Transportation Insight SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Transportation Insight Bundle

What is included in the product

Outlines the strengths, weaknesses, opportunities, and threats of Transportation Insight.

Streamlines Transportation Insight's complex data with an organized SWOT.

Preview Before You Purchase

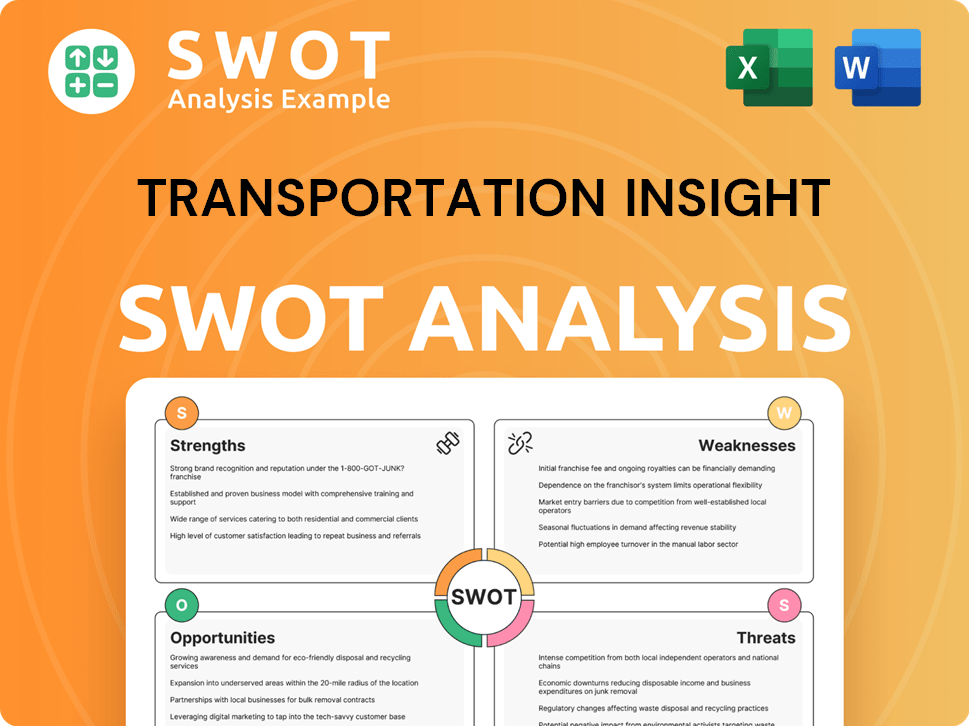

Transportation Insight SWOT Analysis

See the actual Transportation Insight SWOT analysis here! What you see is precisely what you get post-purchase. Unlock the complete, in-depth document by buying now. This detailed analysis will be ready for immediate use.

SWOT Analysis Template

Transportation Insight faces a complex landscape of opportunities and challenges. Our SWOT analysis highlights key strengths, from tech integration to customer service. We also assess vulnerabilities like potential market shifts and the competitive environment. Explore growth drivers and strategic recommendations through our full report. Dive deeper and gain a comprehensive understanding of this company, revealing actionable insights for informed decision-making.

Strengths

Transportation Insight’s strength lies in its comprehensive service portfolio. They provide diverse solutions, from transportation management to supply chain analytics. This extensive offering allows them to serve various industries effectively. For example, in 2024, they managed over $10 billion in freight spend, showcasing their scale and scope.

Transportation Insight excels with advanced tech and data analytics. Beon™ and Insight Fusion offer real-time visibility, boosting efficiency. AI and machine learning drive real-time pricing and capacity matching. This tech advantage helps cut costs. In 2024, this has saved clients up to 15% on shipping.

Transportation Insight boasts a significant market presence in North America. They are consistently ranked among the top 10 logistics companies. Their extensive network includes a large number of shippers and carriers, demonstrating a strong foothold. In 2024, the North American logistics market was valued at approximately $1.8 trillion. This scale allows for competitive pricing and service offerings.

Expertise and Experience

Transportation Insight's extensive experience, spanning over two decades, is a significant strength. Their deep multi-modal expertise positions them well in the logistics sector. Consulting services further enhance their value proposition, offering strategic guidance to clients. This combination allows them to deliver tailored solutions.

- 2024: Transportation Insight managed over $10 billion in freight spend.

- 2024: They served over 1,500 clients across various industries.

- Their expertise includes supply chain optimization and transportation management.

- Experience helps navigate complex logistics challenges.

Recognized as a Great Workplace

Transportation Insight and Nolan Transportation Group earned a spot on Newsweek's list of America's Greatest Workplaces in 2024. This accolade underscores a strong company culture and dedication to employee satisfaction. Such recognition is particularly beneficial in the competitive logistics industry. It aids in attracting and retaining skilled professionals, which can lead to increased productivity.

- Newsweek's 2024 recognition highlights a positive work environment.

- Attracts and retains talent in the logistics sector.

- Contributes to employee well-being and satisfaction.

- Supports a positive company culture.

Transportation Insight’s diverse service offerings, from transportation management to supply chain analytics, position them well. Their tech like Beon™ and Insight Fusion drives efficiency, leading to cost savings, such as up to 15% for clients in 2024. Strong market presence and a deep network allow for competitive pricing. In 2024, they managed over $10 billion in freight spend.

| Strength | Description | 2024/2025 Data |

|---|---|---|

| Service Portfolio | Comprehensive solutions across the supply chain. | Managed over $10B in freight spend in 2024. Served over 1,500 clients. |

| Technology | Advanced tech enhances efficiency. | Savings up to 15% on shipping costs in 2024 due to technology. |

| Market Presence | Strong foothold in North America. | Ranked among top 10 logistics companies. North American market value approx. $1.8T in 2024. |

Weaknesses

Some user reviews, especially on Reddit, highlight customer service issues, such as slow responses and impersonal interactions. This can lead to client dissatisfaction and attrition. In 2024, the average customer churn rate in the logistics industry was about 15%, emphasizing the impact of poor service. Transportation Insight's ability to retain clients may be at risk. Addressing these concerns is vital for future success.

Transportation Insight's financial results are susceptible to shifts in the logistics market, including freight rate changes and economic downturns. For instance, a 2024 report indicated a 15% decrease in shipping volumes during a certain quarter due to economic slowdowns. This vulnerability can lead to reduced profitability and slower growth. Market volatility can create uncertainty in revenue projections and strategic planning. These challenges require proactive risk management and adaptability to navigate fluctuating conditions.

Integrating diverse platforms and services, a strength, presents complexity. Ensuring seamless functionality across systems is vital. Potential integration issues could disrupt operations. Successful integration requires careful planning. This is particularly relevant with Transportation Insight's expanding portfolio.

Talent Acquisition and Retention

Transportation Insight, like others in the transportation and logistics sector, may struggle with talent acquisition and retention. The industry's demand for skilled workers often outstrips supply, creating a competitive landscape. This scarcity could affect Transportation Insight's operational efficiency and service quality. The turnover rate in the logistics sector was approximately 14% in 2024, indicating a persistent challenge.

- High turnover rates can increase costs due to recruitment and training.

- Lack of experienced staff can lead to operational inefficiencies.

- Competition for talent is especially fierce in technology and data analytics.

- Employee satisfaction and retention are vital for maintaining client relationships.

Potential for Over-Reliance on Technology

While Transportation Insight leverages technology, over-reliance poses risks. System failures or cyberattacks could disrupt operations. Data inaccuracies or security breaches might compromise service quality. In 2024, cyberattacks on logistics firms increased by 25%. This highlights the need for robust backup systems and data protection.

- Cybersecurity incidents in the logistics sector rose 25% in 2024.

- Data breaches can lead to significant financial losses and reputational damage.

- System outages can halt operations, impacting delivery schedules.

Customer service issues, such as slow responses and impersonal interactions, can lead to client attrition; logistics' average churn rate was 15% in 2024. Financial results are subject to logistics market shifts; a 2024 report showed a 15% decrease in shipping volumes. Integrating diverse platforms and services may introduce operational disruptions. Talent acquisition and retention are critical issues; the turnover rate in the logistics sector was roughly 14% in 2024.

| Weakness | Description | Impact |

|---|---|---|

| Customer Service | Slow responses, impersonal interactions. | Client dissatisfaction and attrition. |

| Market Sensitivity | Susceptible to freight rate changes. | Reduced profitability, slower growth. |

| Integration Complexity | Seamless functionality vital. | Potential operational disruption. |

| Talent Acquisition | Demand for skilled workers high. | Operational inefficiency, lower service quality. |

Opportunities

The booming e-commerce sector fuels demand for streamlined logistics. Transportation Insight can capitalize on this growth by enhancing last-mile delivery. E-commerce sales are projected to reach $7.3 trillion in 2025, up from $6.3 trillion in 2024. This expansion offers a chance to broaden services and attract new clients.

Ongoing tech advancements, like AI and automation, create opportunities for Transportation Insight. These technologies can boost efficiency and cut costs. For example, the global autonomous truck market is projected to reach \$1.5 billion by 2025. Adopting these innovations gives a competitive edge.

Mergers and acquisitions are prevalent in logistics. This offers Transportation Insight opportunities for strategic acquisitions. In 2024, the global M&A deal value in transportation and logistics was $300B. This can boost market share and capabilities.

Increasing Demand for Supply Chain Visibility and Analytics

The demand for supply chain visibility and analytics is surging. Transportation Insight's tech and data solutions are well-placed to capitalize on this trend. This creates a significant opportunity for growth and market share expansion. Businesses are investing heavily in these areas. This is driven by the need for efficiency and risk management.

- Supply chain analytics market is projected to reach $41.8 billion by 2028.

- Companies are seeing up to a 20% reduction in supply chain costs.

- Data-driven decision-making improves operational efficiency.

Expansion into New Geographies and Verticals

Transportation Insight could explore new markets. This includes regions where they currently have a limited presence or industries with unmet logistics needs. Expanding into new geographic areas can increase market share. This also allows them to diversify their revenue streams.

- Focus on expanding into high-growth markets.

- Tailor services to specific industry requirements.

- Leverage technology for global logistics.

- Explore strategic partnerships for market entry.

Transportation Insight can leverage e-commerce's $7.3T growth (2025) and tech advances, with autonomous trucks expected to hit $1.5B by 2025. Strategic M&As, like the $300B in global deals (2024), can boost their market share. The supply chain analytics market, set to reach $41.8B by 2028, and new markets offer additional opportunities.

| Opportunity | Details | Financial Impact/Stats (2024/2025) |

|---|---|---|

| E-commerce Expansion | Capitalize on growing e-commerce demand for logistics solutions. | E-commerce sales: \$6.3T (2024) to \$7.3T (2025) |

| Technological Advancement | Adopt AI, automation, and autonomous trucks to improve efficiency and cut costs. | Autonomous truck market: \$1.5B (2025 projection) |

| Strategic Acquisitions | Engage in mergers and acquisitions to boost market share and capabilities. | Global M&A in transportation & logistics: \$300B (2024) |

| Data & Analytics | Provide supply chain visibility and analytics. | Supply chain analytics market: \$41.8B (by 2028) |

| New Market Entry | Expand into new geographical areas and industries. | Up to 20% reduction in supply chain costs |

Threats

An economic slowdown or recession poses a significant threat. It reduces consumer spending, which, in turn, lowers freight volumes. This directly impacts the demand for Transportation Insight's services. In 2023, the U.S. saw a 3.1% GDP growth, but forecasts predict slower growth for 2024 and 2025, increasing recession risks.

The transportation and logistics sector faces intense competition. Numerous firms provide comparable services, intensifying rivalry. Aggressive moves by rivals can squeeze pricing and reduce market share. The global logistics market was valued at $10.6 trillion in 2023, with forecasts of continued growth, highlighting the stakes. New entrants are constantly emerging, intensifying the competition.

Cybersecurity threats loom large as transportation firms increasingly depend on technology. Cyberattacks and data breaches can halt operations and harm a company's image. The transportation sector saw a 38% rise in cyber incidents in 2024. Protecting against these threats is a must.

Regulatory Changes

Regulatory changes pose a significant threat to Transportation Insight. Changes in transportation regulations, trade policies, and tariffs can directly impact operational costs and supply chain strategies. For instance, the implementation of stricter emission standards could increase expenses. Transportation Insight must proactively monitor and adapt to these shifts to mitigate risks. Failure to do so could lead to increased costs and reduced competitiveness.

- Increased compliance costs due to new regulations.

- Potential for supply chain disruptions from trade policy changes.

- Unforeseen tariffs affecting operational profitability.

- Need for continuous adaptation and strategic planning.

Disruptions to the Supply Chain

Geopolitical instability, like the ongoing conflicts in Eastern Europe and the Middle East, continues to pose significant threats to global supply chains, potentially increasing Transportation Insight's operational costs. Natural disasters, such as the 2023 Maui wildfires, also disrupt logistics. These events lead to delays, impacting service delivery and potentially increasing expenses. These disruptions can affect Transportation Insight's ability to deliver services effectively.

- The World Bank estimates global supply chain disruptions could increase costs by 5-10% in 2024-2025.

- The Baltic Dry Index, a measure of shipping costs, rose by over 30% in early 2024 due to these disruptions.

- Delays in shipping have increased by an average of 15% in 2024.

Economic downturns, such as projected slower GDP growth of 2.1% in the U.S. in 2025, pose a threat. Intense competition within the $10.6 trillion logistics market and cybersecurity risks, with a 38% increase in sector incidents in 2024, are challenges. Regulatory changes, geopolitical instability, and natural disasters, potentially increasing costs by 5-10% (World Bank estimate) in 2024-2025, further complicate operations.

| Threat | Impact | Data Point |

|---|---|---|

| Economic Slowdown | Reduced demand, lower freight volumes | U.S. GDP growth: 2.1% forecast for 2025 |

| Intense Competition | Price pressure, market share loss | Global Logistics Market: $10.6T in 2023 |

| Cybersecurity | Operational disruption, reputational damage | 38% increase in sector cyber incidents in 2024 |

SWOT Analysis Data Sources

This Transportation Insight SWOT analysis relies on financial performance, market analyses, and expert evaluations, ensuring a reliable and data-driven overview.