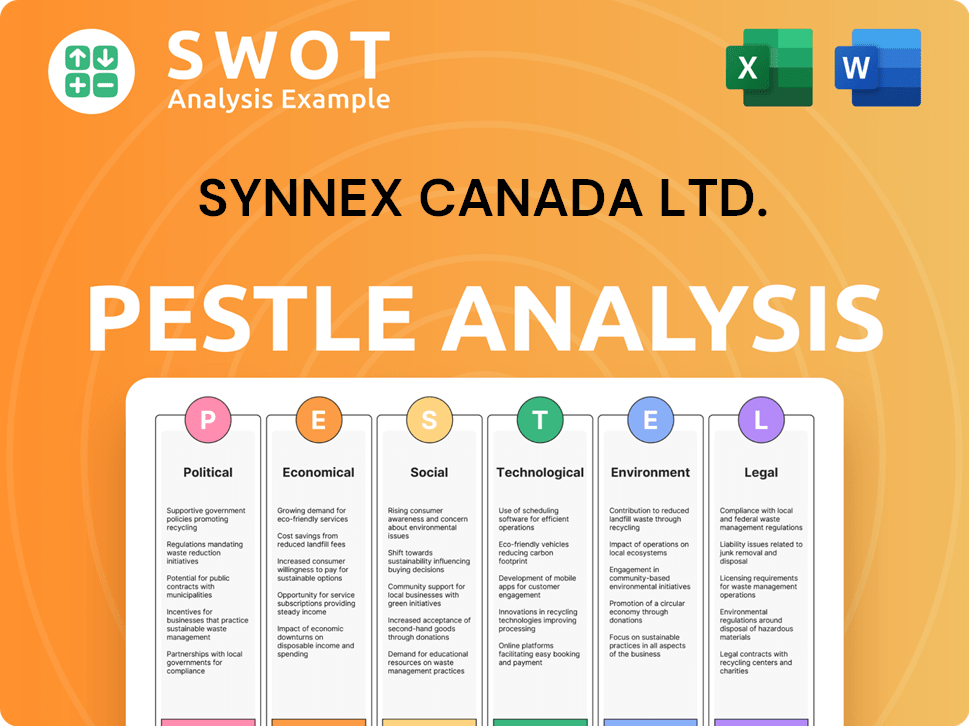

Synnex Canada Ltd. PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Synnex Canada Ltd. Bundle

What is included in the product

Examines external macro-environmental factors affecting Synnex Canada across Political, Economic, Social, etc.

Helps support discussions on external risk and market positioning during planning sessions.

Full Version Awaits

Synnex Canada Ltd. PESTLE Analysis

This Synnex Canada Ltd. PESTLE analysis preview is the complete, finalized document. The content and format you see here is identical to the file you’ll download after purchase. No revisions or changes; it's ready to use immediately.

PESTLE Analysis Template

Navigating the Canadian tech market? Our PESTLE Analysis unveils key factors influencing Synnex Canada Ltd.. Explore the impact of politics, economics, and tech advancements on their operations. Understand social shifts and legal constraints that shape their strategies. This analysis provides valuable insights. Download the full report for detailed intelligence.

Political factors

The Canadian government's stability and tech policies are vital for TD SYNNEX Canada. Recent policies, like the Digital Charter, aim to shape the tech landscape. In 2024, the Canadian tech sector saw over $12 billion in venture capital investment. Changes in trade or regulations can create business opportunities and challenges.

TD SYNNEX Canada faces political risks from trade agreements and tariffs, which directly affect its IT product costs. Canada's trade deals with the US and other nations are crucial. For example, in 2024, tariffs on specific tech goods could increase costs by 5-10%. These changes can strain the supply chain.

Government investments in IT significantly impact TD SYNNEX Canada. Public sector IT spending, encompassing infrastructure and services, can boost demand. Recent data indicates Canadian government IT spending reached $15 billion in 2024. Budget shifts and policy changes can create market volatility, influencing sales forecasts and strategic planning for the company.

Political Risk in Global Operations

TD SYNNEX Canada, while based in Canada, is exposed to political risks globally. Changes in trade policies or political instability in regions where TD SYNNEX sources products or operates can disrupt supply chains. For instance, in 2024, geopolitical tensions led to a 10% increase in shipping costs. These factors indirectly affect the Canadian operations and overall financial performance.

- Trade wars or tariffs can increase the cost of goods.

- Political instability in key sourcing regions disrupts supply chains.

- Changes in foreign policy affect international business deals.

- Government regulations impact market access and operations.

Industry-Specific Regulations and Initiatives

Government regulations and initiatives significantly impact the IT sector, shaping the business landscape for companies like TD SYNNEX Canada. Recent policies concerning cybersecurity, data privacy, and digital adoption are critical. For example, Canada's Digital Charter, launched in 2019, outlines principles for data governance, affecting how TD SYNNEX Canada handles customer data. These changes necessitate adjustments in operational practices and compliance strategies.

- Cybersecurity regulations are increasingly stringent, as evidenced by rising cybercrime costs.

- Data privacy laws, like those influenced by GDPR, demand robust data protection measures.

- Government incentives to boost digital adoption can spur market growth.

Political factors highly affect TD SYNNEX Canada's operations. Government tech policies, such as the Digital Charter, influence its market approach. Trade agreements and tariffs, as seen in 2024 with a 5-10% cost increase, impact product costs and supply chains.

| Political Factor | Impact on TD SYNNEX Canada | 2024/2025 Data/Example |

|---|---|---|

| Trade Policies | Affects IT product costs & supply chains | Tariffs on tech goods increased costs by 5-10% in 2024. |

| Government IT Spending | Influences demand & market volatility | Canadian government IT spending hit $15B in 2024. |

| Cybersecurity Regulations | Requires compliance adjustments | Cybercrime costs rising, increasing regulatory stringency. |

Economic factors

The Canadian economy's health significantly impacts IT spending. Strong growth usually boosts demand for tech products distributed by TD SYNNEX Canada. In 2024, Canada's GDP growth is projected around 1.5%, influencing tech investments. IT spending is sensitive to economic cycles.

Inflation significantly influences TD SYNNEX Canada's operational costs and pricing strategies. As of April 2024, Canada's inflation rate was around 2.7%, impacting inventory and service expenses. Interest rates, currently influenced by the Bank of Canada's monetary policy, affect TD SYNNEX's borrowing and investment choices. Changes in rates also impact customer spending on IT solutions. For example, in 2024, the prime rate was 7.2%.

Currency exchange rate fluctuations significantly affect TD SYNNEX Canada's profitability. The CAD/USD exchange rate is crucial; in 2024, it averaged around 1.35, impacting import costs. A weaker Canadian dollar increases the cost of US-denominated imports, squeezing margins. Conversely, a stronger dollar can boost competitiveness. Monitoring these rates is essential for financial planning.

IT Spending Trends

IT spending trends are vital for TD SYNNEX Canada. The market is shifting toward cloud computing, cybersecurity, and AI. In 2024, global IT spending is projected to reach $5.06 trillion, a 6.8% increase. This growth indicates opportunities for TD SYNNEX Canada.

- Cloud computing is expected to grow by 20% in 2024.

- Cybersecurity spending is forecast to increase by 12% in 2024.

- AI investments are rising rapidly, with significant impacts.

Supply Chain Costs and Disruptions

Global supply chains are significantly influenced by transportation expenses, component shortages, and geopolitical incidents, all of which can affect TD SYNNEX Canada's product sourcing and delivery capabilities. These disruptions can lead to increased operational costs and potential product unavailability. For instance, the World Bank reported a 10% increase in shipping costs in Q1 2024 due to various global challenges. Moreover, the ongoing chip shortage, which impacted many sectors in 2022 and 2023, continues to pose challenges in 2024.

- Increased shipping costs have risen by 10% in Q1 2024.

- The chip shortage continues to impact the technology sector.

- Geopolitical events can cause supply chain volatility.

Economic factors heavily shape TD SYNNEX Canada's performance. Canada's 2024 GDP growth is projected at 1.5%, influencing tech spending. Inflation, at 2.7% in April 2024, impacts costs. The CAD/USD exchange rate, averaging 1.35 in 2024, affects profitability.

| Factor | Impact | Data (2024) |

|---|---|---|

| GDP Growth | Influences tech demand | Projected 1.5% |

| Inflation | Affects costs, pricing | 2.7% (April) |

| CAD/USD | Impacts import costs | Average 1.35 |

Sociological factors

The shift towards remote and hybrid work models significantly impacts IT demand. Recent data shows remote work increased by 30% in 2024. This boosts demand for collaboration tools and home office setups. TD SYNNEX Canada can leverage this by offering these solutions, targeting a growing market.

Digital literacy levels and tech adoption rates significantly shape Synnex Canada's market. Canada's internet penetration hit 95% in early 2024, with mobile data use growing. Industries with higher digital literacy, like finance and IT, drive demand for advanced tech solutions. Understanding these trends helps Synnex tailor its offerings.

Consumer and business confidence significantly impacts tech spending. High confidence boosts investment in IT. In 2024, Canadian consumer confidence showed fluctuations, affecting discretionary tech purchases. Business confidence also mirrored this trend, influencing IT infrastructure spending plans. Data from early 2025 will further clarify the impact.

Education and Skills Development

Education and skills development are crucial for Synnex Canada Ltd. The availability of a skilled workforce impacts the adoption of new technologies and the demand for IT services. Canada's focus on STEM education and digital skills training is a positive factor. However, there might be challenges in keeping pace with rapidly evolving tech skills. The government invested $2.4 billion in 2024 for skills development.

- Canada's tech sector employment grew by 4.5% in 2023.

- Over 60% of Canadian businesses report a skills gap.

- Government initiatives aim to train 500,000 workers by 2025.

Corporate Social Responsibility Expectations

Growing societal demands for corporate social responsibility (CSR) and ethical conduct are reshaping how businesses operate. This impacts customer and partner choices, influencing TD SYNNEX Canada's brand image and partnerships. Companies with strong CSR records often see enhanced brand value and investor interest. In 2024, CSR spending increased by 15% across various sectors.

- TD SYNNEX has CSR initiatives focused on environmental sustainability and community involvement.

- Positive CSR practices can lead to improved employee morale and productivity.

- Ethical sourcing and supply chain transparency are increasingly important.

Societal factors like remote work and digital literacy influence IT demand. Rising Canadian internet penetration and digital literacy rates, at 95% and growing, boost tech solution needs. Furthermore, business and consumer confidence and corporate social responsibility also play key roles.

| Factor | Impact | Data |

|---|---|---|

| Remote Work | Increases demand for collaboration tools | 30% increase in remote work in 2024. |

| Digital Literacy | Drives demand for advanced tech | Canada’s 95% internet penetration (early 2024). |

| CSR | Influences brand and partnerships | 15% increase in CSR spending (2024). |

Technological factors

TD SYNNEX Canada faces rapid tech change. They need to update products, services, and skills. AI, IoT, cloud, and cybersecurity are key areas. In 2024, cloud computing grew by 18%. Cybersecurity spending is expected to reach $9.3 billion in 2025.

Cloud computing is rapidly growing in Canada, with the market expected to reach $17.8 billion CAD by 2025. TD SYNNEX Canada can capitalize on this by offering services for hybrid and multi-cloud setups. However, this also means investing in cybersecurity to protect client data. The company must adapt to support various cloud platforms to stay competitive.

Cybersecurity threats are constantly changing, increasing the need for security products and services. TD SYNNEX Canada distributes these solutions, assisting partners with security demands. The global cybersecurity market is projected to reach $345.7 billion in 2024. This growth highlights the importance of TD SYNNEX's role. Recent data shows a rise in cyberattacks targeting supply chains.

Advancements in Data Analytics and AI

Advancements in data analytics and AI are opening new doors for businesses. This growth fuels the need for robust technology infrastructure, which is a core area for TD SYNNEX Canada. The market for AI in Canada is projected to reach $26.5 billion by 2030. TD SYNNEX Canada's capacity to assist partners in these fields is vital for success.

- AI market in Canada is expected to reach $26.5 billion by 2030.

- TD SYNNEX Canada's role in supporting partners is crucial.

Development of New Hardware and Software

The core of TD SYNNEX Canada's business revolves around the continuous introduction of new hardware and software. Keeping pace with rapid product cycles and understanding market demands for the latest tech is crucial. In 2024, the IT hardware market in Canada was valued at approximately $25 billion. The software market is projected to reach $18 billion by the end of 2025.

- The Canadian IT market is rapidly evolving.

- Staying informed about new technologies is critical.

- Market size for hardware: $25B (2024).

- Software market forecast: $18B (2025).

TD SYNNEX Canada thrives on tech evolution. Cloud computing in Canada is forecast to hit $17.8B by 2025. Cybersecurity spending will reach $9.3B in 2025.

| Tech Aspect | Data | Year |

|---|---|---|

| Cloud Market | $17.8B | 2025 (Forecast) |

| Cybersecurity Spending | $9.3B | 2025 (Estimate) |

| IT Hardware Market | $25B | 2024 (Value) |

Legal factors

Canada's strict data privacy laws, like PIPEDA, significantly impact TD SYNNEX Canada. These regulations mandate how customer data is collected, used, and protected. In 2024, PIPEDA compliance costs for businesses averaged around $50,000 to $100,000. Non-compliance can lead to hefty fines, potentially reaching up to $100,000 per violation. TD SYNNEX and its partners must ensure stringent data security measures to avoid legal repercussions.

TD SYNNEX Canada faces import/export regulations. In 2024, Canada's merchandise imports were valued at CAD 678.8 billion. Export compliance is crucial to avoid penalties. Regulations include tariffs and trade agreements like CUSMA. Non-compliance can disrupt supply chains and incur financial penalties.

TD SYNNEX Canada's operations heavily rely on contracts. These agreements govern relationships with suppliers, partners, and clients. Legal disputes or shifts in contract law can create significant financial impacts, potentially affecting profitability. For instance, contract breaches can lead to costly litigation, with related expenses. Consider the legal landscape's potential influence on the company's financial performance.

Intellectual Property Laws

Intellectual property (IP) laws are critical for TD SYNNEX Canada, given its role in distributing technology products. These laws protect innovations. This includes patents, trademarks, and copyrights, which are all relevant to the company's operations.

Strong IP protection helps secure TD SYNNEX Canada's supply chain. It ensures that the products it distributes are legally protected. It also safeguards the company's relationships with vendors.

With the tech market's value in Canada reaching approximately $200 billion CAD in 2024, IP laws are crucial. They safeguard against counterfeiting and unauthorized use. They also foster innovation.

TD SYNNEX Canada must navigate these complex regulations to protect its business interests. Keeping up with changes in IP law is essential for continued compliance.

Here's what to consider:

- Patent protection for hardware innovations.

- Trademark protection for branding.

- Copyright protection for software.

- Compliance with international IP agreements.

Employment Law and Labor Regulations

TD SYNNEX Canada must adhere to Canadian employment law and labor regulations. This includes hiring practices, workplace conditions, and termination processes. Non-compliance can lead to legal issues and financial penalties. Recent data shows a 15% increase in employment-related lawsuits in Canada in 2024.

- Compliance with the Canada Labour Code.

- Adherence to provincial employment standards.

- Proper handling of workplace safety and health.

- Fair practices in hiring and termination.

TD SYNNEX Canada must comply with data privacy laws such as PIPEDA. In 2024, average PIPEDA compliance costs for businesses were $50,000-$100,000. Import/export regulations, including tariffs, are also significant.

Contracts with suppliers, partners, and clients require legal scrutiny; litigation for breaches can be costly. Intellectual property laws are also critical, protecting innovations in a tech market valued at $200 billion CAD in 2024.

Canadian employment law requires strict adherence to prevent financial penalties. Non-compliance with regulations and related legal issues can lead to significant losses.

| Legal Factor | Impact on TD SYNNEX Canada | Data/Statistics (2024) |

|---|---|---|

| Data Privacy | Compliance costs, penalties | Average PIPEDA compliance cost: $50K-$100K |

| Import/Export | Penalties, supply chain disruptions | Canada's imports: CAD 678.8 billion |

| Contracts | Financial impacts, litigation | Contract breach litigation expenses vary |

Environmental factors

Regulations on electronic waste (e-waste) are crucial environmental factors for TD SYNNEX Canada. The company must adhere to rules about disposing and recycling electronics. In 2024, Canada's e-waste recycling rate was approximately 40%. TD SYNNEX Canada might need to support or manage e-waste programs, impacting its operations and costs.

Energy consumption by IT products and data centers is a key environmental factor. Demand for energy-efficient solutions is growing, influencing Synnex's product offerings. Data centers globally consumed roughly 1-2% of all electricity in 2023. Investment in green IT is expected to reach $300 billion by 2025.

TD SYNNEX Canada's supply chain faces environmental scrutiny. Transportation and packaging contribute to its footprint. The company is working on sustainable transport solutions. They also focus on decreasing packaging waste. In 2024, they reported a 15% reduction in carbon emissions from logistics.

Climate Change Initiatives and Policies

Climate change policies are reshaping the tech landscape. Government regulations and corporate sustainability efforts are pushing for greener technologies. This shift affects companies like Synnex Canada Ltd. in various ways. The Canadian government has set ambitious emission reduction targets, influencing business operations.

- Canada's carbon tax increased to $65/tonne in 2023, impacting operational costs.

- The federal government aims to cut emissions by 40-45% below 2005 levels by 2030.

- Growing demand for energy-efficient products and sustainable supply chains.

Synnex must adapt to these changes to stay competitive. This includes offering eco-friendly products and optimizing its supply chain. Failure to adapt could lead to increased costs and reduced market share.

Sustainable Sourcing and Manufacturing

Sustainable sourcing and manufacturing are increasingly important. Synnex Canada must consider how these practices affect its vendors and customer preferences. Consumers are more likely to support brands committed to environmental responsibility. This shift influences supply chain decisions and product offerings.

- In 2024, the global green technology and sustainability market was valued at approximately $367 billion.

- By 2025, this market is projected to reach over $400 billion.

- Companies with strong ESG (Environmental, Social, and Governance) ratings often experience higher valuation multiples.

TD SYNNEX Canada faces environmental pressures from e-waste regulations, with 40% recycling rate in 2024. Energy efficiency is crucial, especially with data centers consuming 1-2% of global electricity in 2023. Sustainable supply chains are vital; a 15% emission reduction in logistics was reported in 2024.

| Environmental Aspect | Impact | 2024 Data/Fact |

|---|---|---|

| E-waste | Compliance & Costs | 40% recycling rate |

| Energy Consumption | Demand & Cost | Data centers consume 1-2% of electricity |

| Supply Chain | Sustainability, Cost | 15% reduction in emission from logistics |

PESTLE Analysis Data Sources

Our Synnex Canada Ltd. PESTLE analysis relies on governmental data, industry reports, and market research. We analyze political, economic, social, and technological factors using reliable sources.