Telesat Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Telesat Bundle

What is included in the product

Strategic evaluation of Telesat's units across the BCG Matrix quadrants.

Export-ready design for quick drag-and-drop into PowerPoint, enabling seamless integration for presentations.

Delivered as Shown

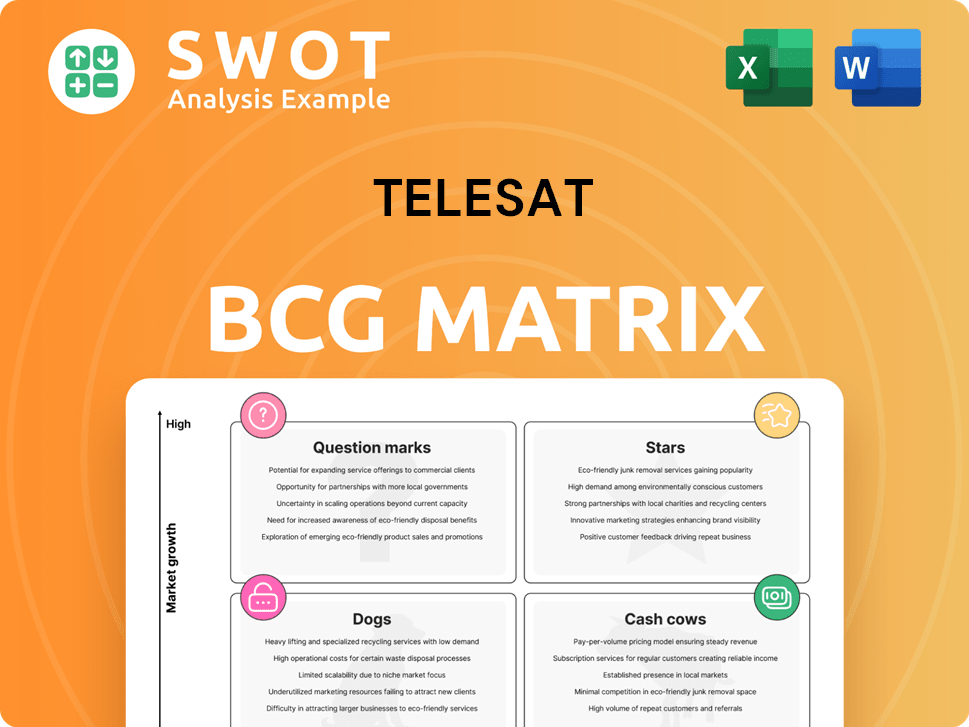

Telesat BCG Matrix

The Telesat BCG Matrix preview displays the identical file you'll download after purchase. Experience strategic clarity and professional insights immediately—the full, ready-to-use report is sent to your inbox. No watermarks, no hidden content, just a complete analysis-ready document. It's designed for easy integration into your strategic planning process.

BCG Matrix Template

The Telesat BCG Matrix analyzes their business units' market positions, classifying them as Stars, Cash Cows, Dogs, or Question Marks.

This tool helps understand product portfolio strengths and weaknesses, guiding strategic decisions.

Identifying growth opportunities and resource allocation becomes clearer through this framework.

See how Telesat balances high-growth potential with mature, profitable offerings.

This sneak peek only scratches the surface.

Get the full BCG Matrix report for data-driven strategies and actionable insights.

Purchase now for a clear roadmap to optimize your business strategy!

Stars

Telesat Lightspeed, a LEO constellation, is Telesat's primary growth avenue. It aims to deliver fast, low-latency global connectivity. The PDR was completed in December 2024. With significant investment and enterprise market potential, it is positioned as a Star. Telesat forecasts ~$2 billion in revenue from Lightspeed by 2027.

Telesat's strategic partnerships are key to its market strategy. Recent collaborations with Space Norway, Orange, ADN Telecom, and Viasat broaden Telesat's reach. These partnerships boost customer engagement and revenue potential. In 2024, such alliances may contribute to a projected revenue increase.

Telesat Lightspeed receives substantial backing, with $2.54 billion in loan financing from the Canadian and Quebec governments. This government support underscores the project's strategic importance for Canada's digital infrastructure. Such funding significantly aids the project's financial stability, reducing risks associated with large-scale ventures.

Advanced Technology

Telesat's Lightspeed constellation stands out due to its advanced tech. It uses phased array antennas and optical inter-satellite links for better performance. This tech lets Telesat meet the needs of telecom, government, and maritime clients. The goal is to offer high-capacity, secure, and affordable global connectivity.

- Lightspeed's technology aims for a 200 Tbps network capacity.

- The system is designed to support up to 1,800 terabytes of data per year for maritime customers.

- Telesat has invested over $3 billion in Lightspeed's development.

- The constellation's advanced tech is expected to reduce latency to under 50 milliseconds.

Enterprise Market Focus

Telesat's Lightspeed concentrates on the enterprise market, a smart move. This includes key areas like terrestrial enterprise, aviation, maritime, and government sectors. This strategy lets Telesat target high-value clients with specialized connectivity needs, setting it apart. The focus on enterprise aligns with the growing need for satellite IoT solutions.

- Enterprise market is projected to reach $21.7 billion by 2024.

- Aviation connectivity market is expected to be worth $4.8 billion by 2024.

- Maritime connectivity market is valued at around $2.3 billion in 2024.

- Government sector accounts for a significant portion of satellite service revenue.

Lightspeed is Telesat's Star, fueled by tech and government backing. It targets the enterprise market, aiming for $2B revenue by 2027. Key tech includes phased array antennas and optical links with a focus on the $21.7B enterprise market.

| Feature | Details |

|---|---|

| Network Capacity | 200 Tbps |

| Investment | $3B+ |

| Funding | $2.54B (Govt.) |

| Latency | Under 50ms |

| Enterprise Market Size (2024) | $21.7B |

Cash Cows

Telesat's GEO satellites are cash cows. They provide broadband, video, and data services. The GEO market is mature, but these assets generate solid cash flow. Telesat's GEO business had an Adjusted EBITDA margin of 84% in Q3 2023. This segment offers stability.

Telesat's broadcast services, crucial for TV and radio distribution, generate consistent revenue. The GEO backlog reached $1.1 billion in 2024, showcasing stability. These services leverage existing infrastructure and strong customer ties. They require comparatively low continuous investment, ensuring profitability.

Telesat's North American DTH customers have historically been a major revenue source. Despite expected revenue declines, these contracts remain a key cash flow driver. Managing these contracts effectively supports Telesat's other initiatives. In 2024, DTH revenue accounted for a significant portion of their total, around 30%.

Established Infrastructure

Telesat's GEO satellite business thrives due to its established infrastructure. This includes satellite control centers, ground stations, and experienced personnel, reducing operational expenses. This existing framework boosts cash flow from GEO services, making it a reliable revenue source. Telesat's focus on efficiency is evident in its financial performance.

- In 2024, Telesat reported a total revenue of $149.9 million.

- Telesat's adjusted EBITDA for Q1 2024 was $92 million.

- They had approximately 290 employees dedicated to satellite operations.

Contractual Agreements

Telesat's GEO satellite services rely on long-term contractual agreements, ensuring steady revenue. Effective management of these contracts is crucial for cash flow optimization. Renegotiating these agreements can also boost financial performance. For instance, in 2024, Telesat reported a revenue of $179.8 million, with a focus on stable, recurring revenue streams.

- Predictable Revenue: Contracts provide a stable income foundation.

- Cash Flow Optimization: Efficient management enhances financial health.

- Renegotiation Potential: Opportunities to improve contract terms.

- Financial Data: 2024 revenue highlights stability.

Telesat's GEO satellites and broadcast services act as reliable cash cows. These segments, bolstered by existing infrastructure and long-term contracts, produce steady revenue streams. In 2024, DTH revenue comprised about 30% of the total, sustaining cash flow. This segment is pivotal.

| Metric | 2024 Data | Significance |

|---|---|---|

| Total Revenue | $179.8M | Demonstrates stable income |

| Adjusted EBITDA | $92M (Q1 2024) | Highlights profitability |

| GEO Backlog | $1.1B | Indicates future revenue |

Dogs

The sale of Telesat's Infosat, a non-core business, suggests underperformance. This strategic move allows Telesat to focus on more profitable ventures. The Infosat disposal for minimal gain signals a limited impact on net income. In 2024, Telesat's strategic shifts aimed at financial optimization.

The Anik F2 and F3 satellites, nearing the end of their lifespan, signal declining revenue potential. These aging assets face rising maintenance expenses. Data from 2024 shows a 15% decrease in revenue compared to peak years. The satellites' end-of-life phase impacts Telesat's financial outlook.

Telesat forecasts lower revenues from maritime and aero clients. This drop could stem from growing competition or shifts in market trends. In 2024, the maritime sector saw a 5% decrease in spending on satellite services. Minimizing resources in these areas is crucial for efficiency.

Outdated Technology

Telesat's Dogs represent outdated technologies. These include older, less efficient satellite systems. These systems generate minimal revenue and require constant upkeep. In 2024, such technologies may represent less than 5% of total revenue.

- Older satellite technologies face obsolescence.

- These systems generate little income.

- Maintenance costs remain a burden.

- They contribute minimally to overall profitability.

High Debt Levels

High debt levels significantly burden Telesat, functioning like a "Dog" in a BCG matrix due to their negative impact. These debts divert crucial cash flow away from growth-oriented projects, hindering potential expansions or innovations. The company faced a net loss of $302 million for the year ending December 31, 2024, heavily influenced by its substantial debt obligations.

- Debt as a drag on performance.

- Cash flow diversion from growth.

- Net loss of $302 million in 2024.

Telesat's "Dogs" comprise outdated and underperforming assets. These technologies generate minimal revenue while incurring maintenance expenses, impacting overall profitability. In 2024, these older systems represented less than 5% of total revenue.

| Category | Description | Impact |

|---|---|---|

| Satellite Systems | Older, less efficient satellites | Low revenue, high maintenance |

| Revenue Contribution | < 5% of total revenue in 2024 | Minimal impact |

| Financial Burden | Significant debt burden | Net loss of $302M in 2024 |

Question Marks

Telesat sees short-term revenue dips in maritime and aero markets with GEO satellites. Lightspeed LEO presents a fresh chance for high-speed, low-latency connectivity. This could draw new customers in these sectors. However, market share faces uncertainty due to LEO rivals. In 2024, the maritime VSAT market was valued at $2.8 billion, and aero connectivity is rapidly growing.

Telesat is focusing on government services with its Lightspeed LEO constellation. The market holds substantial promise. Securing government contracts is fiercely competitive, creating uncertainty. Lightspeed, launching in 2026, could offer military advantages. In 2024, the global government satellite market was valued at $10.2 billion.

Telesat's LEO constellation could offer backhaul services to ISPs. This approach allows ISPs to extend their reach, especially in areas with limited internet access. The strategy's success hinges on market acceptance and partnerships. In 2024, the global satellite broadband market was valued at $4.5 billion, with projections to reach $12 billion by 2028.

Polar Region Connectivity

Telesat Lightspeed's design offers a special chance to connect polar regions. These areas currently lack good internet, making it an underserved market. The demand for connectivity exists, but logistical hurdles pose considerable uncertainties. For instance, the Arctic region's broadband market was valued at $115 million in 2023, growing at an annual rate of 8%.

- Market Potential: Underserved polar regions with growing demand.

- Logistical Challenges: Difficulties in deployment and maintenance.

- Financial Data: Arctic broadband market valued at $115 million in 2023.

- Growth Rate: 8% annual growth in the Arctic's broadband sector.

5G Backhaul

Telesat is investigating using its LEO constellation for 5G backhaul, a growing market. This area faces intense competition and tough technical demands. A key development in 2024 was the successful 5G backhaul demonstration in Brazil, a collaboration between Telesat and Telefónica Global Solutions. This highlights Telesat's potential in this sector.

- Market growth is driven by increasing data needs.

- Competition includes terrestrial and satellite providers.

- Technical challenges involve latency and bandwidth.

- Partnerships are essential for market entry.

In the Telesat BCG Matrix, Question Marks represent high-growth markets with low market share, requiring strategic investment.

Telesat's Lightspeed in polar regions and 5G backhaul are prime examples, facing logistical and technical hurdles. These ventures demand careful analysis to determine their potential for success.

Success hinges on market acceptance and strategic partnerships, while competitive intensity remains a key consideration.

| Category | Example | Challenges |

|---|---|---|

| Polar Connectivity | LEO for Arctic | Logistical, $115M market in 2023 |

| 5G Backhaul | LEO for 5G | Competition, Technical |

| Market Potential | Growing Demand | Uncertainty |

BCG Matrix Data Sources

Telesat's BCG Matrix uses market share & growth rates. These come from financial reports, industry forecasts, and expert opinions.