Thai Beverage Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Thai Beverage Bundle

What is included in the product

ThaiBev's BCG analysis assesses its diverse portfolio, guiding strategic decisions.

Printable summary optimized for A4 and mobile PDFs, offering Thai Beverage insights on the go.

What You’re Viewing Is Included

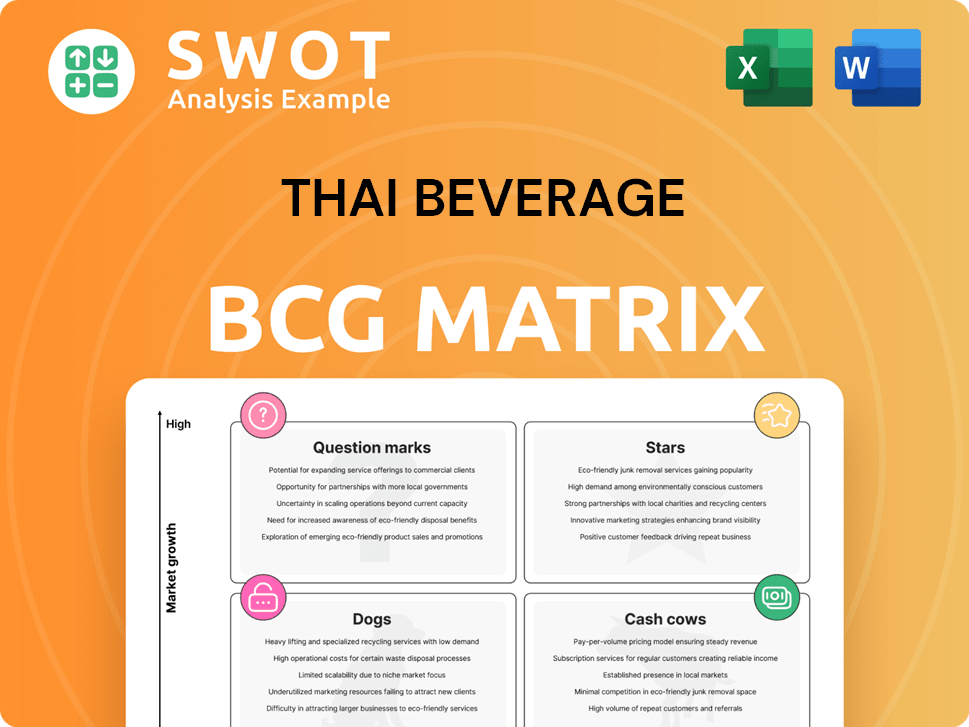

Thai Beverage BCG Matrix

The document you're previewing mirrors the complete Thai Beverage BCG Matrix you'll receive. Immediately after purchase, expect a fully formatted and detailed report. This is the identical version, without any alterations or hidden content. This report is crafted for comprehensive strategic insights, ready for immediate application.

BCG Matrix Template

Thai Beverage's diverse portfolio, from spirits to beer, presents a compelling case for BCG analysis. This snapshot offers a glimpse into its product strengths and weaknesses across rapidly evolving markets. Analyzing the matrix reveals key investments, strategic priorities, and potential growth areas. Uncover the hidden dynamics of Thai Beverage's business. Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Chang Beer is a Star in Thai Beverage's BCG matrix, enjoying a strong market share in the growing beer market. In 2024, the Thai beer market was valued at approximately $6.5 billion. Chang's proactive expansion into the mass premium segment, with offerings like Chang Cold Brew, aims to solidify its leadership. The company's strategic focus on product diversification should help it maintain its market leader position in 2025.

ThaiBev's spirits segment, especially brown spirits, is experiencing revenue growth, boosted by better consumer sentiment in Thailand. The company's push into international markets and its continued growth in spirits show a strong market position. In 2024, spirits accounted for a significant portion of ThaiBev's revenue, reflecting its importance. ThaiBev is focusing on growing its spirits category over the next five years.

ThaiBev's non-alcoholic beverages (NAB) are successful in core markets like Malaysia, Vietnam, Myanmar, and Thailand. The Agri Valley project in Malaysia and new F&N Nutriwell products show commitment to growth. In 2024, NAB sales grew, reflecting its strategic focus. These markets are vital for NAB expansion.

Sabeco (Vietnam Beer)

Sabeco, a star in ThaiBev's portfolio, shines as Vietnam's leading beer brand. ThaiBev's strategic control over Sabeco leverages the recovering Vietnamese beer market. In the past six months, Sabeco has maintained its top position in sales volume.

- Market share dominance in Vietnam's beer sector.

- Strong sales volume performance in the last 6 months.

- Strategic control by ThaiBev.

- Beneficiary of Vietnam's market recovery.

Fraser and Neave (F&N)

Fraser and Neave (F&N) is a star for Thai Beverage (ThaiBev). ThaiBev has boosted its F&N stake, now holding 69.61%, up from 28.31%, focusing on non-alcoholic drinks. This move lets ThaiBev maximize revenue and cost benefits. In 2024, F&N's revenue grew, showing strong market performance.

- ThaiBev's F&N stake at 69.61% enhances control.

- F&N focuses on non-alcoholic beverage growth.

- Synergies drive revenue and cost improvements.

- F&N's 2024 revenue reflects market strength.

ThaiBev's stars include Chang Beer, spirits (brown spirits), Sabeco, and F&N, demonstrating strong market positions. Chang leads the beer market, valued at $6.5 billion in 2024. F&N's 2024 revenue grew, fueled by NAB. Sabeco remains Vietnam's top beer brand.

| Star | Market | Key Factor |

|---|---|---|

| Chang Beer | Thai Beer Market | Market leader |

| Spirits | International | Revenue Growth |

| Sabeco | Vietnam | Market Dominance |

| F&N | NAB | Revenue Increase |

Cash Cows

ThaiBev's mass-market spirits, such as Hong Thong and Sangsom, are likely cash cows. These brands hold significant market share in a mature market, benefiting from strong brand recognition and customer loyalty. They generate substantial cash flow with lower promotional investments. Hong Thong and Sangsom held dominant market shares in Thailand's spirits market in 2024.

Oishi green tea is a cash cow for Thai Beverage. It holds a significant market share in the ready-to-drink tea sector. The brand enjoys strong recognition and a loyal customer base, generating steady cash flow. In 2024, Oishi expanded its reach by launching in Cambodia.

Chang, a star brand, is complemented by cash cows like other ThaiBev beers. These brands leverage economies of scale and distribution networks. In 2024, ThaiBev aimed to expand its premium offerings. Chang Cold Brew, Federbräu, and Chang Unpasteurized helped maintain its market leadership.

Food Business (KFC and Oishi Restaurants in Thailand)

ThaiBev's food business, including KFC and Oishi restaurants in Thailand, is a cash cow, providing steady income. These brands have a strong presence, leading to customer loyalty and solid revenues. ThaiBev plans to invest Bt 1.3 billion in 2025 to grow its restaurant footprint. This reflects the brands' profitability and market position.

- KFC and Oishi generate reliable revenue.

- Established brands reduce marketing costs.

- 2025 investment is for expansion.

- Strong brand recognition in Thailand.

Ready-to-Drink Tea

Thai Beverage's ready-to-drink (RTD) tea is positioned as a "Cash Cow" in the BCG matrix, benefiting from health trends. The Thai tea market generated US$1.5 billion in 2023. The RTD tea segment contributed US$0.51 billion in 2023, with 8.62% annual growth projected through 2027. This steady growth and market share solidify its "Cash Cow" status.

- Market Size: US$1.5 billion in 2023.

- RTD Tea Revenue: US$0.51 billion in 2023.

- RTD Growth Forecast: 8.62% annually until 2027.

- Market Growth: Expected CAGR of 2.16% (2023-2028).

ThaiBev's cash cows are brands like Hong Thong, Sangsom, and Oishi. These brands benefit from established market positions and customer loyalty. They consistently generate substantial cash flow with reduced promotional investments.

| Brand | Market Position | Financial Status |

|---|---|---|

| Hong Thong/Sangsom | Dominant in Spirits | High Cash Flow |

| Oishi | Leading RTD Tea | Steady Revenue |

| Other Beers | Leverage Distribution | Economies of Scale |

Dogs

ThaiBev's lower-alcohol spirits could be dogs due to the shift towards premium drinks. The company should minimize these brands, avoiding costly recovery plans. Thailand's spirits market, a key segment, hit about US$12.3 billion in 2024, 25% of the alcohol market.

Traditional Thai Beverage products, like specific whiskeys, fit the "Dogs" category. These face shrinking demand due to shifting tastes and stiff competition. The whiskey segment has struggled, with a persistent drop in consumer numbers. For example, in 2024, sales of some traditional whiskey brands decreased by around 8%.

Niche food products within Thai Beverage's portfolio, showing limited market share and low growth, are categorized as dogs. The company might consider divesting these to concentrate on more profitable areas. In Q1 2024, the food business generated 5.689 billion baht in revenue, a 2.2% increase year-over-year. This suggests a need for strategic assessment.

Publishing and Printing Segment

The publishing and printing segment of Thai Beverage, categorized as a "Dog" in the BCG matrix, experienced a downturn in 2024. Revenue in this segment decreased by 6.6% year-over-year, reaching 1.34 billion baht. This decline was primarily due to reduced licensing income and title rights. Consequently, EBITDA plummeted by 55.1% year-over-year, settling at 66 million baht.

- Revenue Decline: 6.6% decrease to 1.34 billion baht.

- EBITDA Plunge: 55.1% decrease to 66 million baht.

- Main Drivers: Lower licensing and title rights income.

Non-alcoholic options with little traction

Thai Beverage's non-alcoholic ventures, despite global trends, have faced challenges in Thailand. These products, popular elsewhere, haven't resonated strongly in the local market. The lack of significant market share suggests a "Dog" status within the BCG matrix. This indicates low growth potential and a small market share in the Thai context. The company might need to re-evaluate its strategy for these offerings.

- Non-alcoholic beverages face slow growth.

- Limited market share in Thailand.

- "Dog" classification in BCG matrix.

- Strategy adjustments are needed.

Several segments within Thai Beverage are classified as "Dogs," indicating low growth and market share. These include certain lower-alcohol spirits, traditional whiskey brands, niche food products, and the publishing/printing division. Strategic adjustments, such as divestment or re-evaluation, are necessary to optimize the portfolio.

| Segment | Market Share (2024) | Growth Rate (2024) |

|---|---|---|

| Lower-Alcohol Spirits | Low | Negative |

| Traditional Whiskey | Declining | -8% (sales) |

| Niche Food | Limited | 2.2% (Q1 Revenue) |

| Publishing/Printing | Low | -6.6% (Revenue) |

Question Marks

Agri Valley Farm, a dairy venture in Malaysia, is a question mark within Thai Beverage's BCG Matrix. ThaiBev is significantly increasing its investment in Agri Valley Farm to 18 billion baht, up from an initial 7-8 billion baht. Of this, 8 billion baht is allocated for dairy production. This expansion aims to capture the local market and produce halal-certified products.

The launch of new health products under F&N Nutriwell positions it as a question mark in Thai Beverage's BCG Matrix. This segment is a new venture, requiring significant investment and market validation. The success hinges on consumer acceptance and market share capture. In 2024, the health and wellness market is projected to reach $7 trillion globally.

ThaiBev's Cambodian venture is a "Question Mark" in its BCG matrix. The company is investing 3 billion baht to build a beer factory, starting with 50 million litres capacity. This move aims to capture market share in Cambodia. In 2024, the company invested 2.5 billion baht.

Functional Drinks

Functional drinks represent a "question mark" in Thai Beverage's BCG matrix, indicating high growth potential but uncertain market share. The Thai functional drinks market is projected to reach THB52.4 billion by 2025, according to Euromonitor. Local brands currently dominate with about 80% market share, primarily in energy and sports drinks.

- Market growth is driven by health and wellness trends.

- Energy and sports drinks constitute a significant portion of the market.

- Thai Beverage needs to invest strategically to gain market share.

- Competition is fierce with local brands controlling the majority.

Newer Premium Beer Brands

Newer premium beer brands, like those ThaiBev is introducing, are question marks within the BCG matrix. These brands, including Chang Cold Brew, Federbräu, and Chang Unpasteurized, are aimed at expanding ThaiBev's portfolio. The goal is to capture a share of the mass premium market. This strategy supports ThaiBev's aim to remain the market leader by 2025.

- ThaiBev is expanding its product range to maintain its market leader position.

- Newer brands like Chang Cold Brew are considered question marks.

- The mass premium group is the target market for expansion.

- This strategy is crucial for 2025 market leadership.

Question marks in ThaiBev's portfolio represent ventures with high growth potential but uncertain market share. Agri Valley Farm and the Cambodian beer factory are examples of significant investments in this category. Functional drinks and new premium beer brands also fall under this classification, targeting growth in health and premium segments.

| Category | Example | Investment (Approx.) |

|---|---|---|

| Dairy | Agri Valley Farm | 18 billion baht |

| Beer | Cambodian Factory | 3 billion baht (initial) |

| Functional Drinks | New Products | Variable, market-dependent |

| Premium Beer | Chang Cold Brew | Strategic, market share focused |

BCG Matrix Data Sources

The Thai Beverage BCG Matrix draws on company financials, market reports, and expert evaluations for reliable, data-backed positioning.