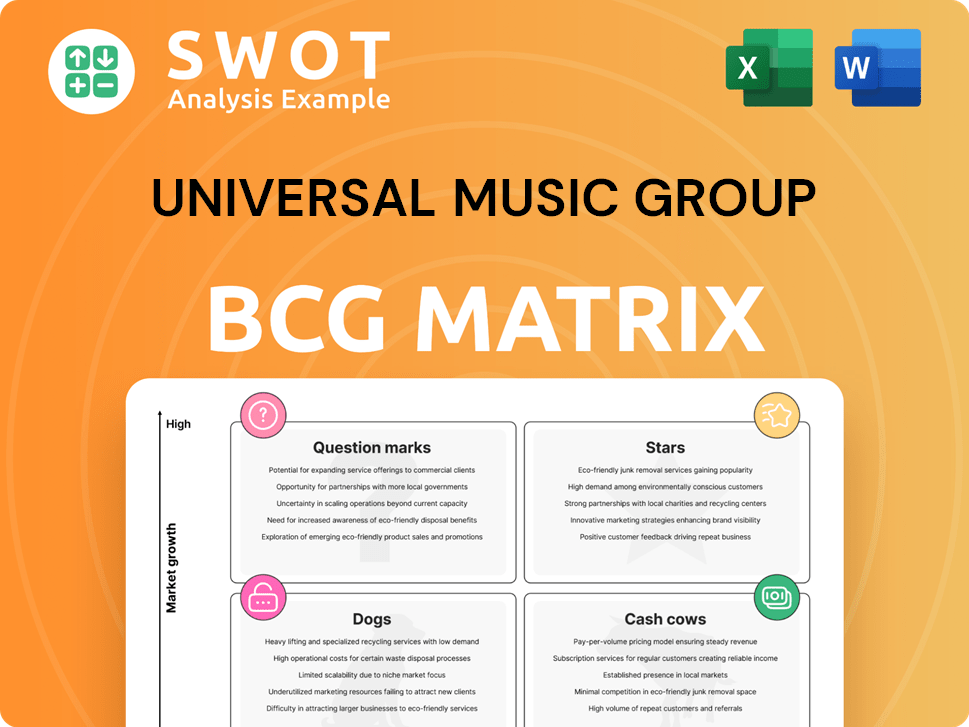

Universal Music Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Universal Music Group Bundle

What is included in the product

Analyzing UMG's diverse music assets, classifying each into Stars, Cash Cows, Question Marks, or Dogs.

Export-ready design for quick drag-and-drop into PowerPoint simplifies presentation creation and saves valuable time.

Delivered as Shown

Universal Music Group BCG Matrix

The BCG Matrix displayed here is the complete document you'll acquire after buying. Get the full version—formatted, ready for strategic planning, and instantly downloadable without any modifications.

BCG Matrix Template

Universal Music Group's BCG Matrix offers a snapshot of its diverse portfolio. We see potential Stars like thriving music streaming services and Cash Cows such as its established catalog. Analyzing Dogs and Question Marks reveals opportunities for strategic shifts. Understanding these placements is crucial for investment decisions. The full BCG Matrix report unveils detailed quadrant breakdowns and actionable insights for UMG. Get yours now for a competitive edge.

Stars

Universal Music Group's "Stars" category includes top-selling global artists. Taylor Swift's "The Eras Tour" broke records, generating over $1 billion. Sabrina Carpenter, Billie Eilish, and Chappell Roan also contribute significantly. UMG's artists drive revenue via streaming, sales, and licensing; their global chart dominance is key.

Universal Music Group's music publishing catalog, boasting 5 million titles, is a cornerstone of its business. This segment consistently brings in revenue via royalties and licensing, a stable income stream. In 2024, UMG's publishing revenue reached $2.2 billion, marking a significant portion of the company's overall earnings. The catalog's strategic expansion has fueled substantial growth, solidifying its long-term value.

Universal Music Group's (UMG) "Streaming 2.0" initiative is designed to revolutionize music streaming. It focuses on consumer segmentation and geographic expansion to boost ARPU. UMG aims to create a fair ecosystem for artists. In Q3 2023, UMG's revenue grew by 10.4% to €2.79 billion.

Strategic acquisitions

Universal Music Group (UMG) strategically uses acquisitions to expand its presence, especially in high-growth music markets. UMG's investments include Mavin Global in Nigeria, RS Group in Thailand, and Outdustry in China/India. These moves help UMG tap into increasing demand for diverse music content globally, solidifying its market position.

- UMG's global revenue in 2024 was $11.1 billion.

- Acquisitions boost UMG's presence in fast-growing markets.

- These investments support diverse music content.

- UMG aims to increase its competitive advantage.

Artist and label services

Universal Music Group (UMG) strategically grows its artist and label services. Acquisitions like PIAS and partnerships, such as with Downtown Music Holdings, boost revenue. These moves expand UMG's service range, accommodating varied artists. Comprehensive services reinforce artist ties and market dominance.

- UMG's Q3 2023 revenue from recorded music was €2.45 billion, with artist and label services contributing significantly.

- In 2024, UMG continues to integrate acquisitions, aiming for further service expansion and market reach.

- Partnerships and acquisitions are key in UMG's strategy to provide end-to-end solutions for artists.

UMG's "Stars" category drives substantial revenue, with artists like Taylor Swift leading the charge, generating billions. Streaming, sales, and licensing fuel growth in this sector. UMG's dominant artists' global chart positions are critical.

| Category | Description | Financial Impact |

|---|---|---|

| Key Artists | Taylor Swift, Sabrina Carpenter | Contribute significantly to revenue |

| Revenue Drivers | Streaming, Sales, Licensing | $1B+ from Eras Tour |

| Market Position | Global chart dominance | Enhances UMG's market share |

Cash Cows

Catalog music, or music over three years old, is a major revenue source for Universal Music Group. This segment generates stable, predictable income through consistent streams and sales. In 2024, catalog accounted for over 50% of UMG's recorded music revenue. The enduring popularity of classic hits ensures financial stability.

Recorded music subscriptions are a key revenue source for Universal Music Group (UMG), contributing billions yearly. UMG's subscription growth, along with price increases, fuels consistent segment expansion. This recurring revenue stream bolsters UMG's financial health. In 2023, UMG's subscription revenue was a significant portion of its $11.1 billion in revenue.

Universal Music Group's merchandising arm is a cash cow, generating revenue from artist-related products. Strategic partnerships and direct-to-consumer channels boost sales. Merchandising enhances branding and fan engagement. In 2024, UMG's merchandising revenue grew by 8%.

Music publishing royalties

Music publishing royalties are a crucial part of Universal Music Group's (UMG) financial health. These royalties, encompassing performance, mechanical, and sync revenues, offer UMG a steady income stream. UMG's vast catalog generates royalties from streaming, radio, and film licensing. In 2024, the music publishing segment reported strong growth, showing its significance.

- 2024 music publishing revenue growth: projected to be around 10-15%

- Key royalty sources: streaming, broadcasting, film/TV licensing

- UMG's catalog size: over 3 million songs

- Industry trend: continued growth in digital music consumption

Licensing and other revenue

Licensing and other revenue streams, including synchronization licenses, are crucial for Universal Music Group (UMG). This diversification helps monetize its extensive music catalog. Licensing revenue helps offset declines in traditional income. In 2024, UMG's licensing revenue reached $1.5 billion.

- Licensing revenue includes synchronization licenses for film and TV.

- UMG's licensing agreements generate a valuable income stream.

- Licensing helps offset declines in physical sales.

- In 2024, licensing revenue reached $1.5 billion.

Cash cows for Universal Music Group (UMG) provide consistent, reliable revenue. Catalog music and music publishing royalties are significant cash cows, generating steady income. Merchandising and licensing further bolster UMG's financial stability. UMG's cash cows contribute significantly to its financial success in 2024.

| Revenue Stream | Description | 2024 Revenue (approx.) |

|---|---|---|

| Catalog Music | Music over 3 years old | Over 50% of recorded music revenue |

| Music Publishing Royalties | Performance, mechanical, sync | Projected 10-15% growth |

| Merchandising | Artist-related products | 8% growth |

| Licensing | Sync licenses | $1.5 billion |

Dogs

Permanent downloads, like songs purchased on platforms such as iTunes, are a declining revenue source for Universal Music Group (UMG). Downloads' sales have decreased considerably, reflecting a shift toward streaming. In 2024, digital downloads accounted for less than 5% of UMG's total recorded music revenue. The shift to streaming services demonstrates evolving consumer behavior in music consumption.

Physical music sales, excluding vinyl, are a "Dog" in UMG's BCG matrix, consistently declining. In 2024, physical format sales (excluding vinyl) accounted for a small portion of total music revenue, a continuing trend. The shift towards digital music consumption has driven this decline, impacting formats like CDs. UMG must prioritize digital revenue to offset these losses, focusing on streaming and downloads.

Ad-funded streaming, a "dog" in UMG's BCG matrix, faces challenges. In 2024, ad-supported streaming saw slower growth in certain areas. Market volatility and competition from platforms like YouTube influence this revenue stream. UMG must strategically manage this segment to boost revenue and user engagement. For instance, Spotify's ad-supported revenue was $467 million in Q1 2024.

Certain legacy artist catalogs

Certain legacy artist catalogs within Universal Music Group's portfolio may see constrained revenue if not actively promoted or streamed. These catalogs, often with limited current engagement, need strategic attention. UMG must assess their potential thoroughly to boost revenue. Consider that in 2024, streaming revenue for legacy artists grew, but not all catalogs benefit equally.

- Identify underperforming catalogs.

- Invest in digital restoration and marketing.

- Explore licensing opportunities.

- Consider re-releasing albums with bonus content.

Non-core audiovisual content

Non-core audiovisual content at Universal Music Group (UMG) can be categorized as a 'Dog' in the BCG Matrix if it doesn't align well with music or struggles to attract viewers. This type of content might need a strategic review to explore monetization possibilities or potential divestiture. UMG's focus should be on audiovisual content that supports its primary business and generates substantial income, especially considering the 2024 growth in streaming revenues. For example, in Q3 2024, UMG saw a 10.7% increase in subscription revenue.

- Content that doesn't align with core business may be considered a 'Dog'.

- Strategic evaluation is needed for potential monetization or divestiture.

- Focus on content supporting core business is important.

- Streaming revenue growth in 2024 shows importance.

Underperforming assets at UMG, like physical music sales and ad-funded streaming, are classified as "Dogs" in the BCG matrix. These segments face declining revenue and require strategic management or potential divestiture. In 2024, they made up a small fraction of UMG's total revenue. The company must pivot towards high-growth areas.

| Segment | 2024 Revenue (Approx.) | Trend |

|---|---|---|

| Physical Sales (Excl. Vinyl) | < 5% of Total | Declining |

| Ad-Funded Streaming | Slower Growth | Variable |

| Legacy Catalogs (Inactive) | Lower Growth | Potentially Declining |

Question Marks

Emerging artists at Universal Music Group (UMG) are classified as "question marks" in a BCG matrix. They have the potential for high growth but currently hold a low market share. In 2024, UMG invested heavily in artist development, allocating a significant portion of its $8.8 billion revenue to marketing and promotion. Success hinges on UMG's ability to identify and nurture talent.

Universal Music Group (UMG) sees substantial growth in Asia and Africa. These regions, however, present hurdles like piracy and regulatory hurdles. UMG must create market-specific strategies. In 2024, streaming revenues in emerging markets are up 20%, showing potential.

Superfan engagement is a high-growth area for UMG, focusing on monetizing dedicated fans. This involves premium content, exclusive experiences, and direct-to-consumer options. The market is evolving, requiring UMG to test engagement and monetization strategies. UMG’s 'Streaming 2.0' initiative targets this opportunity. In 2024, the music streaming market grew, but superfan revenue is still a niche, offering significant growth potential.

AI-driven music creation

AI-driven music creation is shaking up the industry, a trend Universal Music Group (UMG) must navigate. UMG is exploring AI's potential, from copyright concerns to artist payouts and ethical considerations. Strategic partnerships are key for UMG's responsible AI integration. In 2024, the AI music market is estimated to be worth $2.6 billion.

- Market growth: The AI music market is projected to reach $4.8 billion by 2028.

- Copyright issues: Generate concerns about ownership and licensing of AI-created music.

- Artist compensation: Discussions on how artists should be compensated when AI is involved.

- Strategic partnerships: UMG is collaborating with AI companies to stay ahead of the curve.

New digital platforms

New digital platforms, including virtual concerts and metaverse experiences, represent potential revenue streams for Universal Music Group (UMG). These platforms are still developing, requiring UMG to experiment with different monetization strategies. UMG's commitment to digital innovation is evident through partnerships and investments in this area. In 2024, UMG's digital revenue accounted for a significant portion of its total income.

- Virtual concerts and metaverse experiences provide new avenues for revenue.

- The evolving nature of these platforms necessitates experimentation.

- UMG actively invests in digital innovation and partnerships.

- Digital revenue made up a substantial part of UMG's 2024 earnings.

Question marks at Universal Music Group (UMG) are emerging artists. These artists show high growth potential. In 2024, UMG's artist development budget was substantial.

| Category | Description | 2024 Data |

|---|---|---|

| Definition | New artists with high growth potential, low market share. | |

| UMG Investment | Significant investment in marketing and promotion. | $8.8B total revenue |

| Strategy | Focus on identifying and nurturing talent. | 20% streaming revenue growth in emerging markets |

BCG Matrix Data Sources

The BCG Matrix utilizes financial statements, market research, and streaming data to assess UMG's diverse portfolio. We incorporate industry analysis and analyst reports.