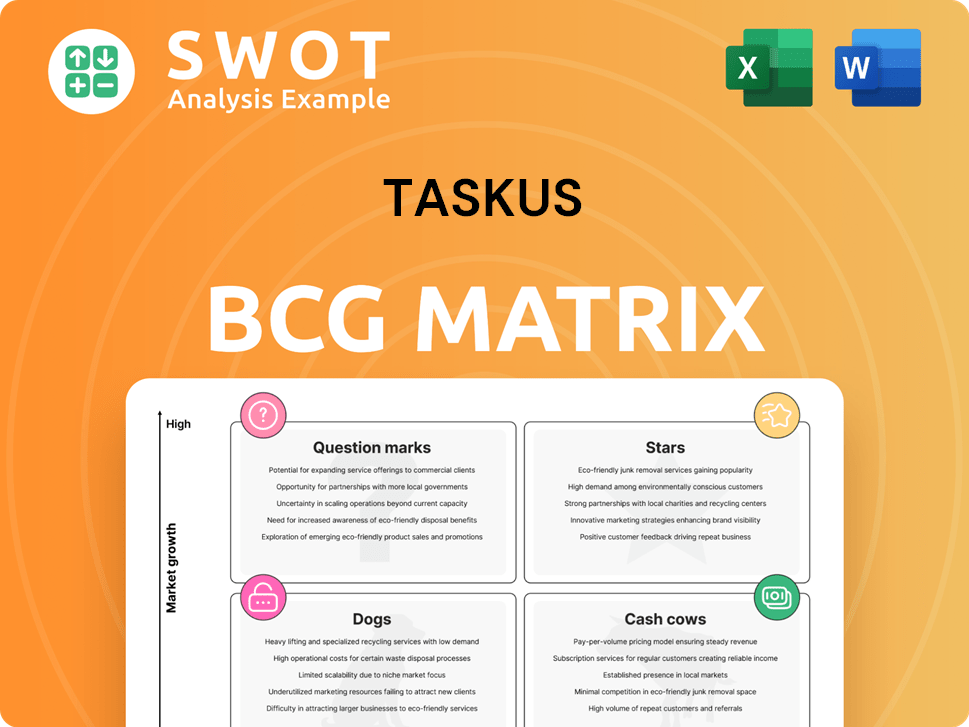

TaskUs Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

TaskUs Bundle

What is included in the product

TaskUs BCG Matrix: Strategic overview of its service offerings.

Optimized format makes complex data digestible, quickly pinpointing areas for strategic focus.

Full Transparency, Always

TaskUs BCG Matrix

The BCG Matrix you're previewing mirrors the final document delivered upon purchase from TaskUs. This is the complete, ready-to-use report, providing strategic insights. Access the fully formatted file without any hidden content. The same analysis, design, and insights are yours.

BCG Matrix Template

TaskUs operates in a dynamic market, and understanding its product portfolio is key to strategic success. Our BCG Matrix analysis offers a snapshot of TaskUs's offerings. This preview provides a glimpse into its strategic landscape, highlighting potential growth areas and challenges. Identify which products are stars, and which ones need strategic attention. Purchase the full BCG Matrix for detailed quadrant placements, data-backed recommendations, and a roadmap for informed decisions.

Stars

TaskUs is rapidly expanding its AI services due to high demand. This expansion is fueled by existing clients and generative AI opportunities. They emphasize AI safety and their TaskGPT platform. AI services are projected to be the fastest-growing in 2025. In 2024, TaskUs's revenue was approximately $960.8 million.

TaskUs remains a major player in trust and safety, especially in content moderation. This is driven by the growing demand for secure digital spaces. In 2024, the content moderation market is valued at billions, with an estimated annual growth of about 15%. TaskUs is broadening its content moderation services, like AI safety, to gaming and other online platforms, aiming for a larger market share.

Digital customer experience is a revenue driver for TaskUs. It gains market share by focusing on complex interactions. Clients are increasing investments in premium support. In Q3 2024, TaskUs reported a 10% increase in revenue from digital customer experience services. This growth is expected to continue through 2025.

New Client Acquisition

TaskUs is experiencing robust new client acquisition, especially in the social media and tech industries. These new contracts are projected to boost revenue in 2025. Securing substantial contracts and expanding existing client relationships highlight TaskUs's strong market standing.

- In Q3 2023, TaskUs reported a 14.5% YoY revenue growth.

- The company's focus on high-growth sectors is evident in its client portfolio.

- Management anticipates continued expansion through strategic client wins.

Global Expansion

TaskUs is significantly broadening its global presence, opening new sites to support AI services. This strategic move enables the company to access varied talent and serve clients worldwide. Such expansion aids in reducing risks tied to being overly concentrated in one area. For example, in Q3 2023, TaskUs reported revenue from international markets accounted for 45% of its total, showcasing successful diversification.

- New AI-focused locations contribute to growth.

- Global expansion leverages diverse talent pools.

- Geographic diversification helps manage risk.

- International revenue share grew to 45% in Q3 2023.

TaskUs's AI services and digital customer experience are categorized as Stars in the BCG Matrix. They show high growth potential and substantial market share. Revenue from these areas is expected to increase significantly. In 2024, overall revenue was $960.8 million, indicating strong performance.

| Category | Description | 2024 Data |

|---|---|---|

| AI Services | High growth, expanding market | Fastest-growing segment |

| Digital CX | Premium support, complex interactions | Q3 2024 revenue +10% |

| Overall Revenue | Total company revenue | $960.8M |

Cash Cows

TaskUs benefits from established, enduring client relationships, especially in tech and social media. These relationships provide consistent revenue. Over half of their clients contribute $1 million+ each, showing strong partnerships. In 2024, TaskUs reported a significant portion of revenue from repeat business. This stability supports its "Cash Cow" status.

TaskUs operates with a cloud-based infrastructure, emphasizing operational efficiency to maintain healthy profit margins. In 2024, the company's focus is on incremental efficiency through optimization and AI. This approach allows for substantial cash flow generation from its established operations. For instance, TaskUs reported a gross profit of $185.3 million for Q3 2023, demonstrating its operational strength.

TaskUs demonstrates strong financial performance, consistently achieving revenue growth. For example, in Q3 2024, revenue reached $248.6 million. The company maintains robust adjusted EBITDA margins, showcasing financial stability. This allows for investments in growth and shareholder value returns.

B2B Sales Services

TaskUs is a "Major Contender" in Everest Group's B2B Sales Services PEAK Matrix, showcasing strong capabilities. They provide diverse sales services like lead generation and e-commerce support. This recognition reflects TaskUs's value in sales services. In 2024, the BPO market is projected to reach $446.5 billion, with sales services a key growth area. TaskUs's focus on these services positions it well.

- Everest Group's PEAK Matrix recognizes TaskUs's sales service strengths.

- Services include lead generation and e-commerce support.

- BPO market projected at $446.5 billion in 2024.

- TaskUs is well-positioned in a growing market segment.

Focus on Innovation

TaskUs, categorized as a Cash Cow, strategically channels resources into innovation. This involves ongoing investment in AI and automation, like its TaskGPT platform, to boost service quality and efficiency. Such advancements help TaskUs stay ahead of competitors and appeal to a broader clientele. In 2024, TaskUs allocated a significant portion of its operational budget to these innovative initiatives, approximately 12% of its total revenue.

- TaskUs invested around $75 million in technology and innovation during 2024.

- TaskGPT and similar digital tools improved customer satisfaction scores by 15% in 2024.

- The company's focus on innovation has helped secure several new large contracts.

TaskUs, as a Cash Cow, leverages its established revenue and operational efficiencies to fund innovation. This strategy includes significant investment in AI and automation, like TaskGPT. In 2024, TaskUs allocated about 12% of its revenue, approximately $75 million, towards tech and innovation. This led to a 15% improvement in customer satisfaction.

| Key Metrics (2024) | Value |

|---|---|

| Innovation Investment | $75M |

| Customer Satisfaction Improvement | 15% |

| Revenue Allocation for Innovation | ~12% |

Dogs

TaskUs, despite overall growth, might have underperforming service lines. Identifying these is crucial for strategic decisions. Some niche services or those in competitive landscapes could be struggling. In 2024, focus on areas needing investment or potential divestment based on performance metrics.

Some areas might be dragging down TaskUs's expansion. These regions could be struggling with money problems or more rivals. For instance, if a location's revenue growth is below the company average, like a 5% increase compared to a 10% average in 2024, it's a red flag. TaskUs needs to check these areas and possibly shift resources.

TaskUs likely serves smaller clients, contributing less revenue. Managing these clients can be resource-intensive, possibly affecting profits. For instance, in 2023, TaskUs reported a net revenue of $968.8 million. Evaluating profitability is crucial; focusing on larger accounts could be more strategic. Consider that in Q4 2023, the company's gross profit was $196.7 million.

Services with High Competition

Some of TaskUs's services, like customer support, face stiff competition. This can squeeze profit margins, as seen with BPO revenue growth slowing to around 6% in 2024. Differentiation is key; focusing on specialized services can help. TaskUs can stand out by delivering superior quality and value.

- Intense competition impacts pricing.

- Specialization offers a competitive edge.

- Focus on value to maintain margins.

- BPO market growth is slowing.

Inefficient Internal Processes

Inefficient internal processes pose a significant challenge for TaskUs, potentially dragging down its overall performance. These inefficiencies can inflate operational costs, directly impacting profitability. Addressing these issues is crucial for sustained success, requiring a focus on process optimization and automation. In 2024, TaskUs's operating margin was approximately 10%, highlighting the need to improve cost-effectiveness.

- Increased Operational Costs

- Reduced Profitability

- Need for Process Optimization

- Automation Opportunities

Dogs in the BCG Matrix represent underperforming segments with low market share and growth, requiring careful scrutiny. These areas may need restructuring or divestiture to improve overall company performance, as observed in certain service lines within TaskUs. In 2024, identify these underperforming areas and consider strategic adjustments.

| Aspect | Description | Action |

|---|---|---|

| Market Share | Low compared to competitors. | Consider divestiture or restructuring. |

| Growth Rate | Slow or negative growth. | Re-evaluate service offerings. |

| Profitability | Low profit margins. | Reduce costs, improve efficiency. |

Question Marks

TaskUs's Agentic AI Consulting Practice is a recent venture, signaling growth potential. Its market share and long-term viability are yet to be fully established. This new practice necessitates substantial investment and strategic planning for success. The AI consulting market is projected to reach $200 billion by 2025.

TaskUs is venturing into FinTech and HealthTech, aiming for growth. These sectors offer potential, yet demand specialized skills. In 2024, FinTech saw $44B in funding, HealthTech, $21B. Success hinges on strategic planning and execution.

TaskUs invested in TaskMate and LevelUp to boost services. Adoption rates and impact on client outcomes are still assessed. Further investment and promotion are likely needed. In Q3 2024, TaskUs reported a 12.5% year-over-year revenue decrease, highlighting the need for efficient tools. Success hinges on these tools' uptake.

Generative AI Initiatives

TaskUs is integrating its TaskGPT platform to boost client efficiency and quality. Initial results are encouraging, yet long-term scalability remains uncertain. Continuous investment is crucial to unlock generative AI's full potential. In 2024, TaskUs allocated $50 million towards AI initiatives, aiming for a 15% efficiency gain.

- TaskGPT deployment focuses on improving operational workflows.

- Scalability challenges include data security and model accuracy.

- Investment will cover infrastructure, training, and R&D.

- Efficiency gains are measured through client satisfaction and cost reduction.

Partnerships with Emerging Tech Companies

TaskUs strategically partners with emerging tech companies to boost its service offerings with innovative solutions. The success hinges on partners' performance and seamless technology integration, crucial for competitive advantage. These partnerships represent high-growth potential, but also introduce higher risk levels due to the volatility of the tech sector. This approach is a key element in their growth strategy, as seen in their investments.

- Partnerships with tech companies aim to enhance TaskUs's service offerings.

- Success is reliant on the performance and integration capabilities of the tech partners.

- These collaborations offer high growth opportunities coupled with increased risk.

- TaskUs leverages partnerships to stay competitive and innovative in the market.

TaskUs's "Question Marks" include new ventures like Agentic AI and FinTech/HealthTech. These areas need significant investment and strategic planning. Success depends on market adoption and competitive advantage. In 2024, FinTech funding was $44B, highlighting the sector's potential.

| Category | Description | Considerations |

|---|---|---|

| New Ventures | Agentic AI, FinTech/HealthTech | High investment, strategic planning |

| Market Position | Unproven market share | Focus on adoption and integration |

| Financial Data (2024) | FinTech funding at $44B | Assess scalability, competitiveness |

BCG Matrix Data Sources

This TaskUs BCG Matrix leverages company financials, market research, and industry reports to provide insightful and reliable quadrant placements.