Vietnam Technological & Commercial Joint Stock Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Vietnam Technological & Commercial Joint Stock Bank Bundle

What is included in the product

This PESTLE analysis explores how external factors impact the Vietnam Technological & Commercial Joint Stock Bank.

Allows users to modify or add notes specific to their own context, region, or business line.

Preview Before You Purchase

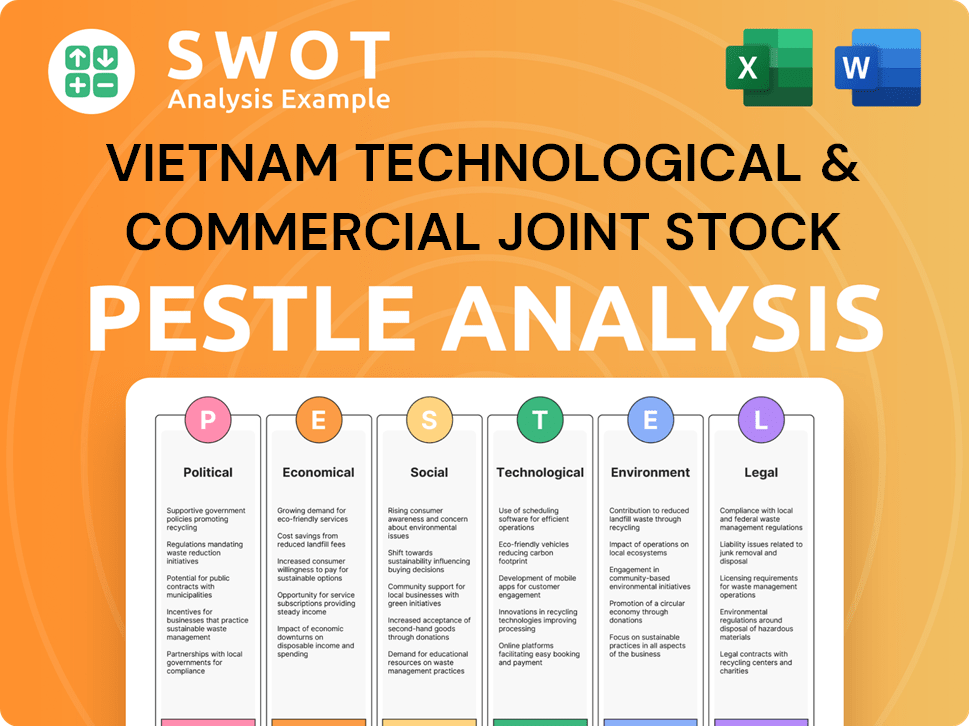

Vietnam Technological & Commercial Joint Stock Bank PESTLE Analysis

The provided preview shows the complete Vietnam Technological & Commercial Joint Stock Bank PESTLE analysis. The content and format in this preview are identical to the downloadable document. You'll receive this ready-to-use analysis immediately after purchasing. The data, insights, and structure will be exactly the same. It’s the final version!

PESTLE Analysis Template

Explore how external factors shape Vietnam Technological & Commercial Joint Stock Bank's trajectory. Our PESTLE analysis uncovers critical political, economic, and social trends impacting its strategy. Dive into the legal, technological, and environmental forces at play. Gain invaluable insights for smarter decision-making and a competitive advantage. Download the full, expert-crafted analysis now!

Political factors

Vietnam's one-party communist system offers political stability, attracting foreign investment. The government heavily influences the banking sector through the State Bank of Vietnam (SBV). SBV, the central monetary authority, ensures financial stability, regulating the industry. In 2024, Vietnam's GDP growth is projected at 5.8%, reflecting this stability.

The State Bank of Vietnam (SBV) significantly shapes Vietnam's banking sector. The SBV controls monetary policy, interest rates, and exchange rates. Corruption and bureaucratic hurdles persist, impacting the financial landscape. Banks like Vietnam Technological & Commercial Joint Stock Bank operate under SBV's influence. In 2024, SBV aimed to keep inflation below 4.5%.

Vietnam's banking sector has traditionally capped foreign ownership at 30% to maintain domestic control. However, a key change effective May 2025 raises the limit to 49% for restructured banks. This aims to boost foreign direct investment (FDI). In 2024, FDI into Vietnam reached $23.18 billion, indicating strong investor interest.

Government Support for Digital Transformation

The Vietnamese government strongly backs the digital transformation of the banking sector, encouraging banks to update and broaden their services. This support is evident through various programs and goals designed to boost digital transactions and financial inclusion. In 2024, the State Bank of Vietnam aimed for at least 70% of adults to have bank accounts, promoting digital financial access. This commitment is crucial for banks like Vietnam Technological & Commercial Joint Stock Bank (Techcombank) as they expand their digital offerings. These government initiatives create a favorable environment for digital banking growth.

- Government targets at least 70% of adults with bank accounts by 2024.

- The State Bank of Vietnam actively promotes digital financial inclusion.

- Techcombank benefits from the government's digital banking support.

Trade Agreements and International Relations

Vietnam's involvement in trade agreements and its global economic integration significantly impact the banking sector's evolution. These agreements attract foreign investment, creating chances for banks like Vietnam Technological & Commercial Joint Stock Bank (Techcombank) to facilitate international trade. For instance, the EU-Vietnam Free Trade Agreement (EVFTA) has boosted trade, with EU-Vietnam trade reaching $62.2 billion in 2023. This growth directly benefits banks handling trade finance and currency exchange.

- EVFTA has increased trade between the EU and Vietnam.

- Trade between the EU and Vietnam reached $62.2 billion in 2023.

Vietnam's political stability, led by its one-party communist system, bolsters foreign investment. The State Bank of Vietnam (SBV) tightly regulates the banking sector, aiming for economic stability; its goal was to keep inflation under 4.5% in 2024. Changes in foreign ownership limits, increasing to 49% for restructured banks from May 2025, aim to boost FDI, which reached $23.18 billion in 2024.

| Political Factor | Impact on Techcombank | Data |

|---|---|---|

| Government Stability | Attracts investment | 2024 GDP growth: 5.8% |

| SBV Regulations | Shapes operations | Inflation target below 4.5% (2024) |

| Foreign Ownership | Influences FDI | FDI in 2024: $23.18B |

Economic factors

Vietnam's economy has grown rapidly, becoming a lower-middle-income country. This growth, fueled by foreign investment and exports, boosts banking activities. In 2024, GDP growth is projected at 5.8%, fostering consumer spending and opportunities.

The State Bank of Vietnam (SBV) manages inflation and financial stability. Inflation has been relatively stable; however, global uncertainties introduce volatility. For example, Vietnam's inflation rate was 3.25% in 2023. The SBV’s decisions, like adjusting interest rates, influence the banking sector.

Vietnam's economy heavily depends on bank credit, reflected in a high credit-to-GDP ratio. The State Bank of Vietnam (SBV) sets credit growth limits for banks. These limits aim to control financial risks and ensure stability. For 2024, credit growth targets are around 14-15%. This aims to balance economic expansion with financial prudence.

Rising Middle Class and Consumer Spending

Vietnam's expanding middle class and rising disposable incomes are key drivers of consumer spending, boosting demand for banking services. This trend, particularly in urban areas, fuels retail banking growth. The State Bank of Vietnam reported a 14.7% increase in consumer credit in 2024. This indicates more spending. Banks like Vietnam Technological & Commercial Joint Stock Bank (Techcombank) can capitalize on this.

- Middle-class growth drives consumerism.

- Retail banking opportunities expand.

- Consumer credit surged by 14.7% in 2024.

- Techcombank can benefit from this.

Foreign Direct Investment (FDI) Inflows

Vietnam's robust Foreign Direct Investment (FDI) inflows continue to fuel economic growth, presenting significant prospects for banks like Vietnam Technological & Commercial Joint Stock Bank (Techcombank). These inflows drive business expansion and the need for financial services, particularly among foreign-invested enterprises. Recent data indicates strong FDI commitments, with disbursed capital reaching billions of dollars annually. Techcombank can capitalize on this by providing tailored financial solutions to these enterprises, such as loans and other banking services.

- In 2024, FDI disbursement reached $23.6 billion, a 15% increase year-on-year.

- FDI registered capital in the first quarter of 2024 reached $6.17 billion.

Vietnam's projected 5.8% GDP growth in 2024 supports increased consumer spending. Stable inflation, at 3.25% in 2023, impacts the State Bank's interest rate decisions, affecting the banking sector. Consumer credit rose 14.7% in 2024, fueling opportunities for banks like Techcombank.

| Economic Factor | Data | Impact on Techcombank |

|---|---|---|

| GDP Growth (2024 Projected) | 5.8% | Boosts loan demand, business growth |

| Inflation (2023) | 3.25% | Affects interest rates, profitability |

| Consumer Credit Growth (2024) | 14.7% | Expands retail banking, revenue |

Sociological factors

Vietnam's young population, with a median age of 32.9 years in 2024, is tech-savvy. Around 70% of the population uses the internet. This drives demand for digital banking. Techcombank can leverage this to grow its customer base and services.

Vietnam's rapid urbanization is reshaping lifestyles and financial demands. This shift influences the products and services that are in demand. Banks like Techcombank must adapt to meet these evolving consumer preferences. In 2024, urban population growth is expected to be 3.5%, driving demand for digital banking solutions.

Vietnam continues to push for greater financial inclusion, aiming to increase the proportion of adults with bank accounts. This strategy is crucial for economic growth and stability. In 2024, approximately 80% of Vietnamese adults have bank accounts, a significant increase from prior years. Banks like Vietnam Technological & Commercial Joint Stock Bank (Techcombank) can capitalize on this by tailoring services to reach unbanked populations, especially in rural areas.

Consumer Behavior and Digital Adoption

Vietnamese consumers are rapidly adopting digital banking. This shift is fueled by the convenience of e-wallets and QR code payments. Real-time transactions and ease of use are central to this trend's growth. In 2024, the usage of mobile banking increased by 30%. Over 70% of Vietnamese adults now use digital payment methods.

- Digital banking usage in Vietnam increased by 30% in 2024.

- Over 70% of Vietnamese adults use digital payment methods.

- E-wallets and QR codes are key drivers of this shift.

- Ease of use and real-time transactions are critical.

Growing Awareness of ESG

In Vietnam, there's a rising focus on Environmental, Social, and Governance (ESG) principles. This trend impacts customer expectations, pushing banks like Vietnam Technological & Commercial Joint Stock Bank to adopt sustainable practices. For instance, a 2024 survey showed that 60% of Vietnamese consumers prefer businesses with strong ESG records. Banks are adapting by offering green financing and promoting ethical investments.

- 60% of Vietnamese consumers prefer businesses with strong ESG records (2024).

- Growth in green bond issuance in Vietnam (2023-2024).

Techcombank thrives on Vietnam's young, tech-savvy population, where 70% are internet users. Rapid urbanization (3.5% growth in 2024) shapes financial demands, driving digital banking. Focus on financial inclusion, with 80% adult bank account ownership. Digital payment methods are used by over 70%.

| Factor | Impact | 2024 Data |

|---|---|---|

| Digital Banking | Increased Demand | 30% Growth |

| Digital Payments | Adoption Rate | 70% Usage |

| ESG Preferences | Consumer Preference | 60% Prioritize ESG |

Technological factors

Vietnam's banking sector is rapidly digitizing; a significant portion of transactions occur digitally. VPBank, for example, saw digital transactions account for 95% of the total in 2024. Banks are investing heavily in tech to improve customer experience and streamline operations. Fintech partnerships are also growing, with over 50% of banks collaborating with fintech firms by early 2025, according to industry reports.

Fintech is revolutionizing Vietnam's economy and banking. The sector's growth is substantial, driven by e-wallets and online payments. In 2024, digital payments in Vietnam surged, with a 30% increase in transaction value. This growth underscores the increasing adoption of fintech solutions. This trend is transforming how people manage finances.

Vietnamese financial institutions, including Techcombank, are actively integrating AI and big data. This includes using AI for customer service chatbots and fraud detection. In 2024, the Vietnamese fintech market grew, with AI-driven solutions becoming more prevalent. Techcombank's digital transformation strategy increasingly relies on these technologies to enhance operational efficiency.

Cybersecurity and Data Protection

As Vietnam Technological & Commercial Joint Stock Bank (Techcombank) expands its digital banking services, cybersecurity threats and data breaches are becoming more significant concerns. Banks must invest in robust security measures to safeguard sensitive customer data and maintain public trust. The financial sector in Vietnam faces increasing cyberattacks, with a 20% rise in incidents reported in 2024. Techcombank is allocating 15% of its IT budget in 2025 to cybersecurity.

- Cybersecurity incidents in Vietnam's financial sector rose by 20% in 2024.

- Techcombank plans to spend 15% of its 2025 IT budget on cybersecurity.

- Data breaches can lead to significant financial and reputational damage.

Development of Digital Infrastructure

Vietnam's digital infrastructure is swiftly developing, creating a strong base for digital banking and fintech expansion. Ongoing investments are key to supporting technological progress in the financial sector. The government aims to boost digital economy contribution to 30% of GDP by 2025. This includes expanding 5G coverage and improving internet access.

- Mobile broadband subscriptions reached 92% in 2024.

- The government plans to invest $1.5 billion in digital infrastructure by 2025.

- Fintech transactions grew by 40% in 2024.

Techcombank's digital transformation is fueled by fintech partnerships and AI, growing the digital banking sector. Digital payments in Vietnam rose significantly, with a 30% increase in value during 2024, highlighting fintech adoption. The bank allocates 15% of its 2025 IT budget to cybersecurity, which is essential.

| Factor | Details | Data |

|---|---|---|

| Digital Transactions | Digital share of total | VPBank's 95% in 2024 |

| Fintech Growth | Growth rate | 30% rise in transaction value in 2024 |

| Cybersecurity Spend | Techcombank IT budget | 15% for 2025 |

Legal factors

Vietnam's banking sector operates under a robust legal structure, with the Law on Credit Institutions as its cornerstone. In 2024, the State Bank of Vietnam (SBV) continued to refine regulations to ensure stability. For instance, the SBV reported that in Q1 2024, the total outstanding loans of the banking system increased by 2.48% compared to the end of 2023. These updates aim to boost transparency and safeguard consumers.

Regulations set credit limits, restricting the amount of credit to one client or related group. These limits are steadily decreasing to enhance banking stability. For example, the State Bank of Vietnam (SBV) has been adjusting these limits. As of late 2024/early 2025, these limits aim to cap large exposures to prevent excessive risk concentration, aligning with international best practices. This promotes a safer financial environment.

Vietnam's legal landscape now enforces stricter data protection. This impacts how Vietnam Technological & Commercial Joint Stock Bank (Techcombank) handles customer data. The State Bank of Vietnam (SBV) has increased oversight to safeguard privacy. In 2024, Techcombank's spending on data security rose by 15% to meet new compliance standards. This reflects the growing importance of legal compliance.

Regulations on Bancassurance and Bundling Products

Recent regulations in Vietnam strictly forbid the mandatory bundling of insurance products with banking services, specifically targeting bancassurance practices. This shift aims to shield consumers from potentially aggressive sales tactics and ensure they have free choice. For VPBank, this change directly affects a revenue stream tied to insurance product sales through its banking network. These regulatory changes are part of a broader effort to strengthen consumer protection within the financial sector.

- Bancassurance revenue contribution: Approximately 15-20% of total revenue for major Vietnamese banks.

- Regulatory impact timeframe: Regulations effective from late 2023 and throughout 2024-2025.

- Consumer complaints related to bundled products: Increased significantly in 2022-2023, prompting regulatory action.

Environmental Risk Management Regulations

The State Bank of Vietnam (SBV) mandates that credit institutions, like Vietnam Technological & Commercial Joint Stock Bank (Techcombank), manage environmental risks in their lending practices. This involves evaluating environmental risks linked to borrowers and incorporating these factors into credit decisions. Recent data shows that in 2024, approximately 15% of Techcombank's loan portfolio was assessed for environmental impact. This regulatory focus aims to promote sustainable lending and reduce environmental liabilities. The bank's compliance with these regulations is crucial for its operational integrity and long-term financial stability.

- SBV regulations require environmental risk management in lending.

- Techcombank assesses environmental impacts of borrowers.

- Around 15% of Techcombank's 2024 loans were assessed for environmental impact.

- Compliance is vital for operational and financial health.

Vietnam’s banking sector has robust laws, with SBV refining rules for stability. Regulations limit credit amounts to enhance safety; data protection is also getting stricter.

Bancassurance changes impact revenue, aimed at consumer protection. The SBV mandates environmental risk management in lending. These changes are ongoing.

| Legal Factor | Impact on Techcombank | 2024-2025 Data/Details |

|---|---|---|

| Credit Regulations | Limits lending & exposure | Q1 2024 loans +2.48%; reducing credit limits |

| Data Protection | Increased compliance costs | 15% rise in security spend; focus on privacy |

| Bancassurance | Impacts revenue stream | Regulations from late 2023; 15-20% bank revenue |

Environmental factors

Vietnam faces significant climate risks, including severe weather events. The banking sector, like Vietnam Technological & Commercial Joint Stock Bank (Techcombank), must evaluate its vulnerability to climate change. This involves adjusting strategies to manage financial risks tied to environmental impacts. For example, in 2024, Vietnam experienced several extreme weather events, causing extensive damage and economic losses.

The State Bank of Vietnam (SBV) is actively fostering green credit and sustainable finance. Updated frameworks and preferential policies support this shift. Banks are incentivized to fund environmentally beneficial projects. In 2024, green credit grew, with over 450 billion VND allocated. Expect continued growth through 2025.

Vietnamese banks must now assess environmental risks in lending. This includes evaluating the environmental impact of projects. In 2024, regulations intensified, requiring detailed environmental risk assessments. This impacts loan approvals and terms. For example, Techcombank's 2024 reports detail these assessments.

ESG Integration in Business Strategy

Vietnam Technological & Commercial Joint Stock Bank (Techcombank) is actively integrating Environmental, Social, and Governance (ESG) factors into its business strategy, reflecting a broader trend among Vietnamese banks. This involves creating green products and services to promote sustainability within the financial sector. In 2024, the State Bank of Vietnam aimed to boost green credit, targeting approximately 20% of total outstanding loans by 2025.

- Techcombank has issued green bonds to finance sustainable projects.

- The bank supports renewable energy and energy-efficient projects.

- ESG integration enhances Techcombank's brand reputation.

Reporting and Transparency on Environmental Impact

Vietnam Technological & Commercial Joint Stock Bank (Techcombank) faces growing pressure for environmental impact reporting. While not fully mandated, the trend is clear, mirroring global sustainable finance practices. Banks must disclose their environmental footprints, including lending activities' impacts. This drives greater transparency and accountability.

- In 2024, ESG-related assets under management globally reached over $40 trillion.

- Techcombank's sustainability report for 2023 highlighted initial steps in environmental impact assessment.

- The State Bank of Vietnam is expected to release more guidelines on green finance by late 2025.

Vietnam's banking sector, including Techcombank, is increasingly shaped by environmental factors. Climate risks, such as extreme weather, require strategic adjustments in 2024-2025. The State Bank of Vietnam promotes green credit, aiming for approximately 20% of total outstanding loans by 2025. Banks now assess environmental impacts in lending, aligning with ESG integration.

| Environmental Aspect | Impact on Techcombank | 2024-2025 Data Points |

|---|---|---|

| Climate Risks | Financial risk; operational disruptions. | 2024: Extreme weather caused significant economic losses in Vietnam. |

| Green Finance Policies | Opportunities for green credit and sustainable finance growth. | Over 450 billion VND allocated to green credit in 2024, with continued growth expected through 2025. |

| Environmental Risk Assessment | Changes in lending and financial operations. | Regulations in 2024 intensified the required assessments in detail. |

PESTLE Analysis Data Sources

The analysis uses data from Vietnamese government sources, reputable financial institutions, and industry-specific reports. Economic indicators and market analyses provide insights.