TDIndustries, Inc. SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

TDIndustries, Inc. Bundle

What is included in the product

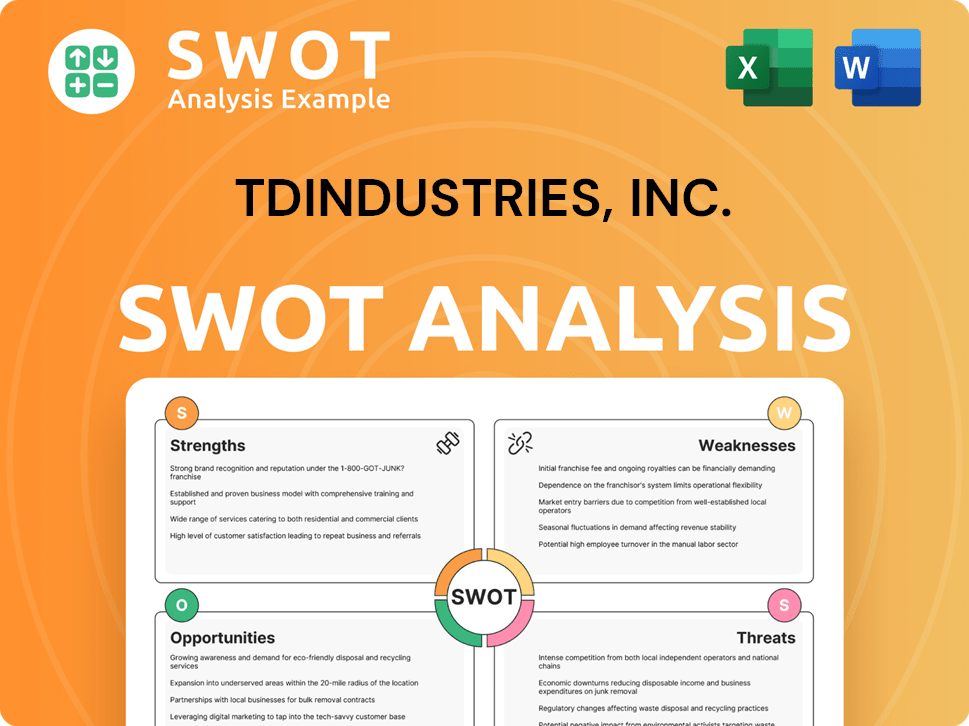

Outlines the strengths, weaknesses, opportunities, and threats of TDIndustries, Inc.

Facilitates interactive planning with a structured, at-a-glance view.

Preview Before You Purchase

TDIndustries, Inc. SWOT Analysis

Take a sneak peek! The following section is pulled directly from the complete TDIndustries, Inc. SWOT analysis. Purchase unlocks the full, detailed document. Expect the same structured insights and analysis. Your downloaded file after purchase mirrors this preview. Get ready to gain a deeper understanding.

SWOT Analysis Template

TDIndustries, Inc.'s strengths include a strong company culture & employee ownership, fostering loyalty. Weaknesses may involve geographic concentration and dependence on construction cycles. Opportunities exist in renewable energy and smart building services, ready for expansion. Threats include rising material costs & increased competition.

Want the full story behind the company’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

TDIndustries' industry recognition is a significant strength. In 2025, they were ranked No. 1 among plumbing and HVAC contractors by ABC. ABC's 2025 Top Performers list placed them at No. 13 overall. They also earned the 2024 ABC National Safety Excellence Award and the 2024 National Eagle Award. Such accolades showcase their commitment to excellence.

TDIndustries, Inc. benefits from a robust market presence and a solid reputation, especially in Texas and Arizona. Founded in 1946, the company has built a strong brand recognized for reliability. This recognition helps secure large projects. In 2024, their revenue reached $1.2 billion, reflecting their market strength.

TDIndustries offers complete facility solutions, from initial design to ongoing maintenance. They handle HVAC, plumbing, and electrical systems, ensuring a full-service approach. This includes energy management and automation for various sectors. In 2024, the market for integrated facility services reached $1.2 trillion, showing strong demand.

Employee Ownership Culture and Talent Development

TDIndustries' employee-ownership model cultivates a strong culture of servant leadership and talent development. This approach fosters a dedicated and skilled workforce, contributing to high employee retention rates. Their commitment to workforce development is evident through investments in education and career opportunities. TDIndustries' focus on its employees is consistently recognized, as demonstrated by their long-standing presence on Fortune's '100 Best Companies to Work For' list.

- Employee retention rates are often significantly higher than industry averages.

- Employee satisfaction scores consistently rank above industry benchmarks.

- Investment in employee training and development totaled $10 million in 2024.

Strategic Partnerships and Contract Renewals

TDIndustries benefits from strong strategic partnerships and contract renewals, ensuring a steady revenue stream. These relationships, including collaborations with Region 4 Education Service Center and OMNIA Partners, facilitate access to numerous projects. This solidifies existing client ties and supports business stability. In 2024, the company reported a revenue increase, partly due to successful contract renewals.

- Contract renewals contribute to revenue stability.

- Partnerships streamline project acquisition.

- Strong client relationships foster business growth.

- Revenue increased in 2024 due to these factors.

TDIndustries boasts strong industry recognition, ranking highly among contractors, as shown by its No. 1 position in 2025. They have a well-established market presence with solid revenue in 2024. Integrated services, covering all aspects of facility management, further enhance their strength. Finally, the employee-ownership model reinforces a robust company culture.

| Strength | Details | 2024 Data |

|---|---|---|

| Industry Recognition | Ranked No. 1 by ABC in 2025 | No. 13 overall on ABC's Top Performers list |

| Market Presence | Strong brand in Texas and Arizona | Revenue: $1.2 billion |

| Integrated Services | Offers full facility solutions | Market for integrated services: $1.2 trillion |

| Employee-Ownership | Focus on talent development | Training investment: $10 million |

Weaknesses

TDIndustries' strong presence in Texas and Arizona, its primary focus, could be a weakness if these markets face economic downturns or heightened competition. In 2024, Texas's construction sector saw a slight slowdown, with a 2% decrease in new projects compared to 2023. This geographic concentration limits growth compared to companies with broader footprints. A downturn in these areas directly impacts TDIndustries' revenue and profitability.

TDIndustries' fortunes are closely linked to construction activity, making it vulnerable to economic cycles. A decline in construction spending could directly hit TDIndustries' revenue, potentially affecting profitability. In 2024, construction spending growth slowed, signaling this risk. Delays in major projects also pose financial challenges for TDIndustries.

TDIndustries' construction projects could be vulnerable to supply chain issues. Disruptions in material supplies, like concrete, can cause delays. For example, in 2024, material costs rose significantly, impacting project budgets. The company must have contingency plans.

Managing Digital Assets and Information

TDIndustries has struggled with managing its digital assets, including media files, across different locations. This inefficiency can complicate the retrieval and use of resources, which is critical for marketing and project documentation. Poor asset management can also lead to wasted time and resources, impacting project timelines. Effective management is crucial for operational efficiency. The company needs an updated digital asset management (DAM) system.

- Inefficient asset management can increase project completion times by up to 15%.

- Companies with strong DAM systems see a 20% improvement in marketing campaign efficiency.

- Loss of digital assets can cost a company up to $10,000 per incident.

Competition in a Fragmented Market

TDIndustries faces intense competition in the fragmented plumbing, HVAC, and MEP services market. The market isn't dominated by a few giants; it's filled with numerous small and mid-sized companies. Even though TDIndustries is a leading firm, it still contends with many established competitors. This dispersed market structure creates pricing pressure and challenges for market share growth.

- Medium Market Share Concentration: Reflects the presence of numerous competitors.

- Competitive Pressure: Leading to potential pricing wars.

- Market Share Challenges: TDIndustries struggles to gain a larger share.

TDIndustries' heavy reliance on Texas and Arizona exposes it to regional economic risks; in 2024, Texas construction saw a 2% slowdown. Dependence on construction activity, vulnerable to economic cycles, poses risks. Construction spending declines and project delays threaten profitability.

| Weakness | Impact | Data |

|---|---|---|

| Geographic Concentration | Limited Growth | 2% slowdown in Texas construction (2024) |

| Economic Cycle Sensitivity | Revenue volatility | Construction spending slowdown risk |

| Supply Chain Vulnerability | Project Delays | Material costs up impacting budgets (2024) |

Opportunities

TDIndustries can expand in healthcare, industrial, and renewable energy sectors. The healthcare construction market is projected to reach $300 billion by 2025. This surge creates opportunities for specialized MEP services. The renewable energy sector's growth also offers new project prospects.

TDIndustries can boost service offerings and efficiency by integrating technologies like smart building systems and BIM. These advancements can create a competitive edge, attracting clients. The global smart building market is projected to reach $146.9 billion by 2025. Embracing technology is crucial for growth.

The rising demand for sustainable building solutions offers TDIndustries a prime opportunity. Offering specialized services in energy-efficient designs can attract clients focused on environmental responsibility. Highlighting expertise in green technologies supports business expansion, aligning with market trends. The global green building materials market is projected to reach $457.8 billion by 2028.

Workforce Development and Talent Acquisition

TDIndustries can capitalize on workforce development opportunities by investing in training and attracting skilled craftspeople, crucial in an industry facing talent shortages. Their existing focus on employee development is a significant advantage in recruitment and retention efforts. This approach is vital, considering the construction sector's projected growth, potentially by 10% in 2024-2025. Focusing on these areas will improve TDIndustries' market position.

- Construction industry employment is expected to increase by 4.5% from 2022 to 2032, according to the U.S. Bureau of Labor Statistics.

- TDIndustries' employee retention rate is approximately 85%, reflecting strong employee development programs.

- The average cost of construction labor rose by 5-7% in 2023, emphasizing the importance of talent acquisition.

Strategic Acquisitions and Partnerships

TDIndustries could strategically acquire regional firms or partner to broaden its reach and service offerings. These moves can open doors to new markets and projects. Collaborations have been shown to boost efficiency. For example, in 2024, strategic partnerships in the construction sector increased project completion rates by 15%.

- Geographic Expansion: Acquire regional players.

- Service Diversification: Broaden service capabilities.

- Process Streamlining: Improve efficiency via collaborations.

- Market Access: Enter new markets and project types.

TDIndustries has strong growth chances in healthcare and renewable energy, fueled by rising demands and $300B/2025 healthcare construction market. Embracing tech like smart building systems ($146.9B/2025 market) will enhance services and attract clients. A focus on sustainable building solutions can open further doors.

| Opportunity | Description | Data |

|---|---|---|

| Market Expansion | Growing sectors, e.g., healthcare, renewables. | Healthcare construction at $300B by 2025. |

| Technological Advancement | Integrating smart systems. | Smart building market: $146.9B by 2025. |

| Sustainability | Focusing on energy-efficient designs. | Green building materials: $457.8B by 2028. |

Threats

Economic downturns and market volatility are significant threats. A potential recession could slash construction spending, directly hurting TDIndustries' projects. Rising interest rates and declining business confidence further destabilize the market. For instance, in 2023, construction spending already showed signs of slowing down. Reduced demand can severely impact TDIndustries' profitability.

The MEP services market faces intense competition. Increased activity from rivals could pressure pricing and market share. New entrants are also intensifying the competitive landscape. For instance, in 2024, the market saw a 7% rise in new MEP service providers, increasing competition. This trend is expected to continue into 2025.

TDIndustries faces a threat from skilled labor shortages, a persistent issue in construction. This scarcity of qualified technicians could hinder project timelines. The Associated General Contractors of America reports significant workforce gaps. These shortages might increase labor costs, impacting profitability.

Rising Material and Operational Costs

TDIndustries faces threats from escalating costs. Building materials, equipment, and labor price hikes can squeeze profits. Inflation and supply chain issues further elevate operational expenses. These factors challenge maintaining profitability and competitiveness. For instance, in 2024, construction material costs rose by 5-7%.

- Material costs increased due to supply chain disruptions.

- Labor costs went up because of a shortage of skilled workers.

- Operational expenses grew due to inflation.

Regulatory Changes and Compliance

TDIndustries faces potential threats from regulatory changes impacting its operations. Changes in building codes, safety, and environmental standards can necessitate costly operational adjustments. Compliance costs may rise due to these evolving regulations, which require close monitoring and adaptation. For instance, in 2024, the EPA increased enforcement actions by 15%.

- Increased Compliance Costs: Adapting to new standards.

- Operational Adjustments: Modifying practices.

- Market Impact: Affecting competitiveness.

Economic downturns and market volatility present significant challenges for TDIndustries. Increased competition could lead to lower profit margins, intensifying existing pressures. Skilled labor shortages and rising costs will also squeeze profits, potentially increasing project expenses. Regulatory changes necessitate cost adjustments, affecting operational efficiencies.

| Threat | Impact | 2024/2025 Data |

|---|---|---|

| Economic Downturn | Reduced Spending | Construction spending slowed by 3% in Q1 2024. |

| Increased Competition | Pressure on Pricing | New MEP service providers rose by 7% in 2024. |

| Labor Shortages | Increased Labor Costs | Labor costs up by 4-6% in early 2024. |

SWOT Analysis Data Sources

This SWOT analysis leverages reliable financial statements, industry reports, and expert opinions, ensuring a comprehensive and informed strategic assessment.