Titan (India) Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Titan (India) Bundle

What is included in the product

Tailored analysis for Titan's product portfolio, detailing BCG Matrix strategic implications.

Clean and optimized layout for sharing or printing the Titan BCG Matrix.

Preview = Final Product

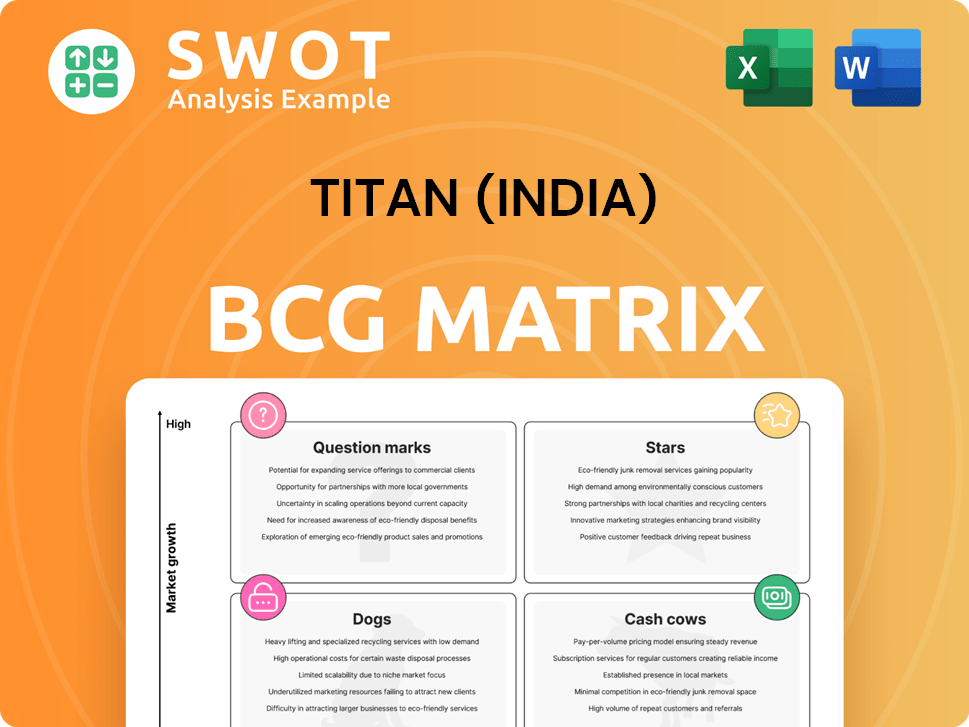

Titan (India) BCG Matrix

The displayed preview is the full Titan (India) BCG Matrix you'll receive. This strategic analysis document, ready for immediate application, offers insights into Titan's portfolio. No differences exist between the preview and the purchased file; it's the complete report.

BCG Matrix Template

Titan, a giant in the Indian market, features a fascinating BCG Matrix. Its diverse portfolio, from watches to jewelry, presents a complex strategic landscape. This preview shows how each product category fits the Stars, Cash Cows, Dogs, or Question Marks. Understanding these placements is key to success.

The complete BCG Matrix reveals exactly how Titan is positioned in a fast-evolving market. With quadrant-by-quadrant insights and strategic takeaways, this report is your shortcut to competitive clarity.

Stars

Tanishq and Zoya, Titan's jewelry brands, are stars due to high market share in India's growing luxury jewelry market. In FY24, Titan's jewelry segment revenue surged by 21% to ₹32,866 crore. Expansion and customer growth are key. Innovation and marketing are vital to maintain the competitive edge.

Titan's premium watch segment, including Nebula, Xylys, and Swiss Made Charriol, targets the luxury market. This segment saw a revenue increase, with the premium segment contributing significantly. Charriol's addition enhances its luxury portfolio. Continued investment is crucial for brand appeal and market share growth. In fiscal year 2024, the watches and wearables segment revenue was INR 3,700 crores.

Titan's premium eyewear, including Runway stores for sunglasses, is a Star. The Indian eyewear market is growing, with a focus on premium products. Brand building and innovation are key. In fiscal year 2024, Titan's eyewear segment saw revenue of ₹890 crore.

CaratLane

CaratLane, Titan's online jewelry brand, shines as a star. Its strong growth trajectory and expanding footprint, both domestically and internationally, highlight its success. The brand's focus on online sales and strategic store openings solidifies its position. Sustained investment in technology and marketing is key to maintaining its growth.

- Revenue increased by 30% in FY24.

- Expanded to 200+ stores by the end of 2024.

- Online sales contribute to 60% of total revenue.

- Plans for further international market penetration in 2024.

International Expansion

Titan's international expansion, especially with Tanishq and CaratLane, is a "Star" in its BCG matrix. This move capitalizes on the Indian diaspora and global retail opportunities. The company's success hinges on market research and adapting to different consumer behaviors. Expansion is a key driver for future growth, with recent strategies indicating a strong international push.

- Tanishq opened its first international store in Dubai in 2018 and has expanded to other GCC countries and the US.

- CaratLane has also started exploring international markets, particularly in the US.

- Titan's international revenue has been growing, although it still forms a small portion of the total revenue.

- The company plans to invest in marketing and brand building to support its international expansion strategy.

Titan's diverse "Stars" drive significant revenue growth. CaratLane's 30% FY24 revenue increase shows strong online performance, with 200+ stores by 2024. International expansion of Tanishq and CaratLane is key.

| Segment | FY24 Revenue (₹ Crore) | Key Highlights |

|---|---|---|

| Tanishq | 32,866 | 21% growth in FY24, leading jewelry brand. |

| Watches & Wearables | 3,700 | Premium segment growth, including Charriol. |

| Eyewear | 890 | Premium eyewear focus, Runway stores. |

| CaratLane | Data not available | 30% revenue increase, 200+ stores by 2024. |

Cash Cows

Titan and Sonata watches are cash cows in Titan's portfolio, holding a major share in India's organized watch market. They bring in significant revenue and profit. In FY24, Titan's watches and wearables segment saw a revenue of ₹3,476 crores. The strategy focuses on keeping market share and boosting profits. This ensures a steady cash flow for other company projects.

GoldPlus, part of Titan's portfolio, is a cash cow, focusing on rural markets with affordable gold jewelry. It benefits from strong brand recognition, leading to steady revenue streams. Marketing costs are kept low due to its established brand value. In 2024, GoldPlus contributed significantly to Titan's revenue, maintaining its cash cow status through customer loyalty and supply chain efficiency.

Titan Eye+ is a Cash Cow within Titan's portfolio. It boasts a robust presence in prescription eyewear, fueled by retail expansion and in-house manufacturing. The brand's focus on customer experience and innovation solidifies its Cash Cow status. In FY24, Titan's vision care segment revenue was ₹989 crore, indicating strong market performance. Efficiency and customer retention are key to maintaining profitability.

Helios

Helios, contributing about 10% to Titan's revenue, is positioned as a cash cow in the BCG matrix. It focuses on premium and luxury watches, aiming to introduce new international brands. This strategy leverages high-profit margins, making Helios a key revenue generator.

- Revenue Contribution: Helios accounts for approximately 10% of Titan's total revenue.

- Brand Focus: Primarily deals in premium and luxury watch segments.

- Expansion Plans: Intends to include more international brands in its portfolio.

- Profitability: Benefits from high-profit margins associated with luxury goods.

Skinn (Fragrances)

Skinn, Titan's fragrance brand, exemplifies a Cash Cow in the BCG matrix. It leverages strong brand recognition and customer loyalty, fostering repeat purchases. The fragrance market's moderate growth aligns with Skinn's established position, ensuring consistent revenue. Focusing on streamlined distribution and targeted promotions can maintain profitability. In 2024, the Indian fragrance market is valued at approximately $260 million, with Skinn holding a significant market share.

- Steady Revenue: Skinn's established presence ensures consistent income.

- Customer Loyalty: Strong brand recall drives repeat purchases.

- Market Position: Operates within a moderately growing market.

- Strategic Focus: Efficient distribution and selective promotions.

Titan's cash cows, including watches and eyewear, generate substantial revenue with strong market positions. They ensure steady cash flow for future investments. In FY24, the watches and wearables segment brought in ₹3,476 crores.

GoldPlus and Skinn also act as cash cows, benefiting from brand recognition. GoldPlus focuses on affordable gold jewelry and Skinn on fragrance, creating consistent revenue.

Helios, with its premium watch segment, and Titan Eye+ contribute significantly too. They leverage high-profit margins, with Titan Eye+ achieving ₹989 crore revenue in FY24, helping maintain strong profitability.

| Cash Cow | Segment | FY24 Revenue (₹ Crores) |

|---|---|---|

| Watches & Wearables | Watches | 3,476 |

| Titan Eye+ | Eyewear | 989 |

| Helios | Premium Watches | ~10% of total |

Dogs

Titan's wearables, like smartwatches, face a downturn, with sales and profits shrinking amid tough competition. To bounce back, Titan is banking on its strong brand reputation, unique designs, and premium price strategy. Financial data from 2024 indicates a 15% drop in wearables revenue. Restructuring or even selling off the segment might be needed if things don't improve soon.

Zoop, a Titan (India) brand targeting kids, struggles in the BCG Matrix. It faces intense competition and low brand recall. Limited marketing efforts have hindered its growth. In 2024, Zoop's market share remained small compared to other Titan brands like Titan Watches. Without a strategic overhaul, Zoop could remain a dog.

Titan's initial foray into the European watch market was a significant setback. The venture, active for several years, consumed resources without yielding profits. Ultimately, Titan withdrew from Europe, failing to gain brand recognition. This underscores the risks of global expansion without thorough market analysis.

Tommy Hilfiger (Watches)

Tommy Hilfiger watches, a licensed brand under Titan, could be categorized as a dog in the BCG matrix. This means it potentially struggles with low market share in a slow-growing market. Despite the brand's global recognition, its watch segment might not be performing optimally compared to other Titan products. Without strategic investments or market repositioning, Tommy Hilfiger watches could remain a less profitable segment for Titan.

- Market share challenges: The watch market is competitive, and Tommy Hilfiger may be losing ground.

- Growth limitations: Slow growth in the watch segment could be impacting the brand.

- Investment needs: To improve, it needs significant capital and strategic changes.

- Profitability: The brand may not be as profitable as other Titan segments.

Lee Cooper (Watches)

Lee Cooper watches, a licensed brand under Titan, might be classified as a dog within the BCG matrix. This indicates that the brand could be struggling to compete effectively in its market segment. The performance of Titan's watches segment showed revenue of ₹2,866 crore in Q3 FY24, a 14% increase, but the specific contribution of Lee Cooper is not detailed separately. Without substantial investment or strategic repositioning, Lee Cooper watches may continue to underperform.

- Market share struggles might affect the brand's growth.

- Limited investment could hinder its ability to compete.

- Repositioning may be needed to boost performance.

- Overall watch segment growth doesn't always reflect individual brand success.

Dogs in Titan (India)'s BCG matrix, like Tommy Hilfiger and Lee Cooper watches, struggle with low market share and growth.

These brands may require significant investment or strategic repositioning to boost performance.

While Titan's watch segment saw a 14% increase in Q3 FY24 revenue, individual brand performance varies.

| Brand | BCG Status | Challenges |

|---|---|---|

| Tommy Hilfiger | Dog | Market share, growth limitations |

| Lee Cooper | Dog | Competition, investment needs |

| Zoop | Dog | Low recall, limited marketing |

Question Marks

Taneira, Titan's ethnic wear brand, is a question mark in the BCG matrix. It operates in the growing Indian ethnic wear market. Despite high growth potential, Taneira has a low market share. In 2024, the Indian apparel market was valued at approximately $65 billion.

Earth, Titan's handbag brand, is a question mark. The Indian handbag market was valued at $775 million in 2024. Earth's low market share faces competition. Partnerships and brand building are essential for growth. Consider strategies to boost market share in 2025.

Titan Eye+ (Sunglasses) likely falls into the "Question Mark" category within Titan's BCG matrix. While it leverages Titan's brand, its sunglasses market share is smaller compared to prescription eyewear. Runway store launches and marketing investments aim to grow market presence. For instance, in fiscal year 2024, Titan's eyewear segment revenue was ₹873.49 crore.

Fastrack (Eyewear)

Fastrack, a Titan brand, operates in the BCG matrix as a question mark within the eyewear segment. While the brand is popular with watches and accessories, its eyewear market share is currently low. Fastrack's potential is high due to its strong youth appeal, but it needs strategic efforts to grow. Aggressive marketing and expansion are key to transforming Fastrack Eyewear into a star.

- Market share in eyewear is low compared to established brands.

- Youth-focused marketing campaigns could boost visibility.

- Expansion into new retail locations is crucial.

- Fastrack's brand recognition is a significant asset.

Wearables (Refocus)

Titan's wearables segment is undergoing a strategic shift, particularly in light of its decline. The company is now concentrating on its core strengths: consumer trust, design quality, and premium pricing. This refocus aims to leverage Titan's existing brand equity. The effects of this strategic adjustment are expected to become apparent within the next 6 to 18 months.

- Wearables market is projected to reach $81.6 billion in 2024.

- Titan's focus on premium pricing could offset the impact of market decline.

- Consumer trust is crucial in the competitive wearables market.

- Design and innovation are key differentiators in the wearables industry.

Titan's question marks, like Taneira and Earth, have low market share in growing sectors. Fastrack Eyewear also struggles for market share. Strategic initiatives and brand-building are crucial for growth. Expansion and youth-focused campaigns are key.

| Brand | Market | Challenge |

|---|---|---|

| Taneira | Ethnic Wear (India) | Low market share in $65B market (2024) |

| Earth | Handbags (India) | Competition in $775M market (2024) |

| Fastrack Eyewear | Eyewear | Low market share, needs growth strategies |

BCG Matrix Data Sources

Titan's BCG Matrix is built on financial reports, market studies, and sales figures for precise strategic insights.