TTM Technologies Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

TTM Technologies Bundle

What is included in the product

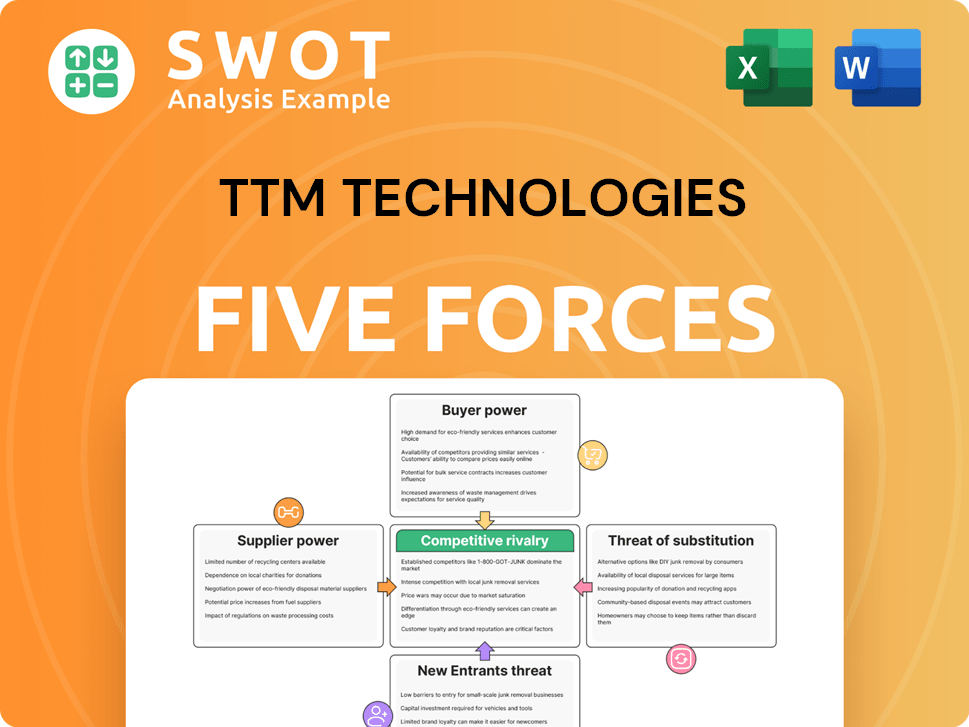

Analyzes competition, buyer power, and new threats impacting TTM Technologies' market position.

Swap in TTM's data to stress test strategies and anticipate market shifts.

Preview Before You Purchase

TTM Technologies Porter's Five Forces Analysis

This preview presents TTM Technologies' Porter's Five Forces analysis in its entirety. The complete, professionally written document you see here is the very same one you'll download immediately upon purchase. It's fully formatted, ready for immediate application, and contains no hidden sections. This ensures complete transparency, giving you instant access to the full analysis. There are no omissions; what you preview is exactly what you receive.

Porter's Five Forces Analysis Template

TTM Technologies faces a dynamic competitive landscape shaped by its position in the printed circuit board (PCB) industry. Buyer power, influenced by customer concentration and switching costs, presents a notable challenge. Supplier power, especially regarding raw materials, also plays a crucial role. The threat of new entrants is moderate due to high capital requirements and specialized expertise. Competition among existing rivals is intense, driven by product differentiation and pricing pressures. Finally, the threat of substitutes, with alternative technologies, is a constant consideration.

Our full Porter's Five Forces report goes deeper—offering a data-driven framework to understand TTM Technologies's real business risks and market opportunities.

Suppliers Bargaining Power

TTM Technologies faces supplier power challenges due to the specialized nature of PCB and RF component industries. A limited number of qualified suppliers for essential materials and technologies gives these suppliers leverage. Dependence on key suppliers can expose TTM to increased costs or supply chain disruptions; for example, in 2024, the cost of raw materials increased by 7%.

TTM Technologies faces supplier concentration risks, especially with essential inputs like copper and chemicals. In 2024, the price of copper fluctuated, impacting PCB manufacturing costs. A few suppliers control a significant market share of these inputs. This concentration enables suppliers to influence pricing and supply availability. This can affect TTM's profitability and ability to meet customer needs.

Switching suppliers, especially for specialized components, is costly for TTM Technologies. Costs include vendor qualification, product re-engineering, and potential production disruptions. These switching costs empower suppliers, as TTM must absorb these expenses to change vendors. This makes it harder for TTM to secure better prices, impacting profitability. In 2024, TTM's cost of revenue was approximately $3.08 billion, highlighting the financial impact of supplier negotiations.

Impact of supplier's product on TTM's differentiation

The quality of components directly impacts TTM's product performance. Suppliers of unique, high-performance materials enhance TTM's differentiation, especially in sectors like aerospace. These suppliers hold more bargaining power. In 2024, TTM's aerospace and defense sales represented a significant portion of revenue, underlining this dynamic.

- TTM's high-reliability applications depend on supplier quality.

- Unique materials from suppliers enable product differentiation.

- Aerospace and defense sectors are key for TTM.

Forward integration potential of suppliers

The forward integration potential of suppliers is a significant factor in assessing their bargaining power, especially in the PCB industry. If suppliers can move into PCB manufacturing or related services, they gain more control. This could threaten TTM Technologies' market share and profitability by creating direct competitors. Suppliers integrating forward can reduce their dependence on TTM as a customer.

- Suppliers with forward integration capabilities can exert more pressure on pricing and terms.

- This threat is amplified when suppliers have the financial resources and technological expertise.

- Consider the example of raw material suppliers expanding into PCB assembly services.

- TTM Technologies must monitor suppliers' strategic moves to mitigate this risk.

TTM Technologies faces supplier power due to the nature of the PCB and RF component industries, including limited suppliers and specialized materials.

Concentration among suppliers, especially for copper and chemicals, allows them to influence pricing; in 2024, copper prices fluctuated, impacting costs.

Switching suppliers is costly for TTM, impacting profitability; in 2024, TTM's cost of revenue was approximately $3.08 billion, highlighting the financial impact of supplier negotiations.

| Factor | Impact | 2024 Data |

|---|---|---|

| Supplier Concentration | Influences pricing and availability | Copper price fluctuations |

| Switching Costs | Impacts profitability | Cost of Revenue: ~$3.08B |

| Raw Material Costs | Increased expenses | Raw material cost increase: 7% |

Customers Bargaining Power

TTM Technologies operates in markets like aerospace, defense, and automotive. Its customer base includes major players in these industries. A concentrated customer base gives these large customers significant bargaining power. They can negotiate for lower prices or improved service terms. For example, in 2024, the top 10 customers accounted for approximately 45% of TTM's revenue.

Customers' price sensitivity varies, especially in markets with standardized products. This sensitivity strengthens their ability to negotiate prices, since alternatives are readily available. In 2024, TTM Technologies needs to focus on showcasing product and service value to offset this pressure, with the company's gross margin at 14.6% in Q1 2024.

Switching costs significantly influence customer bargaining power at TTM Technologies. Low switching costs empower customers, enabling them to readily switch PCB suppliers, as design compatibility and qualification processes play a crucial role. For instance, if a customer can easily transition their orders, TTM's pricing power diminishes. In 2024, TTM's ability to retain customers depends on offering competitive pricing and superior service to offset potential cost savings from switching to other suppliers.

Availability of alternative suppliers

The availability of alternative PCB suppliers significantly impacts customer bargaining power. A wide array of qualified manufacturers gives customers leverage to negotiate better prices and terms. TTM Technologies faces strong competition in a market where numerous suppliers exist. To maintain its customer base, TTM must focus on differentiation.

- The global PCB market was valued at $79.4 billion in 2023.

- TTM's revenue in 2023 was approximately $2.3 billion.

- The top 10 PCB manufacturers account for a significant market share.

- Customers can switch suppliers relatively easily.

Customer's ability to backward integrate

TTM Technologies faces increased customer bargaining power if its clients can produce PCBs or related components. Large OEMs, especially those with the resources, can opt for backward integration, reducing their reliance on TTM. This potential for self-sufficiency can constrain TTM's pricing strategies. For example, in 2024, the electronics manufacturing services (EMS) market, which includes PCB production, was valued at approximately $500 billion, showing the scale customers operate within.

- Backward integration threat increases customer power.

- Large OEMs have the resources for insourcing.

- TTM's pricing power is limited by this threat.

- EMS market was worth $500 billion in 2024.

TTM Technologies faces considerable customer bargaining power. Major clients' concentration allows for price negotiations and service terms leverage. In 2024, top customers generated roughly 45% of TTM's revenue, influencing pricing.

Price sensitivity and switching ease also affect customer power, as alternative suppliers are available. TTM needs to highlight product value, given the Q1 2024 gross margin of 14.6%.

The $79.4 billion global PCB market in 2023, along with easy supplier switching, amplifies customer influence. Backward integration possibilities further constrain TTM's pricing strategies.

| Factor | Impact on TTM | 2024 Data |

|---|---|---|

| Customer Concentration | High bargaining power | Top 10 customers: ~45% revenue |

| Price Sensitivity | Negotiating ability | Q1 Gross Margin: 14.6% |

| Supplier Alternatives | Increased leverage | EMS market ~$500B |

Rivalry Among Competitors

The PCB industry is fiercely competitive, featuring global giants and regional players, which intensifies price and margin pressures. TTM Technologies faces this head-on, necessitating constant innovation. In 2024, the global PCB market was valued at approximately $80 billion. TTM must enhance efficiency to maintain its competitive edge.

In segments of the PCB market, competition is often price-driven. This can trigger price wars, squeezing profits for all, including TTM Technologies. To counter this, TTM concentrates on higher-value, specialized offerings. For example, in 2024, TTM's focus on advanced tech helped maintain margins despite market pressures.

TTM Technologies competes by offering advanced technologies and services. Companies like TTM differentiate through innovation, quality, and service. TTM's HDI PCBs and RF components set it apart, reducing price competition's impact. In 2024, TTM's focus on advanced tech and services helped maintain margins amidst industry pressures.

Consolidation trends in the industry

The printed circuit board (PCB) industry is experiencing significant consolidation. Mergers and acquisitions are creating larger, more formidable competitors with broader market reach. This trend intensifies competitive rivalry. TTM Technologies must strategically adapt to maintain its market position.

- TTM's 2024 revenue was around $2.2 billion.

- Consolidation can lead to pricing pressures.

- Larger firms have more resources for R&D.

- TTM must focus on innovation.

Global competition

TTM Technologies encounters fierce global competition. Rivals span Asia, Europe, and North America, intensifying rivalry. TTM must optimize global operations and supply chains for competitiveness. The printed circuit board (PCB) market, where TTM operates, is highly competitive with numerous players.

- Global PCB market size was approximately $81.3 billion in 2023.

- Asia-Pacific accounts for over 80% of global PCB production.

- TTM's revenue in 2023 was about $2.1 billion.

- Key competitors include larger companies like Jabil and smaller, regional players.

Competitive rivalry in the PCB industry is intense due to numerous global and regional players. Price wars and margin pressures are common, necessitating constant innovation. TTM Technologies focuses on advanced tech to maintain its edge. The global PCB market was valued at approximately $80 billion in 2024.

| Aspect | Details | TTM's Strategy |

|---|---|---|

| Market Size | $80B (2024) | Focus on high-value products |

| Key Competitors | Jabil, others | Innovation, Quality |

| 2024 Revenue (TTM) | ~$2.2B | Optimize operations |

SSubstitutes Threaten

Alternative board technologies, such as flexible circuits, ICs, and COB, present a threat to TTM Technologies. These alternatives are suitable for specific applications where size or flexibility is key. The flexible circuit market, for example, was valued at $14.8 billion in 2023. The continued development of these technologies increases the pressure on traditional PCB manufacturers. The long-term viability of TTM Technologies depends on its ability to innovate and adapt to these changes.

Advanced packaging solutions, including multi-chip modules (MCMs) and 3D packaging, pose a threat as they integrate multiple functions, reducing PCB needs. These solutions are growing in high-performance applications, potentially substituting traditional PCBs. The advanced packaging market was valued at $37.5 billion in 2023 and is projected to reach $58.3 billion by 2028. TTM must offer its own advanced packaging to stay competitive.

Wireless technologies present a substitute for PCBs in some applications. Bluetooth and Wi-Fi can replace wired connections, reducing PCB usage. The shift towards wireless poses a threat, especially in consumer electronics and IoT. The global wireless charging market was valued at $12.63 billion in 2023, showing growth. This trend indicates potential substitution risks for PCB manufacturers like TTM Technologies.

Software-defined hardware

The rise of software-defined hardware presents a threat to TTM Technologies. This technology allows for flexible system design, potentially reducing the need for specialized hardware. This shift could decrease demand for traditional PCBs, impacting TTM's core business. The ability to implement functionalities via software increases the substitution risk. This trend is particularly relevant in applications valuing adaptability.

- The global market for software-defined networking (SDN), which utilizes software-defined hardware, was valued at $17.2 billion in 2023.

- Forecasts project the SDN market to reach $77.8 billion by 2030, growing at a CAGR of 24.1% from 2024 to 2030.

- Companies like Intel and NVIDIA are heavily investing in software-defined hardware solutions, indicating a growing industry trend.

- TTM Technologies' revenue in 2023 was $2.8 billion.

Standardization of components

The standardization of electronic components poses a threat to TTM Technologies. This trend, driven by the increasing integration of functions into standard components, reduces the need for custom PCBs. As a result, the demand for specialized PCBs could decrease, potentially affecting TTM's revenue. To offset this, TTM must focus on providing value-added services.

- Standard components reduce demand for custom PCBs.

- TTM needs to focus on value-added services.

- The market for standard components is growing.

- TTM's revenue could be impacted.

Several technologies substitute PCBs, impacting TTM Technologies. Advanced packaging and wireless tech are growing, posing substitution risks. Software-defined hardware and standard components further challenge TTM.

| Substitute | Market Size (2023) | Growth Trend |

|---|---|---|

| Flexible Circuits | $14.8B | Growing |

| Advanced Packaging | $37.5B | Projected to $58.3B by 2028 |

| Wireless Charging | $12.63B | Growing |

| SDN | $17.2B | Projected to $77.8B by 2030 |

Entrants Threaten

The PCB industry demands substantial upfront investment in machinery and plants, a significant hurdle for newcomers. This capital-intensive nature protects established firms like TTM Technologies. TTM, with its existing infrastructure, benefits from economies of scale, providing a cost advantage. In 2024, the average cost to set up a PCB manufacturing facility could range from $50 million to over $200 million.

Manufacturing advanced PCBs, like HDI PCBs and RF components, needs specialized expertise. New firms may struggle due to the lack of skills needed to effectively compete. TTM's established technical capabilities give it an edge. In 2024, TTM invested $100 million in R&D. This helps maintain a competitive advantage.

TTM Technologies benefits from established customer relationships, particularly in sectors like aerospace and defense. These long-term partnerships create a significant barrier for new entrants. Building trust and securing contracts requires considerable time and resources, making it difficult for newcomers to compete. In 2024, TTM's revenue was approximately $2.1 billion, reflecting the stability provided by its customer base.

Economies of scale

Existing PCB manufacturers like TTM Technologies, benefit significantly from economies of scale, enabling lower per-unit production costs. New entrants often face challenges in matching the efficiency and cost-effectiveness of established players. TTM's substantial operational scale gives it a notable cost advantage, particularly in areas like materials sourcing and manufacturing processes. For example, in 2024, TTM's revenue was approximately $2.4 billion, showcasing its scale.

- Lower per-unit costs for established firms.

- New entrants struggle to compete on cost.

- TTM's scale supports cost advantages.

- TTM's 2024 revenue: ~$2.4B.

Regulatory and environmental compliance

The PCB manufacturing sector faces stringent regulatory and environmental demands. New businesses must invest significantly in meeting these standards, which can be a major hurdle. TTM Technologies, with its established presence, benefits from its expertise and resources in managing these requirements. This gives TTM Technologies a competitive advantage over potential new entrants.

- Compliance costs include expenses for hazardous waste disposal, emissions control, and environmental impact assessments.

- TTM Technologies has demonstrated its commitment to sustainability, as seen in its Q1 2024 results.

- New entrants may struggle with initial capital outlays and ongoing operational costs associated with regulatory compliance.

- The global PCB market is predicted to grow, driven by sectors like AI, telecommunications, and automotive.

The PCB industry's high entry barriers, including significant capital needs, specialized expertise, and regulatory compliance, limit the threat of new entrants. TTM's established market position and strong customer relationships further protect it. The cost to launch a new facility can be between $50M-$200M, while TTM's 2024 revenue was around $2.4B, showing its competitive advantage.

| Barrier | Impact | TTM Advantage |

|---|---|---|

| High Capital Costs | Discourages new entrants | Established infrastructure, economies of scale |

| Specialized Expertise | Challenges new firms | Technical capabilities, R&D ($100M in 2024) |

| Regulatory Compliance | Adds significant costs | Expertise, resources |

Porter's Five Forces Analysis Data Sources

The TTM Technologies analysis draws from annual reports, industry reports, and market data to inform the five forces.