Tech Mahindra PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tech Mahindra Bundle

What is included in the product

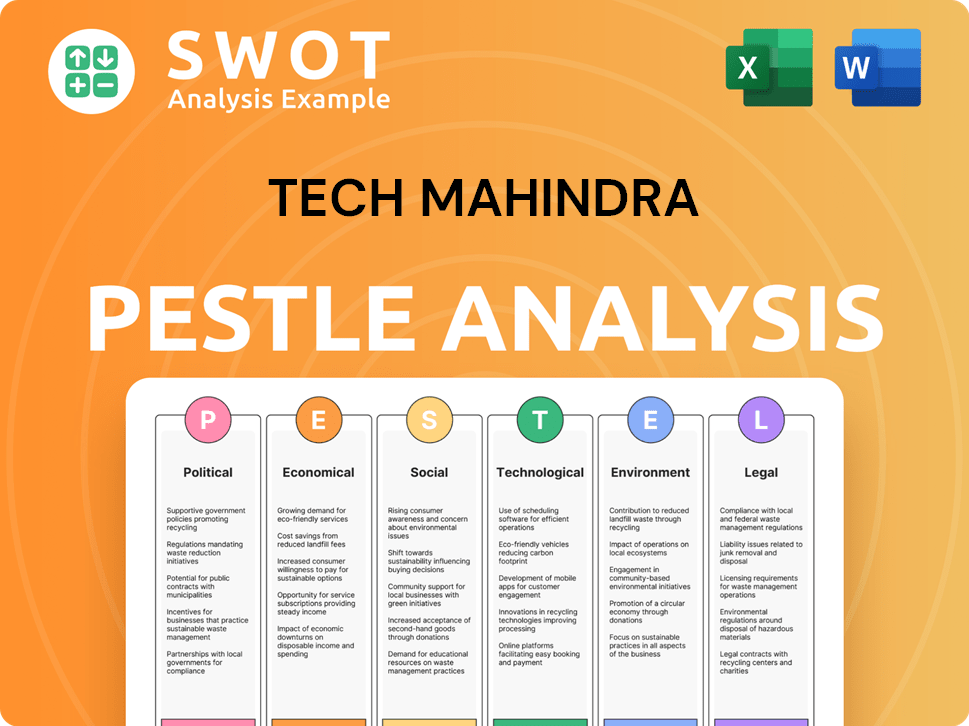

Analyzes external forces impacting Tech Mahindra: Political, Economic, Social, Technological, Environmental, and Legal.

Helps support discussions on external risk and market positioning during planning sessions.

Preview Before You Purchase

Tech Mahindra PESTLE Analysis

Previewing the Tech Mahindra PESTLE Analysis? The content you see here is identical to the file you'll receive instantly upon purchase.

This is the complete, fully formatted, and professional analysis ready to download.

There's no difference. Get access to the very document you are currently previewing!

Download and apply the presented data immediately.

PESTLE Analysis Template

Uncover the external factors shaping Tech Mahindra's trajectory with our expertly crafted PESTLE Analysis. Explore crucial political, economic, and technological influences impacting their operations and strategy. Understand social trends, legal challenges, and environmental considerations relevant to their growth. This detailed analysis offers a competitive edge, ideal for strategic planning and market analysis. Equip yourself with insights to forecast trends and make informed decisions. Download the full PESTLE analysis and gain a comprehensive understanding of Tech Mahindra's landscape today.

Political factors

Changes in government policies, trade regulations, and political stability affect Tech Mahindra. International relations and trade agreements are crucial for its export-driven revenue. Political stability in India impacts domestic operations; in 2024, India's IT sector grew by 7%, demonstrating the influence of stable governance.

Geopolitical tensions are critical. Conflicts affect client investments, potentially disrupting Tech Mahindra's operations. Delayed projects and decreased IT service demand may arise in volatile regions. Global economic interconnectedness means instability elsewhere impacts the IT sector. For example, in 2024, geopolitical risks led to a 5% decrease in IT spending in affected areas.

Government emphasis on digital transformation, smart cities, and e-governance in Tech Mahindra's operational countries presents growth prospects. These initiatives drive demand for IT and consulting services. For example, India's Digital India program and similar efforts globally. Tech Mahindra can capitalize on these trends, with potential revenue increases.

Data Protection and Privacy Regulations

Data protection and privacy regulations are becoming stricter worldwide. Tech Mahindra must comply with rules like GDPR and CCPA, which impacts its services. This means protecting client data to avoid penalties. Non-compliance can lead to significant financial repercussions.

- GDPR fines can reach up to 4% of annual global turnover.

- CCPA violations can result in fines of up to $7,500 per record.

Intellectual Property Laws

Intellectual property laws significantly impact Tech Mahindra's operations. Strong enforcement of these laws protects their software and proprietary processes. This protection is essential for maintaining a competitive edge and securing revenue. Weak IP protection in some regions could lead to losses from piracy or infringement. Globally, IP theft costs are estimated to be in the hundreds of billions annually, with the US alone facing losses exceeding $225 billion in 2024.

- Global IP theft costs are estimated to be in the hundreds of billions annually.

- US losses due to IP theft exceeded $225 billion in 2024.

Political factors significantly shape Tech Mahindra's landscape. Geopolitical tensions and trade regulations impact its operations and client investments. Data protection and IP laws necessitate strict compliance, influencing service offerings and potentially causing financial repercussions.

| Factor | Impact | 2024 Data |

|---|---|---|

| Geopolitical Risk | IT spending decrease | 5% drop in IT spending in affected areas |

| IP Theft | Financial losses | US losses > $225B due to IP theft |

| GDPR/CCPA | Compliance costs and fines | GDPR fines up to 4% of global turnover, CCPA up to $7,500/record |

Economic factors

Tech Mahindra's success is significantly linked to global economic health. Inflation and slower growth, especially in the USA and Europe, may curb deal wins and affect pricing. Strong global economies typically boost IT spending. For instance, the global IT services market is projected to reach $1.4 trillion in 2024.

Tech Mahindra, with global operations, faces currency exchange rate risks. In 2024, a stronger dollar could boost reported revenue from international sales. Conversely, a weaker rupee could decrease profitability. Currency volatility necessitates hedging strategies. For example, in Q3 FY24, the company's revenue was INR 13,129.2 Cr.

Inflation directly impacts Tech Mahindra's operational costs, potentially increasing expenses like employee salaries and infrastructure. The company must carefully manage rising costs while navigating market pressures on its service pricing. As of late 2024, inflation rates in key markets like the US and Europe have shown volatility, influencing Tech Mahindra's financial planning. For example, in Q4 2024, the US inflation rate was around 3.1%, impacting various business costs.

Client IT Spending

Client IT spending is crucial for Tech Mahindra's revenue. Economic conditions significantly influence IT budgets. For instance, in 2023, global IT spending reached approximately $4.7 trillion. Growth encourages tech investment, while downturns cut spending. This directly impacts projects and revenue.

- Global IT spending expected to reach $5.06 trillion in 2024.

- Tech Mahindra's revenue growth closely tied to client IT spending trends.

- Economic uncertainty can lead to project delays or cancellations.

- Digital transformation initiatives drive IT spending in growth periods.

Competition and Pricing Pressure

The IT services sector is fiercely competitive, with many firms chasing projects. This rivalry often results in price wars, potentially squeezing Tech Mahindra's profits. To stay afloat, the company must prove its worth and stand out from the crowd. Staying profitable means offering unique, high-value services.

- In 2024, the global IT services market was valued at approximately $1.3 trillion.

- Tech Mahindra's revenue for fiscal year 2024 was around $6.5 billion.

- The average operating margin in the IT services industry hovers around 15-20%.

Economic conditions globally shape Tech Mahindra’s performance, with inflation impacting operational expenses like salaries. Currency fluctuations affect reported revenue and profitability, necessitating hedging. Client IT spending, closely linked to economic health, drives revenue, while sector competition pressures margins.

| Economic Factor | Impact on Tech Mahindra | Data/Example (2024/2025) |

|---|---|---|

| Inflation | Increases operational costs | Q4 2024 US inflation around 3.1% |

| Currency Exchange | Affects revenue & profit | Stronger USD boosts reported revenue; weaker rupee hurts profitability |

| IT Spending | Drives revenue growth | Global IT spend: $5.06 trillion (2024) |

Sociological factors

Tech Mahindra's success hinges on skilled IT professionals. The fast-changing tech world needs updated skills, especially in AI and cloud. A skills gap can hurt project delivery and raise costs. In 2024, India's IT sector faced a talent shortage, with 45% of companies reporting difficulties in hiring. The global AI market is predicted to reach $1.81 trillion by 2030.

Changing societal norms significantly impact Tech Mahindra. Evolving employee expectations, like work-life balance, are key. In 2024, 60% of employees favor flexible work. Adapting ensures talent attraction. A productive workforce depends on this shift.

Societal focus on diversity and inclusion shapes Tech Mahindra's hiring and workplace culture. A diverse workforce attracts a broader talent pool and drives innovation. In 2024, Tech Mahindra launched initiatives to enhance diversity metrics. Specifically, they aimed for a 40% female representation in leadership by 2025, aiming to mirror global demographic trends.

Customer Behavior and Digital Adoption

Customer behavior shifts and digital tech adoption fuel demand for Tech Mahindra's services. As clients and their customers become digitally savvy, the need for advanced IT solutions grows. This trend is evident in the 2024 surge in digital transformation projects. Tech Mahindra's consulting services see a rise, with a projected 15% increase in demand by early 2025.

- Digital transformation spending worldwide is projected to reach $3.9 trillion in 2024.

- Around 70% of businesses plan to increase their digital transformation budgets in 2024.

- Tech Mahindra reported a 4.6% growth in digital revenue in the last quarter of 2024.

Corporate Social Responsibility (CSR) Expectations

Societal demands for corporate social responsibility (CSR) significantly shape Tech Mahindra's standing and relationships. CSR initiatives can boost Tech Mahindra's brand image and attract stakeholders. The company's commitment to societal well-being is increasingly crucial. In 2024, CSR spending by IT firms increased by 15%.

- Tech Mahindra's CSR spending in FY24 was ₹150 crore.

- Stakeholder expectations emphasize ethical conduct.

- CSR enhances brand reputation and loyalty.

Societal trends affect Tech Mahindra through CSR focus, diversity efforts, and digital adoption. The push for corporate social responsibility, especially environmental initiatives, has grown significantly. This impacts their operational choices and public image, with over 60% of consumers prioritizing sustainable practices. Focus on diversity and inclusion further shape company culture.

| Sociological Factor | Impact | 2024 Data |

|---|---|---|

| CSR & Sustainability | Brand Image, Stakeholder Relations | CSR spending by IT firms increased by 15%, reaching an estimated $400 billion globally. Tech Mahindra's FY24 CSR spend: ₹150 crore. |

| Diversity & Inclusion | Talent Acquisition, Innovation | Tech Mahindra aims for 40% female leadership by 2025; global corporate diversity budgets rose 18% in 2024. |

| Digital Adoption | Service Demand, Customer Expectations | Digital transformation spending: $3.9 trillion (2024 estimate); ~70% of businesses increased digital budgets. |

Technological factors

Rapid AI and ML advancements reshape IT services. Tech Mahindra must invest in these areas for competitive solutions. Generative AI (GenAI) disrupts and drives client cost efficiency. The global AI market is projected to reach $1.8 trillion by 2030. Tech Mahindra's focus on AI solutions grew by 25% in 2024.

Cloud computing's global adoption presents Tech Mahindra with opportunities and challenges. It must offer robust cloud services and assist clients in cloud migration and management. Multi-cloud strategies demand specialized expertise. The worldwide cloud computing market is projected to reach $1.6 trillion by 2025, per Gartner.

Tech Mahindra's prospects are significantly shaped by 5G and 6G advancements. The company can leverage these technologies for network transformation services. According to a 2024 report, the 5G market is projected to reach $14.7 billion by 2025. This creates opportunities in edge computing and new use cases for Tech Mahindra.

Cybersecurity Threats

Cybersecurity threats are escalating, demanding ongoing investments in solutions and expertise. Tech Mahindra faces the challenge of safeguarding its systems and clients' data from increasingly sophisticated cyberattacks. The global cybersecurity market is projected to reach $345.7 billion in 2024, reflecting the urgency of robust defenses. Data breaches cost companies an average of $4.45 million in 2023, highlighting the financial impact of cyber vulnerabilities. Tech Mahindra needs to prioritize cybersecurity to maintain client trust and operational integrity.

- Global cybersecurity market expected to hit $345.7 billion in 2024.

- Average cost of a data breach was $4.45 million in 2023.

Automation and Robotics

Automation and robotics significantly influence Tech Mahindra's IT and BPO service delivery. The company can boost efficiency and introduce automation-as-a-service offerings. However, workforce adjustments are crucial. The global robotic process automation market is projected to reach $13.9 billion by 2025, presenting both opportunities and challenges. Tech Mahindra's strategic investments in these technologies are key.

- Market growth: The RPA market is expected to reach $13.9 billion by 2025.

- Efficiency gains: Automation can reduce operational costs by up to 30%.

- Workforce impact: Up to 20% of current IT jobs could be automated.

Tech Mahindra must prioritize AI and ML, with the AI market predicted at $1.8T by 2030. Cloud computing offers significant growth opportunities, aiming for a $1.6T market by 2025. Cybersecurity investments are critical, as the global market hits $345.7B in 2024 due to rising threats.

| Technology Area | Market Size/Forecast (2024/2025) | Tech Mahindra's Focus |

|---|---|---|

| Artificial Intelligence (AI) | $1.8 Trillion (2030 forecast) | AI Solutions, GenAI integration |

| Cloud Computing | $1.6 Trillion (2025 forecast) | Cloud Services, migration & management |

| Cybersecurity | $345.7 Billion (2024) | Cybersecurity solutions and expertise |

Legal factors

Tech Mahindra, operating globally, faces a complex web of international laws. These include labor laws, tax regulations, and industry-specific compliance rules. Non-compliance can lead to legal battles and financial repercussions. In 2024, the company allocated a significant portion of its budget, approximately $50 million, to ensure regulatory adherence across its global operations. This commitment reflects the critical importance of legal compliance for sustained business success.

Tech Mahindra must comply with data privacy laws like GDPR and CCPA. In 2024, data breaches cost companies an average of $4.45 million. Non-compliance can lead to hefty fines, potentially impacting the company's financial performance. Maintaining robust data security is vital to retain customer trust and avoid legal issues.

Tech Mahindra must navigate varied labor laws across its global operations. In India, recent amendments impact hiring and worker rights. For example, the Indian labor code consolidates several laws, affecting employment terms. Globally, compliance costs can be significant, with potential fines if regulations aren't followed. Tech Mahindra's HR strategies must evolve to align with these changing legal landscapes.

Contract Law and Intellectual Property Rights

Tech Mahindra's operations are significantly shaped by contract law, given its extensive collaborations with clients and partners. Navigating diverse legal frameworks across different regions is essential for its business continuity. Intellectual property protection is also a critical legal aspect. Tech Mahindra must safeguard its innovations and brand. In 2024, legal expenses amounted to approximately $45 million, reflecting the importance of legal compliance and IP protection.

- Contract law compliance is crucial for international operations.

- IP protection includes patents, trademarks, and copyrights.

- Legal risks include contract disputes and IP infringement.

- Tech Mahindra invests in legal teams and compliance.

Litigation and Legal Proceedings

Tech Mahindra, like other global entities, navigates potential legal challenges. Such proceedings, from contract disputes to regulatory investigations, can affect its finances and image. For instance, in fiscal year 2024, the company allocated ₹1,500 crore for contingent liabilities. Legal battles might impact profitability and investor confidence.

- ₹1,500 crore allocated for contingent liabilities in fiscal year 2024.

- Legal proceedings can affect profitability and investor confidence.

Tech Mahindra manages a complex web of international and local laws. Data privacy, like GDPR and CCPA, necessitates robust security to avoid penalties, with average breach costs around $4.45 million in 2024. Contract law, essential for global operations, demands careful compliance, and intellectual property protection safeguards innovation. In 2024, legal expenses hit about $45 million.

| Legal Aspect | Description | Financial Impact (2024) |

|---|---|---|

| Compliance Costs | Meeting global regulations | $50 million (budget allocation) |

| Data Breaches | GDPR, CCPA violations | Average cost of $4.45 million |

| Contingent Liabilities | Potential legal outcomes | ₹1,500 crore allocated |

Environmental factors

Climate change and sustainability are crucial, influencing Tech Mahindra and its clients. There's growing pressure to cut carbon emissions and enhance energy efficiency. The IT sector, including Tech Mahindra, faces scrutiny; in 2024, the IT industry's carbon footprint was estimated at 4% of global emissions. Companies must adopt eco-friendly practices to remain competitive and meet environmental standards. This includes investing in green technologies and sustainable operations.

Tech Mahindra must adhere to diverse environmental regulations globally, focusing on energy use, waste disposal, and emissions. Compliance costs are rising due to stricter rules. For instance, the IT sector's carbon footprint is under scrutiny. In 2024, the company's sustainability initiatives, like renewable energy adoption, are key to meeting these challenges and maintaining operational licenses.

Resource scarcity, especially water, is an environmental concern for Tech Mahindra, particularly at its large campuses. Water conservation and efficient management are increasingly vital. Water stress is a growing global issue, impacting operational costs. In 2024, the IT sector faced scrutiny regarding its environmental footprint, including water usage.

E-waste Management

The IT industry, including Tech Mahindra, inherently produces electronic waste (e-waste). Managing and recycling e-waste responsibly is a crucial environmental concern. Tech Mahindra must implement practices to lessen its environmental footprint. Proper e-waste management is vital for sustainability and regulatory compliance.

- In 2023, the world generated 62 million tons of e-waste.

- Only about 22.3% of global e-waste was recycled in an environmentally sound manner.

- The value of raw materials in e-waste is estimated at $62 billion.

Client and Investor Focus on ESG

Clients and investors are increasingly prioritizing Environmental, Social, and Governance (ESG) factors, influencing business and investment choices. Tech Mahindra's environmental performance directly affects its ability to secure contracts and attract investments. Companies with strong ESG ratings often experience better financial performance. For example, in 2024, sustainable funds saw inflows despite market volatility.

- ESG assets are projected to reach $50 trillion by 2025.

- Tech Mahindra's sustainability initiatives include renewable energy adoption and carbon footprint reduction.

- Investors are using ESG ratings to assess risk and identify long-term value.

Environmental factors significantly shape Tech Mahindra's operations, driven by climate change and regulatory pressures.

The company must reduce its carbon footprint; the IT sector accounted for about 4% of global emissions in 2024.

E-waste management, vital for sustainability, is essential considering the 62 million tons of e-waste generated globally in 2023, with only 22.3% recycled.

| Environmental Factor | Impact on Tech Mahindra | 2024/2025 Data/Insights |

|---|---|---|

| Climate Change | Need for energy efficiency, emissions reduction | IT sector emissions: ~4% of global emissions (2024). |

| Environmental Regulations | Compliance costs, operational adjustments | Rising compliance costs; focus on renewable energy and sustainability. |

| Resource Scarcity | Water conservation efforts at campuses | IT sector under scrutiny for environmental footprint, including water usage. |

| E-waste | Responsible disposal and recycling of electronics | 62M tons of e-waste generated globally in 2023; only 22.3% recycled. |

| ESG Considerations | Influences investment and contract opportunities | ESG assets projected to reach $50T by 2025; sustainable funds saw inflows in 2024. |

PESTLE Analysis Data Sources

The Tech Mahindra PESTLE analysis uses industry reports, financial news, and governmental datasets to cover a broad range of macro-environmental factors.