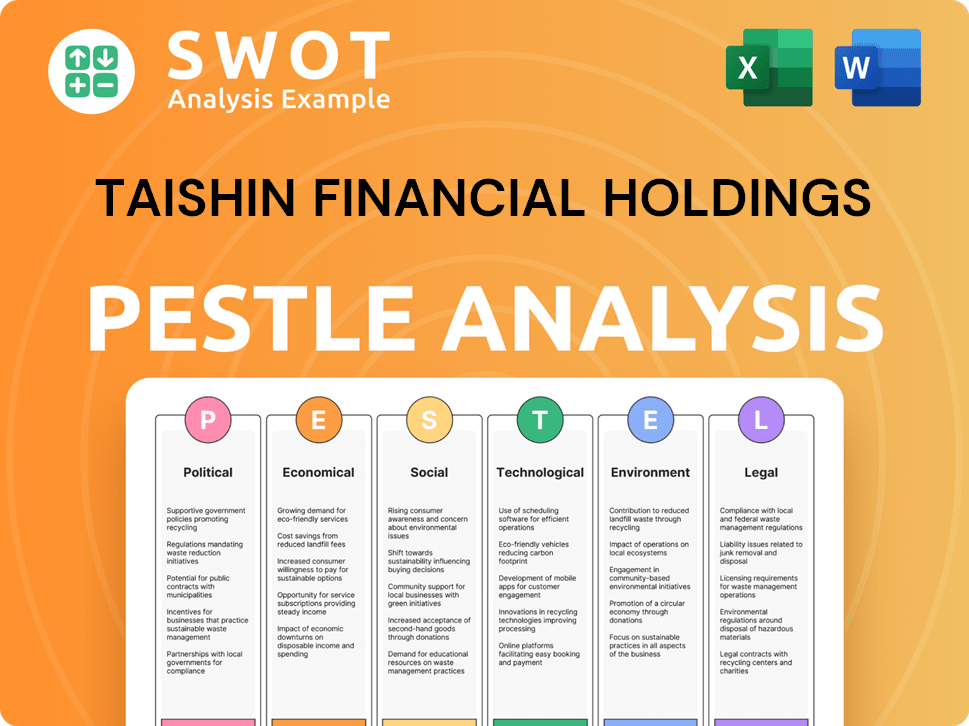

Taishin Financial Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Taishin Financial Holdings Bundle

What is included in the product

Evaluates how political, economic, social, technological, environmental, and legal factors influence Taishin Financial Holdings.

Allows users to modify or add notes specific to their own context, region, or business line.

Preview Before You Purchase

Taishin Financial Holdings PESTLE Analysis

The Taishin Financial Holdings PESTLE analysis you see is the final document. The download is exactly as shown.

PESTLE Analysis Template

Uncover how Taishin Financial Holdings is adapting to external shifts! Our PESTLE Analysis provides critical insights into the forces impacting its performance. From economic trends to technological advancements, we dissect the key factors. Understand potential risks and growth opportunities affecting the company. Equip yourself with expert analysis for strategic decision-making. Download the full PESTLE Analysis now for comprehensive market intelligence.

Political factors

The Taiwanese government strongly backs financial sector growth, targeting an Asian asset management hub status. This includes easing regulations and boosting product variety. In 2024, Taiwan's financial sector saw a 5% rise in assets, driven by these policies.

The Financial Supervisory Commission (FSC) is key in Taiwan, ensuring stability and overseeing financial institutions. Taishin Financial Holdings must adhere to FSC regulations, impacting operations. In 2024, the FSC focused on fintech and cybersecurity. Recent FSC data shows increased scrutiny on risk management and corporate governance.

Cross-Strait relations remain a significant political factor, impacting Taiwan's economy. Geopolitical tensions and trade uncertainties, especially with China, can affect investor confidence. For instance, Taiwan's exports to China accounted for 35.2% of total exports in 2024. Any instability could disrupt these trade flows. This highlights the importance of monitoring political developments for financial planning.

Government Initiatives in Specific Industries

Government initiatives, like Taiwan's 'Six Core Strategic Industries,' significantly shape financial strategies. These initiatives, aimed at boosting sectors like green energy and biotech, direct capital flows. In 2024, the government allocated NT$100 billion to support these industries. This influences Taishin's investment and lending decisions, creating both opportunities and risks.

- Six Core Strategic Industries: Focus areas for government investment.

- NT$100 Billion: Approximate government allocation in 2024.

- Influence: Directs capital flows in the market.

Political Stability and its Impact on Investor Confidence

Taiwan's political stability is crucial for investor confidence and foreign investment, directly influencing Taishin Financial Holdings. Stable governance and predictable policies encourage long-term investments, which are vital for financial market growth. The World Bank's data indicates a stable political environment in Taiwan, positively impacting investment flows. In 2024, foreign direct investment (FDI) into Taiwan reached $10.5 billion. This stability supports Taishin's operations and strategic planning.

- FDI in Taiwan: $10.5 billion (2024)

- Taiwan's Political Risk Index: Consistently low scores, indicating stability.

- Impact: Positive for Taishin's business environment.

Taiwan's political environment strongly shapes Taishin Financial Holdings' operations and strategic planning. Government support, especially in sectors like fintech, is significant. Cross-strait relations, trade dynamics with China (35.2% exports in 2024), and geopolitical stability directly impact investor confidence.

| Factor | Impact | Data (2024) |

|---|---|---|

| Govt. Support | Financial Sector Growth | 5% assets rise |

| Cross-Strait Relations | Trade & Investment | Exports to China: 35.2% |

| Political Stability | Investor Confidence | FDI: $10.5 billion |

Economic factors

Taiwan's GDP growth significantly impacts Taishin Financial. In 2024, Taiwan's GDP grew by 3.4%, driven by tech exports. The 2025 forecast anticipates around 3% growth. This slower pace, still positive, is influenced by global economic trends and local demand.

Inflation and interest rate policies significantly influence Taishin Financial Holdings' operations. In Taiwan, the inflation rate in March 2024 was 2.14%, slightly above the central bank's target. The Central Bank of the Republic of China (Taiwan) held its key interest rate steady at 1.875% in 2024. Rising wages may put upward pressure on inflation.

The Taiwanese financial market is intensely competitive, featuring numerous institutions. This high saturation squeezes profit margins. In 2024, Taiwan's banking sector saw a 1.5% average profit margin. Taishin Financial, like others, faces this pressure. Intense competition necessitates strategic differentiation to maintain profitability.

Private Consumption and Investment

Private consumption and investment are crucial for Taishin Financial Holdings' performance, driving demand for its financial products. In Taiwan, private consumption grew by 1.9% in 2023. Fixed investment increased by 3.2% in the same period. These figures indicate a healthy domestic economy, benefiting Taishin.

- 2023: Private consumption in Taiwan grew by 1.9%.

- 2023: Fixed investment in Taiwan increased by 3.2%.

Global Economic Uncertainty

Global economic uncertainty poses significant challenges for Taishin Financial Holdings. Changes in trade policies and international financial market fluctuations can impact Taiwan's export-driven economy. These factors introduce risks for financial institutions like Taishin. The IMF projects global growth at 3.2% in 2024 and 2025, reflecting ongoing uncertainty.

- Taiwan's 2023 GDP growth was 1.4%, with exports playing a crucial role.

- Fluctuations in the NTD against major currencies can affect profitability.

- Geopolitical tensions add to the volatility of international markets.

Economic factors significantly shape Taishin Financial's performance. Taiwan's 2024 GDP growth of 3.4% supports strong operations, while 2025's projected 3% growth shows a stable outlook. Inflation, at 2.14% in March 2024, and stable interest rates at 1.875% influence financial strategies.

| Economic Factor | 2024 Data | 2025 Forecast (Approx.) |

|---|---|---|

| GDP Growth (Taiwan) | 3.4% | ~3% |

| Inflation (March 2024) | 2.14% | Varies |

| Key Interest Rate | 1.875% | To be determined |

Sociological factors

Taiwan faces rapid population aging and declining birth rates. This demographic shift shrinks the workforce, increasing the old-age dependency ratio. For Taishin Financial, this impacts demand for wealth management, pensions, and insurance. In 2024, Taiwan's old-age dependency ratio is projected to be around 45%.

The surge in digital finance and shifting consumer behaviors are reshaping how people engage with financial services. In 2024, digital banking adoption in Taiwan reached 75%, demonstrating a clear preference for online channels. Taishin must update its offerings to match these digital expectations and stay competitive. This includes focusing on user-friendly apps and personalized digital experiences. This ensures customer satisfaction and market relevance.

Taishin Financial Holdings is focusing on financial inclusion. This involves making financial services accessible to everyone. Recent data shows a push to include underserved groups. In 2024, digital banking expanded access to more remote areas. This aligns with societal shifts towards equality.

Awareness of ESG Issues

Growing public and stakeholder concern about ESG issues significantly impacts customer choices and expectations for financial institutions. Taishin Financial Holdings must adapt to these changing preferences. For example, in 2024, ESG-focused funds saw increased inflows, reflecting growing investor interest. This trend necessitates that Taishin integrates ESG considerations into its products and services.

- Increased demand for sustainable investment options.

- Enhanced scrutiny of corporate social responsibility.

- Pressure to improve transparency and reporting on ESG performance.

Talent Acquisition and Development

Taishin Financial Holdings faces the challenge of attracting and retaining top talent, especially in digital technology and fintech. The financial sector's demand for skilled professionals is increasing, creating a competitive environment. In 2024, the average salary for fintech specialists in Taiwan rose by 8%, reflecting the high demand. This requires robust strategies to secure and develop employees.

- Competition for talent is intensifying.

- Digital skills are highly sought after.

- Employee development programs are vital.

- Retention strategies, including competitive compensation, are key.

Aging populations and falling birth rates are reshaping Taiwan's demographics. Digital finance and evolving consumer preferences demand Taishin adapt its services for modern expectations. ESG concerns drive sustainable investment and CSR scrutiny.

| Factor | Impact on Taishin | 2024/2025 Data/Trends |

|---|---|---|

| Aging Population | Increased demand for wealth management and insurance. | Dependency ratio ~45% (2024). Pension system strains. |

| Digitalization | Need for digital service enhancements. | Digital banking adoption: 75% (2024). Fintech growth. |

| ESG Concerns | Integrate ESG into products and strategies. | ESG fund inflows rising. Focus on sustainable investments. |

Technological factors

Taiwan is rapidly adopting fintech, with financial institutions leveraging AI, big data, and blockchain. Taishin Financial Holdings is actively investing in these technologies to boost digital capabilities. In 2024, Taiwan's fintech market is expected to reach $1.6 billion, growing significantly. This investment aligns with the trend of enhancing digital services.

Digital transformation is crucial for Taiwan's financial institutions to boost efficiency and enhance customer experiences. Taishin Financial Holdings is actively optimizing its digital channels. In 2024, Taiwanese banks significantly increased their digital transaction volumes. Taishin is exploring innovative solutions to stay competitive. The trend towards digital banking is expected to continue in 2025.

Taishin Financial Holdings is leveraging AI and big data to refine its services. In 2024, the global AI market in finance was valued at $20.5 billion, projected to reach $48.5 billion by 2029. This boosts customer service and operational efficiency. Big data analytics aids in crafting innovative financial products.

Cybersecurity and Data Protection

Cybersecurity and data protection are paramount for Taishin Financial Holdings due to its heavy digital technology use. In 2024, cyberattacks cost the financial sector billions, with incidents rising. Robust security measures are essential to safeguard customer data and preserve the firm's reputation. The firm must invest in advanced security systems to mitigate risks effectively.

- Global cybersecurity spending is projected to reach $219 billion in 2024.

- Data breaches in the financial sector increased by 15% in 2024.

- Taishin Financial Holdings' cybersecurity budget increased by 10% in 2024.

Development of Digital Infrastructure

Taiwan's strong investment in digital infrastructure, including high-speed communication networks and advanced data centers, is crucial. This supports the expansion of the digital economy and the integration of financial technology (fintech) within the financial sector. For example, in 2024, Taiwan's government allocated NT$30 billion to enhance digital infrastructure. This includes upgrades to 5G networks and investments in cloud computing. Such advancements are vital for Taishin Financial Holdings to offer innovative digital financial services and maintain a competitive edge.

- NT$30 billion allocated in 2024 for digital infrastructure.

- Focus on 5G network upgrades and cloud computing.

- Supports fintech adoption and digital financial services.

Taishin leverages AI, big data, and blockchain, focusing on fintech growth. Digital transformation boosts efficiency, enhancing customer experiences across channels. Cybersecurity remains critical, with financial sector breaches increasing in 2024.

| Technological Factor | Impact | Data (2024) |

|---|---|---|

| Fintech Adoption | Increased digital services | $1.6B fintech market in Taiwan |

| Digital Transformation | Boosted efficiency, better experiences | Digital transactions up significantly |

| AI & Big Data | Enhanced services, analytics | Global AI in finance valued at $20.5B |

| Cybersecurity | Data protection essential | Cyberattacks cost billions |

Legal factors

Taishin Financial Holdings faces stringent oversight from Taiwan's FSC. Adherence to banking and securities regulations is crucial. In 2024, the FSC imposed NT$20 million in fines on financial institutions for compliance failures. This impacts operational costs and strategic decisions. Robust compliance programs are essential to mitigate legal risks.

Taishin Financial Holdings must comply with stringent AML/CFT regulations in Taiwan. In 2024, Taiwan's Financial Supervisory Commission (FSC) continued to strengthen oversight, with increased scrutiny on due diligence and transaction monitoring. Banks face penalties for non-compliance; in 2023, several Taiwanese banks were fined millions for AML breaches. These regulations impact operations, requiring significant investment in compliance.

Taishin Financial Holdings must comply with stringent data protection laws like Taiwan's PDPA. These regulations dictate how customer data is handled, impacting operational procedures. In 2024, the financial sector faced increased scrutiny regarding data breaches. Compliance costs are rising, with potential penalties for non-compliance. The focus is on safeguarding sensitive financial information.

Regulations on Digital Assets and Fintech Activities

Taishin Financial Holdings faces evolving regulations on digital assets and fintech. The Financial Supervisory Commission (FSC) is updating rules for cryptocurrencies and fintech. In 2024, Taiwan's FSC aimed to clarify crypto regulations. This includes anti-money laundering (AML) and consumer protection.

- FSC is focusing on AML compliance.

- Consumer protection is a priority.

- New guidelines are expected in 2024/2025.

Mergers and Acquisitions Regulations

Regulations on mergers and acquisitions (M&A) significantly affect Taishin Financial Holdings. These rules dictate how Taishin can expand via M&A. In 2024, financial sector M&A deals totaled around $1.2 trillion globally. Compliance with these laws influences Taishin's strategic growth options.

- Regulatory approvals can delay or block acquisitions.

- Compliance costs add to transaction expenses.

- Changes in regulations may alter M&A strategies.

- Taiwan's financial regulations are key for Taishin.

Taishin Financial Holdings is significantly impacted by stringent regulations from Taiwan's FSC, including AML/CFT rules and data protection laws like the PDPA. Digital asset and fintech regulations are evolving, with updates expected in 2024/2025 focusing on consumer protection and AML compliance. M&A regulations also heavily influence Taishin's growth, with global M&A deals in the financial sector totaling approximately $1.2 trillion in 2024.

| Regulation | Impact | 2024/2025 Data |

|---|---|---|

| AML/CFT | Compliance costs; penalties for non-compliance. | FSC strengthened oversight, with several Taiwanese banks fined millions. |

| Data Protection | Impacts data handling procedures; increases compliance costs. | Increased scrutiny regarding data breaches. |

| Digital Assets/Fintech | Updates rules for crypto/fintech, AML focus. | FSC clarified crypto regulations with new guidelines expected. |

Environmental factors

Taiwan's government and FSC champion green finance for sustainability and a low-carbon shift. They boost green industry financing and tighten ESG disclosure rules. In 2024, Taiwan's green bond market hit $5.2 billion, reflecting strong growth. The FSC aims for all listed companies to adopt sustainability reports by 2025, boosting transparency.

Taishin Financial Holdings faces growing pressure to manage climate-related risks. In 2024, the Task Force on Climate-related Financial Disclosures (TCFD) framework became a key standard for financial institutions. The company must assess climate impacts on assets and lending, aligning with global trends. This includes evaluating transition risks like carbon pricing and physical risks from extreme weather events, which can affect investment portfolios.

Taishin Financial Holdings faces increasing pressure to comply with ESG reporting and disclosure standards. In 2024, regulatory bodies are pushing for more detailed sustainability reports. For example, Taiwan's Financial Supervisory Commission (FSC) mandates specific ESG disclosures. This includes data on carbon emissions and social impact metrics. This enhances transparency, affecting investor decisions and operational strategies.

Carbon Emissions Reduction Goals

Taiwan's commitment to net-zero emissions by 2050 significantly impacts Taishin Financial Holdings. This target may trigger new regulations and drive investments in sustainable finance. The government aims to cut emissions by 50% of 2005 levels by 2050.

- Financial institutions must adapt to green financing.

- Opportunities exist in renewable energy projects.

- Regulations may increase compliance costs.

Environmental Regulations and Compliance

Taishin Financial Holdings must adhere to environmental regulations. Compliance involves laws on emissions, wastewater, and waste. These rules impact operations and client risk assessments. Stricter rules may increase costs.

- Taiwan's Environmental Protection Administration (EPA) enforces these laws.

- Failure to comply can lead to fines and reputational damage.

- Environmental risk assessments are becoming increasingly important for lending decisions.

Taishin must navigate Taiwan's green finance push and stricter ESG rules, with green bonds at $5.2B in 2024. Climate risk assessments are vital. Compliance involves adhering to environmental regulations.

| Factor | Impact | Details |

|---|---|---|

| Green Finance | Opportunities/Risks | Adapting to green financing is vital. Renewable energy and regulatory impacts. |

| Climate Risk | Operational/Financial | Assess climate-related risks per TCFD standards. Focus on weather/transition risks. |

| ESG Reporting | Compliance Costs | Adhere to stringent ESG standards. FSC mandates detailed disclosures to boost transparency. |

PESTLE Analysis Data Sources

The analysis relies on data from reputable sources: financial reports, economic forecasts, regulatory updates, and industry-specific databases. We use this data for insights.