TriMark USA SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

TriMark USA Bundle

What is included in the product

Analyzes TriMark USA’s competitive position through key internal and external factors.

Provides a structured overview to rapidly assess TriMark USA's situation.

Preview the Actual Deliverable

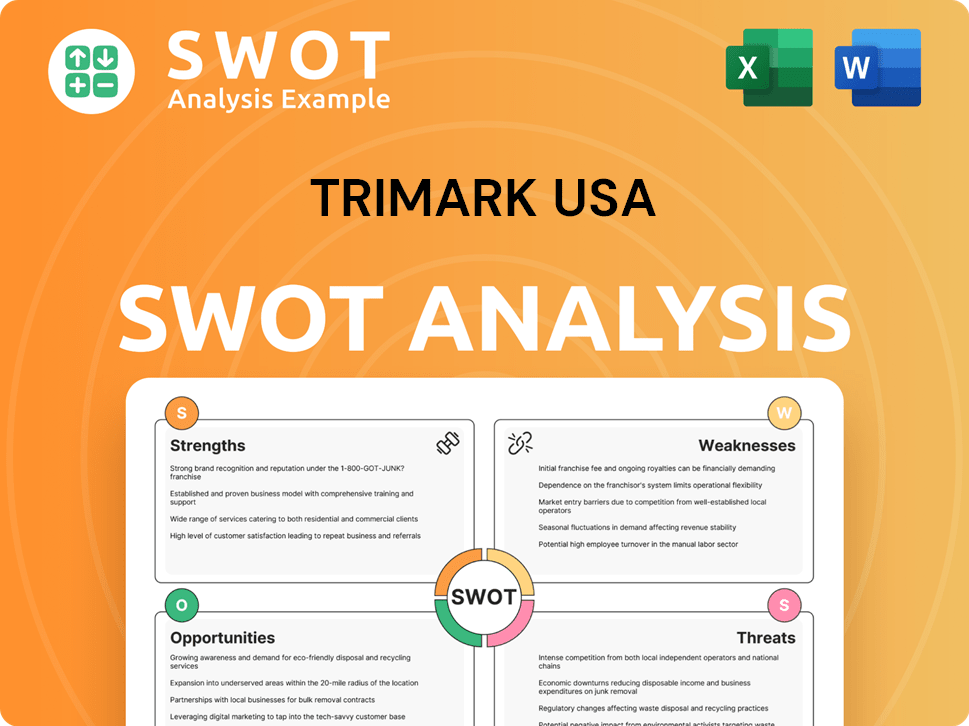

TriMark USA SWOT Analysis

Check out the TriMark USA SWOT analysis preview below. This is the very document you'll download after your purchase, ready for your use.

SWOT Analysis Template

Our TriMark USA SWOT analysis offers a concise glimpse into the company's strategic landscape, highlighting its strengths and weaknesses. We explore opportunities for growth and potential threats it faces. This preview provides valuable context. Unlock the full analysis, delivering detailed insights for strategic planning and informed decisions.

Strengths

TriMark USA has a strong market position. They are a major distributor of foodservice equipment and supplies. In 2024, the company's revenue reached $2.5 billion. They hold a substantial market share in North America, positioning them as a leader.

TriMark USA's strength lies in its comprehensive offerings. They extend beyond equipment and supplies, encompassing design, project management, installation, and repair services. This all-in-one approach provides convenience and potentially cost savings for customers. In 2024, integrated solutions accounted for approximately 30% of TriMark's revenue. This integrated model enhances customer relationships.

TriMark USA benefits from a well-established customer base. It caters to various clients, from national restaurant chains to healthcare facilities. This diversification helps stabilize revenue streams. In 2024, this broad reach supported consistent sales figures. This reduces vulnerability to sector-specific downturns.

Scale and Distribution Capabilities

TriMark USA's substantial scale and wide distribution network are key strengths. As a major distributor, they leverage significant purchasing power. This enables efficient delivery of a diverse product range nationwide. For example, in 2024, TriMark’s distribution network covered over 40 states, ensuring broad market reach.

- Extensive Distribution Network: Serves a wide geographic area.

- Purchasing Power: Benefits from economies of scale.

- Efficient Delivery: Ensures timely product availability.

- Product Variety: Offers a broad selection to customers.

Industry Expertise

TriMark USA's longevity, tracing back to 1896, highlights its extensive industry expertise. This long-standing presence has cultivated a deep understanding of foodservice equipment and operational needs. Experienced leadership further strengthens this, enabling TriMark to serve a wide array of customers effectively. This deep understanding is key to their market position.

- Founded in 1896, demonstrating over 128 years of industry presence.

- Serves diverse customer base, including restaurants, hotels, and healthcare facilities.

- Experienced leadership with decades of combined industry experience.

TriMark USA boasts a strong market presence, reinforced by robust revenue of $2.5B in 2024. Their integrated solutions, like design and installation, comprised about 30% of 2024 revenue, boosting customer value. This diverse customer base strengthens sales, preventing dependence on specific sectors. Their nationwide distribution reached over 40 states, a key to their broad market reach.

| Strength | Details | 2024 Data |

|---|---|---|

| Market Position | Leading distributor in North America. | $2.5 Billion Revenue |

| Integrated Solutions | Design, project management, installation. | ~30% Revenue from Solutions |

| Customer Base | National restaurant chains, healthcare facilities. | Broad Market Reach |

Weaknesses

TriMark USA faces financial challenges, highlighted by negative free operating cash flow. The company's high leverage, even after restructuring, remains a concern. Early 2024 saw declining sales, impacting profitability. Its debt-to-equity ratio is over 3.0, indicating high financial risk.

TriMark USA's financial health is vulnerable due to refinancing risk. Their asset-based lending facility, totaling hundreds of millions, matures in July 2025. This looming deadline introduces significant uncertainty regarding their ability to manage debt obligations.

TriMark's financial performance is significantly tied to the restaurant industry's health, making it vulnerable to economic downturns. In 2024, restaurant sales growth slowed to 4.5%, impacting suppliers like TriMark. A decrease in new restaurant ventures or reduced spending by existing ones directly diminishes TriMark's revenue streams. This dependency poses a key weakness, as shifts in consumer behavior or economic conditions can severely affect their financial stability.

Margin Compression

TriMark USA faces margin compression, impacting profitability. The shift towards lower-margin non-restaurant businesses contributes to this pressure. Labor inefficiencies further exacerbate the decline in profit margins. This trend reduces the financial flexibility needed for investments and expansion. The company's operating margin was 4.5% in 2024, down from 5.2% in 2023.

Intense Competition

TriMark USA operates in a fiercely competitive foodservice equipment distribution market. They encounter significant competition from other major distributors, which can pressure pricing and margins. Additionally, there's a risk of manufacturers bypassing distributors by selling directly to customers. This dynamic can erode TriMark's market share and profitability.

- Intense competition from established distributors.

- Potential for manufacturers to increase direct sales.

- Pressure on pricing and profit margins.

- Risk of market share erosion.

TriMark USA's high leverage and refinancing risks, including a 2025 maturity, pose financial instability. Sales decline and margin pressure, especially in Q1 2024, have negatively affected profitability, reflected by a 4.5% operating margin in 2024. Intense competition in the market erodes their market share, with restaurant industry dependency adding vulnerability.

| Financial Weakness | Impact | Data Point |

|---|---|---|

| High Leverage | Refinancing Risk | Debt-to-Equity Ratio over 3.0 |

| Margin Compression | Reduced Profitability | 4.5% operating margin in 2024 |

| Market Competition | Erosion of Market Share | Significant competition |

Opportunities

The U.S. restaurant and hotel equipment wholesaling industry is forecasted to grow. This expansion creates opportunities for TriMark USA to increase its market share. The industry's revenue reached approximately $28 billion in 2023. Projections indicate continued growth through 2025, fueled by the hospitality sector's recovery and expansion. This positive trend supports TriMark's growth strategies.

TriMark USA can capitalize on the rise of technology within the wholesale sector. AI-powered inventory management and data analytics are key. These tools enhance supply chain efficiency. For example, AI can reduce inventory costs by up to 20% as of 2024. TriMark can gain deeper customer insights, too.

TriMark USA can leverage its existing national distribution network to expand into untapped geographical markets. This strategic move could increase its customer base and market share. For example, opening new distribution centers in the Southeast could tap into a growing foodservice market. This expansion aligns with the projected growth of the U.S. foodservice equipment market, estimated to reach $9.2 billion by 2025.

Increased Demand from Events

Major events like the FIFA World Cup and the Olympics, both coming to the US, present significant opportunities. TriMark USA can expect increased demand for restaurant and hotel equipment in host cities. This surge in demand could lead to substantial revenue growth. The company should prepare to meet this increased need effectively.

- FIFA World Cup 2026 expected to boost hospitality sector spending.

- Olympics 2028 in Los Angeles will drive infrastructure and hospitality upgrades.

- Increased tourism and event hosting to stimulate equipment sales.

Focus on High-Margin Services

TriMark USA can boost its profitability by emphasizing high-margin services. These services, such as design and project management, offer greater returns than standard product sales. Focusing on these areas can offset margin pressures in other parts of the business. For example, in 2024, companies offering value-added services saw a 15% increase in profitability.

- Promote design and project management services.

- Increase profitability by focusing on value-added services.

- Offset margin compression through high-margin offerings.

- Capitalize on the growing demand for comprehensive solutions.

TriMark USA can benefit from industry growth and tech advancements. Geographic expansion, driven by its distribution network, offers another avenue. Major events and high-margin service emphasis enhance profitability.

| Opportunity | Description | Impact |

|---|---|---|

| Industry Growth | Growth in restaurant & hotel equipment wholesaling, reaching ~$28B in 2023, projected through 2025. | Increased market share & revenue. |

| Technology Adoption | Use AI for inventory management; data analytics can cut costs. | Up to 20% cost reduction (2024), & improved customer insight. |

| Geographical Expansion | Leverage existing distribution to enter new markets, for example, Southeast. | Tap into growing foodservice market, aiming at $9.2B by 2025. |

| Major Events | 2026 FIFA World Cup & 2028 Olympics will boost equipment sales. | Significant revenue growth from demand in host cities. |

| High-Margin Services | Emphasis on design, project management & value-added services. | Up to 15% increase in profitability. |

Threats

Economic uncertainty presents a significant threat. Rising inflation and potential recession fears could curb customer spending on dining out. This might lead to decreased demand for TriMark's equipment and services. A slowdown in new restaurant openings, impacted by economic worries, would further hinder revenue growth. In 2024, restaurant sales growth slowed to 4.8%, reflecting these challenges.

Direct sales by manufacturers is a growing threat. Companies are increasingly selling directly to consumers. This can cut out wholesalers like TriMark. This shift reduces their role in the supply chain. In 2024, direct sales grew by 15% in the foodservice equipment sector.

TriMark faces liquidity constraints, a major threat. Their weak position and looming debt maturities are concerning. Refinancing challenges could severely impact operations. A shortfall might limit their ability to function, potentially affecting their ability to meet short-term obligations. The company's financial health is under pressure, as indicated by recent market trends.

Operational Underperformance

TriMark USA faces operational challenges, evidenced by recent underperformance. Sales declines and negative free cash flow signal problems that could worsen. Continued poor performance could severely impact their financial stability. Their operational efficiency needs immediate improvement to avoid further setbacks. In Q4 2023, TriMark's parent company, US Foods, reported a decrease in gross profit margin, which could reflect operational inefficiencies.

Changes in Customer Behavior

Changes in customer behavior pose a threat to TriMark USA. Restaurant operators delaying new store openings directly impacts demand for equipment and supplies. This shift requires TriMark to adapt quickly to maintain sales. The National Restaurant Association projects a 4.3% growth in restaurant sales for 2024, which could be affected by these delays.

- Delayed openings reduce immediate demand.

- Adaptation is key to mitigating the impact.

- Market projections can be affected.

TriMark faces numerous threats, from economic downturns and direct sales by manufacturers to internal liquidity issues. Their sales could be seriously impacted by financial struggles. The shift towards direct sales and restaurant opening delays require agile business adjustments.

| Threat | Description | Impact |

|---|---|---|

| Economic Slowdown | Inflation & Recession | Reduced customer spending, sales declines. |

| Direct Sales | Manufacturers bypassing. | Reduced role, loss of revenue. |

| Operational | Poor Performance | Decreased profit margins, operational issues. |

SWOT Analysis Data Sources

This SWOT analysis is supported by dependable financials, market analysis, expert opinions, and verified reports for data-driven conclusions.