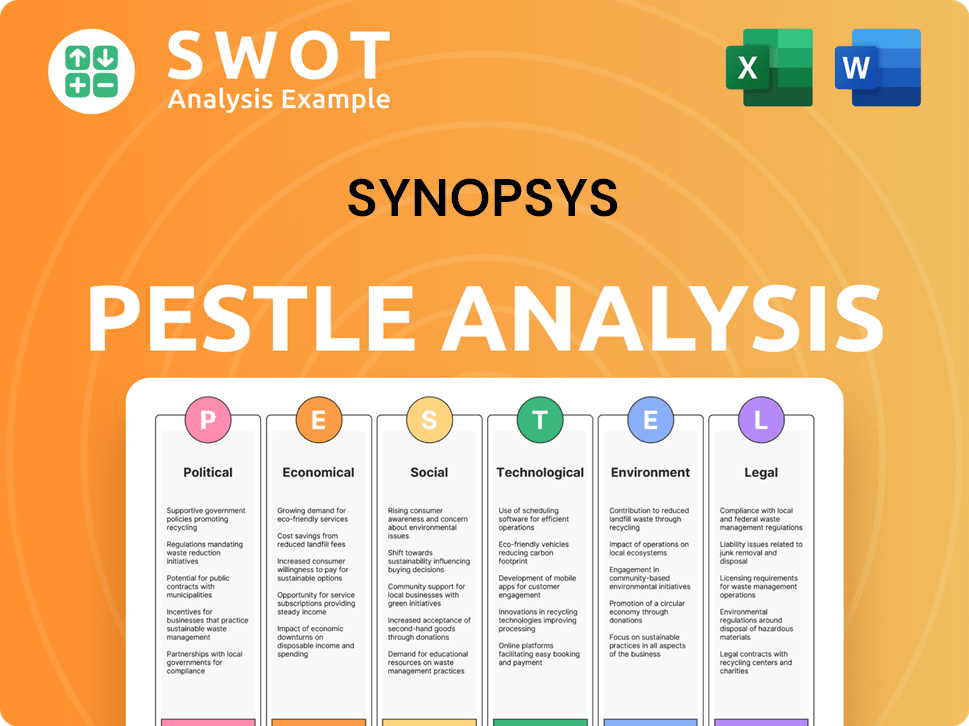

Synopsys PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Synopsys Bundle

What is included in the product

Evaluates how external factors impact Synopsys across six areas: Political, Economic, etc. and demonstrates market understanding.

A PESTLE summary format suitable for easy consumption at a busy executive meeting.

Preview Before You Purchase

Synopsys PESTLE Analysis

The PESTLE analysis preview accurately reflects the full Synopsys document. It’s fully formatted, and professionally structured, and you'll receive the same content after purchase. No edits or modifications—it’s ready for immediate use. The layout and details shown are what you get.

PESTLE Analysis Template

Explore Synopsys's future with our detailed PESTLE analysis. We dissect the political, economic, and technological forces influencing the company's trajectory. Our analysis gives you vital insights for strategic planning and competitive advantage.

Gain an edge by understanding the external factors affecting Synopsys's success. Identify potential risks and opportunities with our expertly crafted report.

This PESTLE analysis is ready to help you strengthen your own market strategy. Download the full version now to get the actionable intelligence.

Political factors

Governments globally, especially the U.S. and China, are heightening regulations on semiconductor tech. These rules can restrict Synopsys' tool sales, impacting revenue and market share. U.S. 'Entity List' limits sales to specific Chinese firms. In 2024, these controls affected roughly 10% of Synopsys' international sales.

Changes in international trade policies, like tariffs, affect Synopsys' global reach and supply chains. Geopolitical issues and trade disagreements between countries cause instability, possibly disrupting product and service flow. For instance, in 2024, the US-China trade tensions continue to affect tech firms. Synopsys reported $5.84 billion in revenue in fiscal year 2023.

Political stability is vital for Synopsys. Regions with major clients or operations must be stable. Instability can disrupt business, harm demand, and create uncertainty. For instance, in 2024, geopolitical tensions impacted supply chains. Synopsys's revenue in the Asia-Pacific region was $1.6 billion in FY24.

Government Investment in Semiconductor Industry

Government investments in the semiconductor industry significantly influence Synopsys. Initiatives like the CHIPS and Science Act in the U.S., which allocated $52.7 billion for semiconductor manufacturing and research, directly impact Synopsys. These investments can boost demand for EDA tools.

Such programs can incentivize the use of specific technologies or favor domestic EDA providers. Synopsys might benefit from increased R&D funding and collaborations. Conversely, these initiatives could also create new competitors.

- CHIPS Act allocates $52.7B for semiconductors.

- EU Chips Act aims for 20% global chip production by 2030.

- India plans $10B investment in its chip ecosystem.

Antitrust and Merger Control

Antitrust and merger control are critical political factors for Synopsys. Regulatory approvals for acquisitions, like the Ansys deal, face scrutiny from global antitrust bodies. These reviews can cause delays, potentially altering Synopsys' strategic growth trajectory. For example, the Federal Trade Commission (FTC) and other agencies worldwide are actively reviewing tech mergers. In 2024, the FTC blocked several major tech acquisitions due to antitrust concerns.

- Regulatory scrutiny is increasing, potentially impacting timelines.

- Antitrust concerns could lead to divestitures or altered deal terms.

- Compliance costs may increase due to complex regulatory requirements.

Government regulations significantly shape Synopsys's market access. Trade policies, like tariffs, affect supply chains. In 2024, US-China tensions affected tech firms.

Geopolitical stability is essential for business operations. Investments in semiconductors impact Synopsys's revenue through R&D.

Antitrust and merger controls are crucial, with scrutiny by agencies globally. These could affect the company's expansion plans and might increase compliance expenses.

| Political Factor | Impact on Synopsys | 2024/2025 Data |

|---|---|---|

| Trade Regulations | Market Access, Supply Chain | US-China trade tensions continue to affect tech firms; approximately 10% of international sales were affected. |

| Geopolitical Stability | Operational Continuity, Revenue | Asia-Pacific revenue reached $1.6 billion in FY24. |

| Government Investment | Demand, Competition, Collaboration | CHIPS Act allocated $52.7B; EU Chips Act aims for 20% global chip production by 2030; India plans $10B. |

| Antitrust Scrutiny | Mergers, Growth | FTC actively reviewing mergers; Compliance costs increased due to complex regulatory requirements. |

Economic factors

Global economic health heavily impacts Synopsys. In 2024, global GDP growth is projected at 3.2%, influencing demand for electronics. Recessions can reduce demand for EDA tools and IP. For example, the semiconductor market declined in 2023. This can affect Synopsys' revenue.

Persistent global inflation and high interest rates pose risks to Synopsys. Rising costs and reduced customer spending are potential impacts. Elevated rates could also affect R&D investments, crucial for innovation. In 2024, the US inflation rate was around 3.1%, influencing Synopsys' financial strategies.

Synopsys, operating globally, faces currency exchange rate risks. Fluctuations affect financial results when converting foreign currencies. In Q1 2024, currency impacts were noted, affecting revenue. For example, a stronger US dollar can decrease reported revenue from international sales. These changes can influence both revenue and profitability.

Semiconductor Industry Growth and Cyclicality

Synopsys' success is heavily influenced by the semiconductor industry's expansion and cyclical nature. Demand is currently robust, fueled by AI advancements. However, this sector is prone to periods of quick growth and subsequent downturns, which directly impacts Synopsys' financial performance. For instance, in Q1 2024, Synopsys reported a revenue of $1.65 billion, a 15% increase year-over-year, showing its resilience in the face of market fluctuations.

- Strong demand from AI and other emerging technologies.

- Industry cyclicality can lead to revenue volatility.

- Synopsys' Q1 2024 revenue: $1.65 billion.

- Year-over-year growth in Q1 2024: 15%.

Customer Consolidation and Spending

Customer consolidation is a significant economic factor for Synopsys. If a substantial portion of revenue comes from a few major clients, any change in their R&D spending can heavily impact Synopsys' sales. For instance, a 2024 report indicated that the top 10 customers of a similar EDA company accounted for over 60% of its revenue. This concentration makes Synopsys vulnerable.

- R&D spending cuts by key customers decrease Synopsys' revenue.

- Customer concentration increases business risk.

- Consolidation leads to pricing pressure.

Economic factors like global GDP growth, currently at 3.2% in 2024, affect Synopsys' demand. Inflation, around 3.1% in the US in 2024, and interest rates influence costs. Currency fluctuations and the semiconductor cycle also pose risks.

| Factor | Impact | Data (2024) |

|---|---|---|

| Global GDP | Demand for EDA tools | Projected 3.2% growth |

| Inflation | Rising costs, spending | US ~3.1% |

| Semiconductor | Revenue, growth volatility | Synopsys Q1 revenue: $1.65B |

Sociological factors

Synopsys heavily relies on skilled engineers and researchers. The availability of this talent pool directly affects innovation and product development. Factors like education quality and migration patterns are key for acquiring and retaining employees. In 2024, the U.S. STEM job market grew, with software developers in high demand. Synopsys must adapt to these trends to stay competitive.

The soaring complexity of semiconductor designs, fueled by AI and advanced packaging, is reshaping customer needs. This necessitates cutting-edge EDA tools and IP from companies like Synopsys. Understanding these evolving demands is crucial for maintaining market leadership. In Q1 2024, Synopsys reported a 16% increase in total revenue, demonstrating its ability to meet customer demands. Synopsys's R&D spending hit $473.6 million in Q1 2024, reflecting its commitment to innovation.

Customer adoption of AI and cloud technologies is crucial for Synopsys. Faster adoption leads to greater demand for their tools. In 2024, cloud-based EDA tools adoption grew by 25% among key customers. Synopsys must align its product releases with these trends to stay relevant.

Remote Work and Collaboration

The shift to remote work is reshaping how Synopsys' customers operate, increasing demand for collaboration-friendly software. This trend necessitates that Synopsys ensures its tools are accessible and support distributed design teams effectively. To stay competitive, Synopsys must adapt its software to meet these evolving work model requirements, focusing on features that enhance collaboration and remote accessibility. This adaptation is critical for maintaining market relevance and meeting customer needs in 2024 and 2025.

- Remote work has increased by 20% among tech companies since 2020.

- Collaboration software spending is projected to reach $40 billion by 2025.

- Synopsys' market share in EDA software is approximately 30%.

Ethical Considerations in AI Development

As AI is increasingly used in chip design, Synopsys must consider ethical implications. Societal focus on responsible AI use is growing, potentially impacting Synopsys tools. This includes adhering to guidelines for AI development and deployment. For example, the global AI market is projected to reach $738.8 billion by 2027.

- Data Privacy: Ensuring customer data is protected.

- Bias Detection: Addressing and mitigating biases in AI algorithms.

- Transparency: Being open about how AI systems make decisions.

- Accountability: Defining responsibility for AI actions.

Synopsys is influenced by societal attitudes toward AI, demanding ethical AI practices in its tools. Concerns about data privacy and algorithmic bias are growing. The global AI ethics market is expected to reach $40 billion by 2025. Synopsys' adaptation to these expectations is essential.

| Aspect | Impact | Data (2024-2025) |

|---|---|---|

| AI Ethics | Customer trust and compliance | AI ethics market: $30B in 2024, $40B by 2025 |

| Data Privacy | Mitigation of risk of legal/reputational repercussions. | Worldwide spending on data privacy software will reach $12 billion by the end of 2025. |

| Bias Concerns | AI algorithm design | AI adoption across business up to 80% in 2025 |

Technological factors

The rise of AI and machine learning significantly impacts Synopsys. These advancements fuel demand for its design tools, crucial for AI chip development. Synopsys leverages AI to boost its product capabilities. In 2024, the AI chip market was valued at $27 billion, growing rapidly. Synopsys is investing heavily in AI-driven automation.

The relentless rise in chip design intricacy, encompassing sophisticated nodes and 3D-ICs, drives demand for advanced Electronic Design Automation (EDA) tools. Synopsys' strategic advantage hinges on its capacity to meet this escalating complexity. In Q1 2024, Synopsys' revenue was $1.46B, reflecting the importance of its solutions. The EDA market is projected to reach $16.1B by 2025.

The rise of advanced packaging, like 3D-ICs, is transforming chip design. This shift creates complex challenges for Electronic Design Automation (EDA) tools. Synopsys needs to develop new tools to support these advanced packaging methods. In 2024, the advanced packaging market was valued at $40.5 billion, projected to reach $65 billion by 2029, showing significant growth.

Evolution of Semiconductor IP

The evolution of semiconductor IP is crucial. Demand for high-quality, silicon-proven IP is increasing, particularly in processors, interfaces, and security. Synopsys' strength lies in its ability to develop and offer a broad range of advanced IP, vital for customers' faster time-to-market. This focus aligns with the growing complexity of chip designs. In Q1 2024, Synopsys reported a 15% increase in revenue from IP products.

- Growing demand for advanced IP solutions.

- Synopsys' strong IP portfolio drives customer success.

- Focus on time-to-market advantages.

Software Supply Chain Security

Software supply chain security is increasingly vital due to reliance on open-source and third-party software. Synopsys' solutions address these risks, protecting its own and its customers' software. Recent reports show a 74% increase in supply chain attacks in 2024, highlighting the urgency. Synopsys' revenue in Q1 2024 was $1.46 billion, partly driven by demand for these security solutions.

- 74% increase in supply chain attacks in 2024.

- Synopsys Q1 2024 revenue: $1.46 billion.

AI and machine learning are crucial, with the AI chip market reaching $27B in 2024, which significantly impacts Synopsys. The rising intricacy of chip design boosts demand for advanced Electronic Design Automation (EDA) tools; the EDA market is set to hit $16.1B by 2025. Synopsys addresses rising complexities with cutting-edge IP solutions.

| Technological Factor | Impact on Synopsys | Data |

|---|---|---|

| AI and Machine Learning | Drives demand for design tools; supports AI chip development | AI chip market: $27B in 2024 |

| Chip Design Complexity | Increases demand for advanced EDA tools | EDA market projected: $16.1B by 2025 |

| Advanced Packaging | Requires new EDA tool development; affects chip design | Advanced packaging market: $40.5B in 2024 |

Legal factors

Synopsys heavily relies on patents, copyrights, and trade secrets to protect its intellectual property. IP protection varies across countries, impacting Synopsys' global operations. Strong IP enforcement is crucial; in 2024, Synopsys spent $400 million on R&D, highlighting the need for protection. Legal challenges and enforcement costs are ongoing concerns.

Synopsys must adhere to export control regulations, especially U.S. rules, when selling technology to certain nations or entities. Non-compliance can lead to substantial fines and legal repercussions. In 2024, the U.S. Department of Commerce enforced export controls with increasing scrutiny. Companies face potential penalties exceeding $1 million per violation.

Synopsys must adhere to antitrust laws globally. These laws scrutinize practices and acquisitions to ensure fair competition. A 2024 study showed antitrust fines in the tech sector reached $2.5 billion. Synopsys' strategic moves must align with these regulations to prevent legal issues.

Data Privacy and Security Regulations

Synopsys, as a software provider, faces stringent data privacy and security regulations worldwide. Compliance with laws like GDPR is crucial for protecting customer data, with potential penalties reaching up to 4% of annual global turnover for breaches. Ensuring the security of its software and systems is a legal obligation. These measures are essential to maintain customer trust and avoid legal repercussions. Synopsys must invest in robust cybersecurity measures to safeguard its operations.

- GDPR fines can be substantial, with the largest to date exceeding €746 million.

- Cybersecurity spending is projected to reach $202 billion in 2024.

- Data breaches cost companies an average of $4.45 million in 2023.

Software Licensing and Compliance

Synopsys' revenue is significantly tied to software licensing, making legal aspects critical. The company must navigate complex software licensing laws, including those related to intellectual property rights and international regulations. Ensuring customer compliance with license agreements is also a key legal concern, impacting revenue streams. Legal challenges can arise from non-compliance or disputes over licensing terms. These factors require constant monitoring and adaptation to legal changes.

- In fiscal year 2023, Synopsys' total revenue was $5.84 billion, with a significant portion derived from software licenses.

- Legal and compliance costs related to software licensing can represent a substantial operating expense.

- Breach of license agreements can lead to lawsuits and financial penalties.

Synopsys faces IP protection challenges and must ensure global compliance with patents and copyrights. Export controls, particularly U.S. regulations, pose another key legal factor; violations can be very costly. Adherence to antitrust laws and rigorous data privacy measures are crucial for avoiding fines.

| Legal Area | Key Issues | Data/Fact (2024/2025) |

|---|---|---|

| Intellectual Property | Patents, copyrights, trade secrets protection globally. | R&D spending by Synopsys: $400M in 2024. |

| Export Controls | Adherence to U.S. and other nations export regulations. | Potential penalties: >$1M per violation. |

| Antitrust Laws | Scrutiny of mergers/acquisitions to ensure competition. | Antitrust fines in tech sector: $2.5B. |

| Data Privacy | Compliance with GDPR/other data protection laws. | GDPR fines may reach up to 4% of annual global turnover. |

Environmental factors

Synopsys' tools support the energy-intensive semiconductor sector. The industry faces growing pressure to cut its environmental impact. This could boost demand for Synopsys' tools. These tools optimize power use in chip design. For example, in 2024, the semiconductor industry consumed about 5% of global electricity.

Environmental regulations are crucial for semiconductor manufacturing. These rules, especially regarding chemicals and waste, affect Synopsys' customers. Compliance tools and eco-friendly design demands are increasing. The global semiconductor market was valued at $526.8 billion in 2024 and is expected to reach $588.2 billion by the end of 2025.

Corporate sustainability is increasingly critical, influencing stakeholder perception and operational costs. Synopsys actively pursues environmental initiatives. In 2024, Synopsys reported a 15% reduction in Scope 1 and 2 emissions. The focus is on renewable energy and waste reduction strategies.

Supply Chain Environmental Practices

Synopsys, while primarily a software company, must consider the environmental impact of its supply chain. This includes the practices of its hardware suppliers and partners, especially in semiconductor manufacturing. The carbon footprint of chip production is substantial, with some estimates indicating that it can take thousands of liters of water and significant energy to produce a single chip. Synopsys can influence these practices by setting environmental standards for its suppliers and promoting sustainable sourcing.

- Global semiconductor sales are projected to reach $611 billion in 2024, highlighting the scale of the industry's environmental footprint.

- Water usage in semiconductor manufacturing is a major concern, with plants consuming millions of gallons daily.

- Synopsys's Scope 3 emissions (indirect emissions from its value chain) are an area of focus for sustainability reporting.

Demand for Eco-Friendly Electronic Products

The demand for eco-friendly electronics is rising, fueled by consumers and regulations. This boosts the need for EDA tools like Synopsys'. The global green electronics market is expected to reach $1 trillion by 2025. Synopsys helps design energy-efficient chips.

- Market for green electronics projected to hit $1T by 2025.

- Synopsys aids in creating energy-efficient chip designs.

Synopsys navigates environmental challenges by focusing on the energy-intensive semiconductor sector. Regulations on chemicals and waste significantly impact the industry, driving demand for eco-friendly design tools.

Corporate sustainability efforts are crucial; Synopsys aims for reduced emissions and sustainable practices within its supply chain, as green electronics' market expands.

Key environmental factors include semiconductor industry electricity consumption (5% globally) and the increasing water usage concerns. Market for green electronics projected to hit $1T by 2025.

| Environmental Aspect | Impact on Synopsys | 2024/2025 Data |

|---|---|---|

| Energy Consumption | Demand for energy-efficient design tools | Semiconductor industry consumes ~5% of global electricity (2024); Growth forecast by the end of 2025. |

| Environmental Regulations | Increased need for compliance tools; market growth. | Global green electronics market expected to reach $1T by 2025. |

| Sustainability Initiatives | Enhance corporate image; Cost management. | Synopsys' Scope 1 and 2 emissions reduced 15% (2024) |

PESTLE Analysis Data Sources

Synopsys' PESTLE analyzes global datasets, from economic forecasts and tech reports to governmental regulations and market analyses.