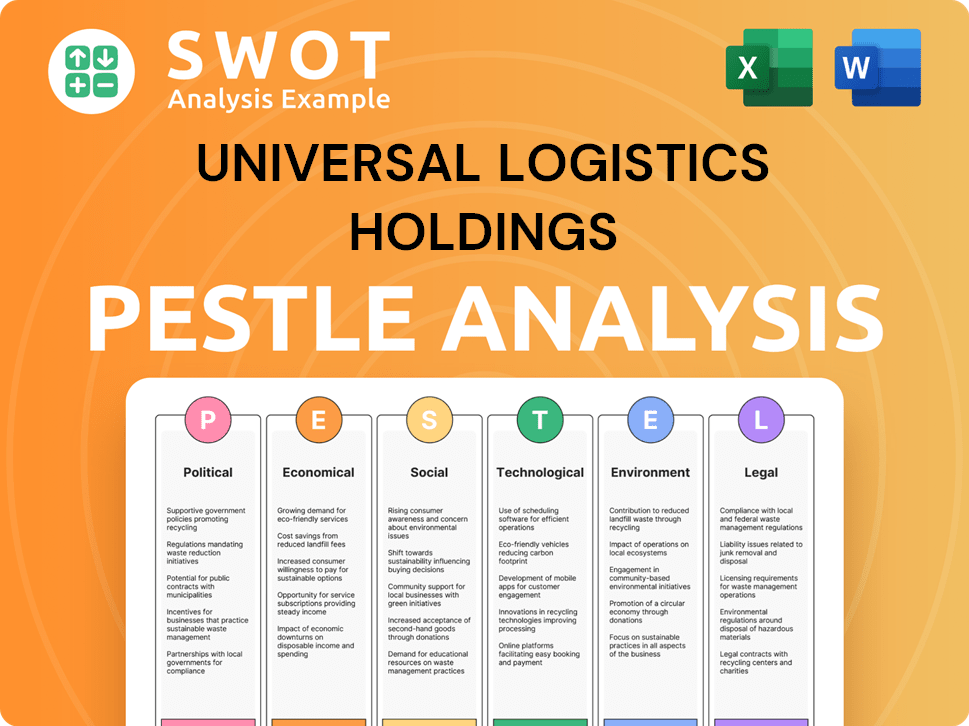

Universal Logistics Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Universal Logistics Holdings Bundle

What is included in the product

Examines how external macro factors impact Universal Logistics Holdings. This supports executives in strategic planning and opportunity identification.

A clean, summarized version of the full analysis for easy referencing during meetings or presentations.

Full Version Awaits

Universal Logistics Holdings PESTLE Analysis

This Universal Logistics Holdings PESTLE analysis preview shows the complete document. The content is formatted and structured as shown here.

PESTLE Analysis Template

Gain a competitive edge with our in-depth PESTLE Analysis—specifically tailored for Universal Logistics Holdings. This analysis uncovers key external factors impacting the company's operations and strategic direction. It dissects the political climate, economic trends, and technological advancements that shape its performance. Understanding social dynamics, legal regulations, and environmental concerns is crucial. Download the complete version for actionable insights.

Political factors

Changes in trade policies and tariffs directly affect Universal Logistics Holdings' cross-border operations. US tariffs on Chinese goods, for instance, influence logistics. The USMCA trade agreement, updated in 2020, impacts trade flows between the US, Mexico, and Canada. In 2024, tariff discussions continue to shape international logistics strategies.

Government investment in transportation infrastructure significantly impacts logistics. Increased spending on roads, bridges, and rail lines enhances network efficiency. For instance, the U.S. government allocated over $1 trillion for infrastructure projects in the Bipartisan Infrastructure Law. This investment potentially cuts transit times and operating costs for Universal Logistics Holdings. Such improvements can boost their competitiveness and profitability.

Transportation regulations, chiefly from the FMCSA, significantly shape Universal Logistics' operations. Mandates like ELDs require compliance, impacting costs. In 2024, ELD compliance costs averaged $500-$800 per truck. These regulations influence both expenses and efficiency.

Geopolitical Events and Stability

Geopolitical events significantly influence Universal Logistics Holdings. The Red Sea crisis, for example, has disrupted shipping, increasing freight rates. Such instability necessitates flexible strategies to navigate supply chain challenges. These disruptions directly affect operational costs and profitability, demanding proactive risk management. For instance, in Q1 2024, global supply chain disruptions increased operational costs by approximately 7%.

- Red Sea crisis impact: increased freight rates by 15% in Q1 2024.

- Supply chain disruptions: increased operational costs by 7% in Q1 2024.

- Geopolitical risks: necessitate flexible logistics strategies.

Policy Changes Affecting Specific Industries

Changes in policies impacting industries like automotive and heavy-haul wind directly affect Universal Logistics' services demand. For instance, a slowdown in automotive production, possibly due to economic shifts or trade policies, could reduce logistics volumes. The automotive sector saw a 9% decrease in U.S. light vehicle sales in Q4 2023, impacting related logistics. Universal Logistics reported a 6.7% decrease in revenue in Q3 2024, partially due to decreased volumes in automotive.

- Automotive sector downturns directly affect Universal's logistics volumes.

- Trade policies and economic factors can influence automotive production levels.

- Q3 2024 revenue decreased by 6.7% due to volume reduction.

- U.S. light vehicle sales decreased by 9% in Q4 2023.

Political factors significantly shape Universal Logistics Holdings (ULH). Changes in tariffs and trade agreements, like USMCA, directly influence cross-border operations. Government infrastructure investment, such as the over $1 trillion allocated by the Bipartisan Infrastructure Law, impacts logistics efficiency and costs.

Transportation regulations and geopolitical events introduce volatility. The Red Sea crisis and supply chain disruptions increased ULH's operational costs. Policies impacting automotive and heavy-haul directly affect ULH's service demand.

In Q1 2024, supply chain issues increased operational costs by about 7%, reflecting the significant impact of external factors on financial outcomes and necessitating proactive risk mitigation. The automotive sector saw a 9% decrease in U.S. light vehicle sales in Q4 2023.

| Political Factor | Impact on ULH | 2024 Data |

|---|---|---|

| Trade Policies | Affects cross-border operations | USMCA, tariff adjustments |

| Infrastructure Investment | Enhances network efficiency | +$1 trillion Bipartisan Law |

| Geopolitical Events | Increases operational costs | Red Sea Crisis, +7% costs |

Economic factors

Economic growth and consumer demand are key drivers for Universal Logistics. In 2024, the U.S. GDP grew, influencing freight volumes positively. Increased consumer spending, such as the 3% rise in retail sales in Q1 2024, boosts demand for logistics services. Conversely, economic slowdowns can reduce freight needs; monitoring these trends is vital. Universal Logistics' performance closely mirrors these economic shifts.

Fuel price volatility, especially for diesel, directly impacts Universal Logistics Holdings' operational costs. Diesel prices in the U.S. averaged around $3.87 per gallon in early 2024. Fuel surcharges help offset these costs, but there's a lag, potentially squeezing margins. This can also affect owner-operator relationships, crucial for capacity.

Inflation significantly impacts Universal Logistics Holdings' operating costs. In 2024, the US inflation rate was around 3.1%, affecting labor and equipment expenses. Rising costs necessitate strategies to maintain profit margins. Universal Logistics must optimize operations to combat inflationary pressures.

Interest Rates and Access to Capital

Interest rate fluctuations significantly impact Universal Logistics Holdings' financial strategy. Higher rates increase borrowing costs, potentially delaying investments in new equipment or tech. In 2024, the Federal Reserve maintained a high-interest rate environment to combat inflation, affecting capital expenditure decisions. Access to affordable financing is crucial for operational enhancements and expansion.

- The Federal Reserve held the federal funds rate steady at a range of 5.25% to 5.50% in 2024.

- Universal Logistics Holdings reported a debt-to-equity ratio of 0.45 as of Q3 2024.

- Capital expenditures for the company were $100 million in 2023.

Industry-Specific Market Conditions

Industry-specific market conditions significantly affect Universal Logistics Holdings' performance. For instance, fluctuations in truckload rates or intermodal volumes directly impact revenue. Softness in automotive production, a key customer segment, can negatively influence contract logistics. Understanding these segment-specific dynamics is crucial for forecasting and strategic planning.

- In Q1 2024, U.S. intermodal volumes decreased by 4.5% year-over-year.

- Truckload rates have shown moderate volatility, with spot rates potentially impacting contract rates.

- Automotive production forecasts for 2024-2025 indicate potential for modest growth.

Economic conditions heavily influence Universal Logistics. The U.S. GDP growth in 2024 impacted freight volumes. High inflation at 3.1% and interest rate changes, with the Federal Reserve holding rates, impact costs.

| Metric | Data | Year |

|---|---|---|

| U.S. GDP Growth | ~3% | 2024 |

| Inflation Rate | 3.1% | 2024 |

| Fed Funds Rate | 5.25% - 5.50% | 2024 |

Sociological factors

The logistics sector grapples with labor shortages, especially for drivers and warehouse staff. These shortages drive up labor costs and limit operations. Universal Logistics Holdings must invest in recruitment, training, and retention to combat these issues. The U.S. trucking industry, for example, faced a shortage of 60,800 drivers in 2022, a figure expected to persist into 2025.

Consumers now expect quicker, more transparent deliveries, which directly impacts logistics strategies. E-commerce's rise demands efficient last-mile solutions. In 2024, e-commerce sales hit $1.1 trillion, showing this trend's importance. Real-time tracking and flexible delivery options are crucial. Universal Logistics must adapt to meet these evolving needs.

Prioritizing workforce safety and well-being is crucial for Universal Logistics Holdings. In 2024, the transportation and warehousing industries faced increased scrutiny regarding worker safety. The Federal Motor Carrier Safety Administration (FMCSA) reported over 4,000 fatal crashes involving large trucks in 2023. Companies must invest in safety programs to mitigate risks, with 2025 likely seeing further regulations.

Community Impact and Social Responsibility

Universal Logistics Holdings' operations significantly influence local communities. Logistics facilities' presence affects noise levels, traffic, and environmental sustainability. Social responsibility, including community engagement, is crucial for maintaining a positive reputation. In 2024, the company allocated $1.5 million for community programs. This included initiatives focused on environmental sustainability and local infrastructure improvements.

- 2024: $1.5M allocated for community programs.

- Focus on environmental sustainability and local infrastructure.

Diversity, Equity, and Inclusion

Societal expectations increasingly emphasize diversity, equity, and inclusion (DEI). Universal Logistics Holdings faces pressure to demonstrate its commitment to DEI. This involves fostering a diverse workforce and inclusive leadership. Failure to meet these expectations can damage reputation and affect stakeholder relationships.

- In 2024, companies with strong DEI practices saw a 15% increase in employee satisfaction.

- Universal Logistics Holdings' 2024 report showed a 10% increase in diverse hires.

- Investors are increasingly considering DEI metrics in their investment decisions.

Labor shortages, particularly for drivers, affect Universal Logistics' operational costs. E-commerce drives demands for faster deliveries, reshaping logistics strategies. Safety, community impact, and DEI are critical societal factors influencing the company.

| Factor | Impact | Data Point (2024-2025) |

|---|---|---|

| Labor | Increased costs, operational limits. | Trucking industry shortage: 60,800 drivers (2022-2025) |

| Delivery | Demands efficient solutions. | E-commerce sales: $1.1T (2024) |

| DEI | Impact on reputation and investment | 15% rise in satisfaction at firms w/DEI in 2024 |

Technological factors

Universal Logistics Holdings faces technological shifts, particularly in automation and robotics. Implementing these technologies in warehousing and transportation could boost efficiency and lower costs. AI-driven predictive analytics and collaborative robots are key. In 2024, the logistics automation market was valued at $50 billion, growing steadily. This trend suggests potential gains for companies that adopt these technologies.

Digitalization is key for Universal Logistics Holdings. Implementing digital freight platforms, IoT sensors, and blockchain improves supply chain visibility. Real-time data access streamlines operations. The global digital freight market is projected to reach $75.6 billion by 2030. Enhanced tech boosts efficiency.

Universal Logistics Holdings can significantly improve operations using data analytics and AI. By 2024, the global AI in logistics market was valued at $5.2 billion. These technologies optimize route planning, inventory, and demand forecasting, which can reduce costs. AI-driven insights enhance decision-making and boost operational efficiency. The logistics sector is actively adopting AI; the market is projected to reach $20.6 billion by 2030.

Electric Vehicles and Alternative Fuels

Universal Logistics Holdings faces technological shifts in transportation. The rise of electric vehicles (EVs) and alternative fuels is reshaping the industry due to environmental regulations and consumer demand. This transition demands investments in charging infrastructure and vehicle upgrades. Integrating EVs could lead to lower fuel costs and reduced emissions, but also higher upfront expenses.

- EV sales are projected to reach 14.5 million units globally in 2024.

- The US government offers tax credits up to $7,500 for new EVs.

- Companies are investing in EV charging infrastructure; for instance, Tesla plans to expand its Supercharger network.

- In 2023, the global market for alternative fuels was valued at $1.6 trillion.

Cybersecurity

Cybersecurity is vital as Universal Logistics Holdings increases its digital presence. Protecting data and operational integrity is crucial in a sector where cyberattacks are rising. The cost of cybercrime is projected to reach $10.5 trillion annually by 2025. The logistics sector is a prime target, with 68% of firms reporting cyberattacks in 2023.

- Cyberattacks in logistics increased by 30% in 2024.

- The average cost of a data breach for logistics companies is $4.45 million.

- Universal Logistics Holdings' cybersecurity budget increased by 15% in 2024.

Universal Logistics Holdings must manage tech changes in automation and robotics, which enhance efficiency and reduce costs in warehousing and transportation. Digital freight platforms, IoT, and blockchain are key to supply chain visibility; the digital freight market could hit $75.6 billion by 2030. AI-driven logistics optimizes route planning and forecasting, the AI market projected at $20.6 billion by 2030.

| Technology | Impact | Financial Data |

|---|---|---|

| Logistics Automation | Improved efficiency | $50B market value in 2024 |

| Digital Freight | Supply chain visibility | Projected $75.6B by 2030 |

| AI in Logistics | Optimized operations | Projected $20.6B market by 2030 |

Legal factors

Universal Logistics Holdings faces intricate transportation regulations. These regulations cover vehicle standards, driver qualifications, and cargo security. For instance, the Federal Motor Carrier Safety Administration (FMCSA) enforces hours-of-service rules. In 2024, FMCSA reported over 4 million roadside inspections. Compliance costs are significant, impacting operational expenses.

Universal Logistics Holdings must adhere to labor laws. This includes wage, hour regulations, and safety standards. Changes in these laws can affect operational costs. For example, in 2024, the U.S. Department of Labor reported over 10,000 workplace safety violations. This can significantly impact their operations.

Environmental regulations, particularly those concerning emissions, are critical for Universal Logistics Holdings. Stricter standards may necessitate investments in eco-friendly technologies. For instance, the EPA's recent focus on diesel emissions could push the company to adopt cleaner vehicles. This shift may impact operational costs.

Trade and Customs Regulations

Universal Logistics Holdings must navigate complex trade and customs regulations. Compliance with trade agreements, customs procedures, and import/export rules is essential for their international operations. Any shifts in these regulations can directly influence the movement of goods, necessitating operational adjustments. For example, in 2024, the World Trade Organization (WTO) reported an increase in trade restrictive measures, impacting global supply chains. This necessitates constant monitoring and adaptation.

- World Trade Organization (WTO) reported an increase in trade restrictive measures in 2024.

- Changes in customs duties and tariffs can significantly affect profitability.

- The USMCA (United States-Mexico-Canada Agreement) continues to shape North American trade.

Contract Law and Liability

Universal Logistics Holdings heavily relies on contracts, including agreements with customers and carriers. These contracts dictate service levels, pricing, and liability terms. Any breach of contract can lead to significant financial penalties or legal disputes. The company's legal team must diligently manage these contracts to mitigate risk. In 2024, legal expenses for contract disputes in the logistics sector averaged $1.2 million per case.

- Contractual obligations are crucial for service delivery.

- Liability management is essential to avoid financial losses.

- Legal teams must proactively manage contract risks.

- Breach of contract can result in substantial costs.

Universal Logistics Holdings manages significant legal and contractual risks impacting operations. The company is subject to detailed transport, labor, and environmental regulations. Trade agreements and customs rules add complexity to international dealings; The USMCA influences North American trade.

| Regulation Type | Regulatory Body | 2024 Impact |

|---|---|---|

| Transport | FMCSA | Over 4M roadside inspections |

| Labor | Dept. of Labor | Over 10k workplace violations |

| Contracts | Legal Dept. | Avg. dispute cost $1.2M |

Environmental factors

The logistics sector significantly impacts air quality via emissions. Stricter rules are emerging to curb carbon footprints. Universal Logistics must consider cleaner tech adoption. For 2024, the EPA reported transportation accounted for 28% of U.S. greenhouse gas emissions.

Climate change intensifies extreme weather, posing risks to Universal Logistics' operations. Increased storms, floods, and other events can damage infrastructure. In 2024, extreme weather cost the US economy over $100 billion. Logistics firms must adapt.

Universal Logistics Holdings faces pressure to enhance fuel efficiency and adopt alternative energy. In 2024, the company may increase investments in electric vehicles (EVs). The shift to sustainable fuels is a way to reduce environmental impact. The average cost of diesel in the US was $3.99 per gallon in late April 2024.

Waste Management and Recycling

Universal Logistics Holdings must prioritize waste management and recycling across its operations. Effective programs in warehouses and facilities are crucial for minimizing environmental impact. Sustainable practices can cut costs and boost efficiency. For example, the global waste management market is projected to reach $2.8 trillion by 2027, highlighting the financial stakes.

- Recycling programs can reduce waste disposal expenses by up to 30%.

- Implementing LEED-certified buildings can decrease operational costs by 8-9%.

- Proper waste management reduces the risk of environmental fines.

Stakeholder Expectations for Sustainability

Stakeholder expectations for sustainability are rising, pushing companies like Universal Logistics Holdings to adopt greener practices. Customers and investors are now prioritizing environmentally responsible businesses. A 2024 study revealed that 60% of consumers prefer brands with strong sustainability commitments. Enhanced sustainability can significantly boost a company's reputation and market competitiveness.

- Consumer preference for sustainable brands is increasing.

- Investors are integrating ESG factors into their decisions.

- Public scrutiny of environmental practices is intensifying.

Environmental factors significantly influence Universal Logistics Holdings. Strict regulations on emissions and stakeholder demands for greener operations are becoming more prominent. For 2024-2025, companies are expected to adopt cleaner technologies.

| Aspect | Details | Impact |

|---|---|---|

| Emissions | Transportation accounts for 28% of U.S. greenhouse gases (2024). | Stricter rules & tech upgrades are necessary. |

| Extreme Weather | Cost US $100B+ (2024). | Operational disruption; infrastructure risk. |

| Sustainability | 60% consumers favor green brands. Waste market $2.8T (2027). | Boost reputation & efficiency. |

PESTLE Analysis Data Sources

Universal Logistics' PESTLE leverages government reports, economic databases, and industry-specific publications.