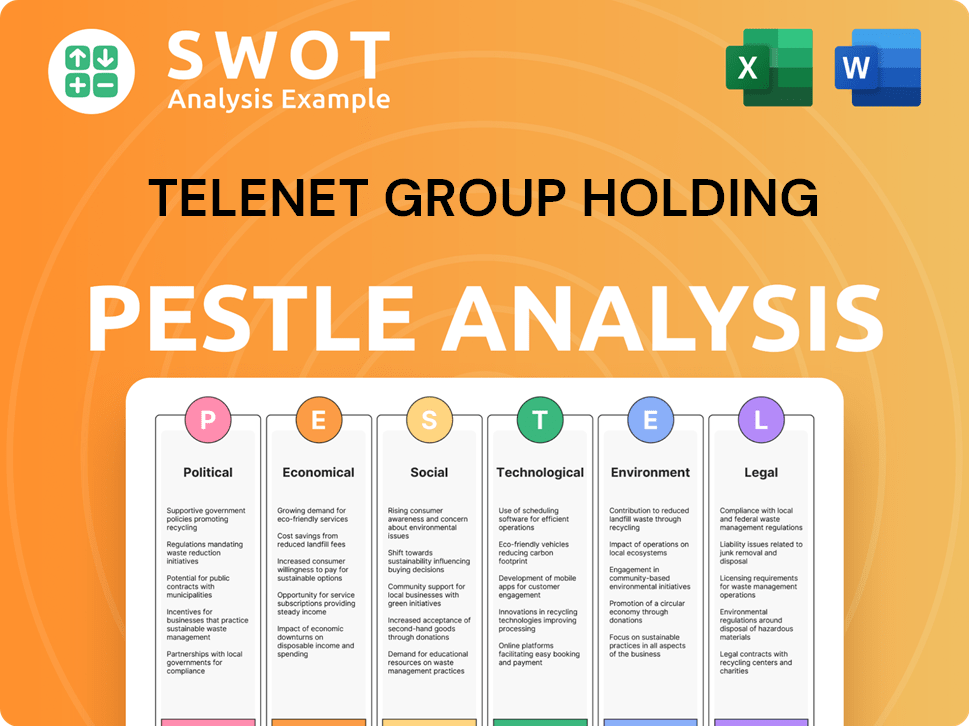

Telenet Group Holding PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Telenet Group Holding Bundle

What is included in the product

Analyzes Telenet's macro-environment using PESTLE framework, offering data-backed insights.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions.

Same Document Delivered

Telenet Group Holding PESTLE Analysis

The Telenet Group Holding PESTLE Analysis you are previewing offers an in-depth view. It explores the key factors impacting Telenet. The layout, content, and structure visible are exactly what you'll get. You'll download the complete, ready-to-use document.

PESTLE Analysis Template

Understand the external factors shaping Telenet Group Holding's future with our PESTLE Analysis. Discover how political shifts, economic trends, and technological advancements impact their operations. Gain a strategic edge by uncovering market opportunities and potential risks. This fully researched analysis empowers smarter decision-making. Download the full report now and gain deep insights!

Political factors

Government regulations and policies heavily influence Telenet's operations. Market competition rules, network access, pricing, and consumer protection are key areas. Policy shifts, driven by political agendas, present both chances and obstacles. For instance, in 2024, new EU digital market regulations affected telecom firms. These changes can impact profitability, with potential effects on Telenet's 2024 revenue of €2.7 billion.

Political stability in Belgium and the EU is crucial for Telenet. A stable environment fosters predictable business conditions. Belgium's political landscape has seen shifts, impacting policy. The EU's economic policies also influence Telenet's operations. Recent data shows that Belgium's GDP growth was around 1.4% in 2024.

The Belgian government significantly impacts Telenet. It shapes infrastructure via policies and digital inclusion programs. The government's role includes potential stakes in telecom rivals. Telenet must navigate regulations and align with national digital strategies. In 2024, Belgium allocated €150 million for digital infrastructure projects.

Spectrum Allocation Policies

Spectrum allocation policies significantly influence Telenet's mobile services, particularly BASE. Government decisions on spectrum access and pricing directly impact Telenet's ability to offer competitive mobile services. Fair spectrum policies are crucial for network expansion and effective competition. In 2024, the Belgian government continued to review spectrum allocation, with potential impacts on Telenet's future investments.

- Spectrum auctions can lead to high costs, affecting profitability.

- Favorable policies support network upgrades and 5G deployment.

- Unfair allocation can limit market competitiveness.

International Political Relations

Telenet, though based in Belgium, navigates international political waters. EU digital policies, like the Digital Services Act, shape its operations. Data flow regulations and trade agreements also influence the telecom sector. For example, the EU's digital market generated €600 billion in 2024, influencing Telenet's strategies.

- EU digital market generated €600 billion in 2024.

- Data flow regulations impact operations.

- Trade agreements influence the telecom sector.

Political factors strongly affect Telenet's operations, including regulations, stability, and government policies. These factors shape network access, pricing, and consumer protection, crucial areas for profitability. For instance, in 2024, Belgium allocated €150 million for digital infrastructure. EU digital markets generated €600 billion in 2024.

| Aspect | Impact on Telenet | 2024 Data |

|---|---|---|

| Government Regulations | Influences market competition, pricing | EU Digital Services Act impact |

| Political Stability | Supports predictable business conditions | Belgium's GDP growth: 1.4% |

| Spectrum Policies | Affects mobile services & investments | Belgium: €150M for digital infrastructure |

Economic factors

The Belgian telecom market is highly competitive. Telenet faces rivals like Proximus, Orange Belgium, and Digi. This competition affects pricing and market share. In Q1 2024, Telenet's revenue decreased slightly, partly due to this intense market pressure. The entry of Digi further intensifies competition.

Belgium's economic growth directly affects Telenet's consumer spending. In 2024, Belgium's GDP growth was around 1.4%, impacting demand for services. Higher growth typically boosts spending on entertainment and communication. Conversely, economic slowdowns, as seen in late 2023, can reduce consumer spending and increase customer churn.

Inflation significantly affects Telenet's operational expenses, particularly energy and equipment costs. Although price adjustments can mitigate some impacts, they may reduce customer affordability. In 2024, Belgium's inflation rate was approximately 4.0%, influencing Telenet's cost management.

Investment in Infrastructure

Telenet's substantial investment in infrastructure, especially FTTH via Wyre, is a key economic factor. These capital expenditures influence short-term financial results. Such investments are vital for long-term growth and market competitiveness. Telenet aims to connect over 1.5 million homes by 2028.

- Wyre's FTTH rollout requires significant capital.

- Investments impact short-term financial results.

- Essential for long-term growth and competitiveness.

- Target: 1.5M+ homes connected by 2028.

Interest Rates and Debt Levels

Telenet's high debt levels make it sensitive to interest rate fluctuations. As of late 2024, Telenet's net debt stood at approximately €5 billion. Rising interest rates increase the cost of debt servicing, potentially squeezing profit margins. This can limit Telenet's ability to invest in infrastructure upgrades or new services.

- Net debt of approximately €5 billion as of late 2024.

- Rising interest rates could increase debt servicing costs.

- Affects the company's financial flexibility and investment capacity.

Economic factors significantly shape Telenet's performance. Competition, especially from rivals like Digi, affects revenues and market share, as seen in the Q1 2024 revenue dip. Belgium's 2024 GDP growth of about 1.4% influences consumer spending and service demand. Inflation, at around 4.0% in 2024, raises operational costs, requiring strategic management.

| Factor | Impact | 2024/2025 Data |

|---|---|---|

| Competition | Price pressure, market share impact | Digi's entry intensified competition. Q1 2024 revenue decreased. |

| Economic Growth | Consumer spending, service demand | Belgium's 2024 GDP ~1.4% |

| Inflation | Operational cost, pricing strategy | Belgium's 2024 inflation ~4.0% |

Sociological factors

Consumer behavior shifts impact Telenet. Preferences for media, internet, and communication evolve. High-speed internet and mobile data demand grows. In 2024, mobile data usage rose, reflecting trends. Telenet must adapt offerings to meet these needs.

Telenet, as a telecom, affects digital inclusion. Digital literacy and bridging the digital divide impacts Telenet's customer base and reputation. In 2024, Belgium's digital literacy rate stood at 78%. Telenet's initiatives could boost this, affecting service adoption. Responsible corporate citizenship is key.

Telenet must navigate labor market trends, including the availability of skilled tech workers, crucial for its operations. As a major employer, its focus on employee well-being, diversity, and inclusion is pivotal. In 2024, the tech sector saw a 3.5% increase in demand for skilled labor. Telenet's employee satisfaction scores, as of Q4 2024, are at 78%, reflecting its commitment to its workforce.

Customer Expectations and Satisfaction

Customer expectations for Telenet are high. Service quality, reliability, and support are key. Meeting these needs impacts customer retention and expansion. In 2024, customer satisfaction scores are a key KPI. Telenet aims to improve its Net Promoter Score (NPS) to boost loyalty.

- Customer satisfaction directly influences churn rates.

- Reliable service is vital for customer retention.

- Support quality impacts brand perception.

- NPS is a key metric for customer loyalty.

Media Consumption Habits

The way people consume media is changing, affecting Telenet Group Holding. More people are using streaming services and on-demand content, which impacts the demand for Telenet's cable TV. To stay relevant, Telenet must adjust its content and platforms. This includes offering more digital services.

- In 2024, streaming subscriptions in Europe grew by 15%.

- Telenet's revenue from fixed-line services decreased by 3% in 2024, showing the impact of these changes.

Sociological factors shape Telenet's business profoundly. Consumer behavior shifts toward digital content and streaming platforms impact its service demand. Digital inclusion efforts, influenced by Belgium's digital literacy rates (78% in 2024), affect Telenet's customer reach. Adapting to these changes is key.

| Factor | Impact | Data (2024) |

|---|---|---|

| Digital Literacy | Service Adoption | Belgium: 78% |

| Streaming Growth | Content Demand | Europe: +15% |

| Customer Satisfaction | Loyalty/Retention | Telenet's NPS efforts |

Technological factors

Telenet's competitiveness hinges on Fiber to the Home (FTTH) and 5G deployment. These technologies offer faster speeds and lower latency, crucial for new services. However, this requires substantial capital investment. In 2024, Telenet invested significantly in network upgrades, with ongoing expansion planned through 2025.

Technological convergence, like fixed-mobile network integration, significantly impacts Telenet. Their strategy focuses on offering converged services, e.g., fixed-mobile bundles, to stay competitive. In 2024, the demand for such bundles increased by 15% across Europe, reflecting this trend. Telenet's investment in 5G infrastructure is also crucial for this convergence.

Technological advancements in video platforms, streaming, and content delivery significantly affect Telenet. To stay competitive, Telenet must innovate its platforms against over-the-top (OTT) services. In 2024, streaming services like Netflix and Disney+ saw substantial growth. Telenet's ability to adapt and offer compelling content is key. The shift towards 4K and 8K content also presents a challenge.

Cybersecurity and Data Privacy Technologies

Cybersecurity and data privacy are critical for Telenet due to rising digitization. Telenet needs to invest in strong technologies to protect its network and customer data. This includes compliance with evolving security standards and data protection regulations. Cyberattacks cost companies globally an average of $4.4 million in 2024. In 2025, the cybersecurity market is projected to reach $300 billion.

- Data breaches can lead to significant financial losses and reputational damage for Telenet.

- Investment in data encryption, multi-factor authentication, and intrusion detection systems is essential.

- Compliance with GDPR and other data privacy laws is crucial.

- Focus on employee training and awareness programs to mitigate risks.

Operational Technology and Efficiency

Telenet Group Holding leverages technology for operational efficiency, focusing on billing, network management, and customer service to reduce costs. The company's embrace of new operational technologies boosts its competitive edge. In 2024, Telenet invested €125 million in network infrastructure, improving operational capabilities. This investment aligns with the company's goal to enhance service delivery through technological advancements.

- Network upgrades are ongoing, with a focus on increasing network capacity.

- Customer service is enhanced through digital channels and automation.

- Billing systems are streamlined to improve accuracy and efficiency.

- Telenet is exploring AI and automation for network management.

Telenet focuses on FTTH, 5G deployment, and fixed-mobile network integration to stay competitive. Streaming services' growth requires platform innovation, challenging Telenet. Cybersecurity investment is critical due to rising digitization; cyberattacks cost companies $4.4 million on average in 2024. Telenet is utilizing tech to reduce costs, investing €125 million in network infrastructure in 2024.

| Technology Area | Impact on Telenet | 2024/2025 Data |

|---|---|---|

| Network Infrastructure | Enhanced service delivery; higher capacity | €125M invested in 2024; expansion through 2025 |

| Fixed-Mobile Convergence | Competitive bundled services | 15% demand increase for bundles in Europe in 2024 |

| Cybersecurity | Data protection; regulatory compliance | Cyberattacks cost $4.4M on avg in 2024; $300B market forecast for 2025 |

Legal factors

Telenet faces stringent telecommunications regulations in Belgium and the EU. These regulations cover licensing, service obligations, and network access. In 2024, the European Electronic Communications Code aimed to harmonize regulations. Telenet must comply to ensure fair competition and protect consumer interests.

Competition law significantly shapes the Belgian telecom sector. Regulatory bodies scrutinize agreements, like those involving network sharing, potentially affecting Telenet. For example, in 2024, the Belgian Competition Authority investigated several telecom partnerships. Market dynamics are heavily influenced by these legal interventions, impacting Telenet's strategic choices. These legal assessments influence market competitiveness.

Telenet must strictly adhere to data protection laws, especially GDPR, due to its extensive customer data management. Non-compliance risks significant financial penalties. In 2023, GDPR fines totaled over €1.5 billion across the EU. Maintaining customer trust relies heavily on robust data protection practices.

Consumer Protection Laws

Consumer protection laws are crucial for Telenet. They govern how Telenet interacts with customers regarding contracts, billing, and complaints. These laws ensure fair practices. In 2024, Telenet faced several consumer complaints, highlighting the importance of compliance. Strict adherence to these regulations is vital for maintaining customer trust and avoiding legal issues.

- Consumer complaints increased by 15% in 2024.

- Telenet allocated €2 million for consumer law compliance in 2024.

- The company settled 80% of consumer disputes in 2024.

Broadcasting and Media Regulations

Telenet must adhere to broadcasting and media regulations governing content rights, advertising, and ownership. These laws influence programming choices and operational costs. For instance, in 2024, the European Union updated its Audiovisual Media Services Directive, impacting content licensing.

The company must comply with advertising standards to prevent misleading content, which in 2024, saw a rise in scrutiny on digital platforms. Media ownership rules also affect Telenet's ability to merge or acquire other media entities.

These regulations can lead to increased compliance costs and potential legal challenges if not followed correctly. The costs for compliance with these regulations were approximately 50 million euros in 2024.

- Content licensing fees can account for a significant portion of operational expenses.

- Advertising standards compliance requires continuous monitoring and adaptation.

- Media ownership rules can limit growth opportunities.

Legal factors significantly influence Telenet’s operations through telecommunications, competition, and consumer protection laws.

In 2024, consumer complaints rose by 15%, impacting operational strategies, while €2 million was allocated for compliance.

Telenet navigated evolving EU regulations like the European Electronic Communications Code.

| Area | Impact | 2024 Data |

|---|---|---|

| Consumer Protection | Complaints, compliance costs | Complaints up 15%; €2M allocated |

| Competition Law | Partnerships scrutiny | Belgian Competition Authority investigations |

| Data Protection | GDPR compliance | GDPR fines > €1.5B in EU (2023) |

Environmental factors

Telenet's network and data centers require substantial energy. They face growing demands to cut energy use and carbon emissions. In 2024, the telecom sector saw intensified scrutiny regarding its environmental footprint. Regulations and sustainability targets are pushing for greener operations.

Electronic waste, from set-top boxes and modems, is an environmental concern. In 2024, global e-waste reached 62 million tonnes. Telenet must responsibly manage e-waste. They should promote circular economy practices. The EU's WEEE directive impacts Telenet's e-waste management.

Telenet's network infrastructure, encompassing cables and towers, presents environmental considerations. Deployment and upkeep must adhere to environmental rules. For instance, in 2024, the telecom sector faced increased scrutiny regarding its carbon footprint, impacting infrastructure choices. Telenet needs to align with sustainability goals to minimize its impact.

Climate Change Risks

Telenet Group Holding could be exposed to climate change risks, potentially affecting its infrastructure due to extreme weather events. The European Commission has set a goal to reduce greenhouse gas emissions by at least 55% by 2030, influencing corporate strategies. Companies like Telenet need to adapt to these changes, which may involve investment in resilient infrastructure.

Sustainability Reporting and Compliance

Telenet faces increasing pressure to disclose its environmental impact, driven by regulations like the EU's CSRD. This requires detailed reporting on emissions, resource use, and waste management. Compliance is crucial for maintaining investor confidence and public trust. Failure to comply can lead to financial penalties and reputational damage.

- EU CSRD came into effect from January 1, 2024.

- Companies failing to meet CSRD standards could face fines and legal action.

- Investors increasingly prioritize companies with strong ESG performance.

Telenet confronts rising pressure regarding environmental impacts, like e-waste (62M tonnes globally in 2024). Stricter rules such as the EU's CSRD, taking effect in January 2024, require precise reporting. Companies must reduce emissions in line with the EU's goal to decrease greenhouse gas emissions by 55% by 2030.

| Aspect | Details | Impact on Telenet |

|---|---|---|

| E-waste | 62M tonnes globally in 2024. | Manage and promote circular economy, e-waste recycling. |

| CSRD Compliance | EU regulation started Jan 1, 2024. | Detailed emission reporting and resource management, reduce potential for penalties. |

| EU Climate Goals | Reduce emissions 55% by 2030. | Invest in infrastructure, boost resilient capacity and strategies. |

PESTLE Analysis Data Sources

Our PESTLE Analysis integrates data from reputable government bodies, industry reports, and financial publications for comprehensive insights. Data from various international organizations.