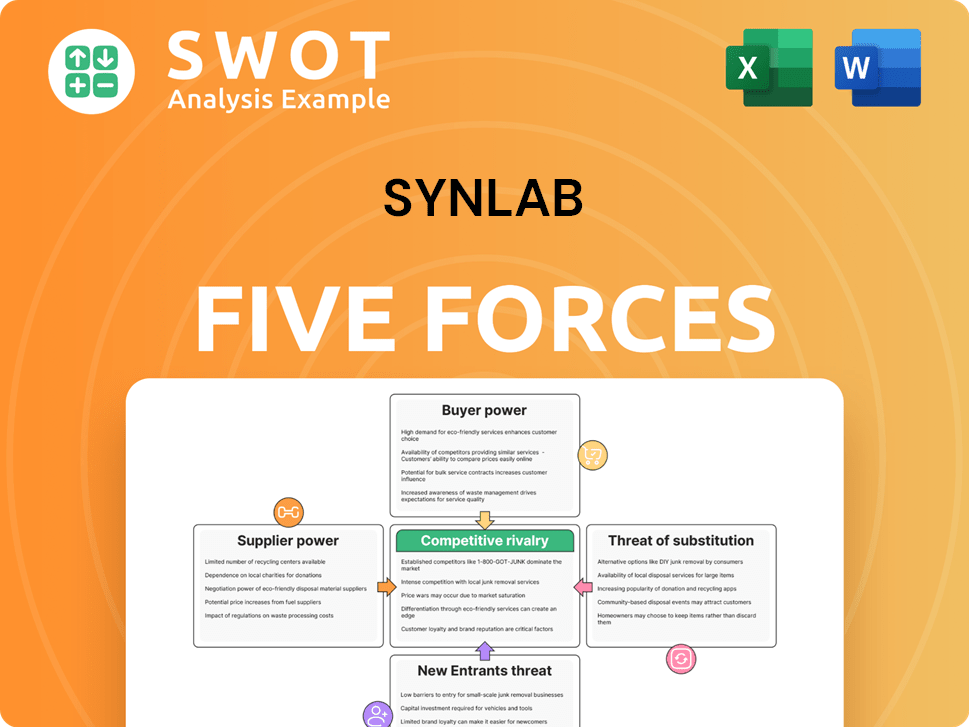

SYNLAB Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

SYNLAB Bundle

What is included in the product

Tailored exclusively for SYNLAB, analyzing its position within its competitive landscape.

Quickly assess competitive forces, highlighting threats and opportunities for actionable insights.

Preview the Actual Deliverable

SYNLAB Porter's Five Forces Analysis

You're viewing the complete SYNLAB Porter's Five Forces Analysis. This detailed analysis, focusing on the competitive forces impacting SYNLAB, is fully formatted. It's ready for immediate download and use. The document you see now is exactly what you'll receive upon purchase. There are no hidden parts or alterations.

Porter's Five Forces Analysis Template

SYNLAB faces a complex competitive landscape, shaped by powerful forces. Buyer power is moderate, influenced by diverse customer needs. The threat of new entrants is limited. Supplier bargaining power varies. Competitive rivalry is intense. The threat of substitutes is present but manageable. Ready to move beyond the basics? Get a full strategic breakdown of SYNLAB’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Supplier concentration varies in the diagnostics industry; it can significantly influence SYNLAB's operations. Key suppliers range from global giants to niche providers. Limited suppliers versus many companies like SYNLAB increase supplier bargaining power. This allows suppliers to set prices. In 2024, Roche and Siemens Healthineers are key players.

SYNLAB faces high supplier power due to substantial switching costs. Changing suppliers demands significant time and investment, impacting operations. For instance, validating new lab equipment and retraining staff adds costs. In 2024, the diagnostic services market hit $100 billion, highlighting supplier influence.

SYNLAB's bargaining power with suppliers hinges on input differentiation. Suppliers of specialized diagnostic tech, like unique reagents, wield more power. If a supplier's offering is hard to replicate, SYNLAB's negotiation ability weakens. For example, in 2024, specialized diagnostic tests costs increased by 7%.

Threat of Forward Integration

Suppliers considering forward integration into SYNLAB's market increase their leverage. If a supplier offers diagnostic services, they directly compete, enhancing bargaining power. This reduces SYNLAB's negotiation strength, impacting profitability. For example, Roche, a major supplier, has diagnostics services, a threat.

- Roche's Diagnostics sales in 2023 were CHF 18.1 billion.

- Siemens Healthineers' Diagnostics revenue in FY23 was €7.6 billion.

- Forward integration could lead to price wars and reduced margins for SYNLAB.

Impact on Quality and Cost

The bargaining power of suppliers significantly impacts SYNLAB's service quality and cost. High-quality reagents are crucial for accurate diagnostic results; if suppliers offer subpar products, SYNLAB's reliability suffers. Input costs, such as specialized chemicals or equipment, heavily influence SYNLAB's expenses, potentially squeezing profit margins if suppliers increase prices. SYNLAB's dependence on specific suppliers for critical inputs strengthens their bargaining position.

- In 2024, the cost of specialized diagnostic reagents could represent up to 40% of SYNLAB's direct operating expenses.

- Quality failures in reagents could lead to a 10-15% increase in repeat testing, increasing costs.

- Dependence on a single supplier for a key machine could lead to an over 20% price increase in the future.

SYNLAB faces strong supplier bargaining power due to high switching costs and specialized inputs. Key suppliers, such as Roche and Siemens Healthineers, hold considerable influence, impacting costs. This power stems from the complexity of diagnostic technologies and the potential for supplier forward integration.

| Factor | Impact on SYNLAB | 2024 Data Point |

|---|---|---|

| Switching Costs | Increases supplier power | Lab equipment validation can cost up to $500,000. |

| Input Differentiation | Impacts negotiation strength | Specialized test costs rose 7% in 2024. |

| Forward Integration | Reduces negotiation ability | Roche's Diagnostics sales: CHF 18.1B (2023). |

Customers Bargaining Power

SYNLAB's customer base spans patients, doctors, hospitals, and pharma. Customer bargaining power increases with fewer clients, or when revenue relies on a few. In 2023, SYNLAB's top 10 clients accounted for ~20% of revenue. Concentrated customers can pressure prices or demand extras, impacting profits.

Low switching costs amplify customer bargaining power over SYNLAB. This means customers can easily switch to competitors if they're unhappy with SYNLAB's offerings. For instance, patients and doctors have alternatives. In 2024, the diagnostic services market saw increased competition, making switching easier.

Informed customers wield significant power. Transparency in pricing helps them compare and negotiate. For example, SYNLAB's market share was approximately 10% in Germany in 2024, indicating competition. This competition means informed customers can seek better deals.

Price Sensitivity

Customer price sensitivity is a key factor in their bargaining power. When customers are very price-sensitive, they actively search for cheaper options, boosting their negotiation strength. This is especially noticeable in sectors where diagnostic services might be seen as standard offerings. For instance, in 2024, the average price for a basic blood test in the US ranged from $100-$200, making patients more likely to shop around.

- Price sensitivity is influenced by factors like income levels and the availability of information on pricing.

- High price sensitivity leads to increased bargaining power, as customers can easily switch to competitors.

- In 2024, the price for a standard MRI scan could vary by as much as 30% depending on the provider.

- The commoditization of services amplifies price sensitivity, making it easier for customers to compare prices.

Ability to Perform Services In-house

Customers' bargaining power rises when they can conduct tests internally. Hospitals and big clinics with labs might depend less on SYNLAB, gaining negotiation power. For example, in 2024, approximately 20% of US hospitals had advanced in-house lab capabilities. This reduces reliance on external services.

- In 2024, about 20% of US hospitals have advanced in-house lab capabilities.

- This trend limits SYNLAB's pricing power.

- Internal capabilities increase customer leverage.

- SYNLAB faces competition from in-house labs.

Customer bargaining power significantly impacts SYNLAB's profitability, especially given the competitive diagnostic services market in 2024. Low switching costs and transparency in pricing empower customers to negotiate or switch providers. Price sensitivity, affected by income and information, further strengthens their leverage, especially in a commoditized market.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Customer Concentration | High Concentration = Increased Power | Top 10 clients accounted for ~20% of revenue |

| Switching Costs | Low = Increased Power | Increased competition in the diagnostic services market |

| Price Sensitivity | High = Increased Power | Standard blood test price: $100-$200 (US) |

Rivalry Among Competitors

The diagnostic services market is intensely competitive. Many regional and global players increase rivalry. This can spark price wars and squeeze profit margins. Marketing costs also rise to stay competitive. For example, in 2024, the market saw intense competition among major diagnostic chains.

The clinical laboratory testing market's projected 9% CAGR from 2024-2034 suggests moderate growth. This growth rate influences competition within the industry. Slower growth intensifies rivalry as companies compete for market share. For instance, in 2024, SYNLAB and other competitors will likely focus on innovation to gain an edge.

Product differentiation is key in the diagnostic market. While standard tests exist, demand is growing for specialized and innovative services. Companies offering unique, high-quality tests, like those using AI for improved accuracy, can reduce rivalry. In 2024, the global in-vitro diagnostics market was valued at $98.89 billion.

Switching Costs

Switching costs are a key factor in competitive rivalry within the diagnostic services market. High switching costs, such as the need for new equipment or retraining, can reduce rivalry. Conversely, low switching costs intensify competition. In 2024, the global in-vitro diagnostics market was valued at approximately $95 billion, highlighting the stakes.

- High switching costs can reduce rivalry.

- Low switching costs intensify competition.

- The global in-vitro diagnostics market was valued at $95 billion in 2024.

- Switching costs influence market share and pricing power.

Exit Barriers

High exit barriers intensify competition. Specialized equipment or long-term contracts make leaving difficult. Firms might keep battling even without profits. This boosts rivalry among competitors. Consider SYNLAB, with its lab infrastructure.

- High exit costs can prolong competition.

- Specialized assets limit alternatives.

- Long-term contracts also bind firms.

- SYNLAB's infrastructure exemplifies this.

Competitive rivalry is strong in the diagnostics market. The market's 9% CAGR from 2024-2034 influences competition. Product differentiation and switching costs also play key roles. High exit barriers intensify rivalry.

| Factor | Impact | Example |

|---|---|---|

| Market Growth (2024-2034 CAGR) | Moderate growth intensifies rivalry | 9% |

| Switching Costs | Low switching costs increase competition | Diagnostic services |

| Exit Barriers | High exit barriers prolong competition | Specialized equipment |

SSubstitutes Threaten

Alternative diagnostic methods, like point-of-care testing (POCT) and at-home kits, pose a threat to SYNLAB. These substitutes offer speed and convenience, potentially luring customers. The global POCT market was valued at $38.4 billion in 2023. SYNLAB must compete by innovating and offering superior services.

Technological advancements pose a threat to SYNLAB. Telemedicine and remote monitoring technologies are emerging. These innovations can provide alternatives to traditional diagnostic tests. In 2024, the global telemedicine market was valued at $61.4 billion. As technology advances, it could substitute some of SYNLAB's services.

Hospitals and clinics building in-house testing labs pose a threat to SYNLAB. This shift allows them control over test results and faster turnaround times. In 2024, the trend of hospitals expanding their diagnostic capabilities continued. For example, in 2024, a significant number of hospitals invested in advanced diagnostic equipment. This offers an alternative to SYNLAB's services.

Delayed or Avoided Testing

Delayed or avoided testing acts as a substitute, reducing demand for SYNLAB's services. Patients might skip tests due to cost or lack of awareness, impacting revenue. This substitution effect is amplified in regions with limited healthcare access. In 2024, around 10% of people delayed medical care due to financial constraints.

- Cost concerns lead to test avoidance, substituting services.

- Lack of awareness also drives this substitution effect.

- Limited healthcare access magnifies the problem.

- Approximately 10% delayed care in 2024 due to cost.

AI-Powered Diagnostics

AI-powered diagnostics pose a threat to SYNLAB. These tools offer faster, more accurate interpretations of medical images, potentially replacing some of SYNLAB's services. The FDA has approved numerous AI diagnostic tools, particularly in radiology, showing their growing acceptance. These technologies can lead to more personalized and effective treatment plans, offering a competitive advantage.

- The global AI in medical diagnostics market was valued at $2.6 billion in 2023.

- It is projected to reach $15.2 billion by 2030.

- FDA has approved over 600 AI-based medical devices.

Various substitutes threaten SYNLAB's market position. These include at-home tests and point-of-care testing (POCT) that offer speed and convenience. The global POCT market was valued at $38.4 billion in 2023. Other substitutes include AI-powered diagnostics, telemedicine, and in-house hospital labs.

| Substitute | Description | Impact on SYNLAB |

|---|---|---|

| POCT/At-Home Kits | Rapid, convenient testing. | Reduced demand for lab tests. |

| Telemedicine | Remote monitoring, virtual consultations. | Potential for fewer diagnostic tests. |

| AI Diagnostics | Faster, more accurate interpretations. | Possible replacement of some services. |

Entrants Threaten

The diagnostic services industry, like that of SYNLAB, demands substantial capital for lab equipment, IT, and staffing. High initial costs serve as a barrier, decreasing the likelihood of new competitors. For example, setting up a modern lab can cost millions, limiting entry to well-funded entities. This is evident in 2024 market data, where established players retain dominant market shares due to these financial hurdles.

The diagnostic industry faces stringent regulations, including ISO 15189 accreditation, increasing entry barriers. Compliance costs, like those for quality control, are substantial. For example, in 2024, the average cost for initial accreditation can range from $5,000 to $20,000, plus ongoing expenses. These regulatory hurdles deter new entrants.

SYNLAB's strong brand reputation and extensive laboratory network pose a significant barrier to new entrants. This established presence allows SYNLAB to leverage existing customer trust. In 2024, SYNLAB reported a revenue of €3.05 billion, showcasing its market dominance. New competitors face challenges in matching this scale and brand recognition.

Economies of Scale

SYNLAB's extensive network and high test volumes create significant economies of scale, a substantial barrier to new entrants. This operational advantage allows for lower per-test costs, enhancing profitability. New competitors face challenges matching SYNLAB's efficiency, especially in areas like bulk purchasing and streamlined logistics. For example, SYNLAB reported a revenue of €2.77 billion in the first nine months of 2023, showcasing its scale.

- Large-scale operations lead to lower per-unit costs.

- Established infrastructure offers a competitive edge.

- New entrants struggle to compete on price.

- SYNLAB's market position is fortified by its size.

Access to Expertise

The diagnostic services industry's threat from new entrants is influenced by access to expertise. Establishing a diagnostic lab requires highly skilled personnel, including pathologists and technicians. Recruiting and retaining these professionals can be a significant hurdle for new companies. This challenge can increase startup costs and operational complexities. Securing qualified staff is crucial for delivering accurate and reliable results, impacting a new entrant's ability to compete effectively.

- Specialized Skills: Pathologists, biochemists, and technicians are essential.

- High Demand: Qualified staff are often in high demand.

- Cost Implications: Recruitment and training add to startup costs.

- Operational Complexity: Managing a skilled workforce adds to complexity.

The diagnostic services sector's new entrant risk is limited by high capital needs for labs and stringent regulations, like ISO 15189. Established players benefit from strong brand recognition and economies of scale, reducing new competitors' chances. For instance, SYNLAB's 2024 revenue of €3.05 billion highlights its market dominance.

| Barrier | Description | Impact |

|---|---|---|

| Capital Requirements | High setup costs for labs, equipment. | Limits entry. |

| Regulations | Compliance costs, accreditation. | Deters new entrants. |

| Economies of Scale | Network and test volumes. | Enhances profitability. |

Porter's Five Forces Analysis Data Sources

The analysis uses annual reports, market research, and financial statements to understand industry dynamics. SEC filings and competitive intelligence sources inform threat assessments.