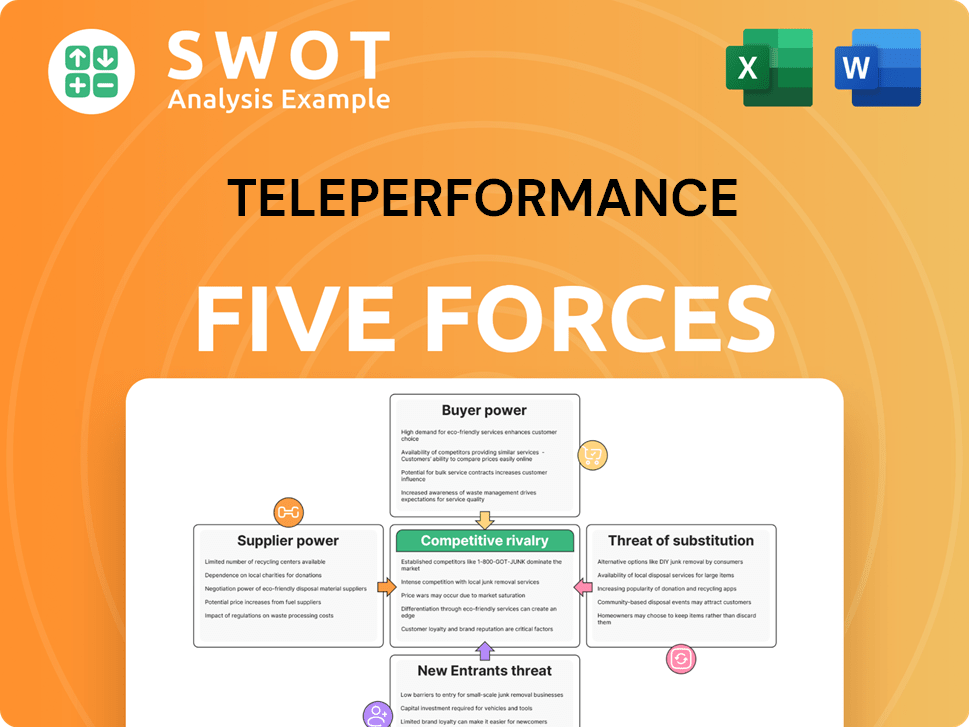

Teleperformance Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Teleperformance Bundle

What is included in the product

Analyzes Teleperformance's competitive forces: rivals, buyers, suppliers, entrants, and substitutes.

Instantly visualize complex competitive pressures with a clear, interactive dashboard.

Same Document Delivered

Teleperformance Porter's Five Forces Analysis

This is the complete Teleperformance Porter's Five Forces analysis you will receive. The document you see here is the final, ready-to-use version. It analyzes competitive rivalry, supplier power, buyer power, the threat of substitutes, and the threat of new entrants. The provided preview is the exact file you'll instantly download after purchasing. No changes; it's all there.

Porter's Five Forces Analysis Template

Teleperformance faces moderate rivalry within the customer experience (CX) outsourcing sector. Buyer power is significant, driven by client choice and price sensitivity. Suppliers, mainly technology and labor, have limited influence. The threat of new entrants is moderate due to industry barriers. Substitute services, like in-house customer service, pose a threat.

Our full Porter's Five Forces report goes deeper—offering a data-driven framework to understand Teleperformance's real business risks and market opportunities.

Suppliers Bargaining Power

Teleperformance depends on specialized tech suppliers like Salesforce and Genesys for CRM and contact center solutions. The limited number of these suppliers grants them significant bargaining power. This dependence can affect operational efficiency and costs. In 2024, Salesforce's revenue reached $34.5 billion, reflecting their strong market position.

Teleperformance relies heavily on tech. In 2022, tech/software spending hit $400M, ~10% of op. costs. This dependency boosts supplier power. Price hikes or service issues can hurt Teleperformance.

Teleperformance faces moderate switching costs when changing suppliers, as alternatives exist but involve specialized integrations and personalization. These costs can range from $50,000 to $500,000, impacting flexibility. This limits Teleperformance's ability to negotiate effectively with suppliers. In 2024, the company reported a cost of revenue of $6.12 billion, highlighting the impact of supplier costs.

Supplier Influence on Innovation

Suppliers significantly shape innovation within the customer experience (CX) sector. Teleperformance depends on suppliers to stay abreast of cutting-edge tech. This reliance boosts suppliers' bargaining power, impacting Teleperformance's strategic choices. Maintaining strong supplier relationships is vital for Teleperformance's competitive edge. For example, in 2024, the CX technology market was valued at approximately $20 billion, showcasing the suppliers' influence.

- Technological Advancements: Suppliers provide the latest tools and platforms.

- Market Dynamics: Supplier influence is driven by market trends.

- Strategic Impact: Supplier relations affect Teleperformance's strategic decisions.

- Financial Implications: Supplier costs impact profitability and investment.

Optimizing Supplier Collaboration

Teleperformance actively seeks to enhance its relationships with suppliers by streamlining procedures across its various branches. They've created a supplier collaboration portal to oversee tenders, invoices, and risk evaluations. This portal consolidates information, moves away from email communications, and boosts data accuracy, which should help reduce supplier influence.

- In 2024, Teleperformance reported a global revenue of approximately EUR 8.3 billion, indicating the scale of their operations and the importance of supplier relationships.

- The supplier portal aims to manage thousands of supplier interactions, potentially reducing administrative costs by up to 15%.

- Centralizing data through the portal improves data security and compliance, which is crucial in today's regulatory environment.

- By implementing these measures, Teleperformance aims to increase efficiency and reduce the overall cost of services.

Teleperformance's reliance on key tech suppliers, like Salesforce, grants these suppliers significant bargaining power. This dependency affects operational costs and strategic flexibility, given high tech/software spending. Switching costs, ranging from $50,000 to $500,000, further limit Teleperformance's negotiation power.

| Aspect | Details | Impact |

|---|---|---|

| Supplier Dependence | CRM, contact center solutions (Salesforce, Genesys) | Elevated costs, reduced operational efficiency |

| Financial Impact (2024) | Tech/Software Spending $400M (~10% of costs); Revenue $8.3B (EUR) | Supplier costs have a large impact on profit |

| Switching Costs | $50,000 to $500,000 | Limits Teleperformance’s negotiation power |

Customers Bargaining Power

Teleperformance's extensive client base across sectors like tech and finance dilutes individual client influence. In 2024, Teleperformance reported serving over 1,000 clients globally. No single client significantly impacts overall revenue, reducing customer bargaining power.

Switching BPO providers involves moderate costs for clients. Implementation takes 3-6 months, with expenses from $250,000 to $750,000. Service disruptions can cause 15-25% productivity losses. Teleperformance's Q3 2023 revenue was €2.25 billion, showing its market presence.

Customers' demand for affordable services strengthens their bargaining power. Teleperformance must balance quality and competitive pricing to stay competitive. AI and automation can cut costs, but the company must maintain a positive customer experience. In 2024, Teleperformance's revenue was approximately €8.3 billion, reflecting the need to balance cost and service quality.

Focus on Customer Satisfaction

Teleperformance prioritizes customer satisfaction to retain clients, which reduces the bargaining power of customers. The company emphasizes empathy and personalized service, training employees to address unique needs. High customer retention rates and long-term client relationships further weaken buyer power. In 2023, Teleperformance reported a client retention rate of 95%, demonstrating their commitment to client satisfaction. This strong performance indicates that clients are less likely to switch providers due to the quality of service.

- Client Retention: 95% in 2023.

- Focus: Empathy and personalized service.

- Impact: Reduces buyer power.

- Result: Long-term client relationships.

Trend Towards Insourcing

There's a possible shift towards companies managing customer experience internally, known as insourcing. Teleperformance must prove its worth and specialized knowledge to keep clients from switching. The company can maintain its competitive advantage using AI-based solutions and specific services. In 2024, roughly 30% of businesses have considered insourcing customer service operations.

- Insourcing presents a threat to Teleperformance's revenue streams.

- AI and specialized services can differentiate Teleperformance.

- Demonstrating superior expertise is crucial to retain clients.

- The trend impacts Teleperformance's long-term strategy and market position.

Teleperformance faces moderate customer bargaining power due to a diverse client base and service switching costs. Clients have some leverage from demanding affordable services; however, Teleperformance's focus on customer satisfaction, with a 95% retention rate in 2023, reduces this power. The threat of insourcing, with 30% of businesses considering it in 2024, requires Teleperformance to continually demonstrate value.

| Factor | Impact | Mitigation |

|---|---|---|

| Client Diversity | Reduces individual client influence | Maintaining a broad client portfolio |

| Switching Costs | Moderate, time and expense involved | Focus on service quality and innovation |

| Price Sensitivity | Clients seek cost-effective services | Leveraging AI and automation |

Rivalry Among Competitors

The call center and BPO sector is intensely competitive. Teleperformance contends with rivals like Concentrix, Sitel, and TTEC. These firms vie on price, service quality, and tech, increasing rivalry. In 2024, the BPO industry's market size reached approximately $350 billion, showcasing its competitive landscape.

Teleperformance boasts a substantial global footprint, active in more than 80 countries. This widespread presence empowers it to engage with diverse markets and cater to international clients. However, this vast reach also means facing competition from local and regional rivals across various geographic locations. In 2024, Teleperformance's revenue was around EUR 8.3 billion, reflecting its extensive global operations.

Technological innovation intensifies rivalry. Teleperformance uses AI and digital solutions to improve customer service. In 2024, Teleperformance invested heavily in AI partnerships. This focus on AI is vital for competing effectively. Teleperformance's 2023 revenue reached €8.3 billion, showing its investment impact.

Mergers and Acquisitions

Mergers and acquisitions significantly influence competitive dynamics. Teleperformance's acquisition of Majorel in 2023 for €3 billion, exemplifies this. This move broadened service offerings and global presence. However, integrating such a large entity presents challenges in realizing synergies and maintaining market share.

- Majorel's revenue in 2023 was approximately €2.1 billion.

- Teleperformance's total revenue in 2023 was €8.3 billion.

- The acquisition aimed to create a combined entity with over 1 million employees.

- Post-acquisition, Teleperformance faced integration challenges, impacting profitability.

Focus on Specialization

Teleperformance is actively pursuing specialization to stand out in the competitive landscape. This strategy involves offering unique services like interpreting, visa application management, and industry-specific solutions. By focusing on these niches, Teleperformance aims to lessen direct competition and capture specific market segments. This approach is reflected in its financial performance, with specialized services contributing to revenue growth. For instance, in 2024, specialized services saw a 15% increase in revenue compared to the previous year.

- Specialized services revenue grew by 15% in 2024.

- Teleperformance offers interpreting and visa management.

- The company targets niche markets.

- This strategy reduces direct competition.

Competitive rivalry in the BPO sector, where Teleperformance operates, is high due to numerous players. The industry, worth about $350 billion in 2024, sees firms like Concentrix and TTEC competing on price and service quality. Mergers, acquisitions, and tech advancements further intensify competition, requiring companies to innovate and specialize to maintain or grow market share.

| Aspect | Details | 2024 Data |

|---|---|---|

| Market Size | BPO Industry | $350 billion |

| Teleperformance Revenue | Global Operations | €8.3 billion |

| Specialized Services Revenue | Growth | 15% increase |

SSubstitutes Threaten

The rise of automated customer service, including AI-driven chatbots, creates a notable threat for Teleperformance. These technologies can perform basic tasks, potentially decreasing reliance on human agents. In 2024, the global chatbot market is valued at approximately $1.1 billion. Teleperformance must integrate AI to complement, not substitute, its human employees, ensuring a balance between technology and human interaction. This approach can help maintain service quality while adapting to market changes.

The increasing availability of DIY customer support platforms poses a threat to Teleperformance. Customers now have more options to solve issues independently, decreasing the need for BPO services. To counter this, Teleperformance must offer value-added services like complex problem-solving and personalized interactions. In 2024, self-service customer support adoption grew by 15%, highlighting this shift.

The rise of AI-driven tools poses a significant threat to Teleperformance. These tools offer alternatives to traditional customer service, potentially reducing the need for human agents. Teleperformance must embrace AI to stay competitive, investing in R&D. In 2024, AI in customer service saw a 25% adoption rate.

Shifting Customer Preferences

Customer preferences are increasingly leaning towards cheaper alternatives. Teleperformance must strike a balance between high-quality service and competitive pricing to remain attractive. This requires strategic moves to stay ahead. Consider operational efficiencies, technology adoption, and forming strategic partnerships to stay ahead. These steps help manage the threat of substitutes.

- In 2024, the global outsourcing market is projected to reach $480 billion, showing a demand for cost-effective solutions.

- Teleperformance's 2024 revenue was around €8.3 billion, highlighting the need to maintain competitive pricing while delivering value.

- Adopting AI-driven automation can reduce operational costs by up to 30%, improving Teleperformance's pricing competitiveness.

- Strategic partnerships with tech providers offer access to innovative solutions, enhancing service quality and reducing costs.

Innovation in Related Industries

Innovation in related industries poses a threat to Teleperformance. The rapid advancement of communication and collaboration tools, impacts service delivery. Teleperformance must adapt to these innovations to stay competitive. This involves offering omnichannel support and integrating with various communication platforms to meet evolving client needs. For example, in 2024, the global customer experience market size was valued at $84.5 billion.

- Adapt to innovation.

- Offer omnichannel support.

- Integrate various platforms.

- Stay competitive.

Teleperformance faces threats from substitute solutions like AI chatbots and self-service platforms, potentially reducing demand for its services. To mitigate this, Teleperformance must offer superior value and adapt to innovation. The company needs to balance quality with competitive pricing to retain its market position.

| Substitute Threat | Impact | Teleperformance's Response |

|---|---|---|

| AI Chatbots | Reduced need for human agents | Integrate AI; invest in R&D; ensure human-AI balance. |

| DIY Platforms | Decreased demand for BPO | Offer value-added services; focus on complex problem-solving. |

| Cheaper Alternatives | Loss of customers | Optimize pricing through tech and partnerships; focus on cost-effectiveness. |

Entrants Threaten

The call center industry presents high barriers to entry, diminishing the threat from new competitors. Substantial capital is required for infrastructure, including data centers and advanced technology. Teleperformance, for example, invested €379 million in digital transformation in 2023. This makes it challenging for newcomers to compete effectively.

Teleperformance, as an established player, enjoys significant economies of scale. This allows the company to spread its operational costs across a vast network of clients, resulting in competitive pricing strategies. New entrants often face challenges in matching these cost efficiencies, especially in areas like technology and infrastructure. For example, Teleperformance's revenue in 2024 reached approximately €8.3 billion, illustrating its substantial scale compared to smaller competitors. This financial advantage makes it tougher for new firms to gain market share.

Brand recognition is crucial in the BPO sector, and Teleperformance benefits from a well-established brand. Teleperformance's reputation for quality service is a key advantage. New entrants face significant challenges, requiring substantial marketing investments to build trust. In 2024, Teleperformance's brand value was estimated at $3.5 billion, illustrating the hurdle for newcomers.

Technological Expertise

Technological expertise is critical in the Business Process Outsourcing (BPO) industry. Teleperformance, for example, invests heavily in AI and digital solutions. These investments help improve service quality and efficiency. New entrants must match this technological prowess to be competitive. This creates a significant barrier to entry.

- Teleperformance's digital revenue grew by 13.2% in 2024.

- The BPO market is expected to reach $446.8 billion by 2024.

- AI adoption in BPO is projected to increase by 30% in 2024.

Regulatory Compliance

The Business Process Outsourcing (BPO) industry, including Teleperformance, faces significant regulatory hurdles. New entrants must navigate complex data privacy and security regulations, such as GDPR and CCPA, which adds to their operational costs. These requirements necessitate substantial investments in compliance infrastructure and processes. Demonstrating the ability to safeguard client data is crucial, creating a barrier to entry.

- Data breaches can cost businesses millions; the average cost of a data breach globally in 2023 was $4.45 million.

- The global BPO market is expected to reach $447.5 billion by 2025.

- Compliance costs can represent a significant portion of a new entrant's initial investment, potentially up to 10-15% of operational expenses.

- Stringent regulations can lead to higher operational costs for all market participants.

The call center industry has high entry barriers, with substantial capital needed for infrastructure and technology. Established companies like Teleperformance, which invested €379M in digital transformation in 2023, have a significant advantage. Regulatory hurdles and brand recognition also increase the challenges for new entrants.

| Aspect | Teleperformance Advantage | New Entrant Challenges |

|---|---|---|

| Capital Needs | €379M digital investment (2023) | Matching infrastructure investment |

| Economies of Scale | €8.3B revenue (2024) | Competitive pricing |

| Brand Recognition | $3.5B brand value (2024) | Building trust |

Porter's Five Forces Analysis Data Sources

We use financial reports, industry studies, and competitor analysis reports, to examine competitive dynamics within the sector.