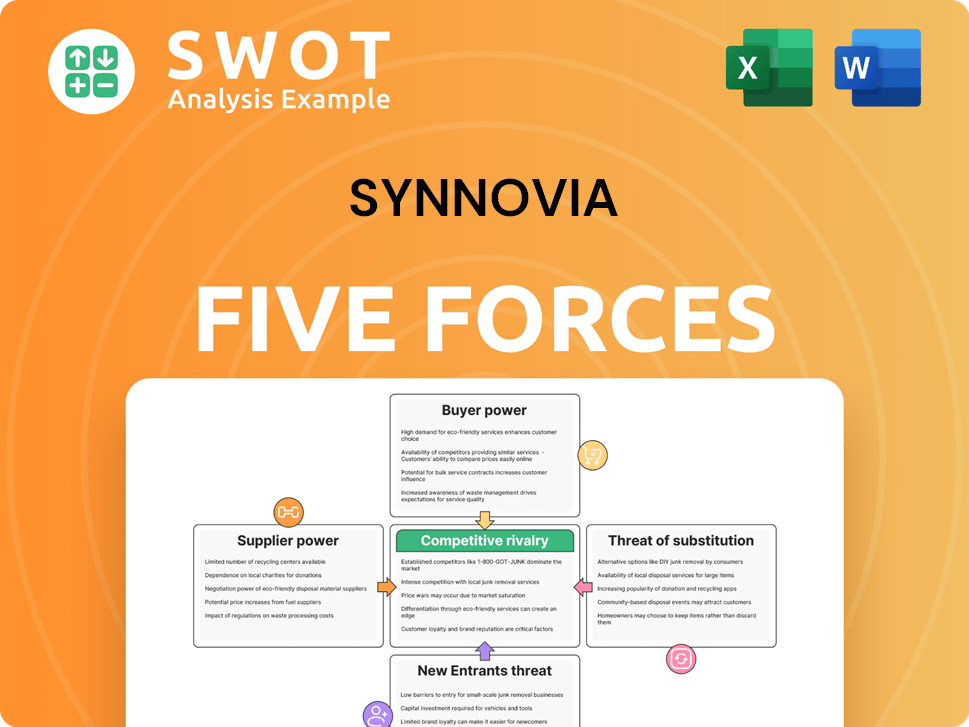

Synnovia Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Synnovia Bundle

What is included in the product

Tailored exclusively for Synnovia, analyzing its position within its competitive landscape.

Instantly identify competitive threats with interactive, color-coded visuals.

Same Document Delivered

Synnovia Porter's Five Forces Analysis

This preview showcases the complete Synnovia Porter's Five Forces Analysis. You're viewing the identical document that will be available for immediate download post-purchase.

Porter's Five Forces Analysis Template

Synnovia faces moderate rivalry, influenced by established players and niche competitors. Buyer power is a factor, with some negotiation leverage. Supplier power is moderate, due to specialized inputs. The threat of new entrants is low, given the industry's barriers. The threat of substitutes presents a manageable challenge.

The full analysis provides a complete strategic snapshot with force-by-force ratings, visuals, and business implications tailored to Synnovia.

Suppliers Bargaining Power

Resin producers are key suppliers for Synnovia. Their strong position comes from the specialized raw materials needed for plastic compounding. In 2024, resin prices saw volatility, with fluctuations impacting production costs. The availability and pricing of different resin types directly affect Synnovia's profitability.

Additive manufacturers, supplying crucial components, wield significant bargaining power. This power fluctuates with the uniqueness and performance of their offerings and the availability of alternatives. For instance, in 2024, the market for advanced 3D printing materials showed a 15% growth, indicating strong demand.

Equipment providers supply machinery for compounding and recycling. Their influence is moderate, influenced by customization and tech advancement. Long-term service contracts can increase dependence. In 2024, the market for recycling equipment was valued at $1.8 billion. Customization impacts costs.

Supplier Power: Transportation and Logistics

Transportation and logistics providers significantly influence Synnovia's supply chain. Their bargaining power fluctuates with fuel costs and geographic reach; for example, in 2024, fuel prices saw considerable volatility. Disruptions in logistics, such as those observed during the 2023-2024 Red Sea crisis, can severely impact Synnovia’s operations, potentially increasing costs and delaying deliveries.

- Fuel costs and their volatility directly affect transportation expenses.

- Geographic coverage is crucial, especially for global operations.

- Availability of alternative logistics solutions impacts negotiation strength.

- Disruptions, as seen in 2024, highlight vulnerability.

Supplier Power: Skilled Labor

Skilled labor, such as chemical engineers and technicians, is vital for Synnovia's production processes. The availability and cost of this labor significantly affect supplier power dynamics. A scarcity of skilled workers could strengthen their bargaining position, potentially increasing labor expenses. Data from 2024 indicates a rising demand for specialized technical roles within the biotech and medical sectors.

- The average salary for chemical engineers in the US reached $110,000 in 2024.

- Technical roles' demand in the biotech sector grew by 15% in 2024.

- A shortage of skilled labor led to a 5% increase in labor costs.

Suppliers of raw materials and specialized components have varying degrees of bargaining power, impacting Synnovia’s profitability. Resin and additive manufacturers hold considerable influence. Fluctuations in 2024, such as volatile resin prices, show this impact. Logistics and skilled labor also affect Synnovia.

| Supplier Type | Bargaining Power | 2024 Impact Example |

|---|---|---|

| Resin Producers | High | Price volatility affected production costs |

| Additive Manufacturers | Moderate to High | 15% growth in 3D printing materials |

| Logistics Providers | Moderate | Fuel price volatility |

Customers Bargaining Power

Plastic product manufacturers represent a significant customer segment. Their substantial purchasing volumes give them strong bargaining power. In 2024, the global plastics market was valued at approximately $670 billion. Synnovia faces pressure to provide competitive pricing and ensure high, consistent product quality. The ability to switch suppliers easily further intensifies this buyer power dynamic.

The packaging industry, a major plastic consumer, wields substantial buyer power. This power comes from volume-based price negotiations and the availability of various packaging materials. In 2024, the global packaging market was valued at approximately $1.1 trillion. Sustainable, recyclable plastics are increasingly vital, influencing purchasing decisions. For instance, the demand for eco-friendly packaging grew by 8% in 2024.

In the automotive sector, Synnovia faces high buyer power due to the use of specialized plastics. Automakers impose stringent quality demands, often secured through long-term contracts. The ability to switch to alternative materials, such as composites, further strengthens their negotiating position. For example, in 2024, the global automotive plastics market was valued at approximately $30 billion, with continued growth expected. Synnovia must meet these specific performance requirements to remain competitive.

Buyer Power: Construction Industry

In the construction sector, buyers' power regarding plastics is moderate. It fluctuates based on project size and material specifics. For example, the U.S. construction industry used approximately 12.2 million metric tons of plastics in 2024. Factors like durability and cost-effectiveness greatly impact buyer decisions. Building codes and regulations also play a crucial role in material selection.

- Construction projects often involve diverse plastic applications, from pipes to insulation.

- Large-scale projects may have increased bargaining power due to higher volume purchases.

- Compliance with building codes is a critical factor influencing material choices.

- Cost-effectiveness and durability are key considerations in purchasing decisions.

Buyer Power: Recycling Companies

Recycling companies are becoming more influential customers. Their bargaining power is amplified by the soaring demand for recycled plastics. Synnovia must offer top-notch recycled materials at competitive prices to win and keep these clients. The market for recycled plastics is expected to reach $63.2 billion by 2024, showing significant growth. Synnovia's pricing and quality directly affect its ability to secure contracts.

- Market size: The global recycled plastics market was valued at USD 54.5 billion in 2023.

- Growth rate: The market is projected to grow at a CAGR of 3.7% from 2024 to 2032.

- Regional analysis: Asia Pacific held the largest revenue share of over 40% in 2023.

- Key drivers: Increasing environmental concerns and government initiatives.

Customer bargaining power significantly impacts Synnovia, particularly in the plastics market, valued at $670 billion in 2024. Major buyers like packaging and automotive sectors wield considerable influence through volume and material choices. Recycling companies are gaining power as demand for recycled plastics surged, the market reaching $54.5 billion in 2023.

| Customer Segment | Bargaining Power | Factors |

|---|---|---|

| Plastic Product Manufacturers | High | Volume, pricing pressure, supplier switching. |

| Packaging Industry | High | Volume negotiations, material alternatives. |

| Automotive Sector | High | Quality demands, long-term contracts, material alternatives. |

Rivalry Among Competitors

Established plastic compounders present considerable competitive challenges for Synnovia. These companies, like industry leader, PolyOne, often have vast market presence and long-standing customer ties. To succeed, Synnovia needs to focus on innovation, sustainable practices, and superior customer support. In 2024, the global plastic compounding market was valued at approximately $80 billion, highlighting the intense competition.

Masterbatch producers, like Ampacet and PolyOne (now Avient), are direct rivals to Synnovia. They battle fiercely on price and customization, mirroring Synnovia's strategies. In 2024, the masterbatch market was valued at approximately $12 billion, with intense competition. Synnovia must excel in specialized solutions to stay ahead.

Large chemical companies, including BASF and Dow, pose a significant threat due to their plastics divisions. These rivals boast vast resources, extensive R&D, and economies of scale, with Dow's 2023 revenue at $45 billion. Synnovia must target niche markets and specialized applications to effectively compete. Focusing on innovation and unique products, like sustainable materials, is crucial for survival.

Rivalry: Regional and Local Players

Regional and local players intensify competitive pressure on Synnovia. These competitors often possess deep local market knowledge, enabling them to tailor offerings to specific regional needs. Synnovia must strategically adapt its approaches to effectively compete with these localized rivals. In 2024, local market share battles intensified, with smaller firms gaining 5-10% market share in several regions.

- Competitive pressure from regional players can lead to price wars.

- Local rivals often have established customer relationships.

- Synnovia needs to differentiate its offerings.

- Adaptation is essential for maintaining market share.

Rivalry: Focus on Innovation and Sustainability

Competitive rivalry is heating up, with a strong focus on innovation and sustainability. Firms that pioneer advanced materials and eco-friendly practices are gaining advantages. Synnovia must boost its R&D spending and highlight its sustainability efforts to stay competitive. In 2024, the sustainable materials market is projected to reach $350 billion, highlighting the importance of this trend.

- R&D investment is critical for creating novel products.

- Eco-friendly solutions provide a competitive edge.

- Sustainability initiatives can enhance brand image.

- Market data shows a rise in demand for green products.

Competitive rivalry in Synnovia's market is intense, fueled by established players and local competitors. Innovation, especially in sustainable materials, is critical for success. Synnovia must focus on differentiation and strategic adaptation to stay ahead.

| Competitor Type | Market Presence | Strategies |

|---|---|---|

| Established Compounders | Vast, Global | Innovation, Customer Focus |

| Masterbatch Producers | Global | Price, Customization |

| Chemical Giants | Extensive, Resources | Niche Markets, R&D |

SSubstitutes Threaten

Bioplastics pose a growing threat as consumers seek sustainable options. These eco-friendly materials, sourced from renewable resources, can substitute traditional plastics. The global bioplastics market was valued at $13.4 billion in 2023. To counter this, Synnovia needs to innovate in bioplastics or improve its recycling programs. The bioplastics market is projected to reach $28.4 billion by 2028.

The threat of substitutes for Synnovia includes metals, which can replace plastics in some applications. Metals provide strength and durability, especially in automotive and industrial contexts. In 2024, the global metal market was valued at approximately $6 trillion, showcasing its significant presence. Synnovia must innovate high-performance plastics to compete.

Glass serves as a substitute for Synnovia's plastic packaging in some applications, especially where recyclability is key. Its inert nature also suits certain products. Synnovia must highlight its plastic's cost-efficiency and design versatility. In 2024, the global glass packaging market was valued at approximately $60 billion, showing the scale of the substitute threat.

Substitute Threat: Paper and Cardboard

Paper and cardboard present a substitute threat to Synnovia, particularly in packaging where they compete directly with plastics. These materials' biodegradability appeals to consumers prioritizing environmental sustainability. To remain competitive, Synnovia needs to focus on developing recyclable or biodegradable plastic alternatives. The global market for sustainable packaging is projected to reach $430.7 billion by 2027.

- Demand for eco-friendly packaging is increasing, influenced by consumer preferences and regulations.

- Synnovia's innovation in sustainable materials is crucial for maintaining market share.

- The cost-effectiveness of paper/cardboard versus plastics also influences the substitution.

- Regulatory changes, like bans on single-use plastics, accelerate this threat.

Substitute Threat: Composites

The threat from substitute products, like advanced composites, is a significant concern for Synnovia. Composites, known for their high strength-to-weight ratios, are increasingly used in place of plastics, particularly in aerospace and automotive industries. For example, the global composites market was valued at $89.7 billion in 2023. This market is projected to reach $125.6 billion by 2028. To remain competitive, Synnovia must develop advanced plastic composites or blends.

- 2023 global composites market value was $89.7 billion.

- The composites market is forecasted to reach $125.6 billion by 2028.

- Composites offer superior strength-to-weight ratios.

- They are used in aerospace and automotive applications.

Synnovia faces a substantial threat from substitutes like bioplastics, metals, glass, and paper. These alternatives gain traction due to sustainability and performance benefits. The global sustainable packaging market is set to hit $430.7 billion by 2027. Synnovia needs to innovate to compete effectively.

| Substitute | Market Value/Size (2024 est.) | Key Driver |

|---|---|---|

| Bioplastics | $18 billion (approx.) | Sustainability concerns |

| Metals | $6 trillion (approx.) | Strength, durability |

| Glass Packaging | $60 billion (approx.) | Recyclability |

| Paper/Cardboard | Significant, part of $430.7B sustainable packaging market | Biodegradability |

Entrants Threaten

High capital investment is a substantial hurdle for new entrants. Building plastic compounding facilities demands considerable funds for machinery, tech, and infrastructure. In 2024, the average cost to establish a new plastics recycling plant exceeded $50 million, according to industry reports. This financial burden discourages smaller firms from entering the market, protecting existing players.

Regulatory compliance forms a substantial hurdle for new players in the plastics sector. Strict environmental regulations and quality standards demand significant investments. Navigating intricate permitting processes and adhering to local and international laws are essential. For example, in 2024, the EU's Single-Use Plastics Directive increased compliance costs by up to 15% for some manufacturers. These measures affect the industry's competitiveness.

Established customer relationships form a substantial entry barrier. Synnovia, with its existing market presence, likely benefits from strong, long-term connections with clients. New entrants face the challenge of overcoming these established bonds. To succeed, they must provide compelling value propositions or introduce innovative solutions. For instance, in 2024, customer loyalty programs helped established firms retain 70% of their customer base.

Entry Barrier: Access to Raw Materials

Access to raw materials forms a significant barrier for new entrants in Synnovia's industry. Securing reliable and cost-effective sources of resins and additives is critical for production. Established players often have long-term supply contracts, giving them a cost advantage. Newcomers may face higher input costs, affecting their competitiveness.

- 2024 Resin prices increased by 10-15% due to supply chain issues.

- Long-term contracts can lock in prices for up to 5 years.

- Smaller firms struggle to match bulk-purchase discounts.

- Alternative material sourcing adds complexity and cost.

Entry Barrier: Economies of Scale

Economies of scale present a significant hurdle for new entrants in the plastics industry. Established companies benefit from lower production costs due to their large-scale operations and established supply chains. New players often struggle to compete on price, needing to find specialized niches or develop proprietary technologies to overcome this cost advantage.

- Large companies have a cost advantage.

- New entrants face higher production costs.

- Niche markets can be a solution.

- Innovative tech can offer competitive edge.

The threat of new entrants in Synnovia's market is moderate. High capital costs and regulatory hurdles, such as environmental compliance, are substantial barriers, costing up to 15% more for some manufacturers in 2024 due to EU directives. However, the need for innovation and specialized niches offers opportunities.

| Barrier | Impact | Example (2024) |

|---|---|---|

| Capital Investment | High | Plastics recycling plant: $50M+ |

| Regulations | High Compliance | EU Directive: +15% costs |

| Customer Relationships | Moderate | Loyalty programs: 70% retention |

Porter's Five Forces Analysis Data Sources

Our Synnovia analysis uses financial reports, market studies, competitor analysis, and regulatory filings. We also consult industry databases.