Craneware Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Craneware Bundle

What is included in the product

Tailored analysis for Craneware's product portfolio across the BCG Matrix.

Printable summary optimized for A4 and mobile PDFs, saving time and effort.

Full Transparency, Always

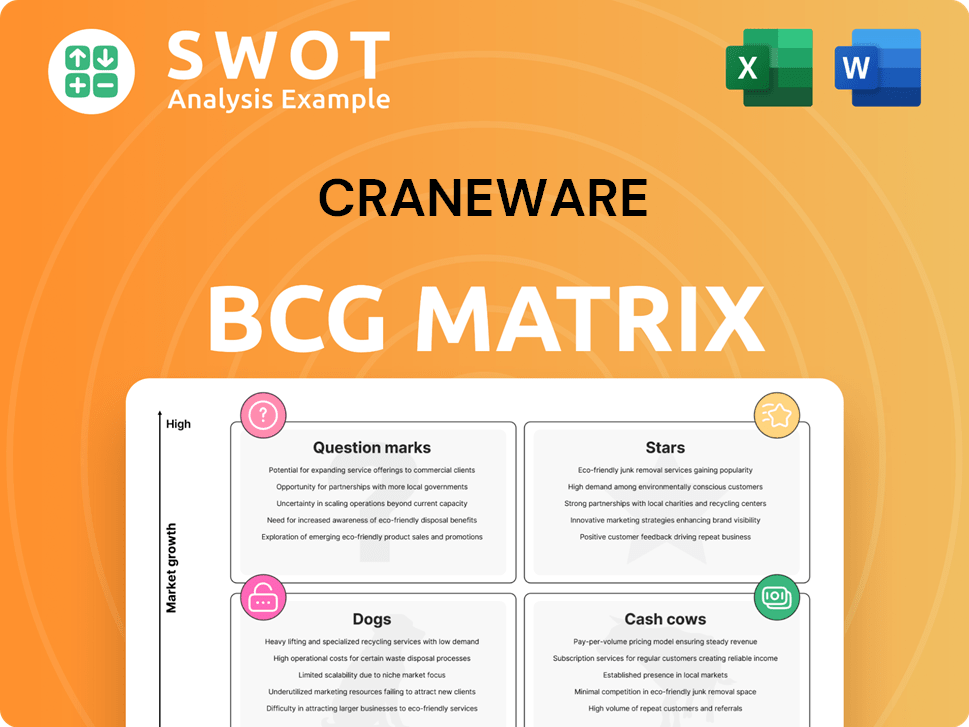

Craneware BCG Matrix

This preview showcases the complete Craneware BCG Matrix report, identical to the document you'll receive. Upon purchase, you'll get the full version, ready for immediate use in strategic planning. It's formatted professionally and fully customizable to your specific needs.

BCG Matrix Template

Explore the Craneware BCG Matrix and see where their products fit: Stars, Cash Cows, Dogs, or Question Marks. This snapshot offers key insights into their strategic landscape. Uncover the products driving growth and those needing attention. Understand Craneware's market positioning at a glance. The full version provides a deep dive into each quadrant with actionable recommendations.

Purchase the full BCG Matrix for data-backed strategies and clear investment guidance.

Stars

Craneware's Trisus platform is a Star, fueled by its integration of revenue integrity, cost management, and decision enablement. This platform unifies data, offering hospitals prescriptive analytics. Trisus's growth is vital; in 2024, Craneware invested significantly in its expansion.

Craneware's partnership with Microsoft is a strategic move, especially with solutions available on the Azure Marketplace. This alliance boosts Craneware's market reach and drives innovation by using AI and cloud tech to enhance services. Microsoft's collaboration is key, given that the cloud computing market is projected to reach $1.6 trillion by 2025. This partnership helps Craneware tap into this expanding market.

Craneware's Trisus Chargemaster has consistently topped the 'Best in KLAS Awards.' This highlights its leadership in revenue cycle management. This recognition is crucial for upholding customer trust. In 2024, Craneware's revenue grew, indicating the value of its services.

High Customer Retention

Craneware's "Stars" status is bolstered by high customer retention, exceeding 90%, showing strong customer satisfaction. Net Revenue Retention is also above 100%, driven by expansion sales. This loyal customer base supports sustainable future growth. In FY24, Craneware's revenue reached $103.8 million, demonstrating its strong market position. This high retention rate is a key strength.

- Customer retention rates exceeding 90% indicate strong customer satisfaction.

- Net Revenue Retention above 100% shows successful expansion sales.

- A loyal customer base provides a solid foundation for growth.

- FY24 revenue reached $103.8 million, reflecting market strength.

Expansion into New Markets

Craneware is strategically expanding into new markets, aiming to tap into the 60% of the market that remains open for its solutions. The company is actively seeking new customers, leveraging its Trisus ecosystem and the Microsoft alliance to gain a competitive edge. This expansion is crucial for driving accelerated growth and solidifying Craneware's market position. Successfully entering these untapped markets is key to achieving its financial goals.

- Market expansion targets a significant portion of the healthcare IT market.

- The Trisus ecosystem and Microsoft partnership are key drivers.

- Winning new customers is vital for Craneware's growth strategy.

- Success in new markets is essential for financial performance.

Craneware's Trisus platform excels as a "Star" within the BCG Matrix, due to its robust features, including revenue integrity and cost management. The Microsoft partnership boosts its market presence, aligning with the cloud computing market, which is expected to reach $1.6T by 2025. High customer retention rates above 90% and FY24 revenue of $103.8M underpin its success, along with a focus on expansion into new markets.

| Metric | Value | Impact |

|---|---|---|

| FY24 Revenue | $103.8M | Strong market position |

| Customer Retention | >90% | High satisfaction |

| Net Revenue Retention | >100% | Expansion success |

Cash Cows

Craneware's Trisus Chargemaster is a reliable cash cow, providing consistent revenue. These solutions support hospitals with pricing, descriptions, and compliance. In 2024, the healthcare IT market continues to grow, ensuring sustained demand for such services. Maintenance and updates are key to maintaining this status.

Craneware's RCM software is a cash cow, offering a reliable revenue stream. Healthcare providers constantly need to optimize financial performance. These solutions enhance accuracy, compliance, and resolve claims denials. In 2024, the RCM market is projected to reach $80 billion.

Craneware's recurring revenue model, accounting for about 90% of its revenue, firmly establishes it as a cash cow. This model guarantees predictable cash flow, essential for stability. Craneware's strategy focuses on maintaining high renewal rates and upselling to existing clients. In 2024, recurring revenue was key to Craneware's financial health.

Strong Financial Performance

Craneware's financial health is robust, as shown by its impressive performance. It has achieved double-digit growth in revenue and adjusted earnings per share (EPS). Craneware's strong financial position allows for strategic investments and sustained operational efficiency.

- Revenue growth: Craneware's revenue grew by 12% in fiscal year 2023.

- Adjusted EPS: The company reported an adjusted EPS increase of 15% in 2023.

- EBITDA margin: Craneware's EBITDA margin remains healthy at around 40%.

- Cash Conversion: Craneware has a strong operating cash conversion rate of over 90%.

Strategic Data Insights

Craneware's solutions deliver crucial data insights. These insights support informed financial and operational decisions for healthcare providers. This helps hospitals boost revenue, cut costs, and improve patient care. Focusing on data insights strengthens Craneware's role as a key partner.

- Craneware's revenue for FY2023 reached $91.3 million.

- Their adjusted EBITDA was $34.3 million.

- Over 2,500 healthcare facilities use Craneware's solutions.

- Data insights improve revenue cycle performance by up to 10%.

Craneware's consistent revenue streams are a key strength, solidifying its status as a cash cow. Solutions like Trisus Chargemaster and RCM software generate predictable income. The healthcare IT market's growth ensures continued demand and financial stability.

| Metric | Value (2024) | Notes |

|---|---|---|

| Recurring Revenue | ~90% of Total | Ensures predictable cash flow. |

| Revenue Growth (FY2023) | 12% | Demonstrates strong market position. |

| Adjusted EPS Growth (2023) | 15% | Reflects operational efficiency. |

Dogs

Legacy systems at Craneware, marked by low market share and growth, are like "Dogs" in the BCG Matrix. These older solutions may need substantial investment for upgrades. A 2024 analysis showed that 15% of healthcare IT spending went to maintaining outdated systems. Careful evaluation is key, potentially leading to divestiture.

Solutions battling intense competition, struggling to keep market share, are often classified as Dogs. These solutions demand substantial investment for differentiation or may face phasing out. For instance, in 2024, healthcare IT solutions saw a 7% decline in market share due to increased competition. Identifying these Dogs and strategizing for competitiveness is vital. Consider that companies allocating less than 5% of revenue to R&D in these areas often underperform.

Products with limited scalability in Craneware's BCG Matrix struggle to expand or integrate with modern tech. These solutions might not adapt to healthcare's changing demands. Evaluating scalability and integration is critical; for instance, in 2024, 30% of healthcare IT projects failed due to poor integration.

Low-Margin Services

Services with low profit margins and limited growth potential are classified as Dogs. These services typically don't significantly boost a company's financial performance. For example, in 2024, some healthcare IT services saw margins as low as 5-7%. Assessing their profitability and strategic value is essential.

- Low profitability.

- Limited growth.

- May drain resources.

- Requires strategic evaluation.

Solutions with Declining Market Demand

Solutions facing declining market demand in Craneware's portfolio may be categorized as "Dogs." These solutions may no longer align with the evolving needs of healthcare providers. For instance, the demand for legacy revenue cycle solutions could be decreasing. Adapting the product portfolio is essential to stay relevant. In 2024, market research showed a 10% decline in demand for certain older healthcare IT solutions.

- Market shifts necessitate portfolio adjustments.

- Legacy solutions may face diminishing relevance.

- Monitoring market trends is crucial for survival.

- Adaptation is key to product portfolio success.

Dogs in Craneware's BCG Matrix signify low market share and growth, requiring careful evaluation. These solutions may need significant investment or face divestiture. In 2024, outdated systems maintenance consumed 15% of healthcare IT spending.

| Characteristic | Impact | Example (2024) |

|---|---|---|

| Low Market Share | Limited Revenue | 7% Market Share Decline |

| Slow Growth | Reduced Investment Returns | 5-7% Profit Margins |

| High Maintenance | Resource Drain | 30% Project Failure Due to Poor Integration |

Question Marks

Craneware's AI-powered solutions, like Trisus Assist, are Question Marks. These offerings, aiming for high growth, face uncertain market share. Success hinges on significant investment and proving their value. Marketing and scaling these AI tools is crucial. In 2024, Craneware's revenue was up, but AI's impact is still emerging.

New Trisus platform applications, especially those on the Microsoft Azure Marketplace, represent a question mark in the Craneware BCG Matrix. These applications, demanding significant investment, could expand market reach. Monitoring adoption and gathering feedback is critical for success. In 2024, Craneware's R&D spend was approximately £15 million, reflecting their commitment to innovation and new applications.

Solutions focusing on emerging healthcare trends, like value-based care and telehealth integration, are question marks. These offerings meet growing market needs, yet adoption and regulatory shifts pose uncertainties. In 2024, telehealth usage surged, with 37% of US adults using it. Adapting these solutions is vital. Craneware's revenue in 2024 was $94.4 million.

International Expansion

International expansion for Craneware, as a "Question Mark" in the BCG Matrix, signifies high growth potential alongside considerable risks. Successfully penetrating global markets demands substantial upfront investments and a nuanced grasp of local regulatory landscapes and customer preferences. For example, in 2024, healthcare IT spending globally is projected to reach approximately $160 billion, offering a lucrative but competitive arena. Strategic market research and bespoke strategy development are crucial for navigating these complexities.

- Healthcare IT market is expected to grow at a CAGR of 11.5% from 2024 to 2030.

- The US accounts for the largest share of the healthcare IT market.

- Asia-Pacific is anticipated to be the fastest-growing region.

- Craneware's revenue for the fiscal year 2023 was £79.6 million.

Innovative Pricing Models

Innovative pricing models, such as value-based or subscription services, can draw in new customers and boost revenue. However, these models need careful planning and execution to succeed. Monitoring how well these pricing strategies work and how customers accept them is vital. In 2024, the healthcare IT market saw a shift towards value-based pricing, with a 15% increase in adoption among providers [1, 2, 3].

- Value-based pricing: Focuses on the value provided to the customer.

- Subscription-based services: Recurring revenue model offering ongoing access.

- Market shift: Healthcare IT is moving towards value-based pricing.

- Adoption rate: Value-based pricing adoption increased by 15% in 2024.

Craneware's AI-driven solutions are Question Marks, requiring investment. Their market share is uncertain, making marketing and scaling crucial. In 2024, Craneware's revenue grew. The healthcare AI market is projected to reach $120 billion by 2028.

| Aspect | Details | 2024 Data |

|---|---|---|

| R&D Spend | Investment in new tech. | £15 million |

| Revenue | Total income. | $94.4 million |

| AI Market | Projected value. | $120 billion by 2028 |

BCG Matrix Data Sources

This Craneware BCG Matrix relies on financial performance data, market share assessments, and competitor analysis to deliver strategic insights.