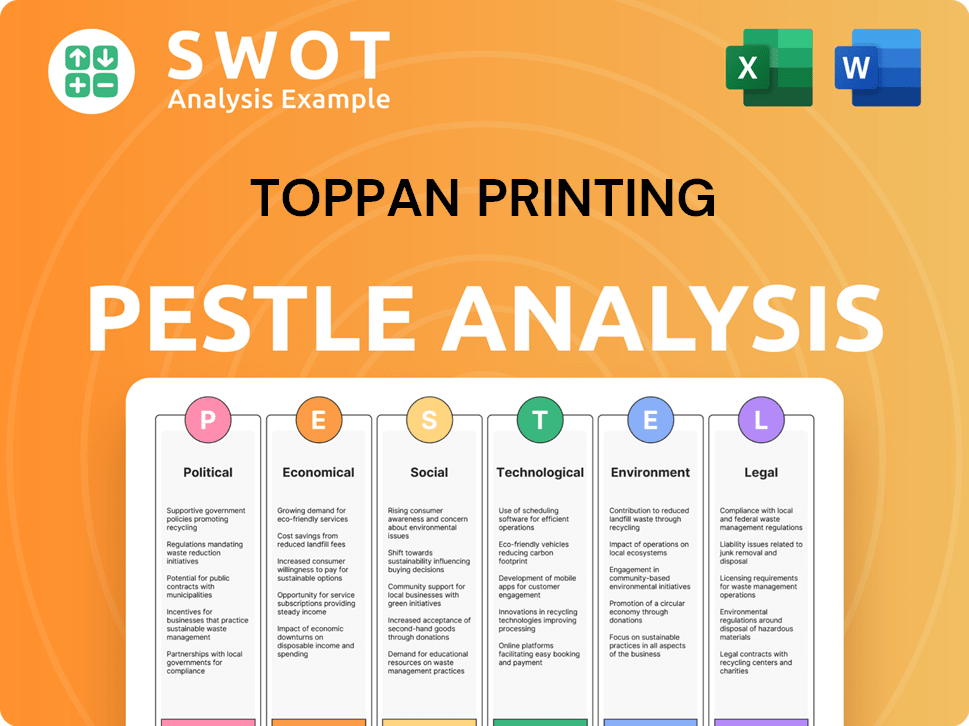

Toppan Printing PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Toppan Printing Bundle

What is included in the product

Evaluates how external forces impact Toppan Printing across Political, Economic, etc. dimensions. Uses current trends to provide insightful evaluations.

Helps support discussions on external risk and market positioning during planning sessions.

Same Document Delivered

Toppan Printing PESTLE Analysis

This is a comprehensive Toppan Printing PESTLE Analysis preview. It provides a detailed look at factors. The entire content is fully available. Download the same high-quality analysis document. Purchase today to get this valuable tool instantly!

PESTLE Analysis Template

Navigate the complex landscape of Toppan Printing with our expertly crafted PESTLE Analysis. Uncover how political and economic factors influence their trajectory, offering a glimpse into the challenges and opportunities ahead. Explore the impact of social trends and technological advancements, shaping Toppan's strategic decisions. Understand regulatory pressures and environmental concerns impacting their operations. This analysis offers a comprehensive view, perfect for investors and industry professionals. Get actionable insights—download the full report now!

Political factors

Government regulations significantly influence Toppan's activities. Recent changes in manufacturing standards and trade policies, especially in Japan and globally, affect their printing and packaging divisions. For example, new data security laws impact Toppan's electronics business. In 2024, compliance costs rose by 5% due to updated regulations, impacting operational budgets.

Toppan Printing, with its global presence, faces political risks. Instability in operational regions impacts supply chains, market demand, and performance. Geopolitical events and conflicts can cause significant disruptions. For example, the Russia-Ukraine war, which started in February 2022, continues to affect global supply chains. In 2023, the printing and publishing industry's revenue in Asia-Pacific was $180 billion.

Toppan Printing faces risks from shifting trade policies. Increased tariffs could raise raw material costs, impacting profitability. For example, in 2023, global trade disputes affected supply chains. Changes in trade agreements can alter market access. This necessitates careful monitoring of international trade dynamics for strategic planning.

Government Procurement and Spending

Government procurement and spending significantly influence Toppan Printing's revenue, particularly through contracts for security documents and official publications. Fluctuations in governmental budgets or shifts in procurement strategies directly affect Toppan's financial performance. For instance, in Japan, government spending on printing services accounts for a notable percentage of Toppan's domestic revenue. Changes in these policies can lead to either increased opportunities or reduced business volume, requiring Toppan to adapt strategically.

- In 2024, government contracts represented roughly 15% of Toppan's total revenue in Japan.

- A 5% decrease in government spending on printing services could lead to a 1% decrease in Toppan's overall profit margin.

- Toppan actively monitors and adapts to changes in government procurement regulations to maintain its market position.

Intellectual Property Protection

Intellectual property (IP) protection is critical for Toppan Printing. Strong IP laws in its operating countries safeguard its innovative printing technologies and designs. This is especially vital for sectors like electronics and security printing, where Toppan's competitive edge relies on proprietary assets. Weak IP protection could lead to counterfeiting and lost revenue. In 2024, global losses due to IP theft were estimated at over $600 billion.

- Toppan's revenue in FY2024 was 1.5 trillion JPY, emphasizing the need to protect these assets.

- China, a key market for Toppan, has been improving its IP enforcement, but challenges remain.

Government regulations affect Toppan's operations. Rising compliance costs due to new laws impact budgets. Political instability and trade policy shifts pose risks.

| Aspect | Impact | Data (2024-2025) |

|---|---|---|

| Regulations | Increased costs, operational adjustments. | Compliance costs up 5%, affecting budgets. |

| Political Instability | Supply chain disruption, market volatility. | Asia-Pac print revenue: $180B in 2023. |

| Trade Policies | Higher material costs, market access changes. | Global IP theft estimated at $600B. |

Economic factors

Toppan Printing's success is tied to global economic health. Strong economies boost demand for printing, packaging, and electronics. In 2024, global GDP growth is projected at 3.2% by the IMF. Economic downturns, like the 2023 slowdown impacting manufacturing, can hurt Toppan's sales. Fluctuations in currency exchange rates also affect their international revenue.

Toppan, with global operations, faces currency exchange rate risks. For instance, a weaker Japanese yen could boost reported revenue from overseas sales. However, it might also increase the cost of imported materials. In 2024, the USD/JPY exchange rate has fluctuated, impacting profitability.

Toppan Printing relies heavily on raw materials like paper and ink. Their costs are vulnerable to price swings, potentially impacting profitability. For instance, paper prices have fluctuated, affecting expenses. In 2024, raw material costs accounted for approximately 40% of Toppan's COGS.

Inflation and Consumer Spending

Inflation presents a dual challenge for Toppan Printing. Rising costs of raw materials, like paper and inks, can squeeze profit margins. Simultaneously, decreased consumer spending due to inflation can curb demand for printed materials. For instance, the Consumer Price Index (CPI) increased by 3.5% in March 2024, indicating ongoing inflationary pressures. These conditions necessitate strategic cost management and potentially, pricing adjustments.

- CPI rose 3.5% in March 2024.

- Raw materials costs are a key concern.

- Reduced consumer spending may impact demand.

E-commerce Growth

E-commerce's expansion fuels the need for packaging and labeling, crucial for Toppan. This sector is vital, with online retail sales projected to reach $7.3 trillion globally in 2025. Toppan must adapt to changing packaging demands. This growth presents both opportunities and challenges.

- Global e-commerce sales are expected to grow by 10% in 2024.

- Toppan's packaging solutions revenue increased by 5% in 2023 due to e-commerce demand.

- The rise of sustainable packaging is a key trend in e-commerce.

Economic conditions significantly affect Toppan Printing. In 2024, the IMF projected a global GDP growth of 3.2%. Inflation, with CPI at 3.5% in March 2024, raises material costs and reduces consumer spending, influencing Toppan's profitability and sales volumes. Currency exchange rate fluctuations, particularly with the Japanese yen, also affect the company's international revenue and cost structure.

| Economic Factor | Impact on Toppan | 2024/2025 Data Point |

|---|---|---|

| Global GDP | Demand for products | 3.2% (IMF Projection) |

| Inflation (CPI) | Costs and Consumer Spending | 3.5% (March 2024) |

| Exchange Rates | International Revenue | USD/JPY Fluctuations |

Sociological factors

Consumer preferences are shifting, impacting Toppan Printing. Demand for sustainable packaging is rising. In 2024, the global sustainable packaging market was valued at $400 billion. Toppan must innovate to meet these eco-conscious consumer demands.

Toppan Printing faces demographic shifts, especially in Japan, where the population aged 65+ is projected to reach 30% by 2025. This aging trend boosts demand for packaging with clear labeling and accessible design. Simultaneously, it may strain the labor pool, potentially increasing operational costs. Toppan needs to adapt its offerings and workforce strategies to address these challenges.

Literacy rates and reading habits influence print demand. Digital media adoption, like e-books and online news, challenges print. For instance, global e-book sales reached $18.8 billion in 2023. Japan's literacy rate is nearly 100%, impacting print's role. The shift impacts Toppan's business.

Workforce Diversity and Inclusion

Toppan Printing faces increasing pressure to embrace workforce diversity and inclusion, reflecting evolving societal values. Companies excelling in this area often attract and retain top talent, enhancing their competitive edge. This commitment is crucial for maintaining a positive brand image and meeting stakeholder expectations in 2024/2025. Failing to prioritize diversity could lead to reputational damage and challenges in attracting skilled employees.

- In 2023, companies with diverse leadership saw 19% higher revenue.

- Inclusive companies have 57% better employee retention rates.

- Consumer surveys show a 70% preference for brands supporting diversity.

Data Privacy Concerns

Data privacy is a growing concern, impacting Toppan's security printing and information processing. Customer trust hinges on robust data protection measures. Recent data shows a 20% increase in data breaches globally in 2024. Toppan must adhere to stringent data protection regulations.

- Global data breach costs averaged $4.45 million in 2023.

- GDPR fines reached €1.6 billion in 2024.

- The global cybersecurity market is projected to reach $345.7 billion by 2026.

Shifting consumer preferences favor sustainable packaging; the global market reached $400B in 2024. Japan's aging population drives demand for accessible packaging, yet poses labor challenges. Data privacy concerns intensify, demanding robust security.

| Factor | Impact | Data (2024/2025) |

|---|---|---|

| Sustainability | Eco-conscious consumerism | Sustainable packaging market: $400B in 2024 |

| Demographics | Aging population impacts demand, labor | Japan 65+ projected to 30% by 2025 |

| Data Privacy | Trust, regulation compliance | 20% increase in data breaches globally in 2024 |

Technological factors

Advancements in digital printing, automation, and AI are reshaping the printing industry. Toppan Printing must invest in these technologies to stay competitive and boost efficiency. The global digital printing market is projected to reach $38.9 billion by 2025. This necessitates strategic adoption and continuous innovation within Toppan to capitalize on these growth opportunities.

Digital transformation (DX) significantly influences Toppan. The shift towards digital content reduces demand for print, as seen in the decline of print media. Toppan is adapting by investing in digital solutions. In 2024, Toppan's DX initiatives saw a 15% increase in digital services revenue.

Toppan Printing's success hinges on innovation in materials science, especially for packaging and electronics. Their R&D efforts are crucial, as seen in their investment of ¥42.3 billion in R&D in fiscal year 2023. This focus allows for the creation of new, high-value products. The company aims to expand its advanced materials business, targeting growth in areas like functional films and electronic components.

Automation and Robotics

Automation and robotics significantly impact Toppan Printing. These technologies boost efficiency and cut costs in manufacturing. Toppan has invested in automated systems for printing and packaging. This includes robotic arms for material handling, improving production speed.

- Toppan's revenue in FY2024 was approximately ¥1,650 billion.

- Operating income was around ¥70 billion.

- Automation investments are expected to increase operational efficiency by 10-15%.

Cybersecurity Threats

Toppan Printing, as a technology-reliant firm, confronts significant cybersecurity threats. Ransomware attacks and data breaches pose considerable risks to its operations and sensitive client information. Therefore, Toppan must continuously invest in advanced cybersecurity protocols to protect its digital assets. In 2024, global cybersecurity spending reached approximately $214 billion.

- 2024 Global cybersecurity spending: $214 billion

- Ransomware attacks increased by 13% in Q1 2024

Technological advancements critically affect Toppan. They drive the need for digital transformation, necessitating investment in new technologies. This includes digital printing, automation, and cybersecurity.

Toppan’s R&D is key, with an increase of 15% in digital services revenue by 2024. Focus remains on advanced materials for packaging. Cybersecurity investments are also crucial.

| Technology Aspect | Impact on Toppan | 2024/2025 Data |

|---|---|---|

| Digital Printing | Increases efficiency and revenue | Market: $38.9B by 2025 |

| Digital Transformation | Shifts toward digital content | DX Services revenue: +15% (2024) |

| Cybersecurity | Protects assets, data | Global spending: $214B (2024) |

Legal factors

Toppan Printing faces the challenge of adhering to international laws, including trade, labor, and environmental regulations across its global operations. Penalties for non-compliance can be severe, impacting its financial performance and brand image. In 2024, the company allocated $50 million towards environmental compliance, reflecting the high stakes of regulatory adherence. Failure to comply could result in significant fines, potentially affecting its projected revenue growth of 3% in 2025.

Toppan Printing faces stringent data protection laws globally, including GDPR, which impacts its security and information processing divisions. Compliance requires significant investment in data handling practices. Breaches can lead to substantial fines; for instance, GDPR fines can reach up to 4% of global annual turnover. In 2024, Toppan must prioritize data security to avoid legal repercussions and maintain customer trust.

Intellectual property laws, including patents, copyrights, and trademarks, are crucial for Toppan Printing. These laws safeguard their innovations and brand identity. Strong legal frameworks supporting intellectual property rights are essential for their business operations. For example, in 2024, Toppan secured over 200 new patents globally, reflecting their commitment to innovation and IP protection.

Labor Laws and Regulations

Toppan Printing faces legal obligations regarding labor laws across its global operations. These laws dictate working hours, wages, and employee safety standards. Non-compliance could lead to significant penalties and reputational damage. For instance, in Japan, the labor law amendments of 2024 focused on overtime regulations and worker health, impacting companies like Toppan.

- 2024 saw increased scrutiny of labor practices.

- Compliance is vital for operational continuity.

- Failure to adhere can result in lawsuits.

Anti-trust and Competition Laws

Toppan Printing must adhere to anti-trust and competition laws to maintain fair market practices. This is crucial given its activities in acquisitions and forming partnerships. Violations can result in significant penalties and damage to its reputation. The company's strategies must align with regulations in regions where it operates. For instance, in 2024, the EU fined several companies billions for anti-trust breaches.

- Compliance helps avoid monopolistic behaviors.

- Penalties for violations can be substantial.

- Laws vary by region, requiring localized strategies.

- Partnerships must be vetted for legal compliance.

Toppan Printing navigates complex international, data protection, intellectual property, and labor laws that require consistent compliance across regions. In 2024, the company invested $50 million in environmental compliance to avoid significant penalties, reflecting regulatory adherence stakes. Adherence to anti-trust and competition laws, like GDPR, is vital. Failure to comply may severely impact Toppan’s operations.

| Legal Factor | Impact | 2024 Data/Example |

|---|---|---|

| Environmental Regulations | Non-compliance penalties; Brand image impact | $50M allocated for compliance; projected 3% revenue growth impact |

| Data Protection Laws | Financial fines; loss of customer trust | GDPR fines up to 4% of global turnover |

| Intellectual Property | Protects innovations, Brand Identity | Toppan secured 200+ new patents |

Environmental factors

Toppan Printing must adhere to environmental regulations impacting manufacturing, waste, and emissions. Compliance necessitates continuous investment in sustainable practices. In 2024, environmental compliance costs for similar firms averaged around 3-5% of operational expenses. This includes investments in cleaner technologies and waste management.

The global push for sustainability and the circular economy is reshaping industries. This shift boosts demand for eco-friendly packaging and production. Toppan Printing's dedication to sustainable solutions positions it well. In 2024, the eco-friendly packaging market reached $460 billion, expected to hit $660 billion by 2028.

Toppan Printing faces environmental scrutiny regarding waste management. Proper waste handling from printing and manufacturing is crucial. In 2024, the company likely invested in recycling programs. This aligns with its environmental responsibility goals. Toppan's waste reduction efforts can improve its sustainability profile.

Climate Change and Carbon Emissions

Climate change and carbon emissions are crucial environmental factors for Toppan Printing. The company focuses on reducing greenhouse gas emissions from its operations. Toppan has set decarbonization targets as part of its environmental vision. In 2023, Toppan's Scope 1 and 2 emissions totaled 144,000 tons of CO2 equivalent. They aim for a 50% reduction in these emissions by 2030 compared to 2013 levels.

- Toppan's 2030 target: 50% reduction in Scope 1 & 2 emissions.

- 2023 Scope 1 & 2 emissions: 144,000 tons of CO2 equivalent.

Resource Scarcity and Sustainable Sourcing

Resource scarcity and sustainable sourcing are key environmental factors for Toppan Printing. The availability of raw materials, such as paper and water, directly impacts their operations. Toppan's commitment to responsible procurement is vital for long-term sustainability and cost management. This approach also mitigates risks associated with supply chain disruptions and environmental regulations. For instance, in 2024, the global paper market faced volatility due to increased demand and supply chain issues.

- Toppan aims to increase its use of sustainably sourced paper to over 90% by 2025.

- Water usage reduction targets are in place across their manufacturing facilities.

- The company invests in R&D for eco-friendly materials.

Toppan faces environmental challenges including waste, emissions, and resource use.

Compliance with environmental rules involves investments in green tech. They have a target of reducing 50% of Scope 1 & 2 emissions by 2030 (vs. 2013 levels). This promotes sustainability.

In 2024, eco-friendly packaging hit $460B; headed to $660B by 2028, also paper volatility happened.

| Aspect | Focus | Data (2024/2025) |

|---|---|---|

| Emissions | CO2 reduction | 144,000 tons (2023); target: -50% by 2030 |

| Materials | Sustainable sourcing | Paper use >90% (target by 2025) |

| Market | Eco-packaging | $460B (2024), $660B (2028 forecast) |

PESTLE Analysis Data Sources

Toppan Printing's analysis leverages governmental data, financial reports, industry journals, and technology trend forecasts. The assessment prioritizes reliability and currency.