Synchrony Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Synchrony Bundle

What is included in the product

Tailored analysis for Synchrony's product portfolio across the BCG Matrix.

Export-ready design for quick drag-and-drop into PowerPoint, so you can swiftly build presentations.

Preview = Final Product

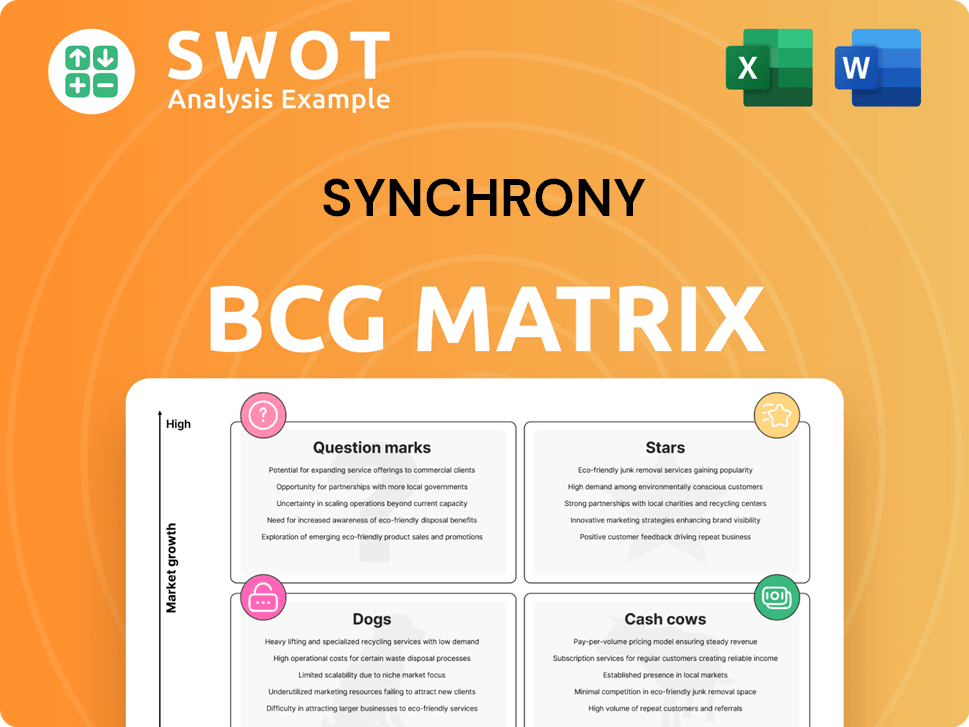

Synchrony BCG Matrix

The preview displays the complete Synchrony BCG Matrix document you'll obtain after purchase. This is the final, ready-to-use report, offering a comprehensive strategic analysis without hidden content or modifications.

BCG Matrix Template

Explore a glimpse of Synchrony's product portfolio! See how its offerings rank in the dynamic market landscape, from Stars to Dogs. This simplified preview offers a taste of strategic positioning. Want the whole picture? Get the full BCG Matrix to unlock crucial investment insights. Discover product placements, growth strategies, and competitive advantages. Purchase the complete report for a clear strategic advantage.

Stars

Synchrony's strategic partnerships are key to its success, collaborating with major retailers, healthcare providers, and manufacturers. In 2024, these partnerships drove significant transaction volume, with over $170 billion in purchase volume. These alliances provide Synchrony with access to diverse customer bases and distribution channels. For example, partnerships with major healthcare providers contributed to a 15% increase in healthcare spending financed through Synchrony in 2024. These collaborations are essential for sustainable growth.

Synchrony's "Digital Innovation" star status signifies its strong investment in digital solutions. This includes mobile and online payment systems. In 2024, digital active accounts grew, reflecting its focus on tech. Synchrony's digital initiatives boost customer engagement and efficiency.

Synchrony, as a "Star" in the BCG Matrix, boasts strong financial health. Its "GREAT" score reflects a robust financial position, backed by a solid return on equity. Analysts predict EPS growth, signaling confidence in its earnings trajectory. In Q4 2023, Synchrony's ROE was approximately 24%, reinforcing its financial strength.

Effective Risk Management

Synchrony's "Stars" benefit from robust risk management, which has led to improvements in credit trends. This is reflected in the stabilization and enhancement of credit metrics. Synchrony's charge-off rate decreased to 3.2% in Q4 2023, down from 3.4% in Q3 2023. This is a positive indicator of effective risk management. The company's focus on prudent lending practices is crucial.

- Charge-off rate decreased to 3.2% in Q4 2023.

- Credit metrics show stabilization and improvement.

- Effective risk management is a key strength.

- Prudent lending practices are emphasized.

Capital Returns

Synchrony Financial's capital allocation strategy, viewed through a BCG Matrix lens, highlights its commitment to shareholder returns. The company has been actively repurchasing shares and increasing dividends, signaling strong financial health. These actions aim to boost shareholder value, reflecting confidence in its future. In 2024, Synchrony's dividend yield was approximately 2.5%, and it repurchased $1.5 billion in shares.

- Dividend Yield (2024): ~2.5%

- Share Repurchases (2024): $1.5 billion

- Capital Allocation Focus: Shareholder value

- Strategic Implication: Confidence in financial position

Synchrony's "Stars" strategy emphasizes partnerships, digital innovation, and financial strength. This position boosts customer engagement and ensures strong financial health. The company's focus on shareholder returns underscores its financial strength.

| Aspect | Details | 2024 Data |

|---|---|---|

| Purchase Volume (Partnerships) | Total transaction volume via partners | >$170 billion |

| Digital Active Accounts | Growth driven by digital focus | Increased |

| ROE (Q4 2023) | Return on Equity | ~24% |

Cash Cows

Synchrony's credit card business is a cash cow, generating significant revenue. This core segment, with a large customer base, fuels consistent cash flow. In 2024, credit card receivables were substantial. The established partnerships further solidify its strong market position.

Synchrony's enduring retail partnerships, including collaborations with Sam's Club and JCPenney, are crucial. These alliances generate a steady revenue stream for Synchrony. In 2024, these partnerships accounted for a significant portion of Synchrony's total loan receivables. They also offer access to established customer bases and distribution networks.

Synchrony's mature credit card segments, tied to established brands, act as cash cows. These segments, like those with Amazon, yield steady profits. In 2024, Synchrony's net interest income reached $16.5 billion, showcasing the profitability of such segments. These require less capital for upkeep.

Strong Market Position

Synchrony's robust market stance in consumer financial services, especially as the premier private-label credit card provider, fuels its reliable cash generation. This dominance, coupled with its extensive scale and proficiency, gives it a significant edge. Synchrony’s ability to maintain its market position is critical for sustained profitability. Its strategic focus on partnerships and customer service bolsters its standing.

- Synchrony holds a substantial market share in private-label credit cards.

- The company's revenue in 2024 was around $17 billion.

- Synchrony's net earnings in 2024 were approximately $3 billion.

- Its total assets are valued at roughly $90 billion.

Disciplined Underwriting

Synchrony's disciplined underwriting and credit management are key to its success. This approach helps them maintain strong risk-adjusted returns, even when market conditions change. They focus on a diversified portfolio of products and spending categories. In 2024, Synchrony's net charge-off rate was 4.6%.

- Disciplined underwriting is crucial for managing risk.

- Diversification across products and categories helps.

- Synchrony's 2024 net charge-off rate was 4.6%.

- They aim for resilient returns.

Synchrony's credit card operations function as cash cows, providing consistent revenue and cash flow. Key partnerships with retailers like Sam's Club and Amazon help maintain this status. In 2024, Synchrony's net interest income reached $16.5 billion.

| Financial Aspect | 2024 Data |

|---|---|

| Revenue | ~$17 billion |

| Net Earnings | ~$3 billion |

| Net Charge-Off Rate | 4.6% |

Dogs

Declining purchase volumes in specialty goods and outdoor products suggest challenges. Synchrony's focus on specific areas needs reassessment. In 2024, these declines may signal the need for strategic shifts, potentially involving divestiture. For instance, a 5% drop in outdoor product spending could impact profitability.

Dogs in the Synchrony BCG Matrix represent ventures with low growth and market share. These might include older partnerships or products. For instance, some older retail credit card programs may fall into this category. In 2024, Synchrony's focus shifted towards high-growth areas to boost returns.

Synchrony's "Dogs" segment, marked by the loss of major partnerships, faces significant challenges. The departure of key partners like Walmart and Gap has underscored the vulnerability of depending on a few alliances. In 2024, Synchrony's net charge-offs rose to 4.7%, reflecting increased credit risk and potentially, the impact of lost partnerships. Replacing these lost partnerships is difficult and can lead to lower profitability.

Segments Impacted by Credit Actions

Synchrony's credit actions, though aimed at risk management, can hinder growth in specific segments. These segments, facing stricter credit terms, may see reduced new account openings and purchase volumes. This can lead to lower profitability, potentially classifying these areas as "dogs" within the BCG matrix. For instance, in 2024, segments with tightened credit saw a 5% drop in transaction volume.

- Credit tightening impacts new accounts.

- Purchase volume can decline in affected segments.

- Reduced profitability may result.

- These segments might be classified as "dogs".

Products Facing Regulatory Headwinds

Synchrony's "Dogs" include products affected by regulatory shifts. Potential late fee regulations could severely impact revenue. These areas may need robust mitigation or become less profitable. For instance, in 2024, late fees generated $500 million, a figure at risk. This segment demands strategic adjustments.

- Regulatory Impact: New rules on late fees could cut revenue.

- Revenue Challenge: Areas facing regulations may see profitability drop.

- Mitigation Needs: Strong strategies are required to manage risks.

- Financial Data: Late fees accounted for $500M in 2024.

Synchrony's "Dogs" face low growth and market share. This includes struggling partnerships like those with Walmart and Gap. In 2024, net charge-offs hit 4.7%, highlighting the issues.

| Category | Impact | 2024 Data |

|---|---|---|

| Partnerships | Lost revenue | Walmart & Gap departures |

| Credit Risk | Increased defaults | 4.7% Net Charge-Offs |

| Regulatory | Revenue decline | Late fees $500M at risk |

Question Marks

New co-brand partnerships, like the Sun Country Airlines deal, are emerging opportunities with low market share for Synchrony. These ventures require investment to build brand recognition and expand customer reach. For example, in 2024, Synchrony's co-branded credit cards saw a 10% increase in new accounts. Success hinges on effectively scaling these partnerships.

Synchrony's Buy Now Pay Later (BNPL) offerings are recent additions. They are in a fast-changing market. BNPL has strong growth prospects. However, they face tough competition, needing substantial investment. In 2024, BNPL transactions are projected to reach $71.3 billion.

Synchrony's foray into new digital payment solutions, like partnerships for buy-now-pay-later options, aligns with the question mark quadrant. These ventures, including collaborations with major retailers, aim for high growth. However, they also carry risks, such as market volatility and the need for substantial investment. In 2024, digital payments accounted for 30% of Synchrony's total purchase volume.

Expansion into New Markets

Synchrony's expansion into new markets, whether geographically or demographically, places it in the "Question Mark" quadrant of the BCG Matrix. These initiatives promise high growth but demand considerable investment, making them risky. The success hinges on effective market analysis and execution. For example, Synchrony's 2024 investments in new digital payment solutions fall into this category, aiming to capture evolving consumer preferences.

- Market entry costs can be substantial, potentially impacting short-term profitability.

- Failure rates in new market entries can be high, leading to financial losses.

- Success depends on effective marketing and adapting to local market needs.

- Synchrony's strategic investments in new markets are ongoing.

Ally Lending Acquisition

The Ally Lending acquisition is a question mark within Synchrony's BCG Matrix. This move opens doors in the home and auto sectors but brings integration challenges. Its success hinges on how well Synchrony can leverage Ally's capabilities and navigate market dynamics. The investment required to fully realize its potential adds further complexity.

- Acquisition aimed at expanding into home and auto sectors.

- Integration poses challenges requiring strategic execution.

- Success depends on effective utilization of Ally's resources.

- Significant investment needed for full potential realization.

Question marks in Synchrony's BCG Matrix represent high-growth potential ventures with low market share. These initiatives, like new partnerships and digital payment solutions, require significant investment and carry considerable risk. Success depends on effective market strategies and execution, as seen with 2024's digital payment growth.

| Characteristic | Description | Example (2024 Data) |

|---|---|---|

| Market Share | Low, in emerging markets. | Co-branded cards: 10% new account growth. |

| Growth Potential | High, driven by innovation. | BNPL transactions: $71.3 billion projected. |

| Investment Needs | Substantial, for expansion. | Digital payments: 30% of purchase volume. |

BCG Matrix Data Sources

Synchrony's BCG Matrix is based on financial filings, market studies, and industry expert insights, for actionable insights.