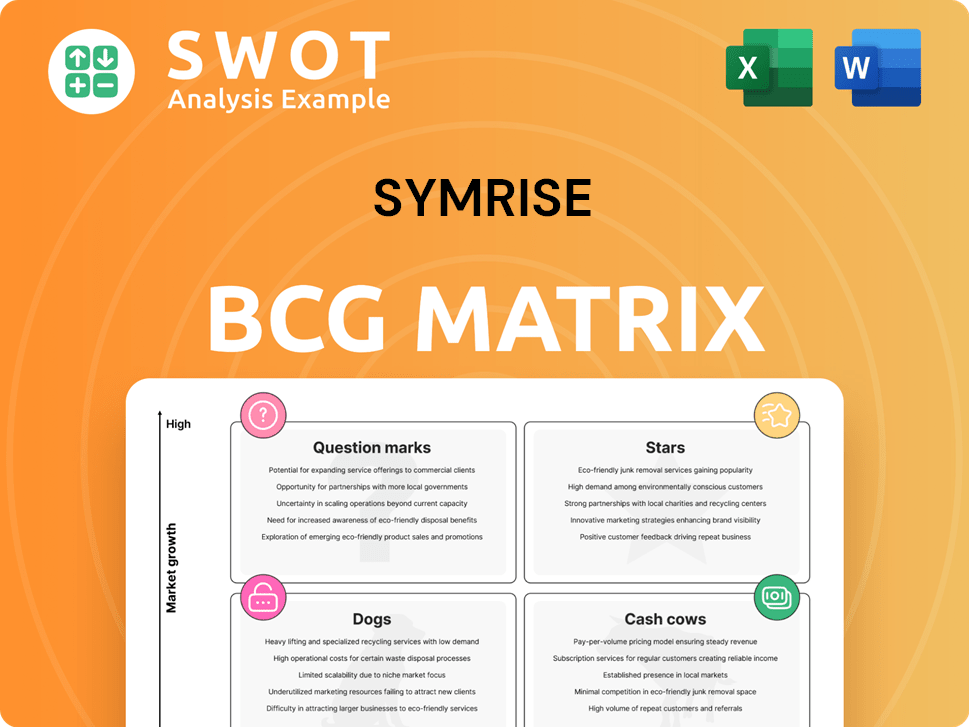

Symrise Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Symrise Bundle

What is included in the product

Symrise BCG Matrix analyzes its product units across quadrants, guiding investment, holding, or divestment decisions.

Printable summary optimized for A4 and mobile PDFs, providing quick, clear, and accessible insights.

What You’re Viewing Is Included

Symrise BCG Matrix

The Symrise BCG Matrix previewed here is the complete document you receive after purchase. This comprehensive report, ready for immediate use, includes insightful analysis, clearly presented data, and strategic recommendations. There are no hidden extras, just the fully-featured BCG Matrix. It's designed to support your business decisions.

BCG Matrix Template

Symrise's product portfolio requires strategic understanding, and the BCG Matrix offers a snapshot of their strengths. Stars likely represent high-growth opportunities, while Cash Cows provide essential revenue. Dogs may need divestment, and Question Marks demand careful evaluation. Get the full BCG Matrix report to uncover detailed quadrant placements and strategic insights for Symrise.

Stars

Fine Fragrances and Consumer Scents were a star for Symrise in 2024, driven by high demand. This growth was fueled by the company's focus on high-margin segments. Symrise should keep investing in innovation. In 2024, the Fragrance & Flavor segment saw a sales increase.

Aroma Molecules, a significant earnings driver for Symrise, saw a robust rebound after the Colonel Island site's restart. This segment's growth potential and market share are substantial. Symrise must focus on operational efficiency and capacity investments. In 2024, Symrise's Fragrance & Aroma division, including Aroma Molecules, reported strong growth, indicating its importance.

The Pet Food segment is a star performer for Symrise, demonstrating robust growth and significant contributions to overall organic sales. Given the global rise in pet ownership and premiumization trends, this segment is well-positioned for continued expansion. Symrise should focus on innovation in flavors and nutrition, and expand its market reach. In 2024, the segment saw a 10% increase in sales.

Cosmetic Ingredients

Symrise's cosmetic ingredients, a star in its BCG matrix, thrives on rising consumer interest in sustainable beauty. This segment shows high growth potential. Symrise can focus on innovation, using its R&D to meet evolving industry needs. In 2023, Symrise's fragrance and cosmetic ingredients sales were strong, with significant growth in naturals.

- Sales of fragrance and cosmetic ingredients showed strong growth in 2023.

- Symrise is investing in sustainable and natural ingredients.

- The beauty market is expanding, creating opportunities.

Savory, Sweet & Beverages

The Savory, Sweet & Beverages segment significantly boosted Symrise's revenue. This segment's performance highlights the company's ability to capitalize on market trends. Innovation in flavor creation is crucial to maintain this growth trajectory. Symrise's focus on R&D should continue to drive success.

- In 2023, the segment showed robust growth, contributing substantially to overall sales.

- Market demand for innovative flavors is consistently high.

- Symrise invested heavily in R&D, with a focus on flavor profiles.

- Continued investment in this area is crucial for long-term success.

Fine Fragrances, Consumer Scents, Pet Food, Cosmetic Ingredients, Savory, Sweet & Beverages were 2024 stars for Symrise, showing high growth. These segments benefit from consumer trends and strategic investments. Innovation and R&D are key for maintaining this momentum.

| Segment | 2024 Performance Highlights | Strategic Focus |

|---|---|---|

| Fine Fragrances | High demand, sales increase | Innovation and high-margin segments. |

| Aroma Molecules | Robust rebound post-restart | Operational efficiency and capacity investments. |

| Pet Food | Strong growth, 10% sales increase | Flavors, nutrition, and market reach expansion. |

Cash Cows

The Scent & Care segment is a cash cow for Symrise, given its strong market presence and diverse offerings. Market growth is steady, yet the segment yields significant cash flow due to its high market share. In 2024, this segment accounted for a large portion of Symrise's revenue. Symrise should maintain its position through efficient operations and strategic pricing.

The Taste, Nutrition & Health segment is a cash cow for Symrise, holding a leading market position. This segment consistently generates strong cash flows due to its high market share. In 2024, the segment's revenue was approximately €2.3 billion. Symrise should prioritize operational optimization and strategic investments to maintain profitability, especially in areas like natural ingredients where demand is growing. This will ensure continued financial strength.

Established fragrance ingredients, like certain aroma chemicals, are cash cows for Symrise. These ingredients, with consistent demand, need little promotion. Symrise focuses on efficient production, cost control, and quality to maximize cash flow. In 2024, these ingredients likely generated significant revenue, contributing to Symrise's financial stability.

Functional Ingredients

Functional ingredients are a cash cow for Symrise, providing steady revenue. These ingredients are crucial across industries, ensuring consistent demand. Symrise should maintain production and supply chain efficiency. In 2024, the flavors and nutrition segment, which includes functional ingredients, saw robust growth.

- Revenue from flavors and nutrition segment grew.

- Demand is stable.

- Focus on efficiency.

Core Flavor Offerings

Symrise's core flavor offerings, essential for staple food and beverage products, are solid cash cows, generating reliable revenue. These flavors, with a wide consumer base, need minimal marketing, ensuring consistent cash flow. Focus on maintaining quality, optimizing production, and extending product lines. In 2024, Symrise reported strong sales in its Flavor segment.

- Flavor sales accounted for a significant portion of Symrise's total revenue in 2024.

- These core flavors enjoy high demand, with minimal marketing costs.

- Symrise can enhance profitability by streamlining production.

- Product line extensions present additional revenue opportunities.

Symrise's Cash Cows include Scent & Care, Taste, Nutrition & Health, and established fragrance ingredients, consistently delivering strong cash flows. These segments benefit from high market share and steady demand, as evidenced by the €2.3 billion revenue from the Taste, Nutrition & Health segment in 2024. Focus on operational efficiency and strategic pricing to maintain profitability.

| Segment | Description | Strategy |

|---|---|---|

| Scent & Care | Strong market presence, diverse offerings. | Efficient operations, strategic pricing. |

| Taste, Nutrition & Health | Leading market position, high cash flows. | Operational optimization, strategic investments. |

| Fragrance Ingredients | Consistent demand, minimal promotion. | Efficient production, cost control, quality. |

Dogs

Some aroma chemicals at Symrise may be "dogs" due to low market share and growth. These underperformers might not boost revenue or profits significantly. In 2024, Symrise's fragrance and flavor sales grew, but some niche products may lag. Symrise should assess these chemicals and consider selling them if improvements fail.

Commoditized flavorings within Symrise's portfolio, facing strong competition and pricing pressures, often reside in the "dogs" quadrant of the BCG matrix. These flavorings, lacking significant differentiation, struggle to yield substantial profits. Symrise's 2024 financial reports showed a 3.5% decrease in revenue for such products. This decline highlights the need for strategic intervention.

Niche cosmetic ingredients with declining demand and limited market growth are classified as dogs in Symrise's BCG matrix. These ingredients, like certain botanical extracts, may face diminishing consumer interest. Symrise's 2024 financial reports indicated a 2.5% decrease in sales for specific fragrance ingredients. Re-evaluating these investments is crucial; divestiture could optimize the portfolio.

Low-Margin Fragrance Compounds

Low-margin fragrance compounds with limited market share are dogs for Symrise. These struggle against alternatives and lack consumer interest. Symrise must assess costs and market conditions for these. Options include reformulation, repositioning, or even discontinuation. In 2024, Symrise's fragrance division saw a 3.5% decline in sales for certain low-margin products.

- Market share under 5% for specific compounds.

- Cost analysis to identify loss-making products.

- Explore potential for new fragrance blends.

- Consider divestment if not viable.

Outdated Technologies

In the Symrise BCG Matrix, business segments using outdated technologies and experiencing market decline are "dogs". These technologies often can't compete with modern alternatives. Symrise needs to evaluate upgrades or phase-out plans to boost efficiency and competitiveness. For example, in 2023, Symrise's Fine Fragrances segment saw a slight decrease in market share due to evolving consumer preferences and more advanced fragrance creation methods.

- Outdated tech segments face declining market share.

- Competition from newer tech is a key challenge.

- Symrise must consider upgrades or phase-outs.

- Focus on efficiency and competitiveness is vital.

Dogs in Symrise's portfolio include aroma chemicals and flavorings with low market share and growth potential. These underperforming products, like commoditized flavorings, face strong competition. In 2024, certain segments saw revenue declines, prompting the need for strategic intervention, such as re-evaluation or divestiture.

| Category | Characteristics | Action |

|---|---|---|

| Flavorings | Low Differentiation, Price Pressure | Re-evaluate/Divest |

| Cosmetic Ingredients | Declining Demand | Divestiture |

| Fragrance Compounds | Low Margin, Limited Share | Reformulate/Divest |

Question Marks

Emerging natural ingredients, like those with potential in wellness, are question marks for Symrise. They have high growth potential but low market share currently. In 2024, the global market for natural ingredients was valued at $35.7 billion, and Symrise should invest in R&D. The goal is to validate efficacy and explore product applications to increase market share.

Innovative delivery systems, like microencapsulation, are question marks for Symrise. These systems, promising unique benefits, face uncertain market acceptance despite high growth potential. Significant investment in development and marketing is crucial. Symrise should assess viability through market research and pilots. In 2024, the global microencapsulation market was valued at $32.5 billion.

Personalized fragrance solutions are a question mark within Symrise's BCG matrix, offering high growth potential. They meet rising demand for customization, requiring advanced tech and marketing. Symrise should invest in platforms and data analytics. The global fragrance market was valued at $61.6 billion in 2023 and is expected to reach $78.7 billion by 2028.

Sustainable Sourcing Initiatives

Sustainable sourcing is a "question mark" for Symrise's BCG matrix, as widespread adoption and market impact are uncertain. These initiatives meet consumer demand for environmental and social responsibility. They need investments and supplier collaboration. Symrise should promote sustainable practices to boost market adoption.

- In 2024, Symrise increased its sustainable sourcing of key raw materials by 15%.

- The company invested €20 million in sustainable sourcing programs last year.

- Consumer demand for sustainable products grew by 10% in key markets.

- Symrise partnered with 50 new suppliers to improve sustainability practices.

AI-Driven Product Development

AI-driven product development is a question mark for Symrise, with high growth potential but uncertain market share. This involves using AI to innovate flavors and fragrances, optimizing formulations, and predicting consumer tastes. Investing in AI and data analytics could give Symrise a significant competitive edge, enhancing both development speed and market responsiveness. However, the success hinges on effective AI implementation and data management.

- Symrise's focus on AI includes predictive modeling for flavor creation.

- The flavor and fragrance market is projected to reach $37.4 billion by 2024.

- AI can reduce product development time significantly.

- Symrise is investing in digital transformation to enhance innovation.

Symrise sees AI-driven product development as a "question mark." AI helps innovate flavors and fragrances. The flavor and fragrance market is projected to reach $37.4 billion by 2024. Investing in AI could boost development.

| Aspect | Details | Impact |

|---|---|---|

| AI Focus | Predictive modeling for flavor creation | Enhanced Innovation |

| Market Size | $37.4 billion (2024 projection) | Competitive Advantage |

| Investment | Digital transformation | Faster Development |

BCG Matrix Data Sources

Symrise's BCG Matrix is built on robust financial data, market studies, and analyst forecasts, delivering actionable insights.