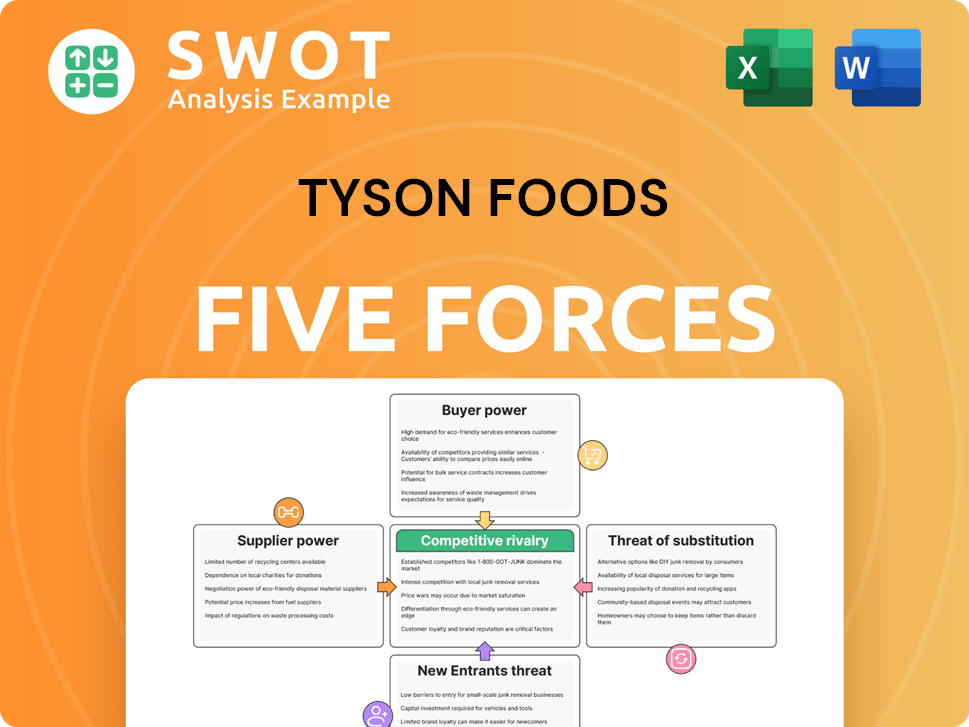

Tyson Foods Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tyson Foods Bundle

What is included in the product

Examines Tyson's competitive environment. It assesses forces like supplier power and the threat of new entrants.

Swap in your own data to reflect current business conditions.

Full Version Awaits

Tyson Foods Porter's Five Forces Analysis

You’re previewing the final version—precisely the same document that will be available to you instantly after buying. This Tyson Foods Porter's Five Forces analysis examines the competitive rivalry within the meatpacking industry, assessing factors like bargaining power of suppliers (farmers) and buyers (retailers). It also explores the threat of new entrants, substitutes (plant-based alternatives), and the overall industry dynamics. The document breaks down each force, providing insightful analysis based on Tyson Foods' position. This comprehensive look at Tyson's competitive environment is ready for immediate use.

Porter's Five Forces Analysis Template

Tyson Foods faces complex industry forces. Supplier power, particularly for feed ingredients, presents a significant challenge. Buyer power is concentrated among large retailers, impacting pricing. The threat of substitutes, like plant-based proteins, is ever-present. New entrants face high barriers, though. Competitive rivalry within the meatpacking industry is intense.

Our full Porter's Five Forces report goes deeper—offering a data-driven framework to understand Tyson Foods's real business risks and market opportunities.

Suppliers Bargaining Power

Tyson Foods faces significant supplier power due to the concentration in livestock production. A few major players control the meat supply, granting them substantial influence. In 2024, the top four beef packers managed 85% of the U.S. beef processing market. Tyson's 24% share underscores this supplier concentration.

Feed grain prices heavily influence Tyson Foods' production expenses, granting suppliers considerable pricing power. In 2023, corn prices averaged $4.73 per bushel. Tyson's yearly feed grain spending hit $2.4 billion, highlighting supplier impact. This affects Tyson's profitability and operational efficiency.

Agricultural supplier consolidation limits Tyson Foods' alternatives, boosting supplier bargaining power. Between 2020 and 2023, agricultural input market concentration rose by 12%. The top three seed manufacturers control 53% of the global seed market, and the fertilizer market sees 67% consolidation. This reduces Tyson's options and increases supplier leverage.

Animal Health Regulations

Tyson Foods faces challenges from suppliers due to stringent animal health regulations. These regulations amplify complexity and costs for livestock producers, narrowing Tyson's supplier choices. Compliance costs, as reported by the USDA, grew by 18% in 2023, averaging $127,000 per farm. This financial burden limits supplier flexibility, fortifying the bargaining power of existing suppliers.

- Increased Compliance Costs: USDA regulatory compliance rose by 18% in 2023.

- Average Farm Expense: Compliance averaged $127,000 per farm.

- Supplier Limitations: Regulations constrain supplier flexibility.

- Barrier to Entry: High costs increase barriers to market entry.

High Switching Costs

Tyson Foods faces high switching costs when changing suppliers. The company estimates that switching can raise costs by up to 15% due to logistics and quality control. This makes Tyson less likely to switch, even if prices increase. This reliance gives suppliers some bargaining power.

- Cost increases can impact Tyson's profitability.

- Logistics hurdles include transport and storage of goods.

- Quality control involves ensuring food safety.

- Tyson's supply chains must be re-established.

Tyson Foods deals with strong supplier bargaining power, mainly due to concentrated markets and high costs. In 2024, a few beef packers controlled the majority of the market, which included Tyson's 24% share. Compliance costs and switching difficulties further strengthen suppliers' position, impacting Tyson's expenses.

| Factor | Impact | Data (2024) |

|---|---|---|

| Market Concentration | Supplier Power | Top 4 beef packers: 85% market share |

| Feed Grain Costs | Influences Production | Corn prices: approx. $5/bushel |

| Switching Costs | Reduce Alternatives | Switching cost increase: up to 15% |

Customers Bargaining Power

Large retailers exert considerable influence over Tyson Foods, affecting pricing and product specifics. Walmart, a major customer, represented 18.4% of Tyson's fiscal year 2024 sales. Their substantial purchasing power enables them to negotiate lower prices and request promotional programs. This impacts Tyson's profitability and strategic choices.

The rising consumer desire for sustainable options boosts customer power. Transparency in sourcing is key, with 66% globally ready to pay extra for eco-friendly brands. Young consumers especially drive this trend, pushing Tyson to meet these demands. This impacts pricing and operational choices, increasing customer influence.

Customers wield significant bargaining power, especially in the grocery market. Price sensitivity is high, with alternatives readily available if Tyson's pricing isn't competitive. A 2021 study showed about 45% of consumers switched brands due to price or quality concerns. This pressures Tyson Foods to offer competitive prices to retain market share.

Switching Ability

Customers in the food industry can easily switch brands. This ease of switching, due to low costs, increases price sensitivity. Tyson Foods must constantly assess its competitive standing because of this. A 2021 study revealed that roughly 45% of consumers changed brands based on price or quality.

- Switching costs are low, increasing price sensitivity.

- Tyson must maintain competitive pricing and quality.

- Approximately 45% of consumers switch brands.

Access to Information

In today's digital landscape, customers have unprecedented access to information, which significantly boosts their bargaining power. They can easily compare Tyson's products, assess farming practices, and validate claims through online platforms. This access allows consumers to make well-informed choices, influencing Tyson's pricing and marketing strategies. A 2021 study by the International Food Information Council found that over 75% of consumers use online resources for food product research. This shift emphasizes the need for Tyson to meet consumer expectations.

- Consumer reviews and social media platforms provide direct feedback on product quality and company practices.

- Transparency in supply chains is increasingly demanded, putting pressure on Tyson to disclose sourcing and production methods.

- The ability to easily switch to competitors if expectations aren't met.

- The rise of ethical and health-conscious consumerism.

Tyson Foods faces strong customer bargaining power, amplified by easily accessible information and a digital landscape. Walmart, a key customer, accounted for 18.4% of fiscal year 2024 sales, affecting pricing strategies. Rising consumer demand for transparency and sustainable options boosts customer influence, especially among younger demographics.

| Factor | Impact on Tyson | Data Point (2024) |

|---|---|---|

| Retailer Influence | Price pressure | Walmart: 18.4% of sales |

| Consumer Demand | Need for transparency | 66% willing to pay more |

| Switching Costs | High price sensitivity | ~45% switched brands |

Rivalry Among Competitors

Tyson Foods confronts fierce rivalry from JBS USA, Cargill, Hormel Foods, and Smithfield Foods. These competitors battle for market share in chicken, beef, and pork. The protein processing industry is highly competitive. In 2024, Tyson's revenue was approximately $52.9 billion, reflecting the competitive pressures.

Market share battles in protein processing demand innovation. Tyson Foods must adapt to shifting consumer tastes. This includes new products. In 2024, Tyson's revenue was $52.8 billion.

Price wars significantly impact the competitive landscape. Intense price competition forces aggressive pricing strategies, squeezing profit margins. Tyson Foods felt this pressure; in 2022, their operating income dropped around 5% due to pricing issues and rising costs. This can lead to reduced profitability across the industry.

Regional Players

Regional players significantly influence the competitive landscape for Tyson Foods. Companies such as Perdue Farms and Sanderson Farms, particularly in the Midwest, directly challenge Tyson. These regional competitors accounted for approximately 30% of the total U.S. meat sales in 2021. This localized competition increases the pressure on pricing and market share.

- Perdue Farms and Sanderson Farms are key regional rivals.

- These companies collectively held a significant market share.

- Competition is especially fierce in local markets.

- This rivalry affects pricing and market strategies.

Innovation Requirements

Competitive rivalry necessitates continuous innovation to stay ahead. Tyson Foods, for example, consistently introduces new products; in 2021, over 100 were launched. The meat processing industry's innovation spending hit roughly $1.5 billion in 2022, highlighting the need for sustained investment. This includes areas like plant-based options and convenient meal solutions.

- Tyson Foods launched over 100 new products in 2021.

- The meat processing industry's innovation spending was about $1.5 billion in 2022.

- Innovation focuses on plant-based and ready-to-eat meals.

Tyson Foods faces intense competition from industry giants like JBS USA and Cargill, fighting for market share in protein processing. Price wars significantly impact profits, demonstrated by Tyson's operating income dip in 2022 due to pricing pressures and rising costs. Regional rivals such as Perdue Farms add to the competitive landscape, especially in local markets, affecting pricing strategies.

| Key Competitor | 2023 Revenue (USD Billion) | Market Focus |

|---|---|---|

| JBS USA | ~$58.5 | Beef, Pork, Poultry |

| Cargill | ~$177 | Meat, Poultry, Ingredients |

| Hormel Foods | ~$12.0 | Packaged Meats |

SSubstitutes Threaten

Plant-based alternatives present a growing threat to Tyson Foods. The rising popularity of plant-based proteins, like those from Beyond Meat and Impossible Foods, is taking market share. In 2022, the global plant-based meat market hit $6.1 billion. It is projected to reach $17.4 billion by 2027. This shift challenges Tyson's dominance in the meat industry.

Consumer interest in alternatives poses a threat. Adoption of plant-based options is driven by consumer interest. Roughly 42% of consumers actively seek plant-based proteins. About 33% of U.S. consumers decreased meat intake in 2022. This shift impacts Tyson Foods.

Growing health and sustainability consciousness significantly impacts consumer choices, posing a threat to Tyson Foods. Many consumers prioritize environmental impact; data shows 62% are now focused on sustainability. Moreover, 47% are willing to pay more for sustainable protein options.

Lab-Grown Meat

The rise of lab-grown meat poses a threat to Tyson Foods. The cultivated meat market is expected to hit $1.4 billion by 2028. This could impact Tyson's market share. In 2022, $366 million was invested in this tech.

- Projected Market: $1.4B by 2028.

- 2022 Investment: $366M in cultivated meat.

- Potential: Shift in protein market.

Favorable Marketing

Favorable marketing significantly impacts the threat of substitutes for Tyson Foods. Plant-based alternatives benefit from marketing, influencing consumer choices. Marketing spending for plant-based foods rose by 16% in 2021. Brands highlighting health, sustainability, and animal welfare gain market share.

- Marketing expenditures for plant-based food categories increased by 16% in 2021.

- Brands focused on health, sustainability, and animal welfare are resonating with younger consumers.

- The alternative protein sector's market share increased, reaching 27%.

Substitutes, like plant-based meats, challenge Tyson. In 2023, the global plant-based meat market was valued at $6.9 billion. This market is projected to reach $20.5 billion by 2028. Consumer preference for alternatives impacts Tyson's market.

| Metric | Value | Year |

|---|---|---|

| Plant-Based Meat Market | $6.9B | 2023 |

| Projected Market Size | $20.5B | 2028 |

| Consumer Interest | Growing | Ongoing |

Entrants Threaten

High capital needs pose a substantial threat. Building a meat processing facility is expensive. In 2024, the cost to start a small-scale operation could range from $5 million to $20 million, deterring new entrants. Large-scale facilities can cost hundreds of millions. This financial hurdle limits competition.

Stringent regulations significantly impact new entrants in the food industry. Compliance with food safety standards increases operational complexity and costs. USDA regulatory compliance costs for livestock producers rose by 18% in 2023, creating barriers. These high compliance costs make it difficult for new companies to compete effectively.

Brand loyalty significantly hinders new entrants in the meat industry. Tyson Foods benefits from this, with a substantial market share. In 2024, Tyson held roughly 22% of the U.S. chicken market. This entrenched position makes it challenging for new competitors to gain traction. Consumers' trust in established brands like Tyson acts as a major entry barrier.

Distribution Access

New entrants face significant hurdles accessing distribution networks, crucial for reaching consumers. Tyson Foods' established relationships with retailers and food service providers create a barrier. Securing similar deals for consistent product delivery and shelf space is difficult. This advantage allows Tyson to maintain market dominance.

- Tyson Foods controls a substantial portion of the meat and poultry market distribution.

- New companies often lack the infrastructure for efficient nationwide distribution.

- Established players, like Tyson, benefit from economies of scale in distribution.

- The cost to build a comparable distribution network is very high.

Consolidated Suppliers

Consolidation among suppliers poses a threat to Tyson Foods by reducing supplier diversity. This trend has led to fewer choices for Tyson. The top two U.S. meat and grain suppliers now control over 40% of the market, limiting options. This concentration can increase Tyson's dependency and potentially raise costs.

- Reduced Supplier Diversity: Consolidation in the agricultural sector decreases the variety of suppliers available to Tyson Foods.

- Market Concentration: The two largest suppliers in the U.S. meat and grain market account for more than 40% of the market.

- Increased Dependency: Tyson Foods becomes more reliant on fewer suppliers.

- Potential Cost Increases: Limited competition among suppliers could lead to higher input costs for Tyson.

New entrants in the meat industry face several barriers. High capital costs, with small-scale startups costing $5-$20M in 2024, deter new firms. Stringent regulations and brand loyalty, especially Tyson's 22% chicken market share, add further obstacles.

| Barrier | Impact | Example (2024) |

|---|---|---|

| Capital Needs | High initial investment | $5M-$20M for small operations |

| Regulations | Increased costs & complexity | USDA compliance costs up 18% (2023) |

| Brand Loyalty | Market share advantage | Tyson: ~22% U.S. chicken market |

Porter's Five Forces Analysis Data Sources

Tyson's Five Forces assessment uses annual reports, market analysis, industry news, and regulatory filings.