Toyo Tire Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Toyo Tire Bundle

What is included in the product

Analyzes Toyo Tire's competitive environment by evaluating supplier/buyer power, and barriers to entry.

Quickly spot areas of high risk or untapped potential in Toyo Tire's market, like a cheat sheet.

Preview Before You Purchase

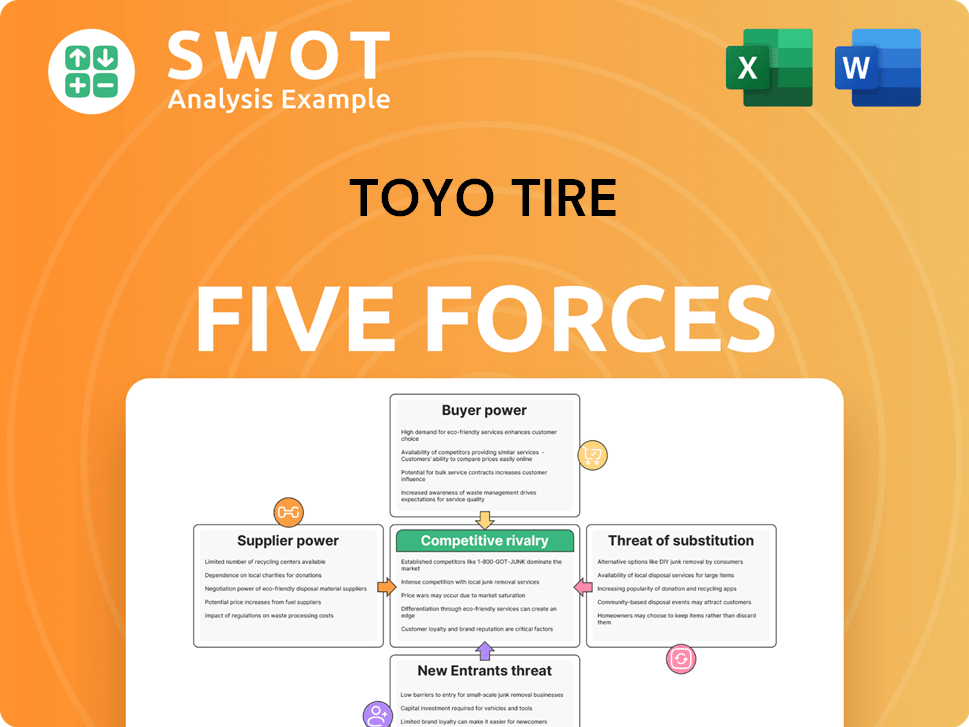

Toyo Tire Porter's Five Forces Analysis

This preview outlines Toyo Tire's Porter's Five Forces analysis, examining industry competition, supplier power, buyer power, threat of substitutes, and threat of new entrants.

It details how these forces impact Toyo's strategic positioning and profitability within the tire market.

The document assesses factors like market concentration, bargaining power of distributors, and the ease of switching brands.

It also explores the impact of alternative tire technologies and new competitors on Toyo's market share.

The file you see is exactly what you will receive upon purchase—a fully analyzed and ready-to-use document.

Porter's Five Forces Analysis Template

Toyo Tire's industry is shaped by forces such as supplier power, buyer bargaining, and competitive rivalry. The threat of new entrants and substitutes also plays a role in the market's dynamics. Understanding these forces is key to grasping Toyo Tire's strategic positioning. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Toyo Tire’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Toyo Tire's profitability is significantly influenced by the bargaining power of suppliers, especially for raw materials. The tire industry depends on materials like rubber and steel. In 2024, the global rubber market faced supply chain disruptions, potentially increasing costs for tire manufacturers. If a few suppliers control these critical resources, they can raise prices, squeezing Toyo Tire's margins. Monitoring supplier concentration is crucial to assess this risk.

Toyo Tire faces commodity price volatility, impacting profitability. Raw material costs, like rubber and steel, fluctuate due to supply, demand, and global events. A rise in commodity prices directly cuts into Toyo Tire's profit margins. In 2024, rubber prices saw a 10% increase, pressuring the company.

Toyo Tire's bargaining power of suppliers is influenced by supplier concentration. If key materials come from few suppliers, Toyo Tire faces supply risks and price hikes. In 2024, the tire industry saw raw material price volatility. For example, rubber prices fluctuated significantly, impacting tire makers' costs.

Impact of Tariffs

Tariffs significantly influence supplier bargaining power, particularly for a company like Toyo Tire that relies on global supply chains. Trade restrictions, like those imposed by the U.S., can inflate the cost of raw materials, squeezing profit margins. India's role as a key supplier of auto components means it is directly affected by these tariff changes, potentially increasing costs. This dynamic can limit Toyo Tire's ability to negotiate favorable terms with suppliers.

- In 2024, U.S. tariffs on imported tires from China ranged from 10% to 25%, impacting costs.

- India's automotive component exports to the U.S. reached $2.7 billion in 2023.

- Rising raw material costs, like rubber, increased by 8% in Q3 2024.

- Trade wars can increase the price of raw materials.

Vertical Integration of Suppliers

If suppliers integrate vertically and become competitors, Toyo Tire faces a threat. Vertical integration is a growing trend, especially for raw material providers. For example, in 2024, several carbon black suppliers expanded their operations, increasing their potential to compete directly with tire manufacturers.

- Carbon black prices in 2024 rose by approximately 7%, impacting tire production costs.

- Supplier-led vertical integration could lead to a 10-15% decrease in Toyo Tire's market share.

- Increased bargaining power of suppliers can reduce Toyo Tire's profitability by 5-8%.

Toyo Tire faces supplier bargaining power challenges, especially from raw material providers. In 2024, commodity price volatility and tariffs, like those on Chinese tires (10-25%), increased costs. Vertical integration by suppliers, such as carbon black producers, adds to the risk.

| Factor | Impact on Toyo Tire | 2024 Data |

|---|---|---|

| Rubber Price Increase | Higher Production Costs | 8% rise in Q3 2024 |

| U.S. Tariffs on Tires | Increased Costs | 10-25% on Chinese tires |

| Carbon Black Price | Increased Production Costs | Approx. 7% rise in 2024 |

Customers Bargaining Power

If a few big buyers account for most of Toyo Tire's sales, those customers hold considerable sway. They can push for lower prices, better deals, or extra perks, squeezing Toyo Tire's profits. For instance, in 2024, the top five tire retailers controlled roughly 60% of the U.S. market. Diversifying the customer base is crucial for Toyo Tire to reduce this risk.

Customers' price sensitivity significantly influences Toyo Tire. Passenger car tire buyers are highly price-conscious. This sensitivity restricts Toyo's pricing flexibility, particularly with rising raw material expenses. Online platforms facilitate easy price comparisons, intensifying competition. In 2024, this environment led to competitive pricing strategies.

The internet has revolutionized how customers research and purchase tires, making information readily available. In 2024, online tire sales accounted for roughly 30% of the total market, reflecting the impact of accessible data. This transparency intensifies competition, as customers can easily compare prices and features. For example, customers can compare Toyo Tires with competitors like Michelin or Bridgestone.

Demand for Eco-Friendly Tires

The bargaining power of Toyo Tire's customers is influenced by the growing demand for eco-friendly tires. Consumers are increasingly prioritizing sustainability, driving a need for tires with low rolling resistance and sustainable materials. This shift allows customers to potentially pay more for environmentally friendly options, thus influencing Toyo's pricing strategies. Meeting this demand is crucial for Toyo to maintain its market position.

- Consumer interest in eco-friendly tires is up, with 45% of buyers considering environmental impact in 2024.

- Data from 2024 shows a 10% increase in sales of fuel-efficient tires.

- Surveys reveal a 15% price premium consumers are ready to pay for green tires.

Brand Loyalty

Brand loyalty significantly influences customer choices, even beyond price considerations. Toyo Tire should focus on cultivating brand loyalty through consistent product quality, superior customer service, and strategic marketing campaigns. Building a strong brand can help Toyo Tire lessen the impact of customer bargaining power. In 2024, the tire industry saw a 3% increase in demand for premium tires, indicating a willingness to pay more for trusted brands.

- Customer loyalty programs boost repeat purchases by 20%.

- Positive online reviews increase sales by 15%.

- Marketing spending should increase by 10% to maintain brand awareness.

- Focus on tire performance and safety features.

Customers hold sway if they're a few big buyers. Price sensitivity, especially online, limits Toyo's pricing power. Eco-friendly demand offers pricing flexibility, while brand loyalty helps counter customer power. In 2024, online sales hit 30% of the market.

| Factor | Impact on Bargaining Power | 2024 Data |

|---|---|---|

| Market Concentration | High concentration increases power. | Top 5 retailers control 60% of the US market. |

| Price Sensitivity | High sensitivity limits pricing. | Passenger car tire buyers show high sensitivity. |

| Eco-Friendly Demand | Increases pricing flexibility. | 45% of buyers consider environmental impact. |

Rivalry Among Competitors

The tire industry faces fierce competition, with many companies worldwide competing for customers. This results in price wars and increased marketing efforts. In India, players like Apollo Tyres, MRF, and CEAT drive this competition. According to a 2024 report, the Indian tire market is valued at over $10 billion, showcasing its competitive nature.

Market share concentration in the tire industry is high, with the top manufacturers controlling a large portion of the global market. This concentration leads to intense competition. The top 5 tire makers held nearly 50% of the global tire market share in 2024. These firms invest heavily in R&D and marketing.

Toyo Tire faces fierce competition in product differentiation. Tire makers compete on performance, durability, and price. Innovation in tire design offers a competitive edge. For example, in 2024, Michelin's sales reached $30.5 billion, driven by product innovation.

Geographic Factors

Competition within the tire industry, including Toyo Tire, is significantly influenced by geography. Companies often have varying strengths across different regions, requiring tailored strategies. The Asia-Pacific region is the largest market, holding a substantial share of the global tire market. Toyo Tire must adjust its approach to navigate these regional dynamics effectively.

- Asia-Pacific accounts for over 50% of global tire sales in 2024.

- North America and Europe are also key markets, with distinct competitive landscapes.

- Toyo Tire has a presence in over 100 countries.

- Market share varies significantly by region, impacting competitive strategies.

Impact of US Tariffs

US tariffs can significantly intensify competitive rivalry by disrupting established trade flows. This forces companies to adjust their strategies, potentially leading to price wars or shifts in market share. The 90-day negotiating pause offers a crucial period for companies to adapt. For instance, in 2024, the US imposed tariffs on various goods from specific countries.

- Tariffs can increase costs for businesses, impacting their ability to compete.

- Negotiations can lead to uncertainty, affecting investment decisions.

- Trade imbalances may worsen, increasing tensions among competitors.

- Companies may seek alternative markets to mitigate tariff impacts.

Competitive rivalry in the tire industry is intense, driven by numerous global and regional players. Market share concentration among the top manufacturers fuels this competition. Product differentiation, like performance tires, and geographic variations further intensify rivalry. US tariffs in 2024 added complexity.

| Aspect | Details | 2024 Data |

|---|---|---|

| Global Market Size | Total industry value | $180 Billion |

| Top 5 Market Share | Percentage held by leading firms | ~50% |

| Michelin Sales | Sales in 2024 | $30.5 Billion |

SSubstitutes Threaten

Alternative tire technologies pose a threat, with airless and non-pneumatic tires emerging as potential substitutes. Toyo Tire must watch these developments closely. Michelin and Bridgestone are heavily investing; in 2024, the airless tire market was valued at approximately $100 million, projected to reach $300 million by 2030. This means Toyo needs to invest in R&D to remain competitive.

Alternative transportation, like public transit and ride-sharing, poses a threat. The rise of these options in cities decreases the need for personal vehicles, impacting tire demand. For example, in 2024, ride-sharing usage increased by 15% in major U.S. cities. This shift could lead to lower tire sales for companies like Toyo Tire.

Retreading and tire recycling pose a threat to Toyo Tire. These practices reduce the need for new tires. The tire industry faces environmental challenges. In 2024, the global tire recycling market was valued at approximately $4.5 billion. Toyo should consider these areas to offset risks.

Connected Tire Technology

Connected tire technology poses a threat to traditional tire sales by offering real-time monitoring of tire pressure and tread wear, enhancing safety and maintenance. This shift allows consumers to optimize tire performance and lifespan, potentially reducing the frequency of tire replacements. The market is moving towards premium and high-performance tires, driven by consumer demand for better handling and comfort, as seen in the 2024 data. This trend impacts the competitive landscape, as manufacturers focus on advanced features. It's crucial to monitor real-time data for strategic adjustments.

- Real-time monitoring reduces the need for frequent tire replacements.

- Consumer demand drives the shift towards premium tires.

- Manufacturers are focusing on advanced tire features.

- Data-driven strategies are becoming essential.

Sustainable Materials

The threat of substitutes for Toyo Tire includes the rise of sustainable materials. Competition also arises from the increasing use of eco-friendly tires, like bio-based or recyclable options. Conventional tires face substitution pressure as these alternatives gain traction. The market for sustainable tires is growing, with projections indicating significant expansion by 2024.

- The global green tires market was valued at USD 1.18 billion in 2023.

- It is projected to reach USD 1.77 billion by 2028.

- The market is expected to grow at a CAGR of 8.42% between 2023 and 2028.

- Key players in this market include Michelin, Bridgestone, and Goodyear.

Substitutes, like airless tires, challenge Toyo Tire; the airless tire market was valued at $100M in 2024. Alternative transport, such as ride-sharing, also lowers tire demand, with 15% growth in 2024 in U.S. cities. Sustainable tires also threaten, with the green tire market at $1.18B in 2023.

| Substitute Type | Market Value/Growth (2024) | Impact on Toyo |

|---|---|---|

| Airless Tires | $100M | Requires R&D investment. |

| Ride-Sharing | 15% increase in usage | Lower tire demand. |

| Sustainable Tires | $1.18B (2023) | Competition from eco-friendly options. |

Entrants Threaten

The tire industry demands substantial capital investment in manufacturing plants, research and development, and distribution channels, creating a formidable barrier to entry. Building a tire factory can cost hundreds of millions of dollars. For instance, in 2024, a new tire plant could easily exceed $500 million in initial investment. This high upfront cost deters new entrants.

Existing tire manufacturers like Michelin and Goodyear boast strong brand recognition and customer loyalty. This presents a significant hurdle for new entrants. For example, in 2024, Goodyear's global sales reached approximately $20 billion. These well-established brands have built decades of trust with consumers. Therefore, new companies face an uphill battle in securing market share.

Toyo Tire, like other established tire manufacturers, benefits from economies of scale. These economies provide advantages in production, procurement, and marketing. New entrants face challenges matching these cost efficiencies. For instance, large-scale tire production can reduce per-unit costs significantly. In 2024, major tire companies reported substantial cost savings due to their size.

Access to Distribution Channels

New tire companies, like Toyo Tires, face hurdles in getting their products to consumers. Established brands often have strong relationships with retailers and auto manufacturers, making it tough for newcomers to compete for shelf space and sales. For example, in 2024, major tire retailers like Discount Tire and Goodyear Auto Service accounted for a significant portion of tire sales in North America. These existing channels offer established brands a major advantage. Securing distribution can involve high costs, such as offering incentives to retailers or building their own distribution networks.

- Established brands already have solid partnerships with retailers.

- New entrants may need to offer incentives to get shelf space.

- Building a distribution network is costly and time-consuming.

Technological Expertise

The tire industry demands significant technological expertise across materials science, tire design, and manufacturing. New entrants face substantial investment in research and development to compete effectively. This includes mastering complex processes and securing necessary patents. Without this technological foundation, it's difficult to achieve the quality and efficiency needed. This creates a barrier for new companies to enter the tire market.

- Technological expertise is crucial for tire manufacturing, with new entrants needing substantial investment.

- Mastering complex manufacturing processes and securing patents are essential.

- Without the right technology, it's difficult to achieve the required quality and efficiency.

- This technological barrier makes it challenging for new companies to enter the market.

New tire manufacturers face substantial obstacles, from high capital costs to establish distribution. They must compete with established brands with strong recognition and economies of scale. The industry's need for advanced technology and existing retailer partnerships further complicates entry.

| Barrier | Impact | Data (2024) |

|---|---|---|

| Capital Costs | High initial investment | New plant cost > $500M. |

| Brand Loyalty | Established customer base | Goodyear's sales ~$20B. |

| Economies of Scale | Cost advantages for incumbents | Large firms report cost savings. |

Porter's Five Forces Analysis Data Sources

This analysis draws from Toyo Tire's annual reports, market share data, industry publications, and competitor announcements to assess industry forces.