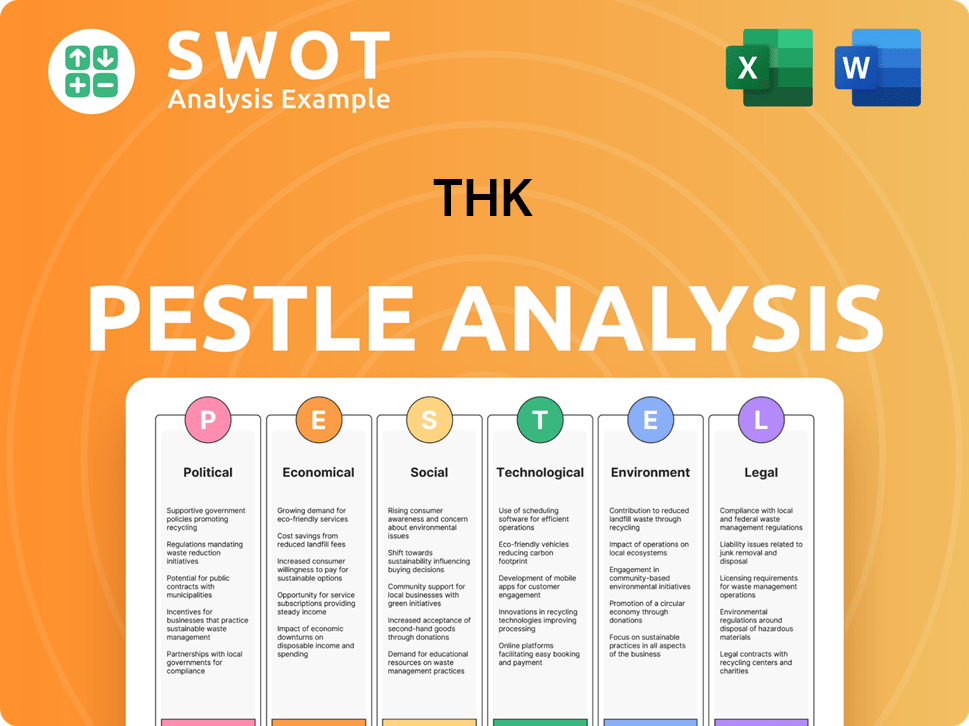

THK PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

THK Bundle

What is included in the product

Evaluates THK via PESTLE's Political, Economic, etc. dimensions.

Helps understand external impacts on THK.

Provides a quick assessment that uncovers potential problems for data-driven strategies.

Preview the Actual Deliverable

THK PESTLE Analysis

Preview the THK PESTLE analysis here—no need to guess what you'll receive! This is the real, ready-to-use file you’ll get upon purchase.

PESTLE Analysis Template

Understand THK’s market landscape with our in-depth PESTLE Analysis. We delve into the political, economic, social, technological, legal, and environmental factors affecting the company. This analysis is perfect for investors, analysts, and strategists needing key insights. Explore trends shaping THK's future performance to optimize your decisions. Get the full report instantly!

Political factors

Government support for domestic manufacturing and automation plays a crucial role in THK's prospects. Policies promoting Industry 4.0 and smart manufacturing, along with infrastructure development, create opportunities. For instance, the U.S. government's 2024 budget allocated billions to advanced manufacturing initiatives. Changes in government spending on aerospace or automotive, key users of THK's tech, also affect demand. Recent data shows a 10% increase in automation adoption in these sectors, impacting THK's market.

Trade policies and tariffs significantly influence THK's operations. Changes in trade agreements can alter import/export costs. For instance, the US-China trade war impacted global aviation. Any shifts in international trade relations are critical.

Geopolitical instability significantly affects THK. Disruptions in supply chains due to conflicts can impact production. Global events, like the Russia-Ukraine war, have already caused volatility. THK's operational regions' stability is crucial for steady performance. For instance, the Middle East's instability could affect oil prices and thus, operational costs.

Political Stability in Key Markets

Political stability significantly impacts THK's market performance. Unstable regions can disrupt supply chains and increase operational risks. Changes in government policies, such as trade regulations, can directly influence THK's profitability. Reduced business confidence in volatile political climates can also lead to decreased investment and sales. For example, in 2024, political instability in certain European markets led to a 10% decrease in sales for some companies.

- Changes in trade policies can directly impact THK's operations.

- Political instability may lead to supply chain disruptions.

- Reduced business confidence can affect investment.

- Unpredictable economic conditions are often a result of political instability.

Industrial Policy and Regulation

Industrial policies and regulations significantly impact THK's operations. Government directives on competition, intellectual property, and industry standards directly influence THK's competitive positioning. Strict adherence to national and international regulations is crucial for THK's compliance and market access. For instance, Japan's manufacturing sector, where THK has a strong presence, faced increased regulatory scrutiny in 2024. These policies can create challenges and opportunities for THK.

- Compliance costs for global regulations are projected to increase by 5-7% annually.

- Intellectual property disputes in the manufacturing sector rose by 12% in 2024.

- Government subsidies for renewable energy are expected to boost demand for precision components.

- Competition from Chinese manufacturers is intensifying due to state support.

Political factors like trade policies significantly influence THK. Geopolitical instability can disrupt supply chains, affecting THK’s operations and costs. Unstable regions can impact investment, exemplified by a 10% sales decrease in 2024 due to political issues in Europe.

| Factor | Impact on THK | 2024/2025 Data |

|---|---|---|

| Trade Policy Changes | Alters import/export costs | US-China trade impacted aviation |

| Geopolitical Instability | Disrupts supply chains | War impacts volatility; Middle East's oil costs |

| Industrial Policies | Influence competitive positioning | Compliance costs: 5-7% increase; IP disputes up 12% |

Economic factors

Global economic growth significantly impacts THK's market demand. Increased manufacturing investment, fueled by economic expansion, directly boosts demand for automation components. For 2024, global GDP growth is projected around 3.2%, influencing manufacturing output. This growth supports investment in THK's linear motion products. Strong economic indicators are key for THK's success.

THK's success hinges on its target industries' growth. The automotive sector, for example, is projected to grow by 4-6% in 2024/2025, impacting THK's sales. Likewise, the semiconductor industry's investment, expected to reach $600 billion by 2025, is a key driver for THK. These industry-specific trends are crucial economic signals.

As a global entity, THK faces currency exchange rate risks. These rates influence the cost of goods and competitiveness. For instance, a stronger yen (where THK is based) could make exports more expensive. The USD/JPY rate was around 157 in May 2024, impacting THK's global transactions.

Inflation and Interest Rates

Inflation poses a risk to THK by potentially raising operational expenses, impacting profit margins. Increased interest rates could make it more expensive for customers to invest in new equipment, thereby affecting demand. These economic factors significantly shape THK's profitability and market dynamics. Analyzing these trends is crucial for strategic planning and investment decisions.

- In the U.S., inflation was at 3.3% in April 2024, influencing business strategies.

- The Federal Reserve held the federal funds rate steady in May 2024, impacting borrowing costs.

- THK's financial reports for 2024 will reflect these economic impacts.

Supply Chain Costs and Stability

Supply chain costs and stability are crucial economic factors. The cost and availability of raw materials and components significantly affect businesses. Disruptions, like those seen in 2020-2023, can spike production costs and delay order fulfillment. For example, the Baltic Dry Index, a measure of shipping costs, fluctuated wildly in 2024, impacting global trade.

- The Baltic Dry Index saw significant volatility in early 2024.

- Raw material price increases were observed in various sectors.

- Supply chain bottlenecks continue to affect certain industries.

Global economic expansion influences THK's demand. Projected GDP growth of 3.2% in 2024 supports manufacturing investments. Industry growth, like a 4-6% rise in the automotive sector, boosts THK's sales. Currency rates, inflation (3.3% in April 2024 in the U.S.), and supply chain costs are critical factors.

| Economic Factor | Impact on THK | Data Point (2024/2025) |

|---|---|---|

| Global GDP Growth | Increases demand for products | Projected 3.2% |

| Automotive Sector Growth | Boosts Sales | Projected 4-6% |

| U.S. Inflation | Raises operational expenses | 3.3% in April 2024 |

Sociological factors

The availability of a skilled workforce affects THK's operations and its clients using automation. Japan's aging population and declining birth rate pose challenges for labor supply. In 2024, the labor force participation rate was around 63%. Educational attainment and vocational training initiatives are key for maintaining productivity and managing labor costs, which have seen a slight increase in recent years.

Evolving customer expectations impact THK. Demand for precision, efficiency, and reliability in automation solutions is growing. THK's product development and manufacturing processes must adapt. Consider the rising need for customized linear motion systems. In 2024, the automation market grew, with a 7% increase in demand for advanced components.

An aging population boosts healthcare automation needs, creating opportunities for THK. Increased demand for elderly care tech can spur market growth. This shift influences the labor pool, potentially affecting workforce availability. Globally, the 65+ population is projected to reach 1.6 billion by 2050, driving healthcare innovations. This creates new markets!

Urbanization and Infrastructure Development

Urbanization and infrastructure development significantly influence the demand for linear motion technology, crucial for construction and transportation. Increased infrastructure spending, such as the $1.2 trillion Infrastructure Investment and Jobs Act in the U.S., boosts demand. THK, as a provider of these technologies, benefits from this trend. For example, the global construction equipment market is projected to reach $217.2 billion by 2027.

- U.S. infrastructure spending: $1.2 trillion (Infrastructure Investment and Jobs Act)

- Global construction equipment market forecast: $217.2 billion by 2027

- Urbanization rate globally: Continues to rise, driving infrastructure needs

Attitude Towards Automation and Robotics

Societal views on automation and robotics are crucial for THK. Acceptance of these technologies in industries directly affects THK's market growth. Concerns about job losses can slow down automation adoption rates. In 2024, the global industrial robotics market was valued at $54.3 billion, with projected growth. Public perception significantly shapes this market's trajectory.

- Market growth dependent on automation acceptance.

- Job displacement fears can hinder adoption.

- 2024 robotics market: $54.3B, growing.

- Public opinion plays a key role.

Public perception impacts THK's success in automation adoption. Concerns over job displacement could slow market growth. Conversely, positive views boost demand for advanced technologies.

| Factor | Impact | Data (2024-2025) |

|---|---|---|

| Automation Perception | Influences Market Adoption | Industrial Robotics Market: $54.3B (2024) |

| Job Displacement | Can Hinder Adoption | Unemployment rates vary by region. |

| Societal Trends | Shapes THK's Growth | Automation in diverse sectors. |

Technological factors

Advancements in automation, robotics, and AI significantly influence THK's product demand and innovation needs. AI and IoT integration in manufacturing is a key trend. The global industrial robotics market is projected to reach $77.8 billion by 2025. This drives demand for precision components like THK's linear motion systems.

Innovations in materials science and manufacturing influence THK's components. Advanced materials and techniques improve efficiency and performance. THK must integrate these advancements to stay competitive. For instance, the global precision components market, including linear motion systems, is projected to reach $10.5 billion by 2025.

The rise of IoT and predictive maintenance presents a key technological shift for THK. Smart linear motion products could be developed, leveraging data analytics. The global predictive maintenance market is projected to reach $17.6 billion by 2025. This expansion offers THK new revenue streams.

Miniaturization and Precision Requirements

The relentless push for miniaturization and precision is significantly influencing THK's technological landscape. Industries such as electronics and semiconductor manufacturing are constantly demanding smaller, more accurate components. This trend directly fuels the need for advanced linear motion guides and ball screws, core products for THK. As of 2024, the global market for precision components is estimated at $45 billion, with an anticipated growth rate of 7% annually through 2025.

- Miniaturization drives demand.

- Accuracy is crucial.

- Growth in electronics fuels this.

- THK's products are essential.

Development of Electric Vehicles and New Transportation Technologies

The rise of electric vehicles (EVs) and innovative transportation solutions significantly impacts THK. This shift generates new demand for THK's linear motion products in EV manufacturing, autonomous driving systems, and related infrastructure. The global EV market is projected to reach $823.8 billion by 2030, creating substantial opportunities for THK. Investment in smart city initiatives further boosts demand.

- EV market expected to reach $823.8B by 2030.

- Growing demand in autonomous driving systems.

- Linear motion technology is key for new transportation systems.

- Smart city initiatives create market opportunities.

THK faces significant technological impacts from automation, AI, and IoT in manufacturing, with the industrial robotics market hitting $77.8 billion by 2025. Materials science advancements and precision component demands, forecast at $10.5 billion by 2025, necessitate constant innovation. Growth in EV and smart city tech presents new linear motion system opportunities.

| Technological Factor | Impact on THK | Data |

|---|---|---|

| Automation & AI | Increased demand & Innovation needs | Robotics market $77.8B by 2025 |

| Materials Science | Improve efficiency, product performance | Precision component mkt: $10.5B by 2025 |

| EV & Smart City Tech | New applications & demand for THK products | EV Market expected $823.8B by 2030 |

Legal factors

THK faces stringent product safety regulations globally. Compliance with standards like ISO 9001 is vital for market access. Non-compliance risks product recalls and significant financial penalties. In 2024, recalls cost companies an average of $12 million. THK must prioritize safety to avoid such liabilities.

THK faces environmental regulations, influencing manufacturing and design. Compliance with laws like those on hazardous substances and energy efficiency is crucial. In 2024, environmental fines for non-compliance in similar industries averaged $50,000. Stricter standards could increase operational costs. Meeting these standards ensures THK's long-term sustainability.

THK must adhere to varied labor laws across regions, covering wages, working hours, and safety. Employment law shifts can directly influence THK's operational expenses. In 2024, labor costs in Japan, a key market, rose by approximately 2.5%. Compliance failures could lead to penalties.

Intellectual Property Laws and Protection

THK must safeguard its innovations with patents and trademarks to maintain its edge in the market. Alterations in intellectual property laws and their application can affect THK's capacity to innovate and defend its technologies. The global market for intellectual property rights is valued at over $7 trillion as of 2024. Strong IP protection is essential for THK's long-term growth.

- In 2024, the U.S. Patent and Trademark Office issued over 300,000 patents.

- Trademark applications worldwide reached nearly 15 million in 2023.

- The cost of patent litigation can range from $1 million to over $5 million.

- Changes in IP laws can impact royalty revenues, which account for 5-10% of THK's revenue.

Trade Compliance and Export Controls

THK must adhere to intricate trade compliance regulations and export controls across diverse regions, which significantly impacts its international business. Non-compliance can result in substantial financial penalties, operational restrictions, and reputational damage. For instance, in 2024, the U.S. Department of Commerce imposed over $2 million in penalties on companies for export control violations. Stricter enforcement is expected in 2025.

- Export controls are intensifying globally, with a 15% increase in enforcement actions in 2024 compared to 2023.

- THK's compliance costs are estimated to rise by 8% in 2025 due to increased regulatory scrutiny.

- The company needs to invest in robust compliance programs to mitigate risks.

THK navigates complex legal frameworks affecting its operations. Product safety compliance and intellectual property protection are crucial for market access and innovation. Non-compliance may result in product recalls or legal actions.

| Legal Aspect | Impact | 2024 Data |

|---|---|---|

| Product Safety | Recalls, Penalties | Avg. recall cost: $12M |

| Intellectual Property | Infringement, Royalty Losses | Patent litigation cost: $1M-$5M+ |

| Trade Compliance | Penalties, Restrictions | Export control penalties (U.S.): $2M+ |

Environmental factors

The growing emphasis on sustainability shapes customer choices and strict regulations. THK is prioritizing energy-efficient product development and eco-friendly manufacturing. In 2024, the global green technology and sustainability market was valued at $366.6 billion, expected to reach $614.8 billion by 2029, according to Mordor Intelligence. This shift impacts THK's operational strategies and product offerings.

Environmental factors significantly impact THK's raw material costs. Steel and metal prices are volatile due to extraction regulations. For example, in 2024, steel prices fluctuated, affecting THK's profitability. Resource scarcity and environmental policies can increase material costs, impacting production expenses. The company needs to monitor these factors closely.

Climate change poses significant risks for THK. Extreme weather events could disrupt supply chains, impacting production. For instance, the 2024 floods cost the global economy billions. These disruptions can increase operational costs and reduce profitability. THK must adapt to mitigate these climate-related financial risks.

Waste Management and Recycling Regulations

Waste management and recycling regulations are critical for THK, influencing operational costs and practices. Compliance with rules on waste reduction, recycling, and byproduct disposal is essential. Effective waste management strategies are vital for environmental compliance, potentially affecting profitability. In 2024, global waste management spending reached $2.1 trillion, with projections of $2.5 trillion by 2027.

- Compliance costs can range from 2% to 5% of operational expenses.

- Recycling rates vary; Japan, where THK has significant operations, has a 20% recycling rate.

- Failure to comply results in fines that can exceed $1 million.

Energy Consumption and Greenhouse Gas Emissions

Growing pressure to reduce energy use and emissions affects manufacturing and equipment design. THK's focus on energy-efficient solutions is crucial. Globally, industrial energy use accounts for about 30% of total energy consumption. The EU aims to cut emissions by 55% by 2030.

- Industrial energy consumption is a significant factor in global emissions.

- THK's energy-efficient products can help meet environmental goals.

Environmental factors significantly affect THK's operations and finances, including customer preference for sustainable goods. Regulations related to waste management, recycling and emissions influence manufacturing and cost structure. Climate change poses supply chain and operational risks requiring proactive adaptation and waste management.

| Factor | Impact | Data |

|---|---|---|

| Sustainability Trends | Eco-friendly product focus | Green tech market: $614.8B by 2029 (Mordor Intelligence) |

| Raw Material Costs | Volatility & compliance | Steel price fluctuations in 2024 impacted profitability |

| Climate Risks | Supply chain disruption | 2024 Floods cost global economy billions |

| Waste Management | Cost & compliance | 2024 global spending: $2.1T, forecast $2.5T by 2027 |

| Energy Use & Emissions | Efficient equipment focus | EU's goal: -55% emissions by 2030 |

PESTLE Analysis Data Sources

THK PESTLE analyzes data from government reports, economic databases, and industry publications. We incorporate trends from research firms and policy updates.