Synchronoss Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Synchronoss Bundle

What is included in the product

Analyzes Synchronoss' competitive position by examining forces such as rivalry, buyers, and new entrants.

Customize pressure levels based on new data or evolving market trends.

Preview the Actual Deliverable

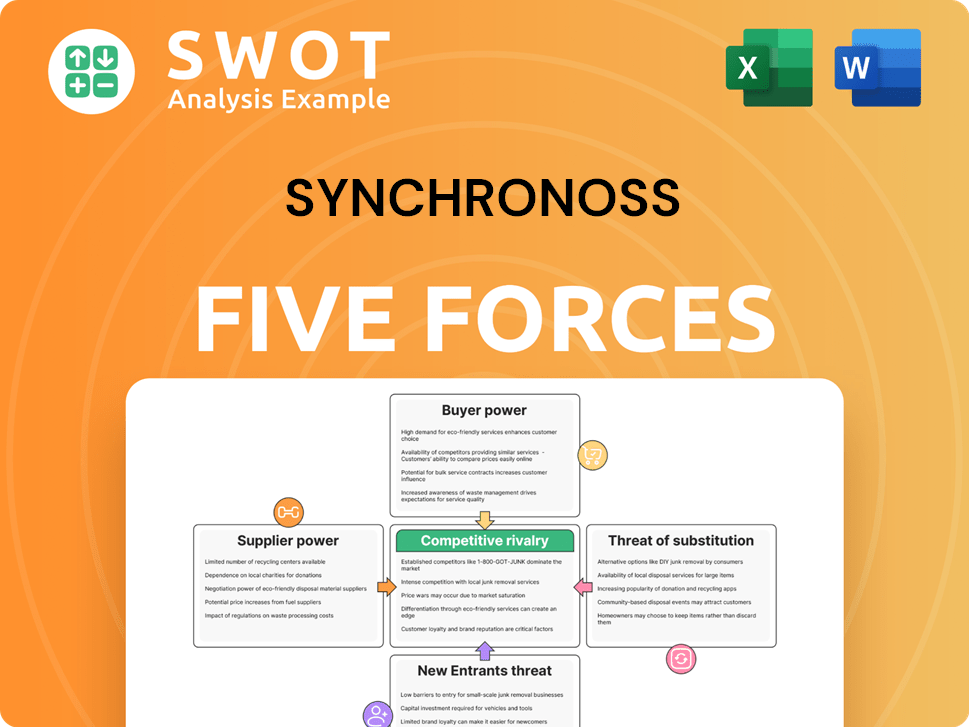

Synchronoss Porter's Five Forces Analysis

This preview presents the full Synchronoss Porter's Five Forces analysis. The document you see is the complete, ready-to-use file you'll receive. It offers a comprehensive look at the industry, with no differences after purchase. Instantly download and use the exact analysis displayed here. This ensures you get the complete insights immediately.

Porter's Five Forces Analysis Template

Synchronoss faces varying competitive pressures. Buyer power stems from its telecom clients, demanding favorable terms. Supplier influence is moderate due to diverse tech component vendors. The threat of new entrants is somewhat limited. Competition within the industry is intense, with established software and cloud providers. Substitute products present a moderate challenge.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Synchronoss’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Synchronoss depends on specialized technology and service providers. Limited suppliers increase their bargaining power. This can inflate Synchronoss's costs or hinder innovation. In 2024, firms using niche tech saw price hikes, impacting operational costs. High supplier power directly affects profitability.

Suppliers holding proprietary tech critical for Synchronoss's offerings wield significant influence. High switching costs might compel Synchronoss to accept less favorable terms. In 2024, Synchronoss's R&D expenses were approximately $20 million, indicating investment in tech. Strong supplier relationships and exploring alternatives are key.

Synchronoss faces supplier power challenges due to cloud infrastructure dependence. Reliance on major cloud providers like AWS and Azure gives these suppliers significant bargaining power. In 2024, AWS held approximately 32% of the cloud market share, and Microsoft Azure held around 23%. To mitigate this risk, Synchronoss could diversify its cloud infrastructure and negotiate better contracts.

Talent pool constraints

The bargaining power of suppliers, specifically concerning talent, is a critical factor for Synchronoss. The availability of skilled engineers and developers directly impacts labor costs. A constrained talent pool increases costs, as seen in the tech sector where salaries have risen significantly. Investing in employee training and development can reduce reliance on external hires and specialized skills, mitigating supplier power.

- In 2024, the average salary for software engineers in the US rose by 5-7%.

- Companies that invested in internal training saw a 10-15% reduction in reliance on external consultants.

- The global demand for cloud computing specialists increased by 20% in 2024.

Software licensing terms

Software vendors hold significant power through licensing terms, potentially impacting Synchronoss's profitability via restrictive agreements or price hikes. For example, in 2024, the average cost of enterprise software licenses increased by 7%. Synchronoss can mitigate this risk by negotiating flexible agreements and exploring open-source alternatives. This proactive approach is crucial, especially given the competitive landscape.

- Licensing costs can significantly affect operational expenses.

- Negotiating favorable terms is essential for cost management.

- Open-source solutions offer alternatives to proprietary software.

- Vendor lock-in increases dependency and reduces flexibility.

Synchronoss faces supplier power challenges across tech and talent. Limited suppliers, especially for cloud services and specialized software, increase costs. In 2024, key tech licensing costs rose 7%, affecting profitability. Mitigating this requires diversification and negotiation.

| Supplier Type | Impact on Synchronoss | 2024 Data/Insight |

|---|---|---|

| Cloud Providers | High bargaining power, cost increases | AWS: ~32% market share; Azure: ~23% |

| Software Vendors | Licensing terms, vendor lock-in | Avg. license cost increase: 7% |

| Specialized Talent | Labor costs, skill scarcity | Software engineer salary rise: 5-7% |

Customers Bargaining Power

Synchronoss faces strong bargaining power from its major telecom clients. These large clients, like Verizon and AT&T, can leverage their size to negotiate favorable terms. In 2024, these firms represented a significant portion of Synchronoss's revenue, highlighting the concentration risk. Diversifying its customer base is crucial to mitigate this power.

Switching costs for Synchronoss customers exist, yet migration to rivals is possible. Synchronoss must innovate, offering compelling value. Enhancing platform stickiness through integrated services and long-term contracts is crucial. In 2024, the company's focus on client retention highlights the need for robust solutions to prevent customer churn. Recent financial reports show the impact of customer retention strategies.

Telecom companies' price sensitivity significantly influences Synchronoss's pricing. In 2024, the telecom sector saw fluctuating ARPU (Average Revenue Per User), with some operators experiencing declines. Demonstrating strong ROI and offering flexible pricing models are vital. Value-added services and customized solutions help justify costs, and can increase customer retention, which is essential.

Demand for customized solutions

Customers' bargaining power rises as they seek customized solutions. Synchronoss faces pressure to meet specific client needs to stay competitive. This demand requires adaptability and responsiveness in service delivery. Successfully navigating this involves offering modular platforms and consulting services, which can effectively address client-specific requirements. In 2024, the demand for tailored tech solutions grew by 15%.

- Customization drives customer influence.

- Synchronoss must adapt to client demands.

- Modular platforms are key.

- Consulting services enhance responsiveness.

Consolidation in telecom sector

The ongoing consolidation in the telecom sector significantly boosts the bargaining power of customers. As the number of telecom providers shrinks, the remaining larger clients gain more leverage in negotiation. This shift compels companies like Synchronoss to focus on building strong relationships with key decision-makers within these consolidated entities, who now represent a greater share of the market. Strategic partnerships and tailored service offerings become crucial for securing and maintaining contracts in this environment. In 2024, the top four telecom companies controlled over 70% of the market share, illustrating this trend.

- Consolidation leads to fewer, larger clients.

- These clients have increased negotiating power.

- Strong relationships with key decision-makers are essential.

- Strategic partnerships and tailored services are key.

Synchronoss's telecom clients wield significant bargaining power due to their size. Customer concentration risks are notable, demanding diversification efforts. In 2024, market consolidation amplified these pressures.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Client Size | Increased negotiating power | Verizon, AT&T: Major revenue sources. |

| Market Consolidation | Fewer, larger clients | Top 4 telecom companies: 70%+ market share. |

| Customization Demand | Requires tailored solutions | Tech solution demand growth: 15%. |

Rivalry Among Competitors

The cloud services market is fiercely competitive, hosting giants and niche players. Synchronoss competes with major tech firms like Amazon, Microsoft, and Google. Differentiation through specialized solutions and top-notch customer service is key for Synchronoss. In 2024, the cloud market is projected to reach over $600 billion. Synchronoss must innovate to stay relevant.

Rapid technological change is a significant factor in competitive rivalry. The need for continuous innovation is driven by the quick pace of technological advancements. Competitors are constantly creating new solutions and features to gain an edge. For instance, in 2024, Synchronoss invested $20 million in R&D. Staying ahead of industry trends is crucial to maintain a competitive advantage.

Intense rivalry can trigger price wars, squeezing Synchronoss's profit margins. To combat this, Synchronoss needs to strategically price its offerings, ensuring value. In 2024, the competitive landscape saw aggressive pricing strategies from key players, pressuring margins. Implementing tiered pricing models and emphasizing high-value services becomes crucial for Synchronoss to maintain profitability amidst fierce competition.

Focus on specific niches

Some competitors, like those specializing in mobile device management, concentrate on specific niches. Synchronoss must identify and protect its core markets to stay competitive. Expanding into related areas and providing integrated solutions could create new opportunities. This strategic approach helps in capturing a larger market share. For instance, in 2024, the cloud computing market is projected to reach $600 billion, indicating the importance of strategic market positioning.

- Identify and defend core markets.

- Explore adjacent markets for expansion.

- Offer integrated solutions for added value.

- Increase market share through strategic moves.

Acquisitions and partnerships

Mergers and acquisitions significantly alter the competitive arena. Synchronoss should stay informed about industry consolidation and potential partnerships. Strategic moves can bolster its market standing and broaden its abilities. For instance, in 2024, the tech sector saw numerous acquisitions aimed at gaining market share and innovative technologies. These moves can impact Synchronoss.

- Industry consolidation influences market dynamics.

- Partnerships offer opportunities for expansion.

- Acquisitions can lead to shifts in competition.

- Monitoring these changes is vital for Synchronoss.

The cloud services market is intensely competitive, with Synchronoss facing major players and niche competitors. Rapid technological change necessitates continuous innovation to maintain a competitive edge, exemplified by 2024's $20 million R&D investment. Intense rivalry can lead to price wars; thus, strategic pricing and high-value services are vital for profitability.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Market Competition | High intensity | Cloud market estimated at over $600B. |

| Technological Change | Requires innovation | Synchronoss invested $20M in R&D. |

| Pricing Pressure | Margin squeeze | Aggressive pricing strategies. |

SSubstitutes Threaten

Alternative messaging platforms pose a threat to Synchronoss. Various platforms offer similar messaging functionality. Synchronoss needs to differentiate through unique features. Focusing on security, reliability, and integration is crucial. In 2024, the messaging app market was valued at $55.7 billion.

Some businesses might favor on-premise solutions instead of cloud-based services, posing a threat to Synchronoss. To counter this, Synchronoss should promote the advantages of its cloud offerings. Highlighting scalability, cost efficiency, and robust security is crucial for attracting customers. For instance, the global cloud computing market was valued at $670.6 billion in 2023, with a projected growth to $1.6 trillion by 2030, reflecting the rising demand for cloud services.

Open-source software presents a notable substitute for Synchronoss' proprietary offerings. To compete effectively, Synchronoss must consistently deliver superior performance and comprehensive customer support. This is critical, especially considering the 2024 market, where open-source adoption is up 15% across various sectors. Synchronoss can justify its costs by providing enterprise-grade features and robust security, ensuring value.

DIY solutions

The threat of substitutes for Synchronoss includes companies developing their own cloud and messaging solutions, a form of DIY. Synchronoss must highlight the complexity and cost advantages of its platforms to counter this threat. By showcasing its expertise and history, Synchronoss can persuade potential clients to outsource. This strategy is crucial, especially given the competitive landscape.

- In 2024, the global cloud computing market was valued at approximately $670 billion, with significant growth expected.

- The cost of building and maintaining in-house solutions can be 20-30% higher than outsourcing.

- Synchronoss has a proven track record, serving over 2,000 clients worldwide.

- Outsourcing allows companies to focus on core competencies.

Evolving communication methods

The threat of substitutes in Synchronoss's market stems from the rapid evolution of communication methods. New technologies could disrupt existing services. Synchronoss must adapt to evolving user preferences to remain competitive. Investing in R&D and exploring emerging technologies is crucial. In 2024, the global unified communications market was valued at approximately $40 billion.

- Competition from OTT messaging apps like WhatsApp and Telegram.

- Changing consumer behavior towards newer communication platforms.

- Need for continuous innovation in Synchronoss's offerings.

- Investment in R&D is crucial for future growth.

Synchronoss faces substitution threats from various sources. These include alternative messaging platforms, on-premise solutions, and open-source software. DIY solutions and evolving communication technologies also pose risks. Adaptability and continuous innovation are key.

| Substitute Type | Threat | Mitigation |

|---|---|---|

| Messaging Apps | Competition | Focus on unique features |

| On-Premise | Cloud alternatives | Highlight cloud benefits |

| Open-Source | Free alternatives | Superior performance |

| DIY Solutions | In-house development | Showcase expertise |

Entrants Threaten

Entering the cloud and messaging market demands substantial capital investment, a significant deterrent for new competitors. Synchronoss, with its existing infrastructure and customer base, holds a competitive advantage. The costs associated with building and maintaining cloud services and messaging platforms are substantial. The industry requires ongoing investment in technology and security, with Synchronoss reporting $24.7 million in cash and cash equivalents as of September 30, 2023, which supports its operations.

Building a strong brand requires significant investment and time, acting as a barrier to new competitors. New entrants often find it challenging to rival established brands in the market. Synchronoss benefits from its well-recognized brand and existing customer relationships. This helps in maintaining its market position, despite the presence of potential new competitors. In 2024, brand value is a key differentiator.

Creating competitive cloud and messaging platforms demands significant technological prowess, which is a major hurdle for newcomers. This technical barrier restricts the pool of potential entrants into the market. Synchronoss leverages its skilled team and unique technology to maintain its competitive edge. In 2024, the cloud computing market was valued at approximately $670 billion globally, highlighting the scale and technical demands.

Regulatory hurdles

New entrants in the tech and cloud services face substantial regulatory hurdles. Compliance with data privacy laws, like GDPR and CCPA, is complex. These regulations demand significant investments in security and compliance. Synchronoss benefits from its established compliance certifications. This experience gives Synchronoss a competitive edge.

- Data breaches cost companies an average of $4.45 million in 2023.

- GDPR fines can reach up to 4% of a company's global revenue.

- The cost of cybersecurity breaches is projected to hit $10.5 trillion annually by 2025.

Economies of scale

Established companies like Synchronoss, benefit from economies of scale, giving them a cost advantage. New entrants often find it tough to match these costs. Synchronoss uses its size to offer competitive pricing. This also allows for continued investment in innovation.

- Synchronoss Technologies, Inc. (SNCR) is listed on NASDAQ.

- Synchronoss announced its fourth-quarter and full-year 2023 financial results on March 21, 2024.

- The company has a presence on LinkedIn.

- Synchronoss provides cloud, messaging, and digital solutions.

High entry costs, including capital and brand building, limit new competitors. Technical expertise and regulatory compliance pose further barriers. Established players like Synchronoss benefit from economies of scale, offering cost advantages.

| Barrier | Impact | Example (2024) |

|---|---|---|

| Capital Investment | High costs hinder entry | Cloud market valued at ~$670B |

| Brand Building | Difficult to compete | Strong brand needed |

| Technical Prowess | Specialized skills are essential | $10.5T cybersecurity cost by 2025 |

Porter's Five Forces Analysis Data Sources

Our analysis employs financial statements, market reports, and competitor data. We also use industry publications and SEC filings to analyze Synchronoss's competitive landscape.