption for risk management. Moreover, AI is projected to save banks up to $447 billion by 2025 through automation and efficiency gains.

- Personalized services can increase customer satisfaction by up to 20%.

- Fraud detection systems powered by AI can reduce financial losses by 35%.

- Operational efficiency improvements can lower costs by 15%.

Technology Infrastructure Investment

Stock Yards Bank & Trust must invest in its technology infrastructure. This includes upgrading core banking systems to maintain operational efficiency. Such upgrades are critical for scaling services and adopting new technological solutions. Recent data indicates that banks allocate a significant portion of their budgets to IT.

- In 2024, IT spending in the banking sector is projected to reach $280 billion globally.

- Cloud computing adoption among banks is expected to grow by 20% in 2024-2025.

- Cybersecurity spending by financial institutions is predicted to increase by 15% in 2024.

Technological advancements require Stock Yards Bank & Trust to enhance its digital capabilities. Investment in cybersecurity is crucial, with global spending reaching $214 billion in 2024. AI and data analytics offer competitive advantages. Banks will allocate substantial IT budgets.

| Technology Factor | Impact | 2024-2025 Data |

|---|---|---|

| Digital Banking | Customer experience & Security | Mobile banking users in the U.S. approx. 200 million; Cybersecurity spending: $214B |

| Cybersecurity Threats | Protecting data and financial assets | Financial institutions faced a 28% rise in cyberattacks in 2024; Cybersecurity spending increase 15% |

| FinTech sector | Innovation and Competition | Global FinTech investments reached $191.7 billion |

| AI & Data Analytics | Personalization & Efficiency | AI adoption increased 30% for risk management; AI could save banks up to $447B by 2025 |

Legal factors

Stock Yards Bank & Trust must comply with stringent banking regulations. These include capital requirements and consumer protection rules. For instance, in 2024, banks faced heightened scrutiny on lending practices. The FDIC reported a 2.8% increase in enforcement actions. This shows the importance of compliance.

Stock Yards Bank & Trust must comply with data privacy laws to protect customer data. This includes regulations like GDPR and CCPA. Failure to comply can lead to significant fines. In 2024, data breaches cost companies an average of $4.45 million globally. Maintaining customer trust is also essential.

Consumer protection laws, like the Consumer Financial Protection Bureau (CFPB) regulations, significantly influence Stock Yards Bank & Trust. These laws govern loan terms, account disclosures, and service fees. For instance, the CFPB's recent focus on overdraft fees directly affects banks' revenue models. In 2024, the CFPB finalized a rule to cut overdraft fees, potentially impacting banks' earnings by millions.

Employment Laws

Stock Yards Bank & Trust faces legal obligations regarding employment across its operational states. These include adherence to federal and state labor laws, influencing recruitment, pay structures, and how it manages its workforce. Compliance ensures fair practices and avoids legal issues, impacting operational costs. Non-compliance can lead to significant fines and reputational damage, affecting financial performance.

- In 2024, the U.S. Equal Employment Opportunity Commission (EEOC) received over 81,000 charges of workplace discrimination.

- The average cost to defend against an employment lawsuit is about $160,000.

- States like California and New York have some of the strictest employment laws.

- Stock Yards Bank & Trust must also consider the impact of the National Labor Relations Act.

Legal and Regulatory Enforcement Actions

Stock Yards Bank & Trust faces legal and regulatory risks. These include potential lawsuits and enforcement actions that could lead to financial penalties. Such actions can also damage the bank’s reputation, as seen with other banks. Operational disruptions are another possible consequence. In 2024, several banks faced significant fines from regulatory bodies.

- In 2024, regulatory fines for financial institutions totaled over $5 billion in the US.

- Reputational damage can decrease stock value by up to 15%.

- Operational disruptions can lead to a 10-20% decrease in efficiency.

Stock Yards Bank & Trust navigates stringent banking regulations, including capital requirements. Data privacy laws like GDPR and CCPA mandate data protection to avoid costly fines, with average breach costs around $4.45M globally in 2024. Employment laws and compliance, reflecting 81,000 EEOC charges in 2024, significantly influence the bank's operational strategies.

| Regulation Area | Impact | 2024 Data |

|---|---|---|

| Banking Regulations | Capital Requirements & Consumer Protection | FDIC enforcement actions increased 2.8% |

| Data Privacy | GDPR/CCPA Compliance | Average data breach cost: $4.45M |

| Employment Law | Compliance & Risk Mitigation | EEOC received over 81,000 discrimination charges |

Environmental factors

Climate change poses significant risks to Stock Yards Bank & Trust's loan portfolio. Physical risks, like increased severe weather events, could damage properties. Transition risks, such as shifting regulations, might affect business valuations. For instance, in 2024, insured losses from climate disasters exceeded $100 billion.

Compliance with environmental regulations indirectly affects Stock Yards Bank & Trust. The bank must consider environmental risks tied to properties it holds or finances. For example, in 2024, banks faced increased scrutiny regarding environmental due diligence for commercial real estate loans. This is due to rising awareness of climate risk.

Growing environmental awareness affects customer/investor choices. In 2024, ESG investments hit $30 trillion globally. Investors increasingly favor sustainable practices. Stock Yards Bank & Trust may face pressure. It needs to show environmental responsibility.

Operational Environmental Footprint

Stock Yards Bank & Trust, despite being a financial institution, should assess its operational environmental footprint. This includes energy use in its branches and offices, waste produced, and paper consumption. Reducing these can lower operational costs and improve its public image, aligning with sustainability trends. For instance, in 2024, the financial sector saw a 15% increase in investments in green initiatives.

- Energy consumption in branches and offices.

- Waste generation from daily operations.

- Paper usage for documentation and communications.

Support for Green Initiatives

Stock Yards Bank & Trust could support green initiatives. This could involve financing sustainable projects. The bank might fund renewable energy or eco-friendly developments. This aligns with rising environmental awareness among consumers and investors. Such actions can enhance the bank's reputation.

- In 2024, sustainable investments reached $19.2 trillion in the U.S.

- The global green bond market grew to over $1 trillion.

- Banks financing green projects often see improved ESG scores.

Environmental factors significantly impact Stock Yards Bank & Trust. Climate risks, like severe weather, affect the bank's portfolio. Environmental regulations, compliance, and customer preferences regarding sustainability also play a role.

Focusing on eco-friendly operations and supporting green projects can enhance the bank's standing. This will help align with investor and societal trends.

By doing so, the bank will align itself with societal trends.

| Factor | Impact | Data (2024) |

|---|---|---|

| Climate Change | Increased risks to loans & assets. | Insured losses from climate disasters exceeded $100B. |

| Environmental Regulations | Indirect impact, requiring environmental due diligence. | Banks faced increased scrutiny on environmental due diligence. |

| Customer/Investor Preferences | Pressure for sustainable practices & investments. | ESG investments hit $30T globally. |

PESTLE Analysis Data Sources

This analysis utilizes data from financial reports, economic indicators, government publications, and market research firms for accurate insights.