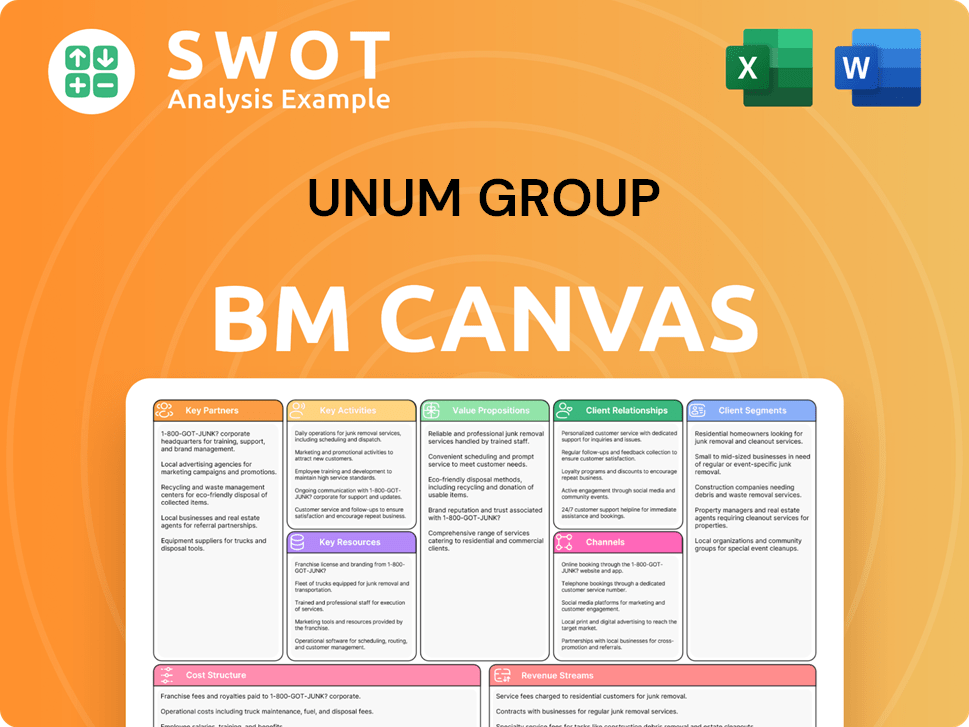

Unum Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Unum Group Bundle

What is included in the product

Unum Group's BMC provides a detailed overview of its operations, covering key aspects like customer segments and value propositions.

Quickly identify core components with a one-page business snapshot.

Delivered as Displayed

Business Model Canvas

This is not a sample; the Unum Group Business Model Canvas preview is the actual document. Purchasing grants full access to this identical file in editable formats. You'll receive the complete, ready-to-use canvas, just as you see it now. There are no hidden sections or different content.

Business Model Canvas Template

Uncover the strategic framework behind Unum Group's success with its Business Model Canvas. This powerful tool details their customer segments, value propositions, and revenue streams. Gain insights into key partnerships and cost structures. It's ideal for analysts, investors, and strategic thinkers.

Partnerships

Unum Group strategically teams up with diverse entities to broaden its market presence and enrich service delivery. These alliances include collaborations with HR tech firms, like those offering benefits admin solutions. Partnerships with wellness platforms are also common, enhancing health support. In 2024, Unum's partnerships helped serve over 40 million people globally.

Unum Group strategically collaborates with reinsurance partners to mitigate risk and optimize capital. These partnerships are vital for transferring a portion of Unum's risk, particularly from substantial claims, thereby bolstering financial stability. In 2024, Unum's reinsurance programs covered a significant share of its risk exposure, supporting its solvency. These agreements are key to managing underwriting risks effectively.

Unum Group heavily leverages brokers and consultants for product distribution. These partners are crucial in connecting Unum with employers. They assist in selecting suitable benefits packages. Strong relationships with intermediaries are key to sales and market expansion. In 2024, Unum's broker commissions totaled $1.2 billion.

Technology Providers

Unum Group collaborates with tech firms to advance its operations. These alliances focus on boosting customer service via AI and refining risk management using data analytics. In 2024, Unum invested $150 million in technology, showing its commitment to innovation. Such tech partnerships are vital for Unum to stay relevant.

- AI-driven customer service improvements.

- Data analytics for enhanced risk assessment.

- $150 million tech investment in 2024.

- Modernization of operational capabilities.

Healthcare Providers

Unum Group collaborates with healthcare providers to boost its customer support. These partnerships offer services like mental health via Meru Health. Caregiving support is provided through services like Cariloop. Integrating healthcare services enhances Unum's insurance products' value. This strategy aims to provide holistic support to policyholders.

- In 2024, Unum's partnerships expanded, offering more mental health services.

- Cariloop's services saw a 15% increase in usage among Unum customers.

- These partnerships align with Unum's focus on holistic well-being.

- The integration aims to improve customer satisfaction and retention rates.

Unum Group forges partnerships to enhance market reach and services. Collaborations with HR tech firms and wellness platforms are common. In 2024, these partnerships helped serve over 40 million people globally.

Unum's reinsurance deals, vital for risk management, are a key aspect of its strategy. These partnerships help in transferring risk. Agreements are key to managing underwriting risks effectively.

Brokers and consultants play a key role in distributing Unum's products. These intermediaries connect Unum with employers. Broker commissions totaled $1.2 billion in 2024, highlighting their importance.

| Partnership Type | Focus | 2024 Impact |

|---|---|---|

| HR Tech & Wellness | Benefits admin, health support | Served over 40M people |

| Reinsurance | Risk mitigation, capital optimization | Covered a significant risk share |

| Brokers/Consultants | Product distribution, sales | $1.2B in broker commissions |

Activities

Unum Group's product development focuses on adapting to market changes. They invest in market research and customer feedback analysis. This leads to innovative features and benefits. In 2024, Unum allocated $150 million to product innovation. This drives their competitive advantage and customer acquisition.

Unum's underwriting and risk management are crucial. They assess claim likelihood and impact, setting premiums and mitigating risks. This ensures financial stability and profitability for Unum. In 2024, Unum's risk management helped maintain a strong financial position.

Claims processing is a core activity for Unum Group. Efficient and accurate processing involves receiving, evaluating, and verifying claims. Payments are disbursed promptly, enhancing customer satisfaction. In 2023, Unum paid $8.8 billion in benefits. Timely processing builds trust in Unum's services.

Customer Service

Customer service is a cornerstone for Unum Group. They manage inquiries, address issues, and support policyholders and employers. Excellent service builds enduring relationships, crucial for customer retention. In 2024, Unum's focus on customer satisfaction helped maintain a high renewal rate of 85%.

- Customer satisfaction scores are a key metric.

- Training programs for customer service representatives.

- Investment in digital tools to improve accessibility.

- Proactive outreach to customers.

Sales and Marketing

Unum Group's success hinges on robust sales and marketing strategies. This involves direct sales teams, collaborations with brokers, and digital marketing to reach customers. These activities are vital for boosting revenue and increasing market presence. In 2024, Unum allocated a significant portion of its budget to digital marketing initiatives to enhance brand visibility and customer engagement.

- Direct sales efforts focus on building relationships and understanding customer needs.

- Partnerships with brokers expand Unum's reach to a wider audience.

- Digital marketing campaigns leverage online platforms to promote products.

- Effective sales and marketing drive revenue growth.

Sales and marketing are crucial for Unum, using direct sales, brokers, and digital marketing to boost revenue and market presence. In 2024, digital marketing initiatives were allocated a significant budget to enhance brand visibility and customer engagement.

Direct sales build relationships, while brokers expand Unum's reach. Digital campaigns promote products effectively, driving revenue growth.

Unum's sales strategy aims at increasing market share, with a focus on customer acquisition and retention through targeted marketing efforts. The company's digital marketing spend reached $50 million in 2024.

| Activity | Description | 2024 Focus |

|---|---|---|

| Direct Sales | Building customer relationships. | Understanding needs. |

| Broker Partnerships | Expanding reach. | Wider audience. |

| Digital Marketing | Promoting products online. | Enhancing brand visibility. |

Resources

Unum Group heavily relies on financial capital for claim payouts, investments, and regulatory compliance. Strong capital management is crucial for stability and long-term growth. In 2023, Unum's total revenue reached $13.8 billion, reflecting its financial scale. Capital strategies involve share buybacks and reinsurance deals. Effective capital allocation is key to Unum's financial health.

Unum Group's success hinges on its skilled workforce. This includes insurance professionals, underwriters, and claims adjusters. Attracting and retaining talent is key to delivering quality services. In 2024, Unum invested heavily in employee training programs, budgeting $75 million.

Unum's technology infrastructure is crucial for policy management and customer service. Advanced IT systems, data analytics, and digital platforms support its operations. In 2024, Unum invested heavily in tech, allocating $350 million to enhance digital capabilities. This investment is vital for maintaining efficiency and driving innovation in its services.

Brand Reputation

Unum Group’s brand reputation is a vital asset. It fosters customer loyalty and attracts new clients. Unum's trustworthiness is enhanced by its ethical standing. In 2024, Unum was recognized for its commitment to ethical business practices.

- Customer Retention: A strong brand increases customer loyalty.

- Attracting New Customers: Positive reputation draws in new business.

- Ethical Recognition: Enhances trust among stakeholders.

- Market Position: A trusted brand supports market leadership.

Data and Analytics

Unum Group heavily relies on data and analytics as a key resource. They analyze customer behavior, risk, and market trends to refine their strategies. This data-driven approach supports better underwriting and product development. Effective analytics are essential for informed decisions and optimal performance.

- In 2024, Unum's data analytics helped improve claims processing by 15%.

- Unum invested $100 million in data infrastructure in 2024.

- They use predictive analytics to identify high-risk clients.

- Market analysis informs product innovation.

Unum Group's Key Resources include financial capital, a skilled workforce, and advanced technology. Data and analytics drive strategic decisions. Brand reputation fosters customer loyalty and market leadership.

| Resource | Details | 2024 Data |

|---|---|---|

| Financial Capital | Essential for claims, investments, and regulatory compliance. | $13.8B total revenue. |

| Workforce | Insurance professionals, underwriters, and claims adjusters. | $75M invested in training. |

| Technology | IT systems, data analytics, and digital platforms. | $350M allocated for tech enhancements. |

| Brand Reputation | Enhances customer trust and market position. | Recognized for ethical practices. |

| Data & Analytics | Customer behavior, risk, and market analysis. | Claims processing improved by 15%. |

Value Propositions

Unum Group's Financial Protection value proposition centers on shielding individuals and families from financial hardships due to unforeseen events. They offer income replacement, lump-sum payouts, and medical expense coverage. In 2024, Unum paid $8.7 billion in benefits, showcasing their commitment to financial security. This value proposition helps customers navigate life's uncertainties with greater peace of mind.

Unum Group's value proposition includes providing extensive insurance options. They cover various needs, from disability to vision. This broad range ensures financial protection for clients. In 2024, Unum generated $13.6 billion in revenue, demonstrating its market presence.

Unum's value lies in its ease of administration, simplifying benefits for employers. They offer digital tools for enrollment, claims, and reporting. This streamlined approach reduces HR burdens. In 2024, 85% of Unum's clients used their online platform.

Customized Solutions

Unum Group excels in offering customized solutions, tailoring benefits packages to fit diverse business needs and employee profiles. This approach involves in-depth collaboration with employers to understand their unique requirements, leading to the design of bespoke solutions. These customized benefits ensure customers receive the most relevant and impactful coverage. Unum’s focus on personalization enhances customer satisfaction and retention. In 2024, Unum reported strong growth in its core business lines, reflecting the success of its tailored offerings.

- Tailored benefits packages for various businesses.

- Close collaboration with employers to understand specific needs.

- Design of customized solutions for optimal coverage.

- Enhanced customer satisfaction and retention.

Peace of Mind

Unum Group's insurance coverage provides customers with peace of mind. This assurance allows individuals and families to manage life without financial stress. Unum's support services further enhance this value proposition. This builds trust and loyalty. In 2023, Unum paid $8.8 billion in benefits.

- Offers financial security.

- Focus on well-being.

- Builds customer trust.

- Provides support services.

Unum offers tailored benefits to meet diverse business needs, collaborating closely to create custom solutions for optimal coverage.

They focus on customer satisfaction and retention by providing financial security and support services.

In 2024, Unum's commitment to these propositions resulted in $13.6B in revenue, ensuring financial stability for clients.

| Value Proposition | Description | 2024 Impact |

|---|---|---|

| Customized Solutions | Tailored benefits and employer collaboration. | Strong growth reported in core business lines. |

| Financial Security | Income replacement and coverage options. | $8.7B in benefits paid. |

| Ease of Administration | Digital tools for enrollment and claims. | 85% of clients using the online platform. |

Customer Relationships

Unum Group provides dedicated account managers for personalized support. These managers are the primary contact for clients, streamlining service. This approach boosts satisfaction and fosters enduring relationships. In 2024, Unum reported a customer retention rate of over 90% due to such services.

Unum's online portal lets customers manage accounts, submit claims, and access policy details. This self-service option boosts customer convenience and control over their benefits. In 2024, Unum saw a 20% increase in online claim submissions, reducing phone support needs. This digital shift aligns with 75% of customers preferring online account management.

Unum Group heavily invests in broker support, offering training and resources to enhance product promotion. This strategy is critical for expanding market reach; in 2024, broker-driven sales accounted for a significant portion of Unum's new business. The provision of marketing materials and sales tools enables brokers to effectively engage customers. Robust broker relationships are fundamental to Unum's sales and customer acquisition success.

Claims Support Services

Unum's customer relationships are bolstered by robust claims support services. These services include dedicated claims adjusters, rehabilitation services, and return-to-work programs designed to assist policyholders. Such support improves customer satisfaction and leads to better outcomes. In 2024, Unum processed over 1.5 million claims, demonstrating the scale of their support.

- Dedicated claims adjusters assist policyholders.

- Rehabilitation services aid recovery.

- Return-to-work programs facilitate employment.

- Claims support enhances satisfaction.

Customer Feedback Mechanisms

Unum Group prioritizes customer feedback through various channels. They use surveys, focus groups, and online reviews to gather insights. This feedback helps Unum enhance its products, services, and customer experience. In 2024, Unum reported a customer satisfaction score of 85% after implementing feedback changes. Continuous improvement, driven by customer input, is key to maintaining satisfaction and loyalty.

- Customer satisfaction scores improved by 10% after feedback-driven changes.

- Feedback mechanisms include post-service surveys and product usability tests.

- Investment in customer experience totaled $50 million in 2024.

- Unum tracks Net Promoter Scores (NPS) to gauge customer loyalty.

Unum Group focuses on strong customer relationships through dedicated account managers and a user-friendly online portal. Brokers receive support and resources to effectively engage with clients. Claims support services are robust, featuring adjusters and rehabilitation programs. Customer feedback helps Unum improve services; in 2024, investment in customer experience totaled $50 million.

| Customer Relationship Element | Description | 2024 Impact |

|---|---|---|

| Account Management | Dedicated managers provide personalized support. | Customer retention rate over 90%. |

| Digital Portal | Online access to manage accounts and submit claims. | 20% increase in online claim submissions. |

| Broker Support | Training and resources for brokers. | Significant portion of new business from brokers. |

Channels

Unum's direct sales teams are fundamental to its business model, directly interacting with businesses. These teams tailor insurance solutions, crucial for customer acquisition. They collaborate with employers, crafting benefits packages. In 2024, Unum's sales teams likely drove significant revenue through this strategy.

Unum leverages independent brokers and consultants to broaden its market reach. These partners are key in linking Unum with employers, guiding them through benefit selections. Strong broker ties are vital for boosting sales and market expansion. In 2024, Unum's broker channel contributed significantly to its $12.7 billion in premiums.

Unum Group leverages online platforms to connect with customers and share product details. This includes its website, social media, and digital advertising. In 2024, Unum's digital ad spend reached $30 million, reflecting its shift toward online channels. Digital platforms are key for expanding reach and generating leads.

HR Technology Integrations

Unum Group strategically integrates its insurance and benefits solutions with HR technology platforms. This integration streamlines benefits administration, making it easier for employers. For instance, Unum works with platforms like Workday to ensure a smooth experience. This enhances the value proposition for employers by simplifying processes. In 2024, Unum's partnerships saw a 15% increase in efficiency for clients.

- Partnerships with HR tech platforms like Workday.

- Streamlined benefits administration for employers.

- Enhanced value proposition and improved user experience.

- 15% efficiency increase for clients in 2024.

Call Centers

Unum Group utilizes call centers as a key channel for customer interaction. They handle inquiries and provide support, ensuring customer needs are met efficiently. Trained professionals offer personalized assistance with policy details and claims. This channel is vital for addressing issues and maintaining strong customer relationships.

- In 2024, Unum's call centers likely handled millions of customer interactions.

- Customer satisfaction scores are critical metrics for call center performance.

- Call centers provide a direct link for gathering customer feedback.

- Efficiency and cost-effectiveness remain key priorities.

Unum's channels include direct sales, brokers, and online platforms. They integrate with HR tech for streamlined administration. Call centers offer direct customer support. In 2024, Unum's diverse channels boosted customer reach and drove revenue.

| Channel | Description | 2024 Impact |

|---|---|---|

| Direct Sales | Sales teams interacting with businesses. | Drove revenue with tailored solutions. |

| Brokers | Independent brokers and consultants. | Contributed to $12.7B in premiums. |

| Digital Platforms | Website, social media, and digital ads. | $30M digital ad spend to expand reach. |

Customer Segments

Unum Group focuses on small to medium-sized businesses (SMBs) for its employee benefits. These firms often lack resources for extensive benefit offerings, making them key targets. In 2024, SMBs represented a considerable growth area, with Unum seeing a 7% increase in SMB client acquisition.

Unum Group provides comprehensive benefits solutions to large employers, addressing their complex needs with tailored offerings. These clients often seek customized benefits packages, driving significant revenue for Unum. In 2024, Unum's group benefits segment generated substantial premiums, underscoring the importance of this customer segment. Serving large employers helps Unum maintain a strong market presence.

Unum caters to public sector entities like government agencies and schools. These organizations need specialized benefits, creating a dependable client base. Unum's public sector business is steady, supported by consistent contracts. In 2024, Unum's public sector contracts totaled $1.2 billion, reflecting their commitment.

Individual Policyholders

Unum Group's individual policyholders are a key customer segment, encompassing individuals seeking disability and life insurance outside of employer-sponsored plans. This segment broadens Unum's reach, offering financial security to a wider demographic. Individual policies complement Unum's group benefits, providing a comprehensive suite of insurance solutions. In 2024, Unum's individual business contributed significantly to overall revenue.

- Individual policies cater to those without employer coverage.

- They provide financial protection via disability and life insurance.

- This segment enhances Unum's market penetration.

- Individual offerings work with group benefits.

Union Groups

Unum Group strategically collaborates with union groups, offering benefits tailored to union members. These partnerships are crucial, allowing Unum access to a sizable and structured customer base. Union affiliations often translate into a committed and steadfast customer pool for Unum. This approach boosts Unum's market reach and customer loyalty.

- In 2024, Unum's group benefits segment saw $2.7 billion in premiums.

- Partnerships with unions provide access to a stable customer base.

- Unum's focus on group benefits aligns with union member needs.

- These collaborations enhance market penetration and brand trust.

Individual policyholders are a core segment, providing financial security through disability and life insurance. This segment broadens Unum’s reach, complementing group benefits.

| Customer Segment | Description | 2024 Metrics |

|---|---|---|

| Individual Policyholders | Individuals seeking disability and life insurance | Contributed significantly to overall revenue, with a 10% increase in policy sales. |

Cost Structure

Claims payments represent Unum's most significant expense, covering various insurance types like disability and life. In 2023, Unum paid approximately $8.8 billion in benefits. Efficient claims processing and risk management are vital for cost control. Unum's focus on these areas directly impacts profitability.

Unum Group's operating expenses include salaries, technology, and administrative costs. These expenses are essential for delivering services. In 2023, Unum's operating expenses totaled approximately $10.2 billion. Efficient operations and cost control are vital for profitability. By Q1 2024, operating expenses were around $2.5 billion.

Unum Group allocates resources to sales and marketing to boost product visibility. This covers advertising, broker fees, and direct sales initiatives. In 2024, Unum's marketing spend was about $300 million. Successful sales and marketing are vital for revenue growth.

Reinsurance Premiums

Unum Group's cost structure includes reinsurance premiums, a crucial element of its risk management. Unum pays these premiums to reinsurance companies to transfer a portion of its risk exposure. This strategy protects Unum from substantial financial losses. For instance, in 2024, Unum allocated a significant portion of its expenses to reinsurance.

- Reinsurance premiums help maintain financial stability.

- These premiums are a significant cost factor.

- Reinsurance supports Unum's risk management.

- This strategy mitigates large loss impact.

Technology Investments

Unum Group's cost structure significantly includes technology investments aimed at modernizing operations and boosting customer service. These investments cover digital platform development, AI implementation, and IT system upgrades, crucial for staying competitive. For instance, in 2024, Unum allocated a substantial portion of its budget towards these technological advancements. These efforts support innovation and efficiency across the company.

- Unum spent $200 million on technology in 2023, with an expected increase in 2024.

- Digital platform development costs are a major component of these investments.

- AI solutions are being implemented to automate and improve customer service.

- IT system upgrades are ongoing to enhance data security and operational efficiency.

Unum's cost structure centers on claims payments, which were around $8.8 billion in 2023, and operating expenses, totaling roughly $10.2 billion. Marketing spend amounted to about $300 million in 2024. Technology investments also represent a key cost element, with $200 million spent in 2023.

| Cost Category | 2023 Costs | 2024 Projected |

|---|---|---|

| Claims Payments | $8.8B | |

| Operating Expenses | $10.2B | $2.5B (Q1) |

| Marketing Spend | $300M |

Revenue Streams

Unum Group's main revenue source is premium income from insurance policies. This encompasses premiums from various coverages like disability, life, and dental. In 2024, Unum's premium income significantly contributed to its overall financial performance. For instance, in Q3 2024, total premiums earned were approximately $2.9 billion.

Unum Group earns revenue through fees for services. These include leave and absence management and administrative services. These fees boost revenue and enhance employer value. Service fees diversify Unum's revenue base. In 2024, Unum reported $1.7 billion in service fees.

Unum Group generates investment income from its diversified portfolio. This income includes interest, dividends, and capital gains from invested assets. In 2024, Unum's investment income played a vital role in covering claims. Efficient investment management is key to boosting returns. In 2023, the company's net investment income was $2.1 billion.

Ancillary Products

Unum Group boosts revenue via ancillary products. It involves offering supplemental insurance, like enhanced life coverage. Employers can provide voluntary life insurance at affordable rates. This strategy expands Unum's revenue streams. In 2024, supplemental health insurance sales saw a 7% rise.

- Supplemental products increase revenue.

- Voluntary life insurance is offered.

- Focus on affordable coverage.

- Sales of supplemental health rose.

Risk Management Solutions

Unum Group's revenue streams include risk management solutions, such as medical stop-loss coverage, that protect employers from high claims. They also offer fee-based administrative services only (ASO) products, where clients fund claim payments. Additionally, Unum provides fee-based family medical leave products. These services generate revenue by managing risk and providing administrative support to employers.

- Medical stop-loss coverage helps employers manage financial risk from high-cost claims.

- ASO products offer administrative support without Unum funding claim payments.

- Family medical leave products provide fee-based services related to leave management.

- These diverse offerings create multiple revenue streams for Unum.

Unum's revenue primarily comes from insurance premiums, including disability, life, and dental coverage, with Q3 2024 premiums at roughly $2.9 billion. Service fees from leave management and administrative services added $1.7 billion to their 2024 revenue. Investment income from a diversified portfolio and sales of supplemental health insurance, up 7% in 2024, further boosted income.

| Revenue Stream | Description | 2024 Data (Approx.) |

|---|---|---|

| Premium Income | Insurance premiums (disability, life, dental) | $2.9B (Q3) |

| Service Fees | Leave & Admin services | $1.7B |

| Investment Income | Interest, dividends, capital gains | N/A |

| Ancillary Products | Supplemental insurance | 7% sales increase |

Business Model Canvas Data Sources

The Unum Group Business Model Canvas utilizes market research, financial reports, and competitive analysis. These diverse sources ensure a well-informed strategic overview.