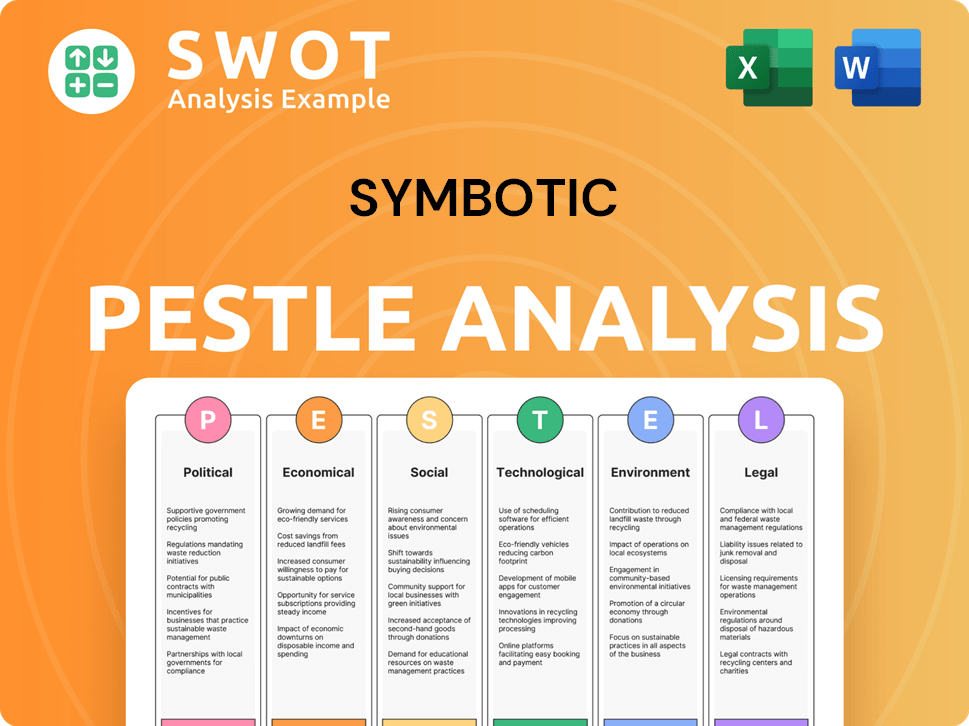

Symbotic PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Symbotic Bundle

What is included in the product

Provides a structured examination of external factors impacting Symbotic's business using the PESTLE framework.

Highlights the key external factors and issues, which is useful for risk management during planning.

What You See Is What You Get

Symbotic PESTLE Analysis

The preview shows the Symbotic PESTLE Analysis document. It provides insights into the company's external factors. The structure and content mirror the final purchased document.

PESTLE Analysis Template

Symbotic faces a dynamic external environment, ripe with both opportunities and challenges. Their success hinges on navigating political regulations and adapting to economic shifts. Social trends, such as consumer behavior, also play a vital role. Technological advancements will redefine their operational efficiency. Understanding these influences is crucial. Download the full PESTLE Analysis for comprehensive strategic insights!

Political factors

Government regulations greatly influence robotics and automation. Workplace safety rules, data privacy, and AI ethics are key. Trade policy changes, like tariffs, affect costs. For instance, the global robotics market is projected to reach $214.5 billion by 2025.

Political stability is vital for Symbotic. Unrest can severely disrupt supply chains and operations. Symbotic's expansion plans depend on stable environments. Walmart, a key customer, faces political and economic impacts, influencing Symbotic. For example, in 2024, supply chain disruptions cost businesses billions.

Government incentives and subsidies significantly impact Symbotic. For example, in 2024, various federal and state programs supported automation. These incentives can drive faster adoption of Symbotic's solutions. If these programs are reduced or eliminated, it could slow down investment. Furthermore, policies favoring domestic manufacturing could create opportunities or challenges for Symbotic's supply chain.

International Trade Relations

Symbotic's international trade is significantly influenced by global political dynamics. Trade barriers like tariffs can increase the cost of components, impacting profitability. Geopolitical instability may deter investments in automation projects, affecting Symbotic's growth. For instance, in 2024, the US-China trade tensions led to increased tariffs on various goods, potentially affecting Symbotic's supply chain and sales.

- Tariffs on goods between the US and China increased by an average of 19% in 2024.

- Geopolitical risks led to a 15% decrease in foreign direct investment in automation projects.

Labor Union Influence and Labor Laws

Labor union influence and labor laws are crucial for Symbotic. Automation-related job displacement raises political concerns. Governments might impose regulations or reskilling investments. The United Auto Workers (UAW) in the US, for example, is highly influential.

- In 2024, UAW's membership was around 400,000.

- Proposed legislation in 2025 might mandate retraining for automated job roles.

Political factors significantly affect Symbotic, including government regulations and international trade policies.

In 2024, trade tensions increased tariffs, impacting supply chains. Stable environments are critical; disruptions can severely disrupt operations. Government incentives for automation are also key.

Labor laws and union influence are crucial factors affecting Symbotic's operations and growth. Policies on retraining and job displacement in 2025 will also be very influential.

| Political Aspect | Impact | 2024 Data |

|---|---|---|

| Trade Policies | Increased costs, supply chain disruptions | Tariffs increased by 19% |

| Political Stability | Disruptions, investment deterents | Geopolitical risks decreased investment by 15% |

| Government Incentives | Faster adoption, investment | Federal/state programs supporting automation |

Economic factors

Overall economic growth and stability heavily impact business investments. Robust economic growth encourages companies to invest in automation, like Symbotic's solutions. In 2024, the U.S. GDP growth was around 3%, signaling a favorable environment for capital expenditure. Economic uncertainty, however, can delay these investments. For instance, during the 2023 slowdown, some projects were postponed.

Interest rates significantly influence Symbotic's operations and customer decisions. Higher rates increase borrowing costs, potentially deterring investments in automation solutions. In early 2024, the Federal Reserve maintained interest rates, impacting capital access. The company's R&D and expansion plans depend on accessible and affordable capital. For 2024-2025, monitoring interest rate trends is essential for Symbotic's financial strategy.

Labor costs are a significant economic factor. The increasing costs and scarcity of warehouse labor drive automation adoption. In 2024, warehouse labor costs rose by 5-7% annually. With automation, ROI becomes more attractive. Symbotic's solutions address these challenges. The shortage of workers is a key driver.

E-commerce Growth and Consumer Demand

E-commerce expansion fuels demand for advanced warehouses, a key area for Symbotic. This growth directly boosts the need for automation solutions. Consumer spending shifts affect warehouse throughput and the types of goods handled. Data from 2024 showed e-commerce sales up, continuing a strong trend.

- E-commerce sales in the U.S. reached $1.1 trillion in 2023, up 7.5% from 2022.

- Analysts project e-commerce to account for 20% of all retail sales by 2025.

- The demand for warehouse space increased by 4.5% in Q1 2024.

Competition and Pricing Pressure

The warehouse automation market is heating up, intensifying competition and potentially squeezing prices. New technologies and players are constantly emerging. Increased competition, especially from companies with lower costs, could challenge Symbotic's profitability. The industry is expected to grow significantly, with projections indicating a market size of $30 billion by 2025. This growth attracts more competitors, increasing pricing pressure.

- Warehouse automation market size projected to reach $30B by 2025.

- Increased competition from new technology providers.

- Potential for lower profit margins due to pricing pressure.

Economic factors are crucial for Symbotic. Positive U.S. GDP growth of roughly 3% in 2024 supports investments in automation. Rising labor costs and e-commerce expansion also boost demand, driving automation needs. The warehouse automation market, forecast to hit $30B by 2025, faces increasing competition, potentially impacting Symbotic's profitability.

| Economic Factor | Impact on Symbotic | Data Point (2024/2025) |

|---|---|---|

| GDP Growth | Influences Investment | 2024 U.S. GDP ~3% |

| E-commerce Growth | Drives Automation Demand | 2023 e-commerce sales up 7.5% |

| Labor Costs | Increases Automation ROI | Warehouse labor cost rise 5-7% |

Sociological factors

Advanced automation, like Symbotic's systems, can displace warehouse workers, sparking job security concerns. This shift demands reskilling initiatives for roles in automated system operation and maintenance. The U.S. Bureau of Labor Statistics projects a 4% decline in material moving occupations by 2032. Symbotic should address the social impact, possibly partnering on training to ease the transition.

Public perception significantly shapes the acceptance of automation. Concerns about job displacement and safety can hinder adoption. Conversely, positive views on efficiency and improved conditions drive market growth. A 2024 study by McKinsey found that 50% of companies planned to increase automation investments. Symbotic's success hinges on navigating these perceptions.

Workplace safety is paramount with human-robot integration. Human-robot collaboration needs safety standards & training. The global industrial robotics market is projected to reach $81.69B by 2028. Effective collaboration can boost productivity by up to 30%.

Changing Consumer Expectations

Consumer expectations are rapidly changing, with demands for quicker delivery and diverse product selections. This shift compels businesses to enhance supply chain efficiency, driving the need for advanced automation. Symbotic's solutions address this demand, offering agile warehouse automation.

- In 2024, same-day delivery services grew by 20% in North America.

- E-commerce sales are projected to reach $7.4 trillion globally by the end of 2025.

- Consumers now expect delivery within 1-2 days on average.

Demographic Shifts and Labor Shortages

Demographic shifts, including an aging workforce and shrinking labor pools, are significantly impacting the logistics and warehousing sectors. These changes are intensifying labor shortages, making it harder to fill essential roles. Automation becomes crucial for maintaining operational capacity and meeting consumer demand in this evolving landscape. For example, the U.S. Bureau of Labor Statistics projects a continued need for automation in these sectors.

- Aging workforce trends are expected to continue through 2025, with a larger proportion of older workers in the labor force.

- Labor shortages in logistics and warehousing are projected to persist, driven by demographic shifts and high turnover rates.

- Automation adoption rates are increasing, with companies investing in robotics and AI to offset labor challenges.

Automation may cause job displacement, requiring reskilling for new roles. Public perception greatly affects the acceptance of automation; addressing safety & efficiency is crucial. Changing consumer expectations drive a need for supply chain improvements.

| Factor | Impact | Data |

|---|---|---|

| Job displacement | Risk of warehouse worker layoffs. | BLS projects 4% decline in material moving occupations by 2032. |

| Public perception | Affects market acceptance of automation. | 50% of companies planned more automation investment in 2024. |

| Consumer expectations | Demands faster delivery & wide product selection. | Same-day delivery grew by 20% in 2024 in North America. |

Technological factors

Continuous advancements in robotics, artificial intelligence, and machine learning are central to Symbotic's operations. These technologies drive efficiency in warehouse automation. For instance, in 2024, the global AI market reached $236.8 billion, with expected growth to $1.81 trillion by 2030. This growth underscores the potential for Symbotic's AI-driven solutions.

Symbotic's success hinges on its seamless integration of software, hardware, and AI. Their proprietary software platform is designed to orchestrate robot movements and manage inventory in real-time. This real-time capability is a key differentiator, crucial for optimizing warehouse efficiency. In Q1 2024, Symbotic reported a revenue of $367.4 million, reflecting the demand for its integrated solutions.

Data analytics and predictive modeling are crucial for Symbotic's warehouse operations. They likely use data to improve inventory management and forecast demand. This streamlines workflows, increasing efficiency. For example, in 2024, the global warehouse automation market was valued at $30.7 billion and is projected to reach $75.3 billion by 2029, with a CAGR of 19.7%.

Connectivity and IoT

Connectivity and IoT are central to Symbotic's operations. The IoT enables real-time data collection, crucial for warehouse automation. This enhances system performance and management. Symbotic leverages this for operational efficiency. For example, the global IoT market is projected to reach $1.8 trillion by 2025.

- Real-time data collection is key.

- Enhances system performance and management.

- Operational efficiency is a focus.

- IoT market to hit $1.8T by 2025.

Development of Collaborative Robots (Cobots)

The emergence of collaborative robots (cobots) is reshaping manufacturing and logistics. These robots are designed to work safely alongside humans, increasing efficiency and flexibility. While Symbotic focuses on high-density automation, cobots could complement its systems, improving adaptability. The global cobot market is projected to reach $12.3 billion by 2028, growing at a CAGR of 25.7% from 2021.

- Cobots offer enhanced safety features, like force sensors and vision systems.

- They can reduce labor costs and improve productivity in warehouses.

- Cobots facilitate human-robot collaboration in various tasks.

Symbotic leverages advanced technologies like AI and robotics for warehouse automation, aiming for high efficiency. The global AI market was valued at $236.8 billion in 2024, indicating strong growth potential. Integrated software and real-time management are crucial, contributing to robust financial performance; for instance, $367.4 million in Q1 2024 revenue.

| Technology | Impact | Data Point (2024/2025) |

|---|---|---|

| AI and Robotics | Drives warehouse efficiency | AI market: $236.8B (2024), Global IoT market: $1.8T (2025). |

| Integrated Systems | Enhances real-time management | Symbotic Q1 2024 revenue: $367.4M. |

| Cobots | Improve adaptability | Cobot market projected CAGR 25.7% (2021-2028). |

Legal factors

Workplace safety regulations are crucial for Symbotic. The Occupational Safety and Health Administration (OSHA) sets standards in the US. Compliance is key for their robotic systems. In 2024, OSHA inspected over 32,000 workplaces.

Symbotic must adhere to data protection laws. GDPR and CCPA compliance is vital, given the data collected from inventory, operations, and staff. Breaches can lead to hefty fines; for example, GDPR fines can reach up to 4% of annual global turnover. In 2024, the average cost of a data breach was $4.45 million globally.

Symbotic heavily relies on its unique technology, making robust intellectual property protection crucial. Securing patents, trademarks, and copyrights safeguards its AI, software, and hardware. Legal battles over IP infringement pose a significant business risk. Symbotic's R&D spending in 2024 was about $100 million, underlining the importance of protecting these investments.

Contract Law and Customer Agreements

Symbotic's operations are heavily influenced by contract law, particularly in its agreements with major clients like Walmart. These contracts dictate performance standards, liabilities, and methods for resolving disputes. As of 2024, Walmart accounted for a significant portion of Symbotic's revenue, highlighting the importance of these legal frameworks. Any breaches can lead to financial penalties or reputational damage. Understanding contract terms is thus crucial for both Symbotic and its stakeholders.

- Contractual agreements are vital for Symbotic.

- Walmart's significant revenue share highlights contract importance.

- Legal compliance impacts financial performance.

- Terms cover performance, liabilities, and dispute resolution.

Product Liability and Safety Standards for Robotics

Symbotic faces product liability risks and must adhere to safety standards for its robotics. Compliance is crucial to avoid legal issues and lawsuits. The robotics market is expected to reach $214 billion by 2025. In 2024, product liability insurance premiums rose by about 10-15% for tech companies.

- Product liability lawsuits are on the rise.

- Robotics safety standards are becoming stricter.

- Insurance costs are increasing for tech firms.

- Compliance is vital to mitigate legal risks.

Contractual obligations are crucial due to Walmart's revenue contribution. Legal compliance directly affects Symbotic’s financial outcomes, with contract terms covering performance, liabilities, and dispute resolution. Product liability and robotics safety standards require strict adherence to avoid potential legal actions.

| Legal Aspect | Impact | Data Point (2024/2025) |

|---|---|---|

| Contract Law | Revenue Dependence/Risk | Walmart represents significant portion of revenue; Contract breaches: potential for financial penalties or reputational damage |

| Product Liability | Risk Exposure | Robotics market expected to $214 billion by 2025, Insurance premiums: 10-15% rise for tech |

| IP Protection | Innovation Investment Protection | R&D spending approx $100 million; Patent/Trademark essential |

Environmental factors

The energy use of automated warehouses is a key environmental factor. Symbotic's focus on energy-efficient designs can be a strong selling point. For example, in 2024, warehouse energy costs averaged $1.50-$2.50 per square foot annually. Focusing on sustainability helps meet client eco-goals.

Warehouse automation, like that offered by Symbotic, aids in waste reduction. Optimized inventory management minimizes waste. By reducing product damage and improving packaging, Symbotic technology helps minimize waste in the supply chain. A 2024 study showed automated warehouses cut packaging waste by up to 15%.

Symbotic's automated storage and retrieval systems (AS/RS) boost warehouse density. This efficient land use cuts environmental impact. In 2024, AS/RS adoption grew by 15% due to efficiency gains. Reduced construction needs lower carbon footprints. This aligns with green building trends.

Transportation and Logistics Optimization

Symbotic's focus on warehouse automation indirectly influences transportation. By optimizing the flow of goods within warehouses, Symbotic helps reduce the need for excessive transportation. This leads to lower emissions and costs. For example, the logistics industry accounts for roughly 15% of global greenhouse gas emissions.

- Reduced Shipping: Efficient warehousing lessens the frequency of shipments.

- Lower Emissions: Optimized routes and fewer trips cut down on fuel consumption.

- Cost Savings: Reduced transportation expenses lead to better margins.

- Supply Chain Efficiency: Improved logistics boosts overall operational effectiveness.

Sustainability Regulations and Customer Expectations

Rising environmental regulations and customer demands for sustainable practices are impacting demand for eco-friendly warehouse solutions. Symbotic must showcase its tech's environmental benefits, integrating sustainability into its operations and development. A 2024 study shows a 20% increase in consumers preferring sustainable brands. This shift necessitates green strategies.

- The global green logistics market is projected to reach $1.2 trillion by 2027.

- Companies with strong ESG (Environmental, Social, and Governance) scores often see higher valuation multiples.

Symbotic's eco-friendly tech lowers warehouse energy use and waste, crucial for sustainability. Automated systems cut emissions from transportation. Meeting rising environmental standards and customer demands is key. By 2024, green logistics market reached $800B.

| Environmental Factor | Impact | Symbotic's Response |

|---|---|---|

| Energy Use | Warehouse energy costs average $1.50-$2.50/sq ft annually | Focus on energy-efficient designs |

| Waste Reduction | Automated warehouses can cut packaging waste by up to 15% (2024). | Optimize inventory & reduce damage. |

| Land Use | AS/RS adoption grew by 15% in 2024 | Increase warehouse density; reduce construction needs. |

PESTLE Analysis Data Sources

The Symbotic PESTLE analysis relies on financial reports, industry analysis, government publications, and tech trend reports to identify external macro-environmental factors.