Transurban Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Transurban Group Bundle

What is included in the product

Analysis of Transurban's assets using the BCG Matrix, highlighting strategic investment decisions.

Streamlines complex data with a concise BCG matrix, aiding in strategic planning and investment decisions.

What You See Is What You Get

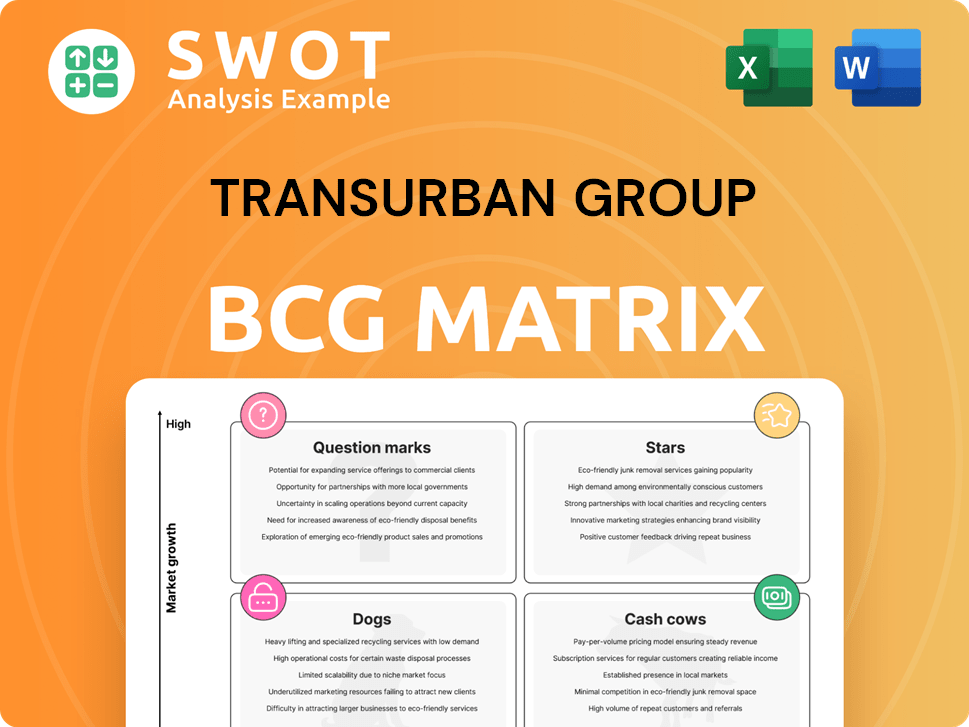

Transurban Group BCG Matrix

The Transurban Group BCG Matrix preview is identical to the purchased document. You'll receive the fully formatted, professional-grade report immediately after buying, ready for your strategic assessments.

BCG Matrix Template

Transurban Group's BCG Matrix offers a snapshot of its diverse portfolio, from toll roads to infrastructure projects. This preliminary view hints at potential Stars, like high-growth assets, and Cash Cows, generating steady revenue. Understanding the Dogs and Question Marks reveals opportunities for optimization and strategic realignment. This glimpse is valuable, but the full picture is essential for informed decisions.

Get instant access to the full BCG Matrix and discover which products are market leaders, which are draining resources, and where to allocate capital next. Purchase now for a ready-to-use strategic tool.

Stars

WestConnex in Sydney is a high-growth, high-market-share project for Transurban. It's experiencing increasing traffic volumes and generating significant revenue. The integration of Rozelle Interchange and Sydney Gateway boosts its operational efficiency. This positions WestConnex as a Star within the BCG Matrix. For instance, it saves commuters an average of 40 minutes during peak hours.

The 95 Express Lanes in North America are a star for Transurban. They're seeing robust performance, with traffic and revenue growth. The Fredericksburg Extension and Opitz Boulevard's debut boosted results. In 2024, the average dynamic toll price was USD 12.14. This asset leads the market with significant growth prospects.

CityLink in Melbourne is a cornerstone asset for Transurban, delivering a dependable revenue stream. In 2024, it displayed robust traffic volumes. Its defensive qualities and competitive advantages secure strong returns. The investment's attractive yield justifies its wide economic moat, ensuring steady cash flow.

M7-M12 Integration Project (Sydney)

The M7-M12 Integration Project in Sydney, a key initiative for Transurban, is currently under development. This project is designed to significantly improve connectivity within Sydney, supporting the company's organic growth strategy. It is a crucial element in enhancing traffic flow, aiming to alleviate congestion in the area. The project's progress is a key factor in the company's performance.

- Expected to improve connectivity in Sydney.

- Supports organic growth through major construction projects.

- Aims to enhance traffic flow in the region.

- Progress is a key factor in the company's performance.

Fredericksburg Extension (North America)

The Fredericksburg Extension is a star for Transurban Group in North America. It has significantly boosted the region's performance. The project's full operation and the opening of Opitz Boulevard on the 95 Express Lanes have been key. The 495 Express Lanes saw a 14.7% increase in average workday toll revenue.

- Fredericksburg Extension's full operating period boosted performance.

- Opitz Boulevard's opening on 95 Express Lanes was crucial.

- 495 Express Lanes saw a 14.7% rise in toll revenue.

- The project's completion confirms its star status.

Stars in Transurban's portfolio show strong growth and market share. WestConnex and the 95 Express Lanes are prime examples. Key projects like Fredericksburg Extension fuel revenue. They demonstrate Transurban's focus on high-performing assets.

| Project | Location | Key Metric (2024) |

|---|---|---|

| WestConnex | Sydney | Average Peak Hour Time Savings: 40 minutes |

| 95 Express Lanes | North America | Average Dynamic Toll: USD 12.14 |

| Fredericksburg Extension | North America | 495 Express Lanes Revenue Increase: 14.7% |

Cash Cows

CityLink in Melbourne is a cash cow for Transurban. It's a mature asset with steady cash flow. High utilization and strategic importance ensures revenue. In 2024, it provided a solid earnings base. High fixed costs translate to strong cash flow.

Hills M2, a Sydney toll road, is a cash cow for Transurban. It has a steady traffic flow, ensuring consistent revenue. This mature asset needs minimal new investment. In 2024, it remains crucial for commuters.

The Gateway Motorway in Brisbane is a key cash cow for Transurban. It’s a vital route for both commuters and freight, ensuring a reliable revenue stream. The Logan Motorway, which this connects to, handles over $350 billion in freight annually. Its mature nature means consistent profits but limited expansion.

Lane Cove Tunnel (Sydney)

The Lane Cove Tunnel in Sydney exemplifies a Cash Cow for Transurban Group. It operates within a mature market, experiencing predictable traffic flow. This infrastructure demands little additional investment, ensuring steady revenue streams. Traffic volume has remained stable, supported by the existing tunnel infrastructure. For example, in 2024, the tunnel saw approximately 75,000 vehicles daily.

- Mature market with consistent traffic.

- Minimal ongoing investment.

- Reliable revenue generation.

- Stable traffic growth.

Cross City Tunnel (Sydney)

The Cross City Tunnel in Sydney, part of Transurban Group's portfolio, functions as a Cash Cow. It operates in a low-growth market with declining traffic volumes, yet it still generates consistent revenue. This stability stems from its established presence in Sydney's transport network, providing essential connectivity. However, recent financial data reveals challenges.

- Traffic volumes have decreased quarter by quarter.

- The tunnel's role in Sydney's infrastructure maintains a steady revenue stream.

- Financial reports indicate revenue challenges despite its established status.

- The Cross City Tunnel's future is contingent on traffic management strategies.

Transurban's Cash Cows deliver steady revenue with minimal investment. These assets, like CityLink, Hills M2, and Gateway Motorway, are mature and established. Their consistent cash flow is key to Transurban's financial stability. In 2024, these assets generated solid returns.

| Asset | Location | Key Feature |

|---|---|---|

| CityLink | Melbourne | High utilization; steady cash flow |

| Hills M2 | Sydney | Consistent traffic flow |

| Gateway Motorway | Brisbane | Vital route for commuters and freight |

Dogs

AirportlinkM7 in Brisbane, part of Transurban's portfolio, operates in a market facing saturation. Despite providing critical transport links, it struggles to significantly expand its market presence. In 2024, traffic volume growth has been modest, reflecting the competitive environment. Revenue figures indicate steady but not explosive gains, with incremental increases rather than dramatic surges. The focus remains on maintaining operational efficiency and customer satisfaction within its existing footprint.

Clem7, part of Transurban Group's portfolio, operates in a low-growth market with limited market share. Since its launch, Clem7 has faced challenges in boosting traffic and revenue. Turnaround strategies are often costly and haven't significantly improved the asset's performance. In 2024, Transurban's toll revenue grew, but specific figures for Clem7's performance were not readily available.

The Go Between Bridge in Brisbane, part of Transurban's portfolio, is a "Dog" in the BCG matrix. It experiences limited growth with lower traffic volumes. As of 2024, its contribution to overall revenue is modest. The bridge offers a service, yet its potential for substantial ROI is restricted. Its performance contrasts with assets that generate higher returns.

Eastern Distributor (Sydney)

The Eastern Distributor in Sydney, part of Transurban's portfolio, is categorized as a "Dog" in the BCG matrix. It operates in a low-growth market with a constrained market share. Its growth potential is limited due to existing capacity and market saturation. Maintaining the asset requires ongoing investment.

- Revenue for the Eastern Distributor in FY24 was AUD 273.6 million.

- Traffic volume growth was 1.1% in FY24.

- The asset faces capacity constraints, limiting expansion possibilities.

- Ongoing maintenance is critical for its operational viability.

Montreal Assets (Canada)

Transurban's Montreal assets, including the A25, show a slower traffic recovery. A25 traffic grew by only 1.5% in 2024, influenced by ongoing repairs. These assets compete in a tough market, which somewhat restricts growth. The LaFontaine tunnel-bridge repairs have continued to affect traffic.

- A25 traffic growth: 1.5% (2024).

- Market competition: High.

- Impact: Limited growth potential.

- Ongoing issue: LaFontaine repairs.

Dogs in Transurban's portfolio include assets with low growth and market share. The Go Between Bridge and Eastern Distributor exemplify this, with limited revenue and growth potential in 2024. These assets require ongoing maintenance, impacting overall ROI. The Eastern Distributor's revenue was AUD 273.6 million in FY24.

| Asset | Category | 2024 Revenue/Growth |

|---|---|---|

| Go Between Bridge | Dog | Modest |

| Eastern Distributor | Dog | AUD 273.6M / 1.1% |

| A25 (Montreal) | Dog | 1.5% Traffic Growth |

Question Marks

The Logan West Upgrade in Brisbane is a major project for Transurban. The Logan Motorway handles over $1 billion in daily freight. Success depends on effective delivery and traffic, creating both opportunities and risks. The project aims to boost capacity and efficiency.

The West Gate Tunnel Project, a key venture for Transurban, is scheduled for completion by the end of 2025. This project aims to alleviate Melbourne's traffic congestion. Successfully integrating it with the existing network could boost traffic volume. However, it also presents construction and integration risks. In 2024, Transurban's total revenue was approximately $4 billion.

Transurban is eyeing expansion in North America, including the 95 Express Lanes extension in Virginia. The company is collaborating with the Virginia Department of Transportation to add 10 miles of bi-directional travel. These ventures boast strong growth potential but demand substantial capital and face market entry hurdles. In 2024, Transurban's North American revenue was approximately $1.3 billion.

Emerging Mobility Trends

Emerging mobility trends are a high-growth but uncertain area for Transurban, fitting the "Question Mark" quadrant of the BCG Matrix. The company actively invests in innovative technologies to optimize its existing assets. These ventures aim to generate substantial future revenue. However, they also carry significant risks and development expenses.

- Transurban invested $15 million in mobility technology in 2024.

- The company forecasts a 10-15% annual growth in smart infrastructure.

- Uncertainty includes regulatory shifts and adoption rates.

NSW Toll Reform

Potential toll reform in New South Wales presents both opportunities and uncertainties for Transurban Group. The company is actively working with the NSW Government regarding potential toll reform. The outcomes of these discussions could significantly affect Transurban's revenue and market position. This situation necessitates careful negotiation and strategic adaptation from Transurban.

- Transurban has invested $36 billion in Sydney over the last two decades.

- Toll reform discussions aim to improve customer outcomes.

- The changes could impact Transurban's financial performance.

- Strategic adaptation is crucial for Transurban's response.

Transurban's investments in emerging mobility and smart infrastructure, such as its $15 million investment in 2024, position it in the "Question Mark" quadrant. These ventures, with a forecast of 10-15% annual growth, carry high potential. However, they are also subject to risks.

| Aspect | Details | Impact |

|---|---|---|

| Investment | $15 million in mobility technology (2024) | Positions in high-growth, high-risk sector. |

| Growth Forecast | 10-15% annual growth in smart infrastructure | Indicates potential for substantial future revenue. |

| Uncertainty | Regulatory shifts, adoption rates | Highlights risks associated with new technologies. |

BCG Matrix Data Sources

Transurban's BCG Matrix relies on financial data, industry reports, and market analyses to deliver reliable insights.